Race & Law template - Corporate Crime Reporter

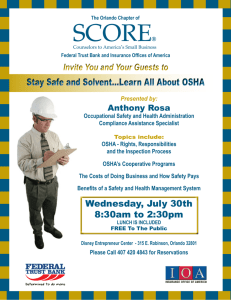

advertisement