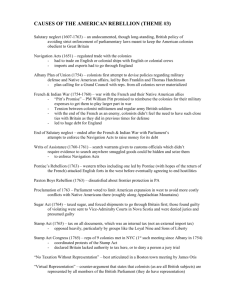

Taxes and Acts of Britain Powerpoint

advertisement

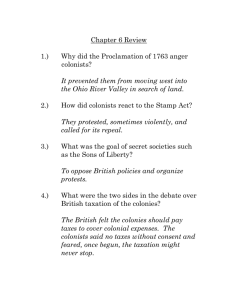

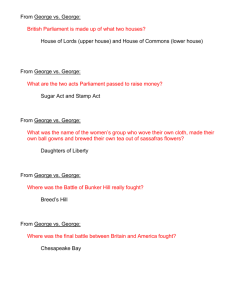

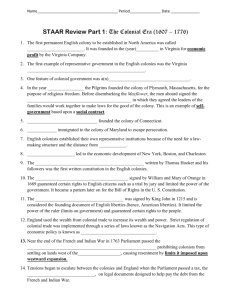

Name: ________________________________________ Class: ____________________ Period: _________________ The American Revolution: Taxes, Trade, and Acts Mercantilism The American colonies provided various _______________ that would be shipped to _______________ for manufacture into saleable products, which would be sold to the _______________ and others around the world. _______________ was the _______________ system whereby an empire’s colonies would provide _______________ for the mother country, increasing the empire’s _______________ and _______________. Why was it important for the British to treat the American colonies with equal respect? How do governments raise revenue? Internal vs. External Taxes “Internal Taxes”: _______________ paid by the colonists to Britain on goods _______________ the colonies itself, on intercontinental trade Instead of supporting the _______________ economy, the revenue was to go directly to the _______________ government. “External Taxes”: Tariffs These duties affected the price of _______________, but weren’t _______________ paid by the colonial consumer Their function was to ___________________________ ___ trade Colonial Opinions The colonists were _______________ with tariffs, accepting the need to regulate trade. The colonists were _______________ with “internal” taxes. _______________ believed that the _______________ government was acting outside of its authority by issuing direct taxes when they did not even have a single member representing the colonies Parliament (Hence the famous slogan, “___________________________________________ _______ ________ __.”) Major Taxation Acts Sugar Act (1764) Stamp Act (1765) Townshend Acts (1767) Tea Act (1773) Coercive (aka “Intolerable”) Acts (1774) Sugar Act (1764) Imposed new duties on imported _______________, _______________, _______________, _______________, and _______________. _______________ the duty already set for imported Caribbean _______________ (an important product for the thriving New England rum industry). Molasses was commonly _______________, not legally imported, because that was more _______________. The British hoped that by _______________ the tariff on molasses, they would cut into the _______________ business, which in turn would upset the _______________, _______________, and slave trades which depended on it. Stamp Act Levied a tax on almost every form of paper good in the colonies: _______________, _______________, _______________, _______________, etc. Enormously popular in _______________; enormously unpopular in the _______________. What types of people would have been annoyed by this tax? Since it was so _______________, the Stamp Act angered _______________ from all different levels of society. _______________ and colonists _______________ British goods. _______________ railed against the tax, mass meetings were held in protest of the tax, petitions were sent to Britain, and rioting and mob violence against stamp distributors spread, organized by the “Sons of Liberty,” of which Samuel Adams was a founder. Stamp Act In response to colonial pressure, Parliament _______________ the _______________ a year after it was passed, but also issued the _______________, which affirmed the supremacy of Parliament to govern the colonies “in all cases whatsoever.” Townshend Acts Placed new tariffs on _______________, _______________, _______________, and _______________. This was done to both raise _______________ and counter the colonial objection to “_______________” taxation. It increased the annual revenue for these products from £2,000 to £45,000, but this only amounted to 1/10th of the annual cost of maintaining the British army in America. Like the Sugar and Stamp Acts, the _______________ Acts sparked colonial protests and boycotts. Lord Frederick North, who succeeded George Grenville as PM, _______________ the Townshend Acts, as the British were spending _______________ money enforcing them than they gained from the taxes themselves. The _______________ was the only exception. Tea Act Parliament granted the ______________________________ a monopoly on colonial tea imports to save the EIC from bankruptcy by allowing it to sell its surplus to the colonists at a reduced cost – it _______________ the tax on tea. Britain believed that the colonists would embrace the cheaper tea, and still bring in revenue from the tax; instead, colonists at several ports refused the tea shipments, again complaining that a tax on tea at all was unjust. In protest, patriots in Boston disguised as _______________ disposed of £10,000 worth of _______________ in the fabled “_____________________________ .” This relatively overblown protest outraged Parliament. Coercive (Intolerable) Acts In response to the mounting colonial protests of British tax policy, capped off by the Boston Tea Party, Parliament passed a ______________________________ to crack down on disorder in the colonies. Boston’s ports were to be closed until the ruined tea was paid for. MA’s government was altered to bring it under the control of the British; a royal governor (and military general, Thomas Gage) was appointed rather than through election by the colonial legislature. Royal officials charged with capital offenses in one colony were to be tried in England or a different colony (to avoid a hostile local jury). Privately-owned buildings could be taken for use as barracks for British soldiers. In addition to taxation, colonists were also frustrated with other British policies: Private residents were bound to quarter British soldiers, which the British claimed was necessary for their protection. Suspected smugglers had to submit to invasive search and seizure and jury-less vice-admiralty courts. A Final Note on Taxation It is important to remember that these taxation acts mainly angered the colonial elite – wealthy merchants, lawyers, and politicians – not the average colonial citizens, who considered themselves loyal British citizens. Nevertheless, the Stamp Act was thought by many colonials (and by some historians today) to be a poor decision, given how many people it alienated relative to how little money it raised. The issue with all of these Acts was not the taxes alone, (some were lowered) but the idea that Britain thought it had a right to directly tax the largely self-sufficient American colonists at all. As a member of the colonies, pick one act that would anger you the most and explain why you chose this act. Be specific and include logical reasons!