Listed Company Information V.S. INT'L

advertisement

Listed Company Information

V.S. INT'L<01002> - Results Announcement

V.S. International Group Limited announced on 18/03/2006:

(stock code: 01002 )

Year end date: 31/07/2006

Currency: HKD

Auditors' Report: N/A

Interim report reviewed by: Both Audit Committee and Auditors

Note

Turnover

:

Profit/(Loss) from Operations

:

Finance cost

:

Share of Profit/(Loss) of

Associates

:

Share of Profit/(Loss) of

Jointly Controlled Entities

:

Profit/(Loss) after Tax & MI

:

% Change over Last Period

:

EPS/(LPS)-Basic (in dollars)

:

-Diluted (in dollars)

:

Extraordinary (ETD) Gain/(Loss)

:

Profit/(Loss) after ETD Items

:

Interim Dividend

:

per Share

(Specify if with other

:

options)

B/C Dates for

Interim Dividend

Payable Date

B/C Dates for (-)

General Meeting

Other Distribution for

Current Period

B/C Dates for Other

(Unaudited )

Current

Period

from 01/08/2005

to 31/01/2006

('000

)

715,532

63,313

(24,475)

(Unaudited )

Last

Corresponding

Period

from 01/08/2004

to 31/01/2005

('000

)

619,721

40,219

(24,554)

(2,973)

(403)

N/A

35,464

+178

0.0426

0.0420

N/A

35,464

NIL

N/A

12,741

N/A

: N/A

: N/A

: N/A

: N/A

%

0.0146

N/A

N/A

12,741

NIL

N/A

Distribution

: N/A

Remarks:

Note 1 :

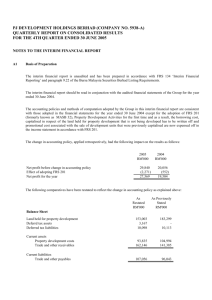

Basis of preparation

This interim financial report has been prepared in accordance with the

applicable disclosure provisions of the Rules Governing the Listing of

Securities ("Listing Rules") on The Stock Exchange of Hong Kong Limited

("Stock Exchange"), including compliance with Hong Kong Accounting

Standard ("HKAS") 34 "Interim financing reporting" issued by the Hong Kong

Institute of Certified Public Accountants ("HKICPA").

This interim financial report has been prepared in accordance with the

same accounting policies adopted in the annual financial statements for

the year ended 31 July 2005, except for accounting policy changes that are

expected to be reflected in the annual financial statements for the year

ending 31 July 2006. Details of these changes in accounting policies are

set out in note 2.

The preparation of an interim financial report in conformity with

requires management to make judgements, estimates and assumptions

affect the application of policies and reported amounts of assets

liabilities, income and expenses on a year to date basis. Actual

may differ from these estimates.

HKAS 34

that

and

results

This interim financial report is unaudited, but has been reviewed by KPMG

in accordance with Statement of Auditing Standards 700, "Engagements to

review interim financial reports", issued by the HKICPA.

The financial information relating to the financial year ended 31 July

2005 that is included in the interim financial report as being previously

reported information does not constitute the Company's statutory financial

statements for that financial year but is derived from those financial

statements. Statutory financial statements for the year ended 31 July

2005 are available from the Company's registered office. The auditors

have expressed an unqualified opinion on those financial statements in

their report dated 23 September 2005.

Note 2 :

Changes in accounting policies

The HKICPA has issued a number of new and revised Hong Kong Financial

Reporting Standards ("HKFRS", which terms collectively includes HKASs and

Interpretations) that are effective or available for early adoption for

accounting periods beginning on or after 1 August 2005. The Board has

determined the accounting policies to be adopted in the preparation of the

Group's annual financial statements for the year ending 31 July 2006, on

the basis of HKFRSs currently in issue.

The following sets out further information on the changes in accounting

policies for the annual accounting period beginning on 1 August 2005 which

have been reflected in this interim financial report.

(a)

Summary of the effect of changes in the accounting policies

(i)

Effect on opening balance of total equity at 1 August 2005 (as

adjusted)

The following table sets out the adjustments that have been made to the

opening balances at 1 August 2005. These are the aggregate effect of

retrospective adjustments to the net assets as at 31 July 2005.

Effect of new policy (increase/(decrease))

Retained Capital and

Minority

Note

profits other reserves Total

interests

Total

equity

Prior period adjustments:

HKFRS 2

Equity settled share-based

transactions

2(d) (689)

689

-

-

-

HKAS 17

Leasehold land and buildings

held for own use

2(b) (1,082) (110,179)

(111,261) (111,261)

------------------------------------------------------------------Total effect at 1 August 2005

(1,771) (109,490)

(111,261) (111,261)

===================================================================

(ii)

Effect on profit after taxation for the six months ended 31

January 2006 (estimated) and 31 January 2005 (as adjusted)

In respect of the six month - period ended 31 January 2006, the following

table provides estimates of the extent to which the profits for that

period are higher or lower than they would have been had the previous

policies still been applied in the interim period, where it is practicable

to make such estimates.

In respect of the six month - period ended 31 January 2005, the table

discloses the adjustments that have been made to the profits as previously

reported for that period, in accordance with the transitional provisions

of the respective HKFRSs.

Effect of new policy (increase/ (decrease))

Note

For the six months ended

31 January 2006

Equity holders Minority

of the Company interests Total

For the six months ended

31 January 2005

Equity holders Minority

of the Company interests Total

HKFRS 2

Equity settled share-based

transactions

2(d)

(1,114)

-

(1,114) -

-

-

HKFRS 3

Amortisation of goodwill

2(e)

137

-

137

-

-

-

HKAS 17

Leasehold land and buildings

held for own use

2(b)

966

966

------------------------------------------------------------------------Total effect for the period

(977)

(977)

966

966

==========================================================================

Effect on earnings per share:

- basic (cents)

(0.12)

0.12

- diluted (cents)

(0.12)

0.12

Effect on amounts recognised as capital transactions with owners for the

six months ended 31 January 2006 (estimated) and 31 January 2005 (as

adjusted)

In respect of the six month - period ended 31 January 2006, the following

table provides estimates of the extent to which the amounts recorded as

capital transactions with owners are higher or lower than they would have

been had the previous policies still been applied in the interim period,

where it is practicable to make such estimates.

In respect of the six month - period ended 31 January 2005, the table

discloses the adjustments that have been made to the amounts recorded as

capital transactions with owners as previously reported for that period,

in accordance with the transitional provisions of the respective HKFRSs.

Effect of new policy (increase/ (decrease))

For the six months ended

For the six months ended

31 January 2006

31 January 2005

Equity holders Minority

Equity holders Minority

Note

of the Company interests Total of the Company interests Total

HKFRS 2

Equity settled share-based

transactions

2(d)

2,364

2,364 -------------------------------------------------------------------------Total effect for the period

2,364

2,364 ==========================================================================

(b)

Leasehold land and buildings held for own use (HKAS 17, Leases)

In prior years, leasehold land and buildings held for own use were stated

at revalued amounts less accumulated depreciation and accumulated

impairment losses. Revaluation surpluses or deficits were normally taken

to the land and buildings revaluation reserve.

With the adoption of HKAS 17 with effect from 1 August 2005, the leasehold

interest in land held for own use is accounted for as being held under an

operating lease where the fair value of the interest in any buildings

situated on the leasehold land could be separately identified from the

fair value of the leasehold interest in the land at the time the lease was

first entered into by the Group, or taken over from the previous lessee,

or at the date of construction of those buildings, if later.

Such leasehold land will no longer be revalued. Instead, any pre-paid

land premiums for acquiring the land leases, or other lease payments, are

amortised on a straight line basis over the lease term. If the property

is in the course of development or re-development, or the property is

otherwise being used in the production of inventory, the amortisation

charge is included as part of the costs of the property under development

or other inventory. In all other cases the amortisation charge for the

period is recognised in the income statement immediately.

Any buildings held for own use which are situated on such land leases

continue to be presented as part of property, plant and equipment.

However, with effect from 1 August 2005 the buildings are also stated at

cost less accumulated depreciation, rather than at fair value, to be

consistent with the new policy required to be adopted for the land

element.

(b)

Leasehold land and buildings held for own use (HKAS 17, Leases)

The new accounting policies have been adopted retrospectively, with the

opening balances of retained profits and the land and buildings

revaluation reserve and the comparative information adjusted for the

amounts relating to prior periods as disclosed in note 2(a) and the

consolidated statement of changes in equity. In respect of the six months

ended 31 January 2006 it is not practicable to estimate the extent to

which the profits for that period, or the income or expenses taken

directly to equity, are higher or lower than they would have been had the

previous policy still been applied in the interim period.

(c)

Financial instruments (HKAS 39, Recognition and measurement of

financial instruments)

In prior years, bills receivable were derecognised in the financial

statements upon settlement or when discounted with financial institutions.

Upon the adoption of HKAS 39 with effect from 1 August 2005, discounted

bills receivable should not be derecognised where the Group retains

substantially all risks and rewards relating thereto and the corresponding

proceeds should be recognised as a liability.

The new accounting policy has been applied prospectively in accordance

with the transitional arrangement under HKAS 39. As a result, comparative

amounts have not been restated.

(d)

Employee share option scheme (HKFRS 2, Share-based payment)

In prior years, no amounts were recognised when employees (which term

includes directors) were granted share options to subscribe for shares in

the Company. If the employees chose to exercise the options, the nominal

amount of share capital and share premium were credited only to the extent

of the option's exercise price receivable.

With effect from 1 August 2005, in order to comply with HKFRS 2, the Group

recognises the fair value of such share options as an expense in the

income statement or as an asset, if the cost qualifies for recognition as

an asset under the Group's accounting policies. A corresponding increase

is recognised in a capital reserve within equity.

Where the employees are required to meet vesting conditions before they

become entitled to the options, the Group recognises the fair value of the

options granted over the vesting period. Otherwise, the Group recognises

the fair value in the period in which the options are granted.

If an employee chooses to exercise options, the related capital reserve is

transferred to share capital and share premium, together with the exercise

price. If the options lapse unexercised, the related capital reserve is

transferred directly to retained earnings.

The new accounting policy has been applied retrospectively with

comparatives restated in accordance with HKFRS 2.

(e)

Amortisation of positive goodwill (HKFRS 3, Business combinations)

In prior periods, positive goodwill which was amortised on a straight line

basis over its useful life and was subject to impairment testing when

there were indications of impairment.

With effect from 1 August 2005, in accordance with HKFRS 3 and HKAS 36 "

Impairment of assets" the Group no longer amortises positive goodwill.

Such goodwill is tested annually for impairment, including in the year of

its initial recognition, as well as when there are indications of

impairment. Impairment losses are recognised when the carrying amount of

the cash generating unit to which the goodwill has been allocated exceeds

its recoverable amount.

The new policy in respect of positive goodwill has been applied

prospectively in accordance with the transitional arrangement under HKFRS

3. As a result, comparative amounts have not been restated.

(f)

Minority interests (HKAS 1, Presentation of financial statements

and HKAS 27, Consolidated and separate financial statements)

In prior years, minority interests at the balance sheet date were

presented in the consolidated balance sheet separately from liabilities

and as a deduction from net assets. Minority interests in the results of

the Group for the period were also separately presented in the income

statement as a deduction before arriving at the profit attributable to

shareholders.

With effect from 1 August 2005, in order to comply with HKAS 1 and HKAS

27, minority interests at the balance sheet are presented in the

consolidated balance sheet within equity, separately from the equity

attributable to the equity holders of the Company, and minority interests

in the results of the Group for the period are presented on the face of

the consolidated income statement as an allocation of the total profit or

loss for the period between the minority interests and the equity holders

of the parent.

The presentation of minority interests in the consolidated balance sheet

for the comparative period has been restated accordingly.

Note 3 :

Segment reporting

Segment information is presented in respect of the Group's business and

geographical segments. Business segment information is chosen as the

primary reporting format because this is more relevant to the Group in

making operating and financial decisions.

(i)

Business segments

The Group comprises the following main business segments:

Plastic injection moulding

: manufacture and sales of plastic

moulded products and parts

Assembling of electronic products: assembling and sales of electronic

products, including processing fees generated from assembling of

electronics products

Mould design and fabrication

: manufacture and sales of plastic

injection moulds

Turnover from

external customers

Plastic injection

moulding

For the six months

ended 31 January

2006

2005

(restated)

$'000 $'000

Assembling of

electronic products

For the six months

ended 31 January

2006

2005

(restated)

$'000 $'000

568,897 489,713

======= =======

97,819 89,081

======= =======

Segment results

79,872

Depreciation and amortisation

for the period

23,942

Turnover from

external customers

Segment results

Unallocated

operating income

and expenses

Profit from operations

Finance costs

Share of losses

of associates

Income tax

59,417

7,825

7,416

23,981

8,843

7,365

Mould design

and fabrication

For the six months

ended 31 January

2006

2005

(restated)

$'000 $'000

Consolidated

For the six months

ended 31 January

2006

2005

(restated)

$'000 $'000

48,816 40,927

======= =======

715,532 619,721

======= =======

10,478

98,175 77,355

10,522

(34,862)(37,136)

---------------63,313 40,219

(24,475)(24,554)

(2,973) (403)

(401) (2,521)

----------------

Profit after taxation

Depreciation and amortisation

for the period

3,995

Unallocated

Depreciation

and amortisation

35,464 12,741

======= =======

2,867

36,780 34,213

3,651 5,080

--------------40,431 39,293

======= =======

Note 4 :

Profit before taxation

Profit before taxation is arrived at after charging/(crediting):

For the six months ended

31 January

2006

2005

$'000 $'000

(a)

Finance costs:

Interest on bank advances repayable within five years

Interest on bank advances repayable over

five years

Interest on loan from a substantial shareholder

Finance charges on obligations under finance leases

Total borrowing costs

Less: Borrowing costs capitalised as

construction in progress *

22,879 16,075

415

857

978

791

1,067

--------------24,527 18,535

(679) (523)

--------------23,848 18,012

Exchange (gains)/losses

(575) 5,299

Other charges

1,202 1,243

--------------24,475 24,554

===============

* The borrowing costs have been capitalised at an average cost of

borrowings to the Group of 5.70% (2005: 4.95%) per annum for construction

in progress.

For the six months ended

31 January

2006

2005

(restated)

$'000 $'000

(b)

Other items:

Processing fees

Amortisation of interest in leasehold land

held for own use under an operating lease

Depreciation

- owned assets

- assets held under finance leases

Operating lease charges in respect of properties

Amortisation of goodwill

Impairment losses for doubtful debts (reversed)/charged

Provision for slow moving inventories

Loss on disposal of fixed assets

Interest Income

Rental Income

8,546

7,930

211

211

37,891 36,467

2,329 2,615

4,324 6,187

137

(214) 1,080

1,675 1,700

4,585 9,536

(2,922) (1,213)

(1,353) (728)

===============

Note 4 :

Earnings per share

(a)

Basic earnings per share

The calculation of basic earnings per share is based on the profit

attributable to shareholders of $35,041,000 (2005 (restated): $11,933,000)

and the weighted average number of 822,323,000 (2005: 820,000,000) shares

in issue during the six months ended 31 January 2006.

(b)

Diluted earnings per share

The calculation of diluted earnings per share is based on the profit

attributable to equity holders of the parent of $35,041,000 and the

weighted average number of ordinary shares of 833,459,000 after adjusting

for the effects of all dilutive potential ordinary shares under the

Company's share option scheme.

There were no potential dilutive ordinary shares in existence during the

six months ended 31 January 2005.