This short survey seeks to evaluate the small business CGT

advertisement

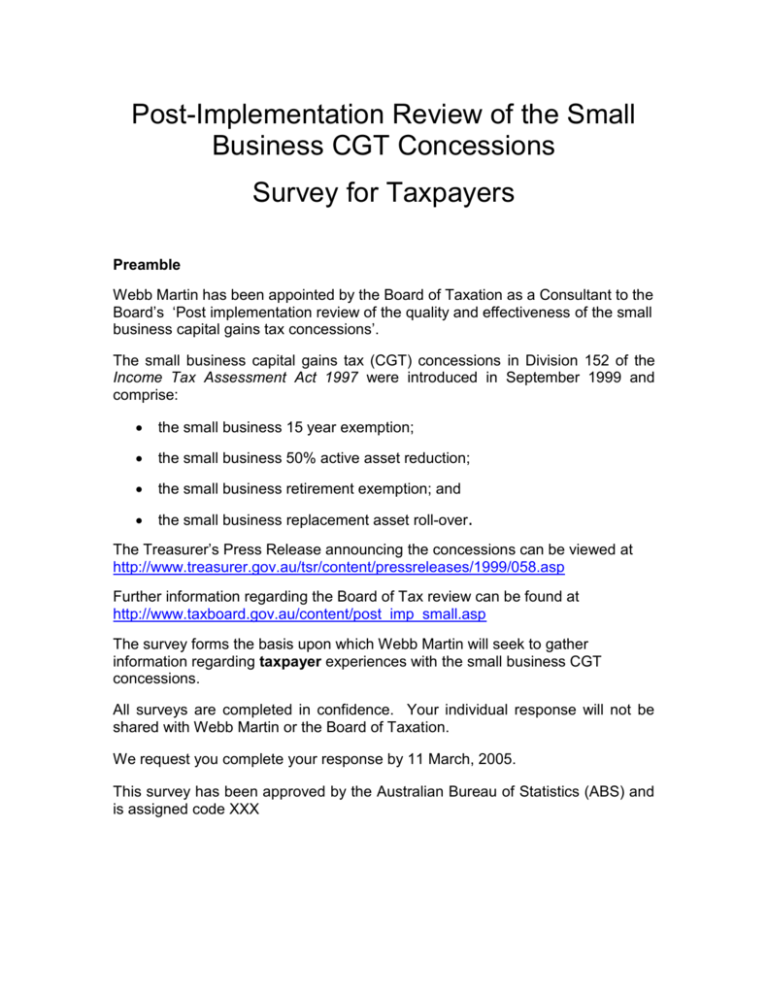

Post-Implementation Review of the Small Business CGT Concessions Survey for Taxpayers Preamble Webb Martin has been appointed by the Board of Taxation as a Consultant to the Board’s ‘Post implementation review of the quality and effectiveness of the small business capital gains tax concessions’. The small business capital gains tax (CGT) concessions in Division 152 of the Income Tax Assessment Act 1997 were introduced in September 1999 and comprise: the small business 15 year exemption; the small business 50% active asset reduction; the small business retirement exemption; and the small business replacement asset roll-over. The Treasurer’s Press Release announcing the concessions can be viewed at http://www.treasurer.gov.au/tsr/content/pressreleases/1999/058.asp Further information regarding the Board of Tax review can be found at http://www.taxboard.gov.au/content/post_imp_small.asp The survey forms the basis upon which Webb Martin will seek to gather information regarding taxpayer experiences with the small business CGT concessions. All surveys are completed in confidence. Your individual response will not be shared with Webb Martin or the Board of Taxation. We request you complete your response by 11 March, 2005. This survey has been approved by the Australian Bureau of Statistics (ABS) and is assigned code XXX Demographic information: Please indicate the location of your firm (PROGRAMMER: OPTIONS TO BE RADIO BUTTONS) State NSW Western Australia Victoria Tasmania Queensland South Australia Northern Territory ACT Location of Taxpayer CBD Metropolitan Regional All of the questions below relate to the application of the small business CGT concessions. When completing this survey please do so in relation to your experiences as a taxpayer regarding the application of the small business CGT concessions to your circumstances. Your response will be confidential. All responses will be aggregated at the end of the survey and individual responses will not be revealed. We appreciate your response to this survey. S01) Are you familiar with the application and impact of the small business CGT concessions in Division 152 of the ITAA 1997? Yes 1 Go to S02 No 2 TERMINATE Don’t know 3 TERMINATE (for assistance refer to Treasurer’s Press Release announcing the concessions http://www.treasurer.gov.au/tsr/content/p ressreleases/1999/058.asp) QS02) How did you become aware of the application and impact of the small business CGT concessions? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Tax adviser ATO Other 1 2 (PROGRAMMER: INSERT TEXT BOX) Q1) Since 1999, have you sought to apply any of the small business CGT concessions? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes No 1 2 CONTINUE THANK AND TERMINATE Q2) Which of the following small business CGT concessions did you seek to apply? Please choose the options from those below. (PROGRAMMER: LIST TO BE RADIO BUTTONS) 15 year exemption 50% active asset reduction Retirement exemption Replacement asset roll-over 1 2 3 4 Q3a) Did you actually claim the small business CGT concessions? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes No Eligibility still being determined Q3b) 1 2 3 GO TO Q4 CONTINUE GO TO Q4 Why not? (PROGRAMMER: INSERT TEXT BOX) Text Box Q3c) Do you feel that you should have been entitled to claim the small business CGT concessions? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes No 1 2 CONTINUE GO TO Q4 Q3d) Why? (PROGRAMMER: INSERT TEXT BOX) Q4a) Were any areas of your claim challenged by the ATO (for example an ATO audit)? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes No Q4b) 1 2 GO TO Q4b GO TO Q5 Which areas were challenged and why? (INSERT TEXT BOX) Q5a) Were the provisions of the small business CGT concessions easy for you to understand? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes No Don’t Know Q5b) 1 2 3 GO TO Q6 CONTINUE GO TO Q6 What did you find difficult? (PROGRAMMER: INSERT TEXT BOX) Q6 To what extent do you think the small business CGT concessions meet the following policy objectives? (for assistance refer to Treasurer’s Press Release announcing the concessions http://www.treasurer.gov.au/tsr/content/pressreleases/1999/058.asp) Policy Objective Improving incentives to save and invest Increase the level of benefits available to small business taxpayers Provide greater flexibility in how small business can access the various benefits Doesn’t Meet Completely Meets 1 1 2 2 3 3 4 4 5 5 1 2 3 4 5 1 2 3 4 5 Don’t Know Don’t Know Don’t Know Rationalise eligibility for small business capital gains tax relief Reduce compliance costs for small business capital gains tax relief Provide small business people with access to funds for retirement or expansion Remove impediments to efficient asset management Allow small business taxpayers to benefit successively from all of the concessions for any one disposal 1 2 3 4 5 1 2 3 4 5 1 2 3 4 5 1 2 3 4 5 1 2 3 4 5 Don’t Know Don’t Know Don’t Know Don’t Know Don’t Know Q6a) Overall (and regardless of whether you were eligible to claim the small business CGT concessions) do you think the concessions are beneficial for small business? (PROGRAMMER: LIST TO BE RADIO BUTTONS) Yes Yes, subject to changes No Q6b) 1 2 3 Why do you say so ? (PROGRAMMER: INSERT TEXT BOX) Q7) Do you have any additional comments that you would like to make about the small business CGT concessions? If yes, please add any additional comments Insert text box Thank respondent