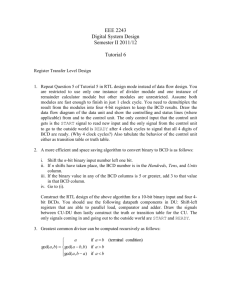

Comments/Student Answers

advertisement

ANTITRUST SPRING 2008 FINAL EXAM: COMMENTS & BEST STUDENT ANSWERS QUESTION I: Professor’s Comments: As we discussed at length, the exact parameters of the §2 conduct requirement are not clear. The courts struggle with the conduct requirement because of the tension between (i) wanting to encourage monopolies to compete rather than stagnate; and (ii) wanting to limit the harms to the market caused by monopoly power. This question was an opportunity for you to discuss how to balance these competing goals. To make the case for legal intervention stronger than in, e.g., Trinko, I gave you an unregulated market without any high-tech components and a defendant with a long-standing monopoly and some history of bad conduct. This problem was harder than I intended because many students had trouble seeing the economic consequences of BarBri’s actions. A. Conduct at Issue/Economic Consequences: The trial court found that the new BarBri pricing policies were exclusionary and decreased the market shares of CCC & LJL. It was helpful to examine why the court characterized the policies as it did and why the decline in market share might have occurred. You also might have discussed, as we did with the earlier BarGreed problem, whether the two aspects of the pricing policy should be considered together. 1. Increase Last Minute Prices & “Increase Discount”: Normally raising a price does not result in increased market share, so why might it have done so here? One possibility is that many consumers are sufficiently irrational or uninformed that marketing the price increase as creating a “larger discount” would attract them, even though the discounted price remained the same.1 Another possibility is that consumers saw the larger last minute price as creating a larger risk for them if one of the newer companies failed. 2. 20% Increase in Deposit: Again, on its face, this looks like a price increase (more money spent now and less later). Could it have driven some consumers to CCC and LJL? Sure. However, fewer consumers were likely switch after paying the deposit because the cost of changing your mind was now higher. B. What I Was Looking For: 1. Approaching the Problem: The language and structure of the problem should have led you to do each of the following: At least in your majority opinion, you should have tried to articulate and defend a rule (or test or standard) for when monopolists can engage in non-predatory business conduct. Between the two opinions, you should have discussed the pros and cons of three outcomes considered by the lower courts (no remedy/enjoin pricing policies/enjoin non-refundable deposits). 1 Almost half of you misread the problem and discussed the significance of BarBri lowering prices to meet competition. I would have hoped that my repeated promise not to make you address predatory pricing on the exam might at least have encouraged you to reread the problem to make sure of the facts. 1 In each opinion, you should have tried to refute the strongest arguments on the other side, including those raised by the lower courts and any additional arguments you raised in the other opinion. 2. Substantive Discussions: To address the question here, you basically could have used any of the analytic tools we talked about in the course: statutory, economic & practical considerations as well as case analysis. Among the more relevant topics: a. General §2 Standards: You might have discussed application of the Grinnell test: There is no superior product (the competitors had bar passage rates that were better than or equal to BarBri’s). Are the new policies “business acumen” or “willful maintenance” of monopoly power. You also might have worked with some of the Court’s general language about §2 from Aspen or Trinko. b. Trinko & United Shoe Machinery (USM): USM endorsed enjoining a monopolist’s business practices that were efficient in the short run, but tended to reinforce the monopoly in the long run. That arguably is true of the non-refundable deposit here. Many of you dismissed the tension between USM and Trinko by distinguishing Trinko as simply a case about a heavily regulated business. While this is plausible (and what I would expect many lower courts to do), you had an opportunity to describe for the Supreme Court how much of USM survives the broad language of Trinko (suggesting that a monopolist can engage in business practices to help it compete) and whether there are circumstances where enjoining efficient practices is still permitted. c. IBM; Berkey Photo, etc.: You might have discussed the extent to which the Supreme Court would adopt the analysis in these lower court cases and how the cases would apply to the problem. C. Common Problems: The Court says it is going to address the conduct requirement of the monopolization cause of action. You need not list the other elements of the claim and you should not discuss attempt to monopolize or any possible §1 claims at all. When you are given findings of fact about market definition and market power, don’t revisit these issues (especially when you are supposed to be addressing conduct). As far as I know, there are no significant network effects to bar review courses. Their value to an individual consumer does not increase if more people purchase it. Question 1: Best Student Answer: This answer showed a solid sense of what’s at stake in the problem. The proposed rule is an interesting idea and barriers to entry are a good focus in general. I liked addressing the two aspects of the policy separately, although the discussion of discounts doesn’t directly address the fact that prices rose. The dissent is a little less strong. Although it contains useful arguments, they are a bit overstatedin places and some of the points come close to arguing with the factual findings. Majority: We are all aware that perfect competition takes place only very rarely and usually only for a short time period. Markets constantly change and monopolies develop and disappear again. However, we are concerned with monopolies when they exclude competition. Therefore, we hold that monopolies are only allowed to engage in non-predatory business practices to strengthen their market position if these practices do not raise barriers to entry. Additionally, measures have to be taken in monopolistic markets to reduce barriers to entry. Therefore, business practices that 2 erect or strengthen barriers can be prohibited. We reverse the Court of Appeals decision and prohibit non-refundable deposits for bar review courses for the VBE. Monopoly Power: Monopoly power can be derived from a high market share. However, market share alone is not enough. With barriers to entry, a monopolist can raise prices without fearing the competitors will enter the market. Without barriers to entry, even a high market share does not demonstrate market power. Syufy. Barriers to entry: Although the Sherman Act does not aim to achieve monopoly, monopolies because of business acumen, superior product or historic accident are not unlawful. Innovation would be frozen if every company has to fear being punished because of inventing a new and superior product. In so far as this creation of legitimate monopolies is concerned, we cannot change anything. What we can do is to influence the barriers to entry. If barriers to entry are erected in a market, our task is to reduce them as far as possible to make competition possible again. The dissent ignores this when it condemns our action as inappropriate intervention into a market. The Sherman Act wants to give a market the possibility to function. By adjusting barriers to entry, the court does not artificially intervene into a market to fight a lawful monopolist but to enable competition. Here, the dissent ignores the fact that competition only started when the state intervened by changing the VBE requirements. Otherwise CCC & LJL wouldn’t have had the possibility to enter the market. As the district court found, there are significant barriers to entry. Economies of scale, Barbri’s reputation and non-refundable deposits. As we can’t change the first two, we have to intervene when barriers are erected artificially. Conduct: It is not easy to determine whether conduct is legitimate business conduct or exclusionary (a means to acquire or maintain monopoly power). Therefore, we discuss the conduct here in detail: Discounts for Early purchase: The district court held that the increased discounts for early sign-up were exclusionary. We disagree. The facts do not tell us enough about this. The only facts we know is that LJL’s prices are similar to BarBri while CCC is 15% cheaper than Barbri. We don’t know about discounts given by CCC and LJL if discounts were given at all. We also don’t know from the facts how much the price for sign-ups less than 6 months before the test increased. We further don’t know how many students sign up early and how many take time until the end to decide which bar review to take. These facts are significant as they might show that Barbri was able to have greater discounts because of its market power. See Barbri. Having to decide the case with the facts at hand, the following is revealed: Barbri was a monopolist before 2000 when the VBE was changed. Following the change, two new entries were possible: LJL and CCC. According to the growing market share, there was competition in Vetter. Barbri decided to react to this decline in market share. If reputation is important and LJL’s and CCC’s passing share were not smaller than Barbri’s, pricing can be a means to distinguish itself from competitors. Exclusionary conduct can be prohibited if a competitor refuses to do business with a competitor. Aspen. It can also be exclusionary, if a monopolist anticipates and forestalls demand. Alcoa. In this case, Barbri faced a declining market share and two new competitors with a similar or even higher bar exam success rate. Therefore, it seems that Barbri just reacted to the competition it faced and made a lawful business decision to stop the decline of its share. This cannot be regarded as conduct needed for a §2 claim. Even a dominant player in the market is allowed to compete if it faces competitors. IBM. Therefore, the price structure is a business decision that makes Barbri attractive to customers but that does not raise any barriers to entry. 3 Non-refundable deposit: Exclusionary conduct that does not have a positive impact on customers and that impairs competition, is prohibited. Aspen. The Court of Appeals held that United Shoe Machinery was overruled by Trinko. We disagree. Trinko can be clearly distinguished from United Shoe. In Trinko a comprehensive regulated scheme was given to decide when a refusal to deal was justified. To declare a refusal to deal invalid under these special circumstances is inappropriate as it is regulated. In United Shoe we declared long-term leases as exclusionary dealing. It seems to be the same in the case at hand: A non-refundable deposit binds a law student to a bar review even if he/she regrets the decision later on. Increasing this amount 20% makes the decision even more severe. As switching was costly before, it becomes even more expensive. From the perspective of a competitor, the barrier to entry is high at first, students sign up and pay the amount for the bar review only 2 years later as that high upfront costs are given. Secondly, the students are almost always tied to an existing bar review. Therefore, the non-refundable deposit is an artificial barrier to entry. The dissent ignores that these artificial barriers are the main means to exclude competitors. Although students are interested that the costs for the bar review doesn’t increase, a refundable deposit erases this barrier and makes competition more likely. Therefore, nonrefundable deposits as artificial barriers are not legitimate business practices. Reversed. Dissent: I do not think that an artificial intervention into this market promotes competition. Therefore I would affirm the lower court’s decision. Barriers to entry are a real problem when considering a monopolistic market. Barriers can encourage a dominant company to raise prices and undertake other means to exclude competitors. However, not all barriers can be influenced. High upfront costs, long development time and other points must be taken as given in certain markets. Distinguishing between artificial and nonartificial barriers to entry blurs the reality. If a company buys almost all resources for a product, its competitors face the problem of how to get the resources to be able to enter the market. This is also an artificial barrier. What should be done? Does this company have to share because it’s difficult to get the resource? Under which circumstances can we do that and under which circumstances can’t we do that? The differentiation of artificial and non-artificial barriers does not help to solve the problem. The case shows that competition is possible as there was competition in Vetter. The passing rates of LJL and CCC were the same or better than Barbri’s. In a market where reputation is important, two new players got 26% in 3 years. That is competition. By just changing the price structure, Barbri stopped the decline of its market share. Why did a price change lead to such big changes? We do not know how LJL and CCC reacted or what the cost structure is, but it seems likely that they did not react appropriately to Barbri’s attack although they might have been able to do so. There is no showing that LJL and CCC couldn’t do anything to stop the decline of their market share. Thus, an intervention in a market where competition seems to work to a limited degree is artificial and inappropriate. The decisions made by Barbri were business decisions: how do we stop the decline? Legitimate business decisions should not be attacked by a court playing firefighter for enhancing competition without knowing exactly where the fire is. Thus, even monopolists are free to do everything to face competition and strengthen their position as long as the practices are not illegitimate. IBM. Therefore, I respectfully dissent. Question 2: Professor’s Comments: Most students did pretty well on this question. The model answers are both solid if unspectacular. In addition to the analysis discussed below, I thought the question was an opportunity to talk about whether curriculum decisions in higher education should be subject to antitrust scrutiny, which only a couple of students raised. 4 A. Market Definition/Power: Many students did not do very much exploration of the product market issues here, which I thought were pretty interesting. I didn’t think the geographic market was particularly relevant here because, even if you were sure you wanted to practice in Vetter, you could get a satisfactory degree at law schools outside the state, some of which even offered courses in Vetter law. 1. RACs/RACs in Vetter Law (VRACs): Because a relatively limited number of schools would be interested in either producing or purchasing courses in Vetter Law, VRACs are almost certainly a separate product from RACs in general. You might have discussed the effects of the agreement on both VRACs and non-state law RACs. Assessing the market is somewhat complicated because law schools decide whether to give credit for other school’s RACs and pay the fees, but individual students take the courses and presumably create the demand for them. Thus, you might measure RAC market share in terms of the number of schools that give credit or in terms of the number of students who are enrolled. At least during 2006-07, the BCD schools sold nearly all the VRACs that were purchased. There was room for an extended Syufy-type discussion of whether BCD had as much power as this apparent monopoly would suggest. You might have talked about barriers to entry, the ease with which S recaptured some market share the following year, and the supply-side substitutability (schools could always offer Vetter law courses themselves as ordinary courses). 2. Law Schools As with the Microsoft problem, I thought there was an interesting issue here of whether the important effects of the agreement would arise in the market for law schools. This is a complex market to define, because applicants choose among law schools for a variety of reasons. Some law schools are the equivalent of BMWs, which generally don’t compete with Kias. However, for some significant group of students, geography is very important, and they’ll apply to both BMW and Kia schools in the same location. E.g., some students apply both to UM and to Ivy League schools, and some even choose us over them. Other schools apply to both UM and St. Thomas, treating the latter as a “safety school.” However, I suspect almost nobody applies to both St. Thomas and Ivy League schools. In any event, prestige law schools probably have some degree of market power and one might view the Agreement as helping BCD cement their prestige status relative to the rest of the Vetter law schools, particularly S. 3. Recurring Problem of Overlapping Terminology: Antitrust “markets” (which consist of one or more producers of a product or service) are not necessarily the same as Sales & Marketing “markets” (which consist of groups of consumers). Sales executives for a soft drink company might ask, “Is there a market for pineapple soda?” By this, they would mean something like, “Are there a sufficient number of consumers who would purchase pineapple soda to make it worthwhile to manufacture the product?” However, an antitrust lawyer defining soft drink markets is very unlikely to view pineapple soda as a separate product market absent strong evidence that enough consumers viewed it as not interchangeable with other fruit sodas that it could be priced separately. Similarly, although in the sales & marketing sense, there is a “market” for, e.g., courses in Vetter Criminal Procedure, these courses are unlikely to be a product market unto themselves. B. Conduct at Issue (Restraint of Trade): There were a number of different ways to characterize the relevant conduct in the problem. I primarily was looking for discussion of boycotts and market division, but also gave credit for solid analysis of the other possibilities noted below. You might characterize the agreement as a joint venture. Although no new business entity was formed, BCD effectively are pooling resources to jointly market the RACs they produce. However, outside of the boycott context and Texaco, we really didn’t cover special rules for joint ventures, so I wasn’t looking for you to focus on that possible characterization. 5 1. Boycotts: There were two different possible boycotts to discuss, both of which look like Prototype II and should have led you to employ NWWS and discuss how to address the unclear relationship between the factors made relevant in that case. You also might have discussed ways in which the case is parallel to those involving standard-setting agencies. a. Refusal to Include S in Jt. Venture: i) Per Se v. Rule of Reason: Room for discussion of all three NWWS factors: BCD may have market power Being part of the joint venture doesn’t seem necessary since S was able to sell by lowering prices Arguably efficiencies since pro-competitive to do quality control screening ii) Harm to Competition: Not strong case for S because it was able to compete some and, like VISA problem, allowing S in would have left no competition. Also the exclusionary effects of the agreement could be due to better quality of BCD product. b. Refusal to Give Credit for Outside VRACs i) Per Se v. Rule of Reason: market power and necessary to doing business as above, plus S was only doing business with B beforehand. Efficiencies is more problematic; hard to see why blanket exclusion is necessary to protect the joint venture. ii) Harm to Competition: Forecloses access to large fraction of possible buyers, although BCD were unlikely to buy lots of VRACs even before the agreement. Law students want the product (which might lead to discussion of whether they are relevant consumers). Might be harm to law school market as well as VRACs market. 2. Market Division: BCD divided up the products they’d produce. Because the division is part of a larger project and because BCD are both producers and consumers of VRACs, this looks more like Topco than like Palmer. You might have discussed: whether some of the BMI/NSPE analysis might apply to market divisions, particularly efficiencies from dividing up the labor. Note that the fact that some new technology is involved doesn’t turn RACs into a new product (they existed before the agreement) or into a practice with which the court is unfamiliar (See Maricopa County). whether the distribution of labor within a joint venture might be presumptively legal (like pricing in Topco) whether there is any harm to consumers (no immediate price increase; output seems to be greater than before agreement) 3. Other Characterizations of 2005 Agreement a. Output Restriction: Total output is not restricted (they’ll sell all VRACs to all schools), so limitations better analyzed as market division. b. Tying: This is always true to some extent in higher education. If you want a UM degree, either have to take UM courses or courses elsewhere approved by UM. To show a cause of action, would need to show that RACs are separate product from law school generally. Might analogize to Kodak and see as sort of aftermarket. Otherwise, probably no market power. c. Price-Fixing: There seems to be profit-pooling & a division of fees that doesn’t depend on number of students taught. If this is a joint venture, OK (Texaco) Also might get to RoR under BMI because ancillary to agreement to divide production and jointly market. 6 d. Predatory Pricing: No evidence price to outsiders below costs. Price to each other is not zero, but barter for other school’s RACs. (Again, I said I wouldn’t test this topic) Question 2: Student Answer #1: [This answer contains some strong two-sided analysis and a solid sense of the economic significance of the practices. However, there also is a little bit of confusion/overlap about legal categories and no discussion of market division.] Section 1 of the Sherman Act recognizes that all contracts in some way restrain trade. The analysis that courts must engage in is whether or not such a contract restrains trade unreasonably. In this case, the actions under consideration are those of 3 companies engaged in a Prototype II Boycott (Joint Venture(JV)). Here this issue is which conduct by a JV might be a §1 violation. Per Se v. ROR: As a threshold matter, it should be noted that this case would most likely not be adjuged using the per se standard. The per se standard is applied in cases where the challenged action is so anticompetitive on its face, that no reasonable justifications for the action may be presented. It is important to decide per se vs. ROR because if certain actions are judged under Per Se, the P only need prove that the conduct took place to win the case. NWWS (not a JV but a group boycott case) has presented a test to adjudge whether a boycott should be adjuged under such a standard (1) does the D have market Power; (2) did the JV completely cut off resources necessary to conduct business; (3) no plausible economic efficiences. Because many of these topics are discussed infra the most relevant concern is whether or not the D has market power. Here, not clear if BCD possess market power, prob depends on market definition. If market definition is all law school classes, then clearly no market power. However, fairly clear that RAC is a separate market; in this case teaches only Vetter topics, taught from a video screen, seperate from other classes, less personal interaction with professor. Might have market power if demonstrated that its RACs were the only ones bought after a certain period of time, but not clear from facts. Lastly, barriers to entry are interesting because to become player in market, have to basically get agreements from the other schools that they will accept your RACs. JV like this exclude players from the market by refusing to accept other RACs, and will eventually shrink market, so market power is prob. bigger than market share currently indicates. [MAF: This is a nice point]. However, even if there is market power, not necesarilly determinitve of ROR vs. Per Se. Still have to look at whether the JV cut off resources necessary to conduct business. Did not do this here- S could still conduct business once it lowered price. Also, JV here does have efficiences (infra). Should not be judged under per se, judged under ROR. Now question becomes, under ROR, what conduct discussed here would be a violation of S.1? (1) No Longer giving credit to other RACs from other law schools if same RAC available within JV: Not giving credit to other RACs means that BCD have cut off their students’ ability to participate in those classes and have excluded a competitor from the market. Evidence that students from these schools want at least one RAC offered by S (Prof. Kenny's class). In Aspen (even though §2 monopoly case, exclusive conduct still similiar to unreasonable conduct here) [MAF: good quick explanation for using §2 case], Court found that because D’s actions excluded a service that people wanted (skiing Highlands) the action was anticompetitive. Here, BCG cut off access to a good that its consumers (students) want. Also, although didn't give credit for all classes, did give credit for aforementioned particular class. Evidence that before JV, the schools were willing to engage in business with excluded participant. Type of action that excludes one school from market unreasonable because doesn't allow students the freedom to take RACs from other schools that they could benefit from and is evidence that before JV, would have given credit for at least one class. With the bar exam difficulty going up, unreasonable to restrict student's ability to get the best class that they can in a certain area. [MAF: Nice point re bar exam.] 7 However, at the same time, no necessity for a JV to do business with rivals (Visa). If BCD sees RACs from other schools as rivals, then unless their actions completely cut off all access to the market, prob. reasonable under §1. (NWWS). Furthermore, the agreement states that BCD will not give credit for RACs that it itself offers. Argument that this type of activity is OK bc for example, highly unlikely that law school X would give credit to another student to take Crim Pro at Law School Y if the course is offered at Law School X. Schools don't let you take classes that they offer themselves because certain schools (and especially BCD which are the three highest ranked schools in Vetter) worry about the quality of the class that you are taking somewhere else. Also, if you attend UM (higher rankes than NOVA for example) and NOVA has one really good class, but it is also offered at UM, doubtful that credit would be transfered regularly. Furthermore, two of the JV players did not individually give credit from the excluded school in the first place (even though did for one class), but appears that generally did not like to give RAC credit from inferiror schools and Browder never did, even before the JV. Evidence that they truly believed that the RACs from such schools are "inferior" to their own education. Actions of saying that you can't take a class from another law school if it is offered there is on its own most likely ok under §1 because of the unique set up of law schools and the class structure of generally not giving credit from another school if your school offers that class. OTOH, could be §1 claim bc access to product was cutoff by the JV. This behavior in long run could make it very difficult for competitors to do business by raising the barriers to entry. By not accepting other RACs raises barriers because there is a dependency in the field of allowing other schools to accept the RAC for credit- students won't take the class without credit. Thus, if three big players as a policy won't accept your RAC, then makes entry into market very difficult from other law schools trying to offer RAcs. Makes conduct more likely to lose under §1 by raising barriers. (2) Giving its students free access to course/charging outside students: [MAF: Not a major issue, but some nice analysis here] BCD made enrollment in their RACs free. Some courts hold that such pricing patterns that tend to exclude over time a player in the market can be unreasonable (again §2 analysis, but still applies here for unreasonable behavior). The free pricing of the RAC courses makes students less likely to go take another RAC somewhere else, even if not offered at BCD. Student would prob wait until a semester that certain RAC course was offered to take it at BCG. Makes it difficult to imagine that a student would give money on top of their tuition to take a class somewhere else if the school offered it for free. Important, especially if students are parttime and pa yper credit b/c can decide where to divy their money more easily, and if can get courses for free at their own school, won't go elsewhere to get course. Also evidence that before the courses became totally free at their own schools, students DID choose to get the RAC from another school if it was good enough. Lastly, no evidence that BCD teachers are "better" or "more effective" than other inferior schools. Making prices free at their own school pretty much guarantees that students will not go outside to sign up for RACs no matter how good they are at other schools, and eventually students will stop petitioning for outside courses. However, the students at the prestigious law schools involved in the JV are already paying enough tuition and unreasonable to think that PT students paying per credit make up large portion of student body. Here, JV is simply looking out for the student body at their respective schools by allowing their own students to take classes offered there for free (presumably included in tuition). No evidence that before the JV the schools charged extra for RACs taught there. If this was the case, then there could be evidence that giving free RACs is part of a scheme to totally exclude for no practical efficiencies (naked restraint). However here, plausible explanations for free RACs is that BCG wants its students to take the best course generally and the highest ranked schools could arguably have the better teachers. Giving their students free RACs guarantees the best education for their students, and not charging students for the classes prob does not indicate a §1 violation, without evidence that before the JV they charged students, and are only giving their students free classes purposfully to exclude Shafrir from the market. 8 (3) Efficiencies as a defense to conduct/aggregation: Given that it is unclear whether or not the above actions constitute a §1 violation, want to look at actual outcome of 2005 agreement and the plausible efficiencies therein. Evidence of efficiencies (got together and decided who would teach what) so that there was no overlap or wasting of resources. Allowed for the most popular RACs to be kept and presumably, least effective ones to be changed or thrown out. Second, the efficiencies here arguably allow students at these schools to benefit from the best teachers in the State. OTOH, there is an indication that students (the consumers) did not want such a restriction, and therefore ask, is this a naked restraint? Not necessary for function of the industry (BMI). No reason that BCD could not allow S to be part of the RACs class offerings, if only in the one class that students actually asked for. The blanket restraint of outside classes while students were still asking for certain classes from other schools indicates the restraint is naked and for no reason but to stifle outside competition. However, also evidence that (1) there is a legitimate business justification for the actions and (2) those "excluded" from the JV could still participate in the market. First, the legitimate business justification is that BCD are the three top ranked law schools in Vetter, and so would want to pool resources because arguably their students will be at the same intellectual level. Second, when S lowered its prices, it still got clients. Furthermore, the clients were the schools that are grouped together at the "bottom" of the Vetter rankings, meaning that their students may be better suited to work together. OTOH, the overwhelming evidence indicates that the students at BCD still wanted at least one RAC from the "lower ranked" S, indicating that the consumers did not care about this. Important fact bc makes restraints look like they have no efficiencies except to exclude. In sum, this action is probably OK given the nature of the market. The three top private schools in a region have no reason to want to deal with the lower schools, aside from one class being offered that their students want. At the same time, they have no reason to exclude this one class other than to restrain trade unreasonably. Ultimatly, the set up of the agreement would in the aggregate prob. be OK under §1 because of the unique market and the fact that Shafrir could still compete even without help from the JV. Question 2: Student Answer #2: [This answer had the best market analysis, doing a nice job utilizing the student’s understanding of how law school works. There is also some pretty solid work on the particular types of conduct]. Sherman Act §1 violation: (1) Agmt or concerted action that (easily proven in this instance by the "2005 Agmt" which involves three entities); and (2) Unreasonably restrains trade (will be discussed below by showing conduct that had negative impact on the market) Market Def'n: The geographic market could be broadly defined as Vetter b/c of the difficulty of the bar exam there or it could be defined more narrowly for each campus. Defining narrowly also makes sense b/c students start selecting courses once they get to campus not beforehand (for the most part). Furthermore, if a remote class isn't offered there is room on a campus for anyone to come in and offer the course (demonstrating supply-side subsitution). Students will not drive to other campuses for a remote course - this defeats the whole purpose of getting a remote course. However, by looking at the way the entities that make the courses view the market it appears they look across the wide spectrum of places they can sell their product and do not choose to limit themselves. Therefore, the market will be defined more broadly as Vetter. The product market: The market should be limited to solely remote access and not regular classes because they offer different things to the consumer: students (yes administrators are the ones who contract for the programs but likely after deciding what students’ wants/desires are), and serve different functions 9 - Remote access courses can be taught at several schools by one person at the same time. This is not the case for normal lecture style coures - Remote access allows students to be taught by the preeminent person in a field (i.e. Karen Kenny) even if they do not attend the school where that professor teaches; with regular courses you are more than likely locked into the classes and profs at your school, save the occasional visiting prof but these individuals are not enough to alter the market - Students might select their school based on what profs teach at a certain school, but they would not make a decision based on what remote access classes are offered b/c you likely only take them for big bar classes that you might not have that much interest in. For something you are really passionate about, say Space Law, you would want to go to school where THE Space Law prof is. [MAF: Hard to tell because so many profs frequently seem to do space law.] - Schools probably view the regular and remote as different. For instance, many schools limit the number of courses you can take at other schools and transfer to your home school. Similarly it is likely administrators would weigh remote access classes and regular classes differently and limit the number of remote access that you could take Thus, students seek out the product of remote access law school courses in a way different than they seek out regular law school courses, administrators likely value them differently and therefore remote access is its own product BC&D's Market Power: The parties that entered the 2005 Agmt have 50% of the students who are seeking JDs at their schools. Based on the facts, it is not entirely clear to how many other schools in Vetter are using their product, Rouhani and Grant might also be, which would give BC&D 75% of the market, leaving Shafrir with 25%. Therefore, it is somewhat debatable whether they have sufficient market power in the relevant market but it will be assumed. Territorial Restraint: By dividing up the responsibility for teaching courses and specifically what courses are taught, the members of the joint venture have created the equivalent of a territorial restraint. While territorial restraints typically speak to geography, not how courses are broken up, the impact is the same in this instance --> each member is granted a monopoly in their course for the semester as each member agrees not to compete in the others' submarket. These restraints violate the AT laws when they have the "purpose and ...the effect of raising" prices. Palmer. Similar to Palmer, the parties here have agreed to who can do what where, meaning which school can teach what course and when that course will be offered. The parties have also made clear that they will split profits from selling to other schools, similar to the arrangement made between the dfts in Palmer. However, the 3 charged the same price that had been the prevailing market price so they might be able to defeat a claim that the JV had the purpose and effect of raising prices. Had the parties not made this agmt to split and grant monopolies, each would have to had to charge their own fee, letting the markets take care of finding the appropriate price based on students demand for specific courses. The territorital restraint in this instance might be saved by the fact that the 3 did not charge students on their own campus a fee for the courses and therefore were able to pass along the efficiencies from having a JV with a territorial restraint. However, this would require the JV get to rule of reason analysis and territorial restraints have typically been found to be per se illegal but the efficiency argument might be enought to get the JV to ROR analysis. [MAF: This would be a good place to discuss whether BMI applies to market division] Prototype II Boycott - Joint Venture (JV): BC&D have entered into a joint venture which is not on its face illegal but can become so when the venture's actions make it such that being in the venture provides such a leg up in the relevant market that someone's failure to be included means 10 they cannot participate in the relevant market. Here, S could claim that the Exclusion from B, C & D's campuses & Refusal to Deal w/Shafrir were boycotts. In order for S to bring a claim against the JV for refusing to deal with it, it will have to show that being part of the JV was necessary for competition in the relevant market. It is clear that S has been harmed by not being in the JV as it relates to B, C and D's campuses. This represents 50% of the market. On the one hand, a court may say that S still has access to the other 50% of the market but it also appears B,C &D's actions have impacted S's ability to compete in that 50%. 1) S had to alter its marketing materials and can no longer say its product is used by some of the best schools (likely hurts ability to compete b/c people want the product that is not only the best but also the product that is used by the person they consider to be the best in their same field); 2) Initially, S lost even more market share to B, C & D and could only recoup that lost market share by substantially lowering prices and thereby losing profits. S's potential claim against the JV is benefited by the evidence that students at B & D want S's course back. An inference can be drawn that not providing S's course does not have to do with a procompetitive reason b/c procompetitive reasons typically do not include depriving the consumers of the product they want. Limitation on output: The JV has placed a limitation on output as they decide specifically what courses will be taught each year. Were they not in a JV, it is likely that each campus might produce their own product. This limitation probably has an impact on the price they are able to charge for the courses b/c based on the facts it appears that only the JV's product and S's product are available in Vetter. If there were four courses per subject (B, C, D & S) competition would increase and the price would have a greater likelihood of being set by the market. 11