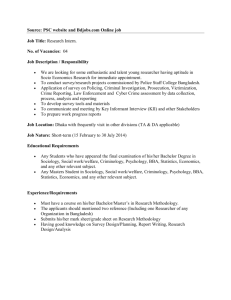

Investment for Development

advertisement