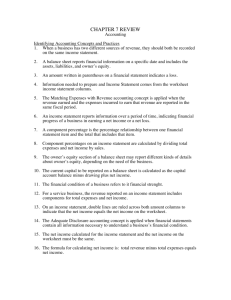

Module 4 - Report Navigation - UBC Finance

advertisement