Certification of an equivalent payroll service for community

advertisement

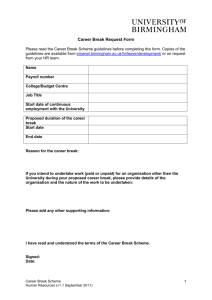

PD03 Declaration of an equivalent payroll service for community based organisations It is a condition of funding that all community-based, not for profit organisations delivering a funded kindergarten program use a payroll service. The department funds a contractor to provide a payroll support service free of charge to eligible organisations. For more information about eligibility refer to the current Victorian kindergarten policy, procedures and funding criteria Eligible organisations that do not use the department's contracted service must certify that they use an equivalent payroll service by completing Sections 1 –3 of this form. Note that the payroll provider must complete Section 4. If any of the information provided subsequently changes the organisation must submit a new form certifying the new arrangements. The completed declaration form (sections 1-4) should be forwarded to the relevant Department of Education and Early Childhood Development regional office. Regional office addresses can be found at: http://www.education.vic.gov.au/about/contact/regions.htm Statement of purpose of collection The information provided on this form is stored on the Department’s computerised databases, and will be used to enable the Department to make a decision about the funding your organisation is eligible to receive, and produce statistics and reports, without identifying personal information, about trends in kindergarten funding, workforce and operation. Service level information may be shared with Local Government Authorities for the sole purpose of informing the development of municipal early years plans. The information will not be disclosed to any person or organisation other than the staff or contractors of the Department of Education and Early Childhood Documentary evidence must be retained which justifies the information included on this application form. Children’s Services Advisers of the Department of Education and Early Childhood Development may request to view this evidence at any time. Where incorrect or unsubstantiated data has been provided which has resulted in an overpayment of the kindergarten per capita grant, the kindergarten fee subsidy or other financial payments associated with the Victorian Government kindergarten program, the Department will seek to recover this overpayment. Applicable from Jan 2011 PD03 Checklist Please ensure the following actions have been completed before submitting the form A contact name and business telephone has been included in Section 1 of this form The Funded Organisation Certification in Section 2 has been signed by an authorised officer The Payroll Provider has completed Section 4 You have taken a copy of the completed form for your records Applicable from Jan 2011 PD03 Section 1 - Organisation details The Organisation is the legal entity that receives the grant payment from the department and is responsible for the management of the kindergarten funds. This form is lodged by: Organisation name: Postal address: Postcode: Name of contact person: Position: Telephone no. (business hours): Organisation email address: Organisation ABN State briefly why the Departments’ approved payroll provider is not used Section 2 – Certification Note: An authorised officer of the organisation must sign this form. By signing this certification the signatory warrants that he/she is duly authorised to sign on behalf of the organisation. I, _________________________________________________ certify that the information on this form is true and correct and that the payroll provider nominated in Section3 provides a payroll service to the funded organisation consistent with the check list in Section 4. Signed: Date: Position: / / Section 3 - Payroll provider If your funded organisation contracts an external payroll provider please provide details of their business name and address. If your payroll service provider is employed internally within your funded organisation, please provide the employee’s name. Name of payroll provider: Street address: Suburb: Applicable from Jan 2011 Postcode: PD03 Section 4 – Payroll service functions checklist – to be completed by payroll provider Fortnightly contact and follow-up with the nominated organisation representative to seek relevant data and authorisations to allow staff salary payments and entitlements to be calculated Fortnightly calculating, processing and payment (via Electronic Funds Transfer and cheques) of staff salaries and other entitlements. Calculations, processing and payment of staff’s Ordinary pay Sick leave Annual leave Long service leave Leave without pay Overtime Workcover Allowances (such as in charge, uniform, cleaning, first aid, meals, travel) Back pay Employer superannuation, and Termination payments Provision of a payroll service, which covers regular staff, new staff and relieving employees Payment of taxation, superannuation and other appropriate payroll deductions as required Electronic lodgment of employment declaration forms Production of payment summaries Production of pay slips for staff, which comply with the relevant award(s)/workplace agreement(s), legislative and taxation requirements and include information concerning their accrued entitlements Clear fortnightly summary reports of salary expenditure for eligible organisations. The information provided should be compliant with the relevant Workplace Relations Regulations to assist employers meet their record keeping obligations. Reports including details of Staff’s pay for the fortnight (including gross pay, tax and other deductions and nett pay) Staff’s pay rate and increment date Year to date earnings for each employee Leave taken and leave balances of each employee and Identification of payments that eligible organisations are required to make (including monthly taxation remittances, nett amounts due to employees, employer superannuation) If any of the items listed above are not provided by the payroll service please provide an explanation. Name and position of person completing this checklist Applicable from Jan 2011 PD03 DEECD Regional Staff Use Only Organisation name: Agency ID: Lead Region (organisation) Name of Payroll Provider Payroll Provider approved by (name) Included in DTR Declaration retained on file Send copy to ELSI Branch Name and Signature Position Date Applicable from Jan 2011