Final Study Guide 1(ACC I)

advertisement

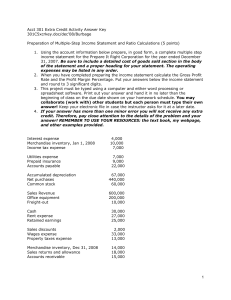

Accounting I Final Question and Answers: Which of the following is not a step in providing accounting information to stakeholders? prepare accounting surveys Equipment with an estimated market value of $45,000 is offered for sale at $65,000. The equipment is acquired for $10,000 in cash and a note payable of $40,000 due in 30 days. The amount used in the buyer's accounting records to record this acquisition is ________. $50,000 The assets and liabilities of the company are $155,000 and $60,000 respectfully. Owner’s equity should equal ________. $95,000 If total liabilities decreased by $25,000 during a period of time and owner's equity increased by $30,000 during the same period, the amount and direction (increase or decrease) of the period's change in total assets is ________. $5,000 increase If total assets decreased by $47,000 during a period of time and owner's equity increased by $24,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total liabilities is ________. $71,000 decrease The Kennedy Company sold land for $60,000 in cash. The land was originally purchased for $40,000, and at the time of the sale, $15,000 was still owed to First National Bank on that purchase. After the sale, The Kennedy Company paid off the loan to First National Bank. What is the effect of the sale and the payoff of the loan on the accounting equation? assets increase $5,000; liabilities decrease $15,000; owner's equity increases $20,000 Which of the following applications of the rules of debit and credit is true? increase Supplies Expense with a debit and the normal balance is a debit XYZ Hospital purchased X-ray equipment for $3,000, paid $750 down, with the remainder to be paid later. The correct entry would be __________. Equipment 3,000 Accounts Payable 2,250 Cash 750 June 23 Cash Able, Capital Invest cash in Able, Co. 6,000 6,000 The journal entry will _________. Increase Cash and increase Capital July 14 Accounts Payable 1,000 Cash Paid creditors on account Decrease accounts payable, decrease cash 1,000 June 26 Equipment 14,000 Cash 4,000 Notes Payable 10,000 ????????? Purchased equipment, paid cash of $4,000, with the remainder to be paid in payments The accounts in the ledger of Mickeys Park Co. are listed below. All accounts have normal balances. Accounts Payable 500 Fees Earned 2,000 Accounts Receivable 800 Insurance Expense 300 Common Stock 1,000 Land 2,000 Cash 1,600 Wages Expense 400 Withdrawals 200 Retained Earnings 1,800 The total of all the assets is: 4,400 The accounts in the ledger of Mickeys Park Co. are listed below. All accounts have normal balances. Accounts Payable 500 Accounts Receivable 800 Common Stock 1,000 Cash 1,600 Withdrawals 200 Fees Earned 2,000 Insurance Expense 300 Land 2,000 Wages Expense 400 Retained Earnings 1,800 Prepare a trial balance. The total of the debits is _________. $5,300 An overpayment error was discovered in computing and paying the wages of a Bartson Repair Shop employee. When Bartson receives cash from the employee for the amount of the overpayment, which of the following entries will Bartson make? Cash, debit; Wages Expense, credit Which of the following errors, each considered individually, would cause the trial balance totals to be unequal? a payment of $311 to a creditor was posted as a debit of $3,111 to Accounts Payable and a debit of $311 to Accounts Receivable The balance in the prepaid rent account before adjustment at the end of the year is $15,000, which represents three months' rent paid on December 1. The adjusting entry required on December 31 is _______. debit Rent Expense, $5,000; credit Prepaid Rent, $5,000 The balance in the office supplies account on June 1 was $5,200, supplies purchased during June were $2,500, and the supplies on hand at June 30 were $2,000. The amount to be used for the appropriate adjusting entry is _________. $5,700 What is the proper adjusting entry at June 30, the end of the fiscal year, based on a prepaid insurance account balance before adjustment, $15,500, and unexpired amounts per analysis of policies, $4,500? debit Insurance Expense, $11,000; credit Prepaid Insurance, $11,000 A business pays weekly salaries of $20,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on Thursday is ________. debit Salary Expense, $16,000; credit Salaries Payable, $16,000 If the prepaid rent account before adjustment at the end of the month has a debit balance of $1,600, representing a payment made on the first day of the month, and if the monthly rent was $800, the amount of prepaid rent that would appear on the balance sheet at the end of the month, after adjustment, is ________. $800 The following adjusting journal entry was found on page 4 of the journal. Select the best explanation for the entry. Wages Expense 2,555 Wages Payable 2,555 ???????????????? Record wages expense incurred and to be paid next month The balance in the supplies account, before adjustment at the end of the year is $625. The proper adjusting entry if the amount of supplies on hand at the end of the year is $325 would be ________. debit Supplies Expense $300, credit Supplies $300 When is the adjusted trial balance prepared? After adjusting journal entries are posted In the accounting cycle, the last step is _________. preparing a post-closing trial balance What is the major difference between the Unadjusted Trial Balance and the Adjusted Trial Balance? The Adjusted Trial Balance includes the postings of the adjustments for the period in the balance of the accounts. Once the adjusting entries are posted, the Adjusted Trial Balance will prepared to ________. verify that the debits and credits are in balance The income statement is prepared from the _________. either the adjusted trial balance or the income statement columns of the work sheet When preparing the Statement of Owner’s Equity the beginning balance should be followed by ____ to arrive at the ending balance of owner’s equity. investments plus net income (loss) less withdrawals Long-term liabilities are those liabilities that ________. are due to be paid in more than one year The owner’s equity is ________. added to liabilities and the two are equal to assets On which financial statement will Income Summary be shown? No financial statement There are four closing entries. The first one is to close ____, the second one is to close ____, the third one is to close ____, and the last one is to close ____. Revenues, expenses, income summary, drawing account The entry to close the appropriate insurance account at the end of the accounting period is _______. debit Income Summary; credit Insurance Expense A summary of selected ledger accounts appear below for Ted's Auto Services for the 2007 calendar year end. 12/31 Ted, Capital 7,000 1/1 12/31 5,000 17,000 6/30 11/30 Ted, Drawing 2,000 12/31 5,000 7,000 12/31 12/31 Income Summary 15,000 12/31 17,000 32,000 Net income for the period is ________. $17,000 Red Rock Stone purchased a one-year liability insurance policy on January 1st of this year for $3,600 and recorded it as a prepaid expense. From the selections of a. through d., select the value that would be utilized in the closing entry for insurance expense and prepaid insurance during the closing process at the end of the first fiscal period on January 31st. $300 Account Title Cash Accounts Receivable Supplies Equipment Accumulated DeprEquip Accounts Payable Wages Payable L. Mantle, Capital L. Mantle, Drawing Mantle Company Worksheet For the Year Ended December 31, 2008 Adjusted Trial Income Statement Balance Sheet Balance Debit Credit Debit Credit Debit Credit 16,000 16,000 6,000 6,000 2,000 2,000 19,000 19,000 6,000 6,000 10,000 2,000 11,000 1,000 10,000 2,000 11,000 1,000 Fees Earned Wages Expense Rent Expense Depreciation Expense Totals Net Income (Loss) 47,000 21,000 6,000 5,000 76,000 21,000 6,000 5,000 76,000 32,000 15,000 47,000 47,000 47,000 44,000 47,000 44,000 29,000 15,000 44,000 The journal entry to close revenues would be: _________. debit Fees Earned $47,000; credit Income Summary $47,000 The proper sequence for the steps in the accounting cycle is a follows: ________. analyze and record transactions, post transactions to the ledger, prepare a trial balance, analyze adjustment data, prepare adjusting entries, prepare financial statements, journalize closing entries and post to the ledger The following are steps in the accounting cycle. Of the following, which would be prepared last? An adjusted trial balance is prepared. The fiscal year selected by companies _________. begins with the first day of the month and ends on the last day of the twelfth month A fiscal year ________. ordinarily begins on the first day of a month and ends on the last day of the following twelfth month The natural business year _______. is a fiscal year that ends when business activities are at its lowest point A company using the periodic inventory system has the following account balances: Merchandise Inventory at the beginning of the year, $4,000; Transportation-In, $450; Purchases, $12,000; Purchases Returns and Allowances, $2,300; Purchases Discounts, $220. The cost of merchandise purchased is equal to _______. $9,930 Using the following information, what is the amount of cost of merchandise sold? Purchases Merchandise inventory April 1 Sales returns and allowances Purchases returns and allowances 25,780 $28,000 6,500 750 1,000 Purchases discounts Merchandise inventory April 30 Sales Transportation In $800 7,800 57,000 880 Using the following information, what is the amount of merchandise available for sale? Purchases Merchandise inventory April 1 Sales returns and allowances Purchases returns and allowances 33,580 $28,000 6,500 750 1,000 Purchases discounts Merchandise inventory April 30 Sales Transportation In $800 7,800 57,000 880 A retailer purchases merchandise with a catalog list price of $10,000. The retailer receives a 25% trade discount and credit terms of 2/10, n/30. What amount should the retailer debit to the Merchandise Inventory account? $7,500 Which account will be included in both service and merchandising companies closing entries? Sales Taking a physical count of inventory ________. is a detective control Which of the following is not true about taking physical inventories? Physical inventories are taken when inventory levels are at their highest. The Baby Company sells blankets for $30 each. The following was taken from the inventory records during July. Product T Units Cost 5 3 10 6 3 10 $15 Date July 3 July 10 July 17 July 20 July 23 July 30 Purchase Sale Purchase Sale Sale Purchase $17 $20 Assuming that the company uses the perpetual inventory system, determine the cost of merchandise sold for the sale of July 20 using the Lifo inventory cost method. $102 Beginning inventory, purchases and sales data for tennis rackets are as follows: Feb 3 11 Inventory Purchase 12 units 13 units @ @ $15 $17 14 21 25 Sale Purchase Sale 18 units 9 units 10 units @ $20 Assuming the business maintains a perpetual inventory system, calculate the cost of merchandise sold and ending inventory under First-in, first-out: _______. cost of merchandise sold 461; ending inventory 120 The following lots of a particular commodity were available for sale during the year: Beginning inventory First purchase Second purchase Third purchase 10 units at $50 25 units at $53 30 units at $54 15 units at $60 The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the first-in, first-out method? $1,170 The following lots of a particular commodity were available for sale during the year: Beginning inventory First purchase Second purchase Third purchase 10 units at $60 25 units at $63 30 units at $64 15 units at $70 The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year. What is the amount of the inventory at the end of the year according to the lower of cost or market, using the first-in, first-out method, if the current replacement cost is $64 a unit? $1,280 During a period of falling prices, which of the following inventory methods generally results in the lowest balance sheet amount for inventory? FIFO method During the taking of its physical inventory on December 31, 2008, Albert’s Bike Shop incorrectly counted its inventory as $210,000 instead of the correct amount of $180,000. The effect on the balance sheet and income statement would be as follows: _________. assets and retained earnings overstated by $30,000; net income overstated by $30,000 If, while taking a physical inventory, the company counts their inventory figures more than the actual amount. How will the error affect their bottom line? Net income will be overstated