FAIS - Bankseta

advertisement

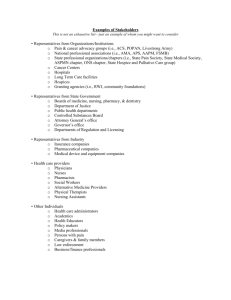

FAIS LEARNING GUIDE MODULE 2 LESSON 5 Inter-Bank Compliance Training Project Sponsored by BANKSETA Representatives Topics: 1 2 3 4 Differences between KIs and Representatives Relationships: The FSP, KIs and Representatives Fit and Proper and the Representative Restrictions and conditions B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 INTRODUCTION Link A Representative is a person representing a FSP under contract of employment or any other mandate (ie mandatory) in rendering services or giving advice in relation to a Financial Product. A “mandatory” could be a temporary member of staff, a casual, a consultant or an outsourced person amongst others. Representatives need not be licensed under FAIS. However, due to the fact that they work for an FSP who is licensed, they need to comply with the fit and proper requirements and be listed in the FSP’s Representatives Register. Relevance to you You no doubt, presently represent your organisation in some way. In your interaction with clients, what do you feel encourages your clients to have more confidence and trust in you and your organisation? What do you think makes a great Representative? Note down your thoughts here and bear them in mind as you work through this lesson. Learning outcomes This lesson covers four important issues that have a direct impact upon a Representative’s activities in the organisation: 1 Distinguish between a Key individual and a Representative 2 Describe the relationship between the Representative and the FSP and the Representative and a KI 3 Specify how the Fit and Proper requirements impact on the Representative 4 Explain the restrictions and conditions under which a Representative may operate. Page 2 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #1 DIFFERENCES BETWEEN KIS & REPRESENTATIVES L/O#1 Distinguish between a Key Individual and a Representative. Key Individual versus Representative The following table highlights the key differences between these important individuals. Representative Key Individual The Key Individual Is the person responsible for managing or overseeing the activities of the FSP whenever they offer any financial service in relation to a financial product. The Representative Is the person who interacts directly with the client, and offers financial services for or on behalf of the FSP in connection with a financial product. Is a senior executive appointed by the FSP based upon qualification and experience in a specific financial product category. Is appointed by the FSP based upon qualification and financial product expertise. Is appointed by the FSP based upon management and financial product expertise. Is appointed by the FSP based upon financial product expertise. Uses management skills, product knowledge and codes of conduct to ensure that the business is run ethically and that the client is treated fairly. Uses product knowledge, skills and codes of conduct to ensure that the client is ethically treated in terms of understanding both client’s needs and financial products. Page 3 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #1 DIFFERENCES BETWEEN KIS & REPRESENTATIVES – cont. Key Individual versus Representative cont. The Key Individual Can be a director, manager, partner, etc. The Representative Can be an employee or a mandatory. KIs need to satisfy the Registrar that they comply with the Fit and Proper requirements. The FSP must be satisfied that the Representative meets the Fit and Proper requirements and is competent and qualified to act on their behalf. Page 4 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #2 RELATIONSHIPS: THE FSP, KIs & REPs L/O #2 Describe the relationship between the Representative and the FSP and the Representative and a KI. Relationship The boxes below indicate the relationship between the Representative and the FSP as well as the relationship between the Representative and the Key Individual. FSP Licenced Employs Representatives Appoints Key Individuals. Key Individual Responsible for the actions of Representatives Can be anywhere in the country Does not change Representatives’ reporting structure Is Fit and Proper. Line manager / Supervisor Manages the Representatives. Representatives Works for the FSP Is Fit and Proper Reports to Line Manager / Supervisor May be an employee or mandatory. Apply the learning to your environment Place yourself into this diagram. Think about it in terms of your own bank. How do you see these relationships impacting upon your activities? What do you see as the key differences between a Representative relationship with a KI and with a line manager? Page 5 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #3 FIT AND PROPER AND THE REPRESENTATIVE L/O #3 Specify how the Fit and Proper requirements impact on the Representative. Link A common thread that runs through each module in this course is the need to meet Fit and Proper requirements. Fit & Proper: Impact on Representative A Representative has to comply with the Fit and Proper requirements laid down by FAIS. This means that the Representative needs to meet requirements of Honesty and Integrity Competence for the financial product(s) s/he is representing. Broad consequences the FAIS imposes conditions and restrictions if the Representative does not meet the Fit and Proper requirements. The table below takes you through broad conditions and their consequences. If A person does not meet minimum Fit and Proper requirements. Then That person is prohibited from functioning as a Representative. A person only meets the minimum Fit and Proper requirements. That person has a specific period of time in which to attain the next level of competence. Circumstances change for a person who is a Representative so that the “Fit and Proper” status is in question. That Representative must declare the changed circumstances to the FSP. Page 6 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #4 RESTRICTIONS AND CONDITIONS L/O #4 Explain the restrictions Representative operates. Link There are checks and balances in place which regulate FSPs, KIs, financial products, etc. Representatives are no exception. and conditions under which a The restrictions and conditions, under which the Representatives operate, form part of these checks and balances. Representatives: Restrictions and Conditions Representatives: May only represent a FSP Must maintain their Fit and Proper status Must provide clients with a certified copy of their authority to act on behalf of the FSP if requested to do so. May not act as a Representative once debarred. Tip: If your responsibilities as a Representative take you out of the office, you’ll need to carry a certified copy of your authority. FSPs: Have to be satisfied that their Representatives are Fit and Proper Must check that their Representatives comply with the relevant codes of conduct Must maintain an up to date register of all Representatives and their current Fit and Proper status Must debar a representative who no longer complies with and/or breaches any aspect of FAIS. Page 7 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #4 RESTRICTIONS AND CONDITIONS Debarment: A definition In this context, debarment means that a Representative is prohibited from performing his/her duties. Debarment is a serious step to take. It means that once the Representative’s name is removed from the FSP register s/he may no longer act as a Representative. The FSB must be notified within 30 days and will maintain records of such debarments. Debarment A Representative can be debarred if s/he: No longer complies with the Fit and Proper requirements Has contravened or failed to comply with any provision of FAIS. Debarment: FSP’s Responsibilities Every FSP’s KI must at all times be satisfied that Representatives are competent to act on its behalf. The Representative must meet Fit and Proper requirements and adhere to the various codes of conduct. In particular, the FSP must view very seriously information related to: Any infringement by the Representative of FAIS Any failure by the Representative to comply with any part of FAIS. Page 8 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 L/O #4 RESTRICTIONS AND CONDITIONS Consequences of debarment If a Representative is debarred, then the FSP must act in terms of the debarment requirements. If The Representative’s change of circumstances means that s/he is no longer Fit and Proper. If a Representative is debarred Apply the learning to your environment Then The FSP must remove the Representative from the register (debar the Representative), and must notify the FSB within thirty days. The FSP must: Prohibit the Representative from offering any new financial service, by withdrawing any authority to act on its behalf Take immediate steps to ensure that the debarment does not prejudice the interests of the clients Conclude all of the Representative’s unfinished business with clients Inform the Registrar that the Representative’s name has been removed from the register, within the prescribed time limit. By now you have a broad understanding of the impact that FAIS has upon your work in a financial institution. Within your context, what might prompt the FSP to debar a Representative? Page 9 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 CONSOLIDATION Summary This is the end of the lesson on the Representatives of FSPs. You should now be able to explain that a Representative: Is an employee or mandatory of the FSP Operates under the FSP’s license Is responsible to the KI for their actions in the course and scope of their work Must produce a certified copy of the FSP’s license to clients, when necessary Must comply with the Fit and Proper requirements of FAIS Can be debarred from the register of Representatives if they contravene or fail to comply with any provision of the FAIS Act. Apply the learning to your environment Page back to the thoughts you noted down on page 1 of this lesson. What are your views now of an excellent representative? Have your ideas changed? Page 10 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 ASSESSMENT Test your knowledge & understanding Answer these short questions to test your knowledge and understanding of this material. Choose the right answer. Question 2.5.1 A Representative: a Can be a temporary, a casual, a consultant or an outsourced person b Is responsible for attaining and maintaining their “Fit and Proper” status for each product that they deal with c Is a person who renders a financial service to a client on behalf of a FSP d Is listed on the FSPs register of representatives. 2.5.1.1 2.5.1.2 2.5.1.3 2.5.1.4 2.5.1.5 Question 2.5.2 All of the choices are true None of the choices are true Choices (a) and (b) are true Choices (a) and (c) are true Choices (b) and (c) are true. A representative uses product knowledge, skills and codes of conduct to: a Sell as many products as possible to a client b Earn as much commission as possible to increase their bonuses c Ensure that the client is ethically treated in terms of understanding both client’s needs and financial products d Ensure that clients understands the advice and makes an informed decision. 2.5.2.1 2.5.2.2 2.5.2.3 2.5.2.4 2.5.2.5 All of the choices are true Choices (a) and (b) are true Choice (b) and (d) are true Choices (c) and (d) applies None of the choices are true. Page 11 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Representatives Module 2: Lesson 5 ASSESSMENT Statement 2.5.3 True/False? Ms Basson, who was a personal banker, accepts a position in the training department. She can stay on the FSP’s register as a representative. 2.5.4 Mr Radebe is found guilty of mismanagement of funds. He is debarred as a representative. His employer, ABC Bank, must contact all his clients and inform them that Ms Dube, who is a qualified representative, will take over all his accounts. 2.5.5 Ms Dube often travels to see clients in their offices. She does not have a document authorising her to act on behalf of ABC Bank at the office. This is not a problem. Page 12 Learner guide Developed by Gray Training 011 472 3516 Jan 2004