File - Vonzetta M. May

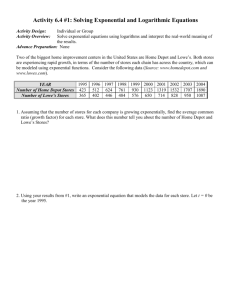

advertisement