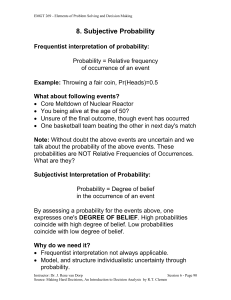

Document

advertisement

EMGT 269 - Elements of Problem Solving and Decision Making 5. Sensitivity Analysis Used through the entire modeling process Purpose of Sensitivity Analysis 1. To analyze what really matters in the decision problem 2. To construct a requisite decision model Examples of Sensitivity Analysis Techniques in DA 1. Determine if deterministic dominance or stochastic dominance is present 2. Identifying the important variables through Tornado Diagrams 3. Identify interaction effects between important variables 4. Identify the importance of probability assessments. THE EAGLE AIRLINE CASE: Dick Carothers wants to expand his operation Mid West has to offer: 1. An airplane @ price $95000. (He can probably by the plane for $85K-$90K) 2. An option to buy the airplane a year later (Cost of the option $2.5 – $4k) Currently: 1. Eagle Airlines (=Dick Carothers) owns 3 plains 2. 60% of flights are chartered flights and 40% are scheduled Instructor: Dr. J. Rene van Dorp Session 5 - Page 75 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Cost Data Mid West Plane: 1. New Engines, FAA Maintained 2. Contains all equipment that Eagle Airlines needs 3. 5 seats 4. Operation Cost: $245 per hour 5. Fixed Cost: $20k (=Yearly Insurance) + Finance Charges Finance Charges: Borrow 40% of the price at 2% above the prime rate (=9.5%, but subject to change). Revenue Data: 1. Chartered Flights: $300 - $400 per hour 2. Scheduled Flights: $100 per person per hours, plains are on average 50% full 3. Expected number of hours flown with new plane 8001000. Variables in control: 1. The price you are willing to pay 2. The amount financed Variables not in control: 1. Insurance Cost 2. Operation Cost Carothers could always invest his cash @8% yearly interest rate Instructor: Dr. J. Rene van Dorp Session 5 - Page 76 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making 1. Sensitivity Analysis: Problem Identification Level Are we solving the right problem? Error of the 3rd kind: Solving the wrong problem How to avoid: continue to be skeptical if the problem on the surface is the real problem Eagle Airlines Case: Carothers wants to expand his operation. The fact that he owns an airline company does not mean he has to expand by buying another plane. He could expand by investing in computer industry. 2. Sensitivity Analysis: Problem Structure Level Are any of pieces of the puzzle missing? Is this a single or multiple objective problem? 2.1. Sensitivity Analysis: Dominance Considerations Ask whether one alternative could end up better than another. If not, ignore that alternative. Eagle Airline Case: “Buying the option” is consider never better than “the buying the plane alternative” as asking price a year from now will be adjusted be similar. Instructor: Dr. J. Rene van Dorp Session 5 - Page 77 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making 2.2. Sensitivity Analysis: Importance of Variables Eagle Airlines Case: Objective: Maximize Profit. Consider Annual Profit, Ignore Taxes 1. Annual Profit = Annual Total Revenue – Annual Total Cost 2. Total Revenue = Revenue from Charters + Revenue from scheduled flights 3. Total Cost = Variable Cost + Fixed Cost Revenue from Charters: (Charter Ratio)*(Hours flown per year)*Charter Price Revenue from Schedules Flights: (1-Charter Ratio)*(Hours flown per year)*(Ticket price per hour)*(Number of Seats)*(Average Occupancy) Fixed Cost: Insurance + (Purchase Price)*(% Financed)*(Interest Rate) Variable Cost: (Hours flown per year)*(Operating Cost) STEP 1: 1. Determine a range for every decision variable and a best guess. (Low, Base, High) Instructor: Dr. J. Rene van Dorp Session 5 - Page 78 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Eagle Airlines Case: 800 500 $325.00 $300.00 $100.00 $95.00 50.00% 40.00% 50.00% 45.00% $245.00 $230.00 $18,000.00 $20,000.00 0.4 0.3 11.50% 10.50% $85,000.00 $87,500.00 C h ar ter P r ice p er h o u r T icket P r ice p er h o u r O ccu p an cy R ate o n S ch ed u led F lig h ts % o f C h ar ter F lig h ts O p er atin g C o st p er H o u r In su r an ce P r o p o r tio n F in an ced In ter est R ate P u r ch ase P r ice U sin g L o w V alu es T o tal R even u e T o tal C o st T o tal P r o fit R even u e F r o m C h ar ter s R even u e F r o m S ch ed u led F lig h t F ixed C o st V ar iab le C o st H ig h B ase Low H o u r s F lo w n U sin g B ase V alu es 1000 $350.00 $108.00 60.00% 70.00% $260.00 $25,000.00 0.5 13.00% $90,000.00 U sin g H ig h V alu es $119,750.00 $135,677.50 -$15,927.50 $230,000.00 $220,025.00 $9,975.00 $342,200.00 $290,850.00 $51,350.00 $67,500.00 $52,250.00 $20,677.50 $115,000.00 $130,000.00 $100,000.00 $24,025.00 $196,000.00 $245,000.00 $97,200.00 $30,850.00 $260,000.00 One Way Sensitivity Analysis STEP 2: 1. Select a particular variable = free variable 2. Set all other variables to their best guesses (=base values) 3. Set free variable to its lowers value and calculate payoff 4. Set free variable to its highest value calculate payoff 5. Set free variable to some intermediate values and calculate payoff 6. Draw results in a one way sensitivity analysis graph Eagle Airlines Case: Fix all variables, except hours flown. Instructor: Dr. J. Rene van Dorp Session 5 - Page 79 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making S e n s itiv ity G r a p h fo r T o ta l P r o fit H o u rs F lo w n 500 6 0 0 664 7 0 0 800 900 1000 15000 10000 H o urs F lo w n 5000 0 Money Market T o tal P ro fit ($) 20000 -5 0 0 0 STEP 3: 1. Perform a one way sensitivity analysis for all variables 2. Plot results in a Spider Diagram or Tornado Diagram Eagle Airlines Case: Spider Diagrams Hours Flown Spider Graph for Total Profit/D5 Charter Price per hour % Change in Input 40.00 % 60.00 % $35,000.00 $30,000.00 $25,000.00 $20,000.00 $15,000.00 $10,000.00 $5,000.00 $0.00 -$5,000.00 -$10,000.00 -$15,000.00 Ticket Price per hour Change in Profit -60.00 -40.00 -20.00 20.00 % % % 0.00% % Occupancy Rate on Scheduled Flights % of Charter Flights Operating Cost per Hour Insurance Proportion Financed Instructor: Dr. J. Rene van Dorp Session 5 - Page 80 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Powerful Technique: Tornado Diagrams STEP 4: 1. Calculated Payoff Range is a measure of uncertainty in payoff due to uncertainty in the free variable 2. Plot the payoff ranges in a Tornado Diagram 3. Visually determine the important variables. Tornado Graph for Total Profit O c c u p a n c y Ra t e o n S c h e d u le d Flig h t s - 2 0 0 . 5 0 13 % to + 2 0 0 . 5 0 13 % O p e ra t in g Co s t p e r Ho u r - 12 0 . 2 5 2 6 % to + 12 0 . 2 5 2 6 % Ho u rs Flo wn - 12 7 . 8 19 5 % to + 8 5 . 2 13 0 4 % Ch a rt e r P ric e p e r ho ur - 10 0 . 2 2 0 6 % to + 10 0 . 2 2 0 6 % % o f Ch a rt e r Flig h t s - 3 0 . 0 7 5 19 % to + 12 0 . 3 0 0 8 % Tic ke t P ric e p e r h o u r - 5 0 . 12 5 3 1% to + 8 0 . 2 0 0 5 % In s u ra n c e - 5 0 . 12 5 3 1% to + 2 0 . 0 5 0 13 % $2,500,000 $2,000,000 $1,500,000 $1,000,000 $0 -$500,000 - 1. 15 4 0 3 7 % to + 1. 15 4 0 3 7 % -$1,000,000 P u rc h a s e P ric e -$1,500,000 - 5 . 2 6 17 5 8 % to + 3 . 5 10 5 2 4 % $500,000 - 10 . 0 8 7 7 2 % to + 10 . 0 8 7 7 2 % In t e re s t Ra t e -$2,000,000 -$2,500,000 P ro p o rt io n Fin a n c e d Change in Profit Instructor: Dr. J. Rene van Dorp Session 5 - Page 81 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Two Way Sensitivity Analysis One way sensitivity analysis ignores the effect of changing multiple variables at the same time "One Way" under estimates sensitivity due to: Additive effects of varying more than one variable Multiplicative effects of varying more than one variable Eagle Airlines Case: Tornado Diagram indicates that Occupancy Rate (OR) and Operating Cost (OC) on scheduled flight are critical. Determine Annual Profit (AP) as a function of OR and OC: AP = R*H*CP + (1-R)*H*TP*NPS*OR-H*OC-I-PP*F*IR Set all other parameters at their base values AP = $130000 + $20000*OR-800*OC-$24025 For what values of OR and OC is "buying the plane" worse than "putting money in the savings account" AP < $4200 $130000 + $200000*OR-800*OC-$24025 < $4200 $200000*OR < $800*OC -$101775 OR < 0.004*OC - 0.509 Instructor: Dr. J. Rene van Dorp Session 5 - Page 82 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Draw graph of values of OR and OC such that one is indifferent between "buying the plane" and "the saving account". OR = 0.004*OC - 0.509 Base Case 245 0.5 Operating Cost 230 235 240 245 250 255 260 Occupancy Rate 0.41 0.43 0.45 0.47 0.49 0.51 0.53 BASE VALUES 0.54 Occupancy Rate 0.53 AP > 4200 0.52 0.51 0.50 0.49 0.48 0.47 0.46 0.45 0.44 0.43 0.42 0.41 0.40 230 AP < 4200 235 240 245 250 255 260 Operating Cost Instructor: Dr. J. Rene van Dorp Session 5 - Page 83 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Sensitivity to Probabilities Thus far, one way sensitivity and two sensitivity acknowledge that parameters are uncertain by indicating a range for the difference variables Uncertainty Analysis: Parameters are uncertain by assessing a range and by specifying how uncertain these parameters are by assessing probability distributions for uncertainty of input parameters Given the uncertainty distributions of the input parameters and the model calculate the uncertainty distribution of the output parameters INPUT UNCERTAINTY 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 0.00 0.20 0.40 0.60 0.80 1.00 OC MODEL 3 .5 0 3 .0 0 2 .5 0 BLACK BOX MODEL 2 .0 0 1.5 0 1.0 0 0 .5 0 0 .0 0 0 .0 0 0 .2 0 0 .4 0 0 .6 0 0 .8 0 1.0 0 OUTPUT UNCERTAINTY 1.40 1.20 1.00 0.80 0.60 OR 0.40 0.20 0.00 0.00 0.20 0.40 0.60 0.80 1.00 AP 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 0.00 0.20 0.40 0.60 0.80 1.00 H Instructor: Dr. J. Rene van Dorp Session 5 - Page 84 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Eagle Airlines Case: Simplified Approach Sensitivity Analysis on Probabilities From Tornado Diagram it follows that critical variables are: Occupancy Rate Operating Cost Hours Flown Charter Price Decision Variable STEP 1: Develop an Uncertainty model for variables over which one has no control Occupancy Rate Operating Cost Hours Flown UNCERTAINTY MODEL Operating Cost Occupancy Rate Hours Flown Instructor: Dr. J. Rene van Dorp Session 5 - Page 85 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Uncertainty Model Operating Cost: $253 (p) Operating Cost $237 (1-p) Uncertainty Model (Occupancy Rate, Hours Flown): Occupancy Rate - Flights Cancelled - Hours Flown 650 (r) 45% (q) Hours Flown 900 (1 - r) Occupancy Rate 650 (s) 55% (1-q) Hours Flown 900 (1 - s) r = Pr(Low Hours | Low Occupancy Rate) s = Pr(Low Hours | High Occupancy Rate) Low hours when occupancy rate is low is more likely than Low hours when occupancy rate is high. Assumption: s = 0.8 r, p=0.5 Instructor: Dr. J. Rene van Dorp Session 5 - Page 86 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Incorporate Uncertainty Model in Eagle Airlines Decision: Max Profit 650 (r) - $ 9725 45% (q) Hours Flown 900 (1 - r) - $ 4225 $253 (0.5) Occupancy Rate 650 (0.8 r) $ 6525 55% (1-q) Hours Flown 900 (1 - 0.8 r) Purchase Plane Operating Cost $ 18275 650 (r) 45% (q) $ 675 Hours Flown 900 (1 - r) $ 10175 $237 (0.5) Purchase Decision Occupancy Rate 650 (0.8 r) $ 16925 55% (1-q) Hours Flown 900 (1 - 0.8 r) $ 32675 Do not Purchase Plane, Earn 8% on $52500 $ 4200 STEP 2: Assess sensitivity of purchase decision to q and r. Express EMV(Purchase) in terms of q and r EMV(Purcha se) 0.5q 9725r 4225(1 r ) (1 - q)6525(0.8r ) 18725(1 0.8r ) 0.5 * q675r 10175(1 r ) (1 - q)16925(0.8r ) 32675(1 0.8r ) or EMV(Purcha se) q(3500r - 22500) - 11000r 25475 Instructor: Dr. J. Rene van Dorp Session 5 - Page 87 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making For what values of q and r is "buying the plane" worse than "putting money in the savings account" EMV(Purcha se) 4200 or q(3500r - 22500) - 11000r 25475 4200 or q 11000r - 21275 3500r - 22500 Draw graph of values of q and r such that one is indifferent between is "buying the plane" and putting money in the savings account" q r 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 q 0.95 0.93 0.91 0.89 0.88 0.86 0.84 0.82 0.80 0.78 0.76 0.74 0.72 0.70 0.68 0.66 0.63 0.61 0.59 0.56 0.54 11000r - 21275 3500r - 22500 1.00 0.90 Savings Account B 0.80 0.70 0.60 q 0.50 A 0.40 0.30 0.20 Purchase Plane 0.10 0.00 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 r EMV(Purchase) = 25475 for r=0, q=0 Instructor: Dr. J. Rene van Dorp Session 5 - Page 88 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen EMGT 269 - Elements of Problem Solving and Decision Making Two Way Sensitivity Analysis for Three Alternatives Read and study pages 169 - 172 and answer the following question. PROBLEM DESCRIPTION In trying to make an investment a decision analyst draws the following decision tree. The decision analyst is not sure of his assessment of the probability p or q. When pressed, he says he is sure that 0.3 p 0.7 and 0.1 q 0.4, but he is not sure of the actual values. Can he make the decision? PROFIT Outcome 1 20,000 (p) Option A Option B Outcome 2 (q) 2,000 Outcome 3 (0.2) -8,000 Outcome 1 (p) Outcome 2 (q) Outcome 3 (0.2) Option C 8,000 6,000 -2,000 5,000 Instructor: Dr. J. Rene van Dorp Session 5 - Page 89 Source: Making Hard Decisions, An Introduction to Decision Analysis by R.T. Clemen