Hydro Ottawa EDR Manager's Summary

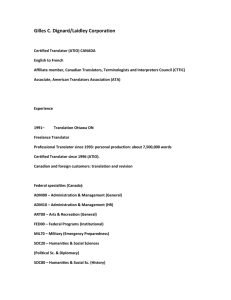

advertisement