Child Tax Credit

advertisement

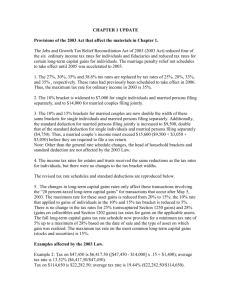

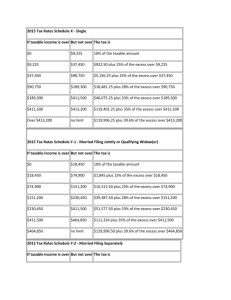

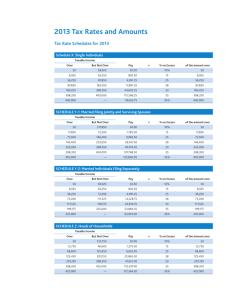

CHAPTER 11 UPDATE Provisions of 2003 Act that affect the materials in Chapter 11. The 2003 Act made four major changes that affect the material in this chapter: (1) the married couple filing jointly standard deduction was increased; (2) tax rates were reduced and certain tax brackets widths were adjusted; (3) the AMT exemption amounts for individuals were increased and (4) the child tax credit was increased. Although not specifically addressed in this chapter, the change in the taxation of most dividends received by individuals affects the determination of the total tax liability. Standard Deduction The standard deduction for married couples filing joint (and surviving spouses) is now $9,500 for 2003 (up from $7,950). This amount is double the standard deduction for single individuals and married persons filing separately. This standard deduction is scheduled to remain at double the single rate for 2004. After 2004, the standard deduction for married couples will fall to 180% of the standard deduction for single individuals and then rise gradually until it is again double the single deduction in 2009. There is no change in the 2003 standard deductions for single persons, married persons filing separately or heads of household, nor for the additional standard deductions for age and blindness. The revised table of standard deductions for 2003 follows: Revised Standard Deductions for 2003 Filing Status Single (Unmarried) Individual Head of Household Married Filing a Joint Return Surviving Spouse (Qualifying Widow or Widower) Married Filing a Separate Return Dependent (or if larger, earned income plus $250) Basic $4,750 7,000 9,500 9,500 4,750 750 Additional (For each instance of blindness or age 65) $1,150 1,150 950 950 950 Example A: Clyde and Sara are married and file a joint tax return. Clyde is 67 years old and Sara is 62 and legally blind. Their standard deduction for 2003 is $11,400 ($9,500 + $950 + $950). Clyde and Sara would not have to file a tax return until their taxable income equaled or exceeded $16,550 ($9,500 + $950 [for age only] + $3,050 + 3,050). Tax Rate Changes There are two types of changes to the tax rate schedules for 2003—actual rate changes and bracket adjustments. Rates of 25%, 28%, 33%, and 35% replace the old 27%, 30%, 35% (2% rate reductions) and 38.6% (a 3.6% rate reduction). The 10% and 15% rates remain unchanged but certain 10% and 15% tax brackets are broadened. For single individuals and married persons filing separately, the 10% tax bracket is broadened to 0 to $7,000 from 0 to $6,000. (The 15% bracket width is narrowed by the $1,000 increase, however, to $7,000 to $28,400.) Thus, every person in this filing status with income of at least $7,000 will realize a $50 reduction in taxes ($1,000 x [15% 10%]). Their remaining bracket widths remain unchanged. Married persons filing joint have their 10% tax bracket broadened to 0 - $14,000 (from 0 to $12,000), double that of single persons. In addition, their 15% bracket is broadened to double that of singles and married persons filing separately, that is, to $14,000 to $56,800. Their 25% bracket is narrowed, however to accommodate the broadening of the 10% and 15% brackets. Their remaining bracket widths remain unchanged. The 10% and 15% bracket widths for married persons filing jointly remain twice those of single persons in 2004. They are reduced to 180% of the single brackets in 2005 gradually broadening again until they are double these brackets in 2008. The tax bracket widths in Schedule Z for heads of households have not been adjusted. Thus, heads of household only benefit from the general rate reductions for brackets above 15%. The complete revised tax rate schedules for 2003 appear below: Revised Tax Rate Schedules for 2003 Schedule X— Single If taxable income is: Not over $7,000 Over $7,000 but not over $28,400 Over $28,400 but not over $68,800 Over $68,800 but not over $143,500 Over $143,500 but not over $311,950 Over $311,950 Tax liability is: 10% of taxable income $700.00 + 15% of the excess over $7,000 $3,910.00 + 25% of the excess over $28,400 $14,010.00 + 28% of the excess over $68,800 $34,926.00 + 33% of the excess over $143,500 $90,514.50 + 35% of the excess over $311,950 Schedule Y-1—Married Filing a Joint Return If taxable income is: Tax liability is: Not over $14,000 10% of taxable income Over $14,000 but not over $56,800 $1,400.00 + 15% of the excess over $14,000 Over $56,800 but not over $114,650 $7,820.00 + 25% of the excess over $56,800 Over $114,650 but not over $174,700 $22,282.50 + 28% of the excess over $114,650 Over $174,700 but not over $311,950 $39,096.50 + 33% of the excess over $174,700 Over $311,950 $84,389.00 + 35% of the excess over $311,950 Schedule Y-2—Married Filing Separately If taxable income is: Tax liability is: Not over $7,000 10% of taxable income Over $7,000 but not over $28,400 $700.00 + 15% of the excess over $7,000 Over $28,400 but not over $57,325 $3,910.00 + 25% of the excess over $28,400 Over $57,325 but not over $87,350 $11,141.25 + 28% of the excess over $57,325 Over $87,350 but not over $155,975 $19,548.25 + 33% of the excess over $87,350 Over $155,975 $42,194.50 + 35% of the excess over $155,975 Schedule Z—Head of Household If taxable income is: Not over $10,000 Over $10,000 but not over $38,050 Over $38,050 but not over $98,250 Over $98,250 but not over $159,100 Over $159,100 but not over $311,950 Over $311,950 Tax liability is: 10% of taxable income $1,000.00 + 15% of the excess over $10,000 $5,207.50 + 25% of the excess over $38,050 $20,257.50 + 28% of the excess over $98,250 $37,295.50 + 33% of the excess over $159,100 $87,736.00 + 35% of the excess over $311,950 Example B: John and Marsh have $100,000 of taxable income in 2003. Under the 2003 Law, their income tax is $18,620 ($7,820 + .25 [$100,000 - $56,800]). Under prior law, their tax would have been $20,706 ($6,517.50 + .27 [$100,000 - $47,450])—a $2,086 reduction in their income taxes. Example C: Assume John and Marsha each have $50,000 of taxable as single individuals. Each will pay a tax of $9,310 ($3,910 + .25[$50,000 - $28,400])—or one-half the tax of the married couple filing jointly with $100,000 of income. The combination of the increased standard deduction and the doubling of the 10% and 15% bracket widths alleviate the marriage penalty for lower income taxpayers. Because the brackets above 15% are not double the single taxpayer bracket widths for married couples, the marriage penalty has not been completely erased. The new dividend rate of 10% (5% for taxpayers in the 10% or 15% tax brackets) affects the calculation of the tax liability. Example D: Assume John and Marsha (Example 2) have $5,000 of dividend income as part of their $100,000 of taxable income. Now their tax liability is $17,870 ($7,820 + .25 [$95,000 - $56,800] + [$5,000 x .10])—an additional reduction in taxes of $750 ($18,620 - $17,870). Example E: Clara is single and has $30,000 of total taxable income, $4,000 of which is from dividends. Clara’s total income exceeds the 15% bracket but her nondividend income is within the 15% bracket. Thus, some of her dividend income is taxed at 5% and the rest is taxed at 10% as follows: $28,400 (15% bracket limit) - $26,000 = $2,400 taxed at 5% or $120 $30,000 - $28,400 = $1,600 taxed at 10% or $160 Her total tax is $700 + [.15 ($26,000 -$7,000) + $120 + $160 = $3,830. Alternative Minimum Tax Exemption To prevent certain unsuspecting individual taxpayers (for example, taxpayers with a large amount of itemized deductions relative to their income) from being subject to the alternative minimum tax (AMT), the AMT exemption amount was increased to $58,000 for joint filers ($29,000 for married persons filing separately) and $40,250 for single filers for 2003 and 2004. The exemptions revert to their original $45,000 and $33,750 in 2005, however. No changes were made in the alternative minimum tax rates for individuals or the AMT income thresholds at which the exemption amount is phased out. Due to the increased exemptions, however, the income at which the exemption is fully phased out has increased. The revised table of alternative minimum tax exemptions follows: Revised Alternative Minimum Tax Exemptions Filing Status Exemption Threshold at which exemption phase out begins AMTI at which exemption is fully phased out Married Filing Jointly Married Filing Separately Head of Household Single $58,000 29,000 40,250 40,250 $150,000 75,000 112,500 112,500 $382,000 191,000 273,500 273,500 Child Tax Credit The final provision of the 2003 Law affecting this chapter is the increase in child tax credit from $600 to $1,000. No other changes were made to this credit, however, other than the $400 tax credit increase. Thus, the phase-out provisions remain unchanged at $50 for every $1,000 (or part thereof) that AGI exceeds $110,000 for married taxpayers filing jointly ($55,000 for single persons). Due to the increased credit, however, taxpayers whose AGI previously prevented their benefiting from the credit may now be allowed a partial credit. The advance payments of $400 per child based on taxpayers who were eligible for the 2002 credit is bound to add complexity to the 2003 filing year for taxpayers for whom the number of eligible children changed between 2002 and 2003. In addition, the increased tax credit does not benefit taxpayers at or near the poverty level because their taxes are too low to take tax advantage of the credit, which is nonrefundable. Congress may yet adjust the credit provisions for 2003 to provide an increased credit for those lowincome taxpayers, however. Example F: Gina and Joe have 2 children eligible for the child tax credit. Their AGI is $32,000 and they use the standard deduction. Their taxable income is $14,300 ($32,000 $9,500 – 4 x [$3,050]). Their gross tax liability of $1,195 ($700 + .15 [$14,300 $7,000]). The old $600 credit per eligible child would have reduced their tax to zero; thus, they do not benefit from the increased credit. Example G. Stuart and Margaret have one child, 6 years of age and they have and AGI of $125,000. Under the old law, they got no benefit from the child tax credit. ($125,000 - $110,000 =$15,000 $15,000/1,000 x $50 = $750 $1,000 - $750 = $250 available credit. Introductory Case: Amy and Steve are in the 25% marginal tax bracket and their standard deduction for 2003 is $9,500. They remain better off postponing the closing until 2004. Their $13,800 in itemized deductions is only $4,300 greater than their standard deduction. Their additional tax savings are only $1,075 ($4,300 x .25). Examples affected by the 2003 Law. Example 5: Susan is in the 25% marginal tax bracket; her tax liability is reduced by $250; the $250 is the credit equivalent of her $1,000 deduction. Marie is in the 35% marginal tax bracket; her tax liability is reduced by $350; the $350 is the credit equivalent of her $1,000 deduction. Example 13: John is in the 35% marginal tax bracket. The $3,050 dependency exemption reduces his taxes by $1,068 ($3,050 x .35). John is better off by $68 taking the exemption in exchange for $1,000 additional child support paid. Example 21: The couple’s total standard deduction is $12,350 ($9,500 + $950 + $950 + $950). Example 36: Jennie’s gross income tax liability is $7,445 as head of household. $5,207.50 + .25 ($47,000 - $38,050) = $5,207.50 + $2,237.50 = $7,445 Filing as surviving spouse, her tax liability is $6,350. $1,400 + .15 ($47,000 - $14,000) = 41,400 + $4950 = $6,350. Example 37: George’s tax on $45,000 of regular income is $8,060 ($3,910 + .25 ($45,000 – $28,400). His tax on the capital gains is $1,500 ($10,000 x .15). His total tax liability is $9,560. The alternative capital gains rate saves George $1,000 ($10,000 x [25%- 15%]). Example 38: Carol and John’s child tax credit is $1,300 ($2,000 for two eligible children less the $700 reduction). Example 43: $3,267 in the last paragraph should be $3,286. Example 45: Sonja’s $40,250 exemption is reduced by the $5,000 to $35,250. Problems affected by the 2003 Law. Problem numbers: 21, 27 (The answer to this problem does not change if Craig includes his dividend income in investment income. If he does this, however, he cannot use the reduced income tax rates for dividend income, but must include dividends as ordinary income as under prior law.) 32, 37, 40, 60, 62, 63, 65 (capital gains rate of 15%)