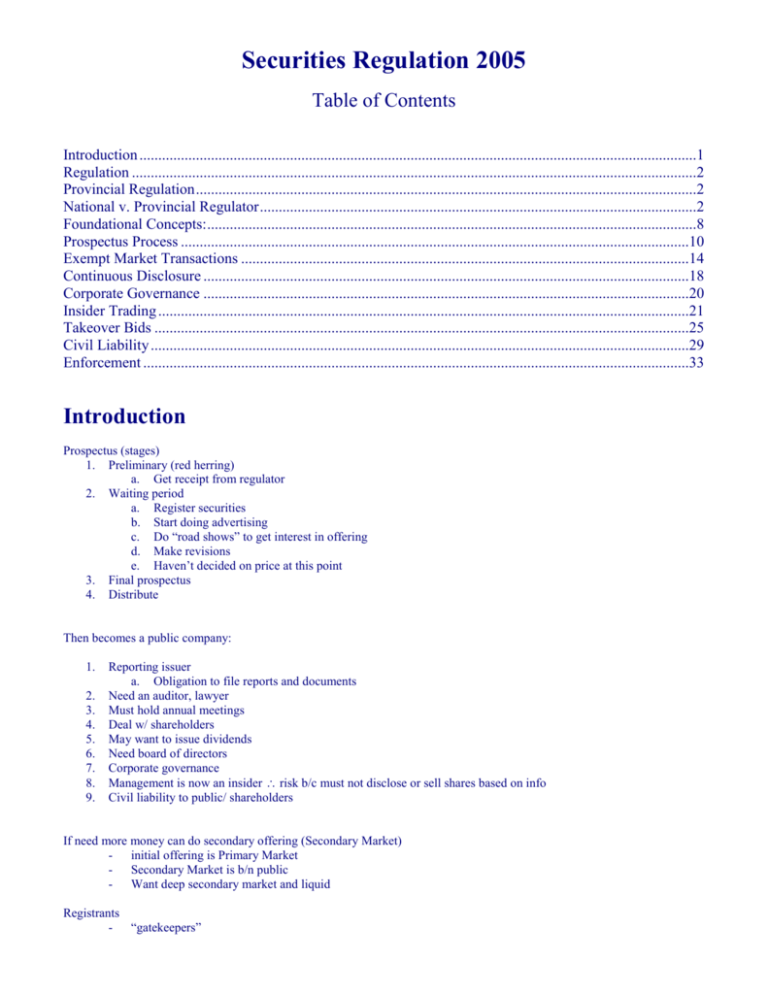

Law-463-Securities-by

advertisement