Econ 2000 - Supply and Demand Section

advertisement

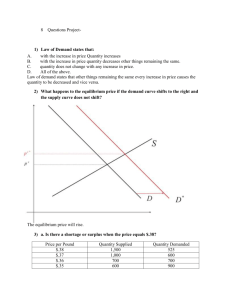

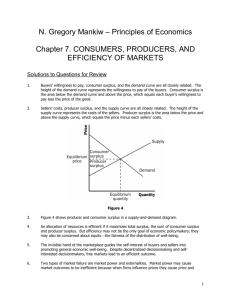

Econ 2000 - Supply and Demand Section: Applications and Extensions Slide 1-4: Intro We are another step up in climbing the economic mountain and the next step is the Supply and Demand one which students in this class often consider to be the hardest so make sure you stay with me and keep coming to class because I will take you through it step by step. Slide 5: Law of demand This just means that when the price goes up, the quantity demanded goes down (and when price goes down the quantity demand goes up). You already know this! We read graphs like we read everything else in this country, from left to right. So a downward sloping curve (running down hill) means that when one goes up the other goes down. (ex. GPA and hours partying or GPA and hours smoking illegal substances). Slide 6: Deriving the demand curve Ex. Poll the class about the amount of pizzas they would buy if a large pizza is $8, $10, $12, $15, $20 Ex. Kashi Honey Almond Flax Cereal Price Quantity Demanded $4.50 0 $4.00 1 $3.50 2 $3.00 3 $2.50 4 Graph: P D Q 1 Slide 7: The Demand Curve Another way to think of it is that the height of the demand curve represents the marginal value derived by the consumption of that unit (marginal value of consumption is equal to the maximum willingness to pay). At 1 box of cereal, the maximum amount that I am willing to pay for that first box is $4.00. At 4 boxes of cereal, the most I am willing to pay for that fourth box is $2.50. Slide 8: Consumer Surplus Ex. Who missed lunch? How much would you pay for a pizza? What is the consumer surplus. Ex. If the price is $3.50. What is the consumer surplus of the first unit, the second unit, etc. add up the consumer surplus of all the units to get the consumer surplus (above price but below the demand curve). If price goes up, then consumer surplus goes down. Ex. return to student pizza example If price goes down, then consumer surplus goes up. Graph: P D Q Slide 9: Demand vs. Quantity Demanded The most missed question in all of principles of economics classes (red ink question of the year). Ex. Change in quantity demanded is a change between two points on the same curve. A move from point A to point B: increase in quantity demanded A move from point B to point A: decrease in quantity demanded Ex. Your out at the club and there is a drink special that goes from 11:00 – 12:00, so all drinks are cheaper. This will increase you quantity demanded for alcohol. Graph: 2 P D Q Ex. What causes a change in quantity demanded of Budweiser beer. Slide 10: Demand Vs. Quantity Demanded Ex.. A change in demand is a change from one demand curve to another. A move from D1 to D2: Increase in Demand A move from D2 to D1: Decrease in Demand P D2 D1 Q Ex. What causes a change in the demand for Budwieser beer (a change in the price of Miller, change in income, etc.). Ex. Think about a romantic relationship: as your significant other drinks you reach a different stage in the same relationship (movement along the curve). Trading up to a new significant other is a whole new relationship: Graph: 3 Slide 11: Change in Consumer Income 1. Change in consumer income: Ex. What is a product that you don’t like, but buy because it is cheap. What is a product that you would like to buy but is too expensive. Normal goods: (shrimp) When income increases, demand for a normal good increases (direct relationship). I DN I DN Inferior goods: (Roman Noodles) When income increases, demand for an inferior good decreases (inverse relationship). I DI I DI Graph: P D2 D3 D1 Q Slide 12: Change in the number of consumers (1) 2. Change in the number of consumers: Imagine if the class had twice as many people when deriving the demand curve (demand would shift right)? Half as many people (demand would shift left)? Ex. During the summer, when everybody leaves, the demand for goods falls. Slide 13: Change in the number of consumers (2) Watch I Am Legend Video Clip (1:43): The world’s population has been decimated to the point where there is only Will Smith left and so he sets up a number of mannequins to talk too to keep sane. The loss in number of consumers has drive demand so low, that price is actually zero. Slide 14: Change in the price of a related good Substitutes: (butter and margarine) When the price of a good increases, the demand for its substitute good increases (direct relationship). P Dsub P Dsub Compliments: (peanut butter and jelly) When the price of a good increases, the demand for its complimentary good decreases (inverse relationship). P Dcomp P Dcomp Slide 15: Changes in expectations Ex. If you thought the price of gas was going to go down to $2.00 a gallon tomorrow, would you fill up your tank now, or wait until tomorrow? 4 Change in expected price (NOT CURRENT PRICE!): If you expect future price to increase, you will demand more now (direct relationship) Pfut D Pfut D Change in expected income: If you expect future income to increase, then you will demand more now (direct relationship) Ifut D Ifut D Think, if you knew you were going to have a lot more money in the future then you would start spending now (even if you did not have it yet, you would borrow and/or run up credit and then repay it when you had the money. You would make it rain!). Slide 16: Changes in tastes and preferences (I include change in demographics into this category, which your book includes separately). Ex. Compare the level of demand for a Britney Spears Poster today compared to eight years ago. What about Eminem posters? Originally he was unpopular then he signed with Dr. Dre and became very popular for a while then kind of tapered off. Ex. A report indicating that tuna fish has dangerous levels of mercury would cause the demand for Tuna fish to go down. Ex. What do you think will happen to the demand for Michael Phelps posters after he won the eight gold medals? What about after he got caught with the bong pipe? Slide 17: Shifting Demand: change in consumer tastes and preferences Watch Hudsucker Proxy: a change in demand (3:00) Slide 18: Examples 1. The demand for beef would increase 2. The demand for steak would decrease 3. Nothing: The quantity demanded for milk would increase (shift along the curve) Slide 19: law of supply The more money we can get for a good, the more we want to sell This just means that when the price goes up, the quantity supplied goes up (and when price goes down the quantity supplied goes down). You already know this! We read graphs like we read everything else in this country, from left to right. So a upward sloping curve (running up hill) means that when one goes up the other goes down. (ex. GPA and hours studying). Slide 20: Deriving the supply curve Ex. Poll the class about how many people would be willing to tutor somebody for $3 an hour? $5, $8, $15 an hour (or Naked Supply Curve) Ex. Joab’s Rock Stand (not rocks as in drugs, but as in actual rocks) Price Quantity Supplied 0 0 $.50 1 $1.00 2 $1.50 3 $2.00 4 5 Graph: P S Q Slide 21: The height of the supply curve Or you can think of the height of the supply curve as the opportunity cost of producing that additional unit. How can it be both? The minimum price required to induce a supplier to sell a unit is exactly the marginal cost of producing it. The minimum price I am willing to accept for the first cup of rocks is $0.50. Slide 22: Producer Surplus Producer Surplus is different from profit. Producer Surplus is the net gains of all people who produced the good (including those who are employed by the firm), not the benefit that accrues to the owners of a company. Ex. Who owns a car? What value do you place on your car? What is the producer surplus if I bought it for some amount? Ex. If the price is $1.50, how much producer surplus for the first unit, second unit, etc. Add up the whole area until you get the total producer surplus (area above the supply curve bit below price. If price goes up, producer surplus goes up. If price goes down, producer surplus goes down. Slide 23: Example of consumer and producer surplus Watch Pretty Woman Clip: Consumer and Producer Surplus (2:09) Edward’s Max willingness to pay: $4,000 CS = $1,000 Vivian’s Min willingness to accept: $2,000 PS = $1,000 Price: $3,000 Slide 24: Changes in Supply vs. Quantity Supplied Ex. Change in quantity supplied is a change between two points on the same curve. A move from point A to point B: increase in quantity supplied A move from point B to point A: decrease in quantity supplied What would cause a change in the quantity supplied of Budweiser beer Graph: 6 P S Q Slide 25: Supply Vs. Quantity Supplied Ex.. A change in supply is a change from one supply curve to another. A move from S1 to S2: Increase in Supply A move from S1 to S3: Decrease in Supply P S3 S1 S2 Q Ex. What causes a change in the Supply of Budweiser beer (an increase in the price of Barley, a new and improved fermenting process, an increased tax on beer etc.). Slide 26: Change in resource price Ex. If the price of steel goes up (like it did when President Bush imposed the steel tariff in 2002) then there is a reduction in the supply of all products that use steel (automobiles). Ex. If the cost of lemons goes up then you will make less lemonade. Ex. workers are a resource used to make goods, and increase in wages (minimum wage for example) will decreases supply Slide 27: Change in Technology Ex. With the invention of the printing press, there is an increase in the supply of books and newspapers. Ex. With the invention of frozen concentrate lemonade comes an increase in the supply of lemonade 7 Slide 28: Change in nature and politics Ex. OPEC (Organization of Petroleum Exporting Countries) reduced the supply of oil with the 1973 oil embargo Ex. a crop freeze reduces that destroys the lemon crop will reduce the supply of lemonade Slide 29: Change in taxes Ex. Previously mentioned yacht example: a luxury tax on yachts drastically reduced the supply of yachts Ex. If the government imposed a tax on lemonade that made you give them half the revenue for each cup, then you would sell less lemonade. Slide 30: elasticity of demand (depends on availability of substitutes) A. Inelastic demand: for goods where there are not a lot of substitutes and goods that are addictive or necessary. Ex. cigarettes B. Elastic demand: goods with a lot of available substitutes Ex. Hamburgers Ex. Graphs: Cigarettes and Hamburgers P DH Dc Q Perfectly inelastic: Vertical demand curve, quantity demanded stays the same regardless of price. Ex. chemotherapy (looks like letter I) Graph: P D Q 8 Perfectly elastic: Horizontal demand curve, quantity demanded is zero if the price is above $1, and quantity demanded is infinite if it is less than $1. ex. Farmer Jones’ Wheat Graph: P D Q The narrower the definition of the good, the more elastic it is (McDonalds hamburgers and hamburgers, Marboro cigarettes and cigarettes). It works the same way with supply curves as well. Graph: P S S1 2 Q Slide 31: Market Equilibrium! Philosophically: The perfect blending of two forces into a state of harmony (ying-yang) Economically: When quantity demanded is equal to quantity supplied. Graph: 9 P S P* D Q Q* Slide 32: Market Equilibrium! Remember the demand curve is the buyer’s maximum willingness to pay and the supply curve is the seller’s minimum willingness to accept. So all beneficial trade will happen when the demand curve is above the supply curve. When the supply curve is above the demand curve, the trade will not be mutually beneficial. Producer surplus + Consumer surplus is maximized Graph: P S P* D Q* Q Slide 33: Market Equilibrium! No Excess Supply: Qs > QD (price is too high) No Excess Demand: QD > QS (price is too low) Graph: 10 P S P* D Q Q* Slide 34: How does a change in demand affect equilibrium price and quantity A change in demand causes price and quantity to move in the same direction: D P, Q / D P, Q Graph: P S P* D Q* Q Ex. A new study shows that Vitamin C can help prevent some forms of cancer! Slide 35: Changes in Supply How does a change in Supply affect equilibrium price and quantity A change in demand causes quantity to move in the same direction, price to move in the opposite direction: S P, Q / S P, Q Graph: 11 P S P* D Q Q* Ex. A freeze destroyed the orange crop in Florida Slide 36: Double Shifts Ex. A new study shows that Vitamin C can help prevent some forms of cancer and a freeze destroyed the orange crop in Florida. D P, Q S P, Q P, Q? Graph: P S P* D Q* Q Do possible double shift activity here (or at least post it on blackboard) Slide 37: labor market Just like there is a market for goods, there is a market for labor. It works the same way. Graph: 12 W SL W* DL E E* Slide 38: labor demand It is important to remember that firms demand your labor (ask student where he or she works). You are not demanding that you work, but firms demand your labor Graph: W DL E Slide 39: Changes in demand for labor Dl W E Dl W E Graph: W SL W* DL E* E 13 Slide 40: Labor Supply People supply labor. People (the laborers) will be the ones who supply labor (use previous example). Graph: W SL E Slide 41: Changes in the supply of labor Sl W E Sl W E Graph: W SL W* DL E* E Slide 42: Linking the markets How is the resource (Labor) market related to the market for goods and services? The two markets are interrelated. What goes on in one market affects what happens in another market. Slide 43: Linking the markets Ex. If the demand for cars increases, then the demand for labor to produce cars will increase. Graph: 14 Slide 44: Price Floor When the price is not allowed to go below a certain level (think about a real floor, you can’t go below it). If the floor is above equilibrium, it creates a surplus, but if the floor is below equilibrium then it does nothing. The market will still get to equilibrium (alright if floor is below you, but if the floor is above you it causes a problem). Graph: Quantity supplied increases and quantity demanded decreases P S P* D Q Q* Slide 45: Application: Minimum Wage (1) raising the minimum wage increases unemployment. However, those who keep their job at the new wage will be better off. Graph: W SL W* DL E* E Slide 46: Application: Minimum Wage (2) Watch Video Clip: Stossel 2011: The Unintended Consequences of Minimum Wage (4:29) – may not work through PowerPoint, must open it directly from USB. Slide 47: Price ceiling When the price is not allowed to go above a certain level (think about a real ceiling, you can’t go above it) 15 If the price ceiling is below equilibrium price it creates a shortage, if it is above equilibrium price then it does nothing. The market will still get to equilibrium (alright if the ceiling is above you, but if it is below you it causes a problem). Graph: Quantity demanded increases and quantity supplied decreases P S P* D Q* Q Slide 48: Disaster Markets Price ceilings were used to prevent price gouging in Charleston, South Carolina. Before the regulation was imposed, the prices sky-rocketed so that bags of ice went from $1 up to $10, gasoline was close to $11 a gallon, plywood cost $200 per sheet, etc. This caused people to bring in these goods from outside of the city in order to sell them at higher prices. Once price controls that made it illegal for people to sell goods at a price higher than the pre-hurricane level were instituted, than the inflow of goods stopped. As a result, gasoline powered electric generators were distributed to friends and families, rather than the highest bidder (so businesses, including those that operated ATM’s were out of luck – remember there are many ways to ration goods, price is most efficient). Some generators were taken out of the city and sold in for higher prices in less damaged markets Watch: Stossell Myth 2 – Price Gouging (4:35) Slide 49: Rent Controls Government steps in and says that you can not charge more than a certain amount for rent. A price ceiling intended to protect individuals from high housing prices. Graph: 16 P S P* D Q* Q 1. Decline in supply of future rental housing: price controls cause investors to take their money elsewhere whether then build new and better rental housing 2. The quality of rental housing will deteriorate. Since landlords can’t raise price, they have no incentive to keep apartments nice, so quality deteriorates (Morgantown). 3. Non-Price methods of Rationing: People will rent apartments based on lines (waiting lists), discrimination, as favors to friends and families. (No longer go to those who are willing to pay the most). 4. Housing mismatch: people will stay in apartments that do not suit them (too much room, because they are afraid that they might not find another one). 5. Black markets: People will make an under the table payment for apartments. However, black markets operate outside of the legal system so you have more delinquent goods and contracts (apartments do not have to be up to code), more violence, higher prices, and higher profits for those who do not get caught. (Christmas gift of the year). Slide 50: Black Markets Should we legalize drugs (marijuana)? What are the costs and benefits? 1. Benefits: safer and less potent drugs, more regulation, tax revenue, less crime, better use of police resources, less police corruption, etc. 2. Costs: possibly have more people use drugs, drugs are easier to get, less productive society Should we legalize prostitution? What are the costs and benefits? 1. Benefits: safer prostitutes, more regulation, tax revenue, less crime and violence, better use of police resources, etc. 2. Costs: possibly have more people visit prostitutes, prostitution is more visible, more marital strife, etc. Note on black markets: Baptists and Bootleggers for Prohibition (1920-1933), legalizing drugs. Why are we arguing these crimes and not other crimes like theft and murder? Because these crimes are based on voluntary exchange where both people expect to be made better off. In such cases, legal markets work better than illegal markets. 17 Slide 51: Impact of a tax – Lessons from Snooki Watch this short video clip of how the tanning tax has altered Snooki’s behavior and witness the great editing of one of our economics professors. Video Clip: Snooki Tanning Tax upgraded edition – (0:30) Slide 52: Impact of a tax Ex. Graph P S P* D Q Q* Slide 53: Deadweight loss Ex. Think if the trade had not happened during the candy game, the numbers would have been lower. This area does not go to the government but is lost. The top part of the triangle is that lost in consumer surplus, the bottom part is that which is lost to producer surplus. Slide 54: Tax Incidence On whose shoulders does the tax fall? Buyers or Sellers? It does not depend on whom the tax is imposed: Graph: A tax imposed on buyers shifts the demand curve left instead of the supply curve. But everything else remains unchanged. P S P* D Q* Q 18 Slide 55: Tax incidence does depend on elasticity Ex. 1. Demand is more inelastic 2. Supply is more inelastic Slide 56: Average Tax Rate Ex. K-fed makes $100 and pays $5 in taxes, so the ATR = 5/100 = 0.05 or 5% Slide 57: Tax System 1. A person makes $200 and pays $20 in taxes, so the ATR = 20/200 = 0.10 or 10% 2. A person makes $200 and pays $5 in taxes, so the ATR = 5/200 = 0.025 or 2.5% 3. A person makes $200 and pays $10 in taxes , so the ATR = 10/200 = .05 or 5% makes $100 $200 $200 $200 taxed ATR $5 $20 $5 $10 type 5% 10% 2.50% 5% progressive regressive proportional Slide 58: Marginal tax rate Ex. K-fed gets a raise and makes $200 and pays $15 (ATR = 7.5%) in taxes, so the MTR is $15 - $5 = $10 / $200 - $100 = $100 so the MTR is $10/$100 = .10 or 10%. Ch. 4 Income 20,000 30,000 40,000 Tax Liability 1,000 3,000 10,000 ATR 5% 10% 25% MTR 20% 70% Progressive Slide 59: fairness and efficiency 1. Is the tax system economically efficient - No Graph: W SL W* DL E* E 19 2. Is the progressive tax system fair (subjective)? Ex. What if I redistribute points from people with A’s in the class to people with F’s class (is that fair?) How much should the richest 1% of Americans (those that make over $300,000 a year) pay in taxes (5% of all taxes, 10% of all taxes?). How much do you think is fair? How much do you think they actually pay? (As of 2006, the richest 1% pays 39.9% of all income taxes. Top 5% pays 60.1%. Top 50% pays 97% (bottom half of the country pays little to no income taxes). Slide 60: The Laffer Curve Graph: Higher tax rates could result in lower tax revenue! Slide 61: Subsidies Graph: P S P* D Q* Q Ex. The government has been known to subsidize agricultural producers as well as education. Ex. the cost of subsidies is often underestimated. If the government put a $50 subsidy on treadmills the cost is assumed to be 50 x 10 million = 500 million, when it would really be 50 x 11 million = 550 million. It also ignores the cost of the deadweight loss incurred by imposing a tax to pay for the subsidy. 20 Slide 62: Farm Subsidies Watch Stossell: Micro – Farm Subsidies (4:46) Slide 63: Review (1) 1. Demand: as the price increases, quantity demanded decreases (inverse relationship) Supply: as the price increases, quantity supplied increases (direct relationship) 2. Consumer Surplus: area above price but below the demand curve Producer Surplus: area below price but above the supply curve 3. Shifters of demand are: Change in consumer income: I DN / I DI Change in number of consumers: Change in price of related good: P Dsub / P Dcomp Change in expectations: Pfut D / Ifut D Change in tastes and preferences: 4. Shifters of supply are: A change in resource price A change in technology A change in nature and politics Changes in taxes 5. Characteristics of market equilibrium Occurs at the intersection of supply and demand curves Quantity demanded = Quantity supplied Where you find efficient quantity and price No excess demand and supply 6. I will give you two situations, tell me what happens to equilibrium price and quantity Slide 64: Review (2) 7. As wage decreases, firms will demand more labor. As wage increases, employees will supply more labor 8. A price ceiling under the equilibrium price will cause a shortage A price floor above the equilibrium price will cause a surplus 9. The impact of a tax Know-: How much buyer pays How much seller receives Amount of a tax Amount sold after taxes Amount of government revenue Amount of Deadweight loss 10. ATR = Tax Liability / Taxable Income MTR = Change in Tax liability / Change in Taxable income 11. Know what the Laffer curve looks like and how it works. 12. Understand the impact of subsidies and where that money comes from 21