Productivity Improves Among U

advertisement

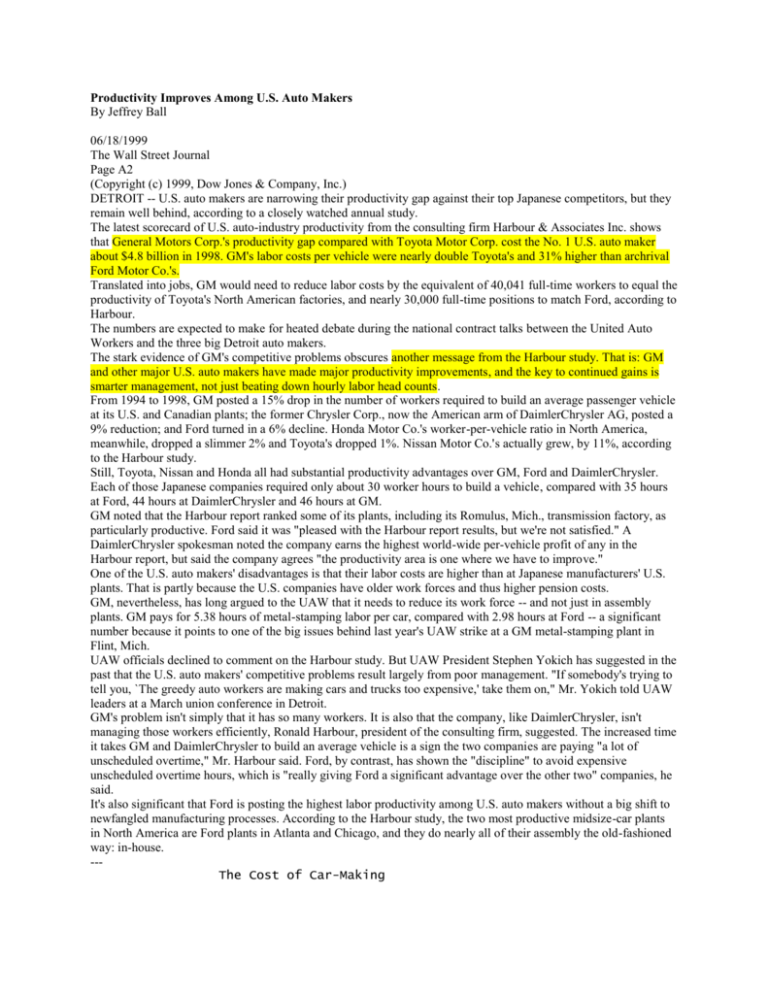

Productivity Improves Among U.S. Auto Makers By Jeffrey Ball 06/18/1999 The Wall Street Journal Page A2 (Copyright (c) 1999, Dow Jones & Company, Inc.) DETROIT -- U.S. auto makers are narrowing their productivity gap against their top Japanese competitors, but they remain well behind, according to a closely watched annual study. The latest scorecard of U.S. auto-industry productivity from the consulting firm Harbour & Associates Inc. shows that General Motors Corp.'s productivity gap compared with Toyota Motor Corp. cost the No. 1 U.S. auto maker about $4.8 billion in 1998. GM's labor costs per vehicle were nearly double Toyota's and 31% higher than archrival Ford Motor Co.'s. Translated into jobs, GM would need to reduce labor costs by the equivalent of 40,041 full-time workers to equal the productivity of Toyota's North American factories, and nearly 30,000 full-time positions to match Ford, according to Harbour. The numbers are expected to make for heated debate during the national contract talks between the United Auto Workers and the three big Detroit auto makers. The stark evidence of GM's competitive problems obscures another message from the Harbour study. That is: GM and other major U.S. auto makers have made major productivity improvements, and the key to continued gains is smarter management, not just beating down hourly labor head counts. From 1994 to 1998, GM posted a 15% drop in the number of workers required to build an average passenger vehicle at its U.S. and Canadian plants; the former Chrysler Corp., now the American arm of DaimlerChrysler AG, posted a 9% reduction; and Ford turned in a 6% decline. Honda Motor Co.'s worker-per-vehicle ratio in North America, meanwhile, dropped a slimmer 2% and Toyota's dropped 1%. Nissan Motor Co.'s actually grew, by 11%, according to the Harbour study. Still, Toyota, Nissan and Honda all had substantial productivity advantages over GM, Ford and DaimlerChrysler. Each of those Japanese companies required only about 30 worker hours to build a vehicle, compared with 35 hours at Ford, 44 hours at DaimlerChrysler and 46 hours at GM. GM noted that the Harbour report ranked some of its plants, including its Romulus, Mich., transmission factory, as particularly productive. Ford said it was "pleased with the Harbour report results, but we're not satisfied." A DaimlerChrysler spokesman noted the company earns the highest world-wide per-vehicle profit of any in the Harbour report, but said the company agrees "the productivity area is one where we have to improve." One of the U.S. auto makers' disadvantages is that their labor costs are higher than at Japanese manufacturers' U.S. plants. That is partly because the U.S. companies have older work forces and thus higher pension costs. GM, nevertheless, has long argued to the UAW that it needs to reduce its work force -- and not just in assembly plants. GM pays for 5.38 hours of metal-stamping labor per car, compared with 2.98 hours at Ford -- a significant number because it points to one of the big issues behind last year's UAW strike at a GM metal-stamping plant in Flint, Mich. UAW officials declined to comment on the Harbour study. But UAW President Stephen Yokich has suggested in the past that the U.S. auto makers' competitive problems result largely from poor management. "If somebody's trying to tell you, `The greedy auto workers are making cars and trucks too expensive,' take them on," Mr. Yokich told UAW leaders at a March union conference in Detroit. GM's problem isn't simply that it has so many workers. It is also that the company, like DaimlerChrysler, isn't managing those workers efficiently, Ronald Harbour, president of the consulting firm, suggested. The increased time it takes GM and DaimlerChrysler to build an average vehicle is a sign the two companies are paying "a lot of unscheduled overtime," Mr. Harbour said. Ford, by contrast, has shown the "discipline" to avoid expensive unscheduled overtime hours, which is "really giving Ford a significant advantage over the other two" companies, he said. It's also significant that Ford is posting the highest labor productivity among U.S. auto makers without a big shift to newfangled manufacturing processes. According to the Harbour study, the two most productive midsize-car plants in North America are Ford plants in Atlanta and Chicago, and they do nearly all of their assembly the old-fashioned way: in-house. --The Cost of Car-Making U.S. auto makers are closing the gap, but remain behind Japanese competitors in labor productivity. Labor hours per vehicle GM DaimlerChrysler Ford Honda Nissan Toyota 45.60 44.25 34.79 30.84 30.76 30.38 Source: Harbour Report Total labor cost per vehicle $2,052 1,991 1,566 1,079 1,077 1,063 Annual volume 4,946,000 2,906,000 4,299,000 695,000 309,000 647,000