2012 European Trade Team - News Kit

advertisement

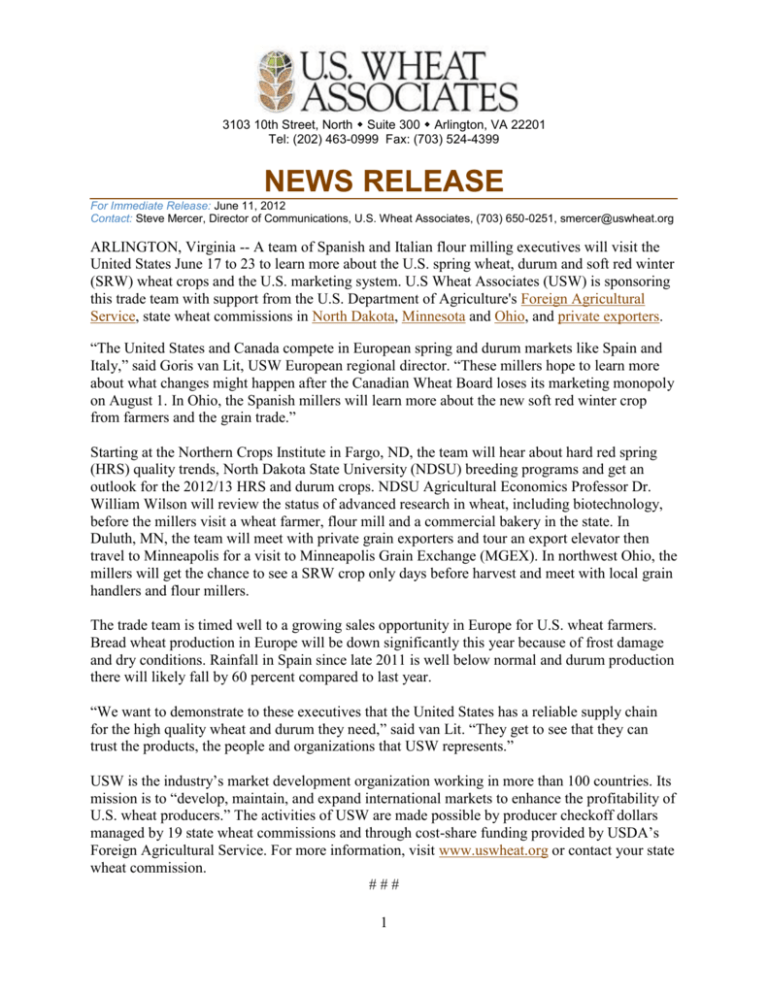

3103 10th Street, North Suite 300 Arlington, VA 22201 Tel: (202) 463-0999 Fax: (703) 524-4399 NEWS RELEASE For Immediate Release: June 11, 2012 Contact: Steve Mercer, Director of Communications, U.S. Wheat Associates, (703) 650-0251, smercer@uswheat.org ARLINGTON, Virginia -- A team of Spanish and Italian flour milling executives will visit the United States June 17 to 23 to learn more about the U.S. spring wheat, durum and soft red winter (SRW) wheat crops and the U.S. marketing system. U.S Wheat Associates (USW) is sponsoring this trade team with support from the U.S. Department of Agriculture's Foreign Agricultural Service, state wheat commissions in North Dakota, Minnesota and Ohio, and private exporters. “The United States and Canada compete in European spring and durum markets like Spain and Italy,” said Goris van Lit, USW European regional director. “These millers hope to learn more about what changes might happen after the Canadian Wheat Board loses its marketing monopoly on August 1. In Ohio, the Spanish millers will learn more about the new soft red winter crop from farmers and the grain trade.” Starting at the Northern Crops Institute in Fargo, ND, the team will hear about hard red spring (HRS) quality trends, North Dakota State University (NDSU) breeding programs and get an outlook for the 2012/13 HRS and durum crops. NDSU Agricultural Economics Professor Dr. William Wilson will review the status of advanced research in wheat, including biotechnology, before the millers visit a wheat farmer, flour mill and a commercial bakery in the state. In Duluth, MN, the team will meet with private grain exporters and tour an export elevator then travel to Minneapolis for a visit to Minneapolis Grain Exchange (MGEX). In northwest Ohio, the millers will get the chance to see a SRW crop only days before harvest and meet with local grain handlers and flour millers. The trade team is timed well to a growing sales opportunity in Europe for U.S. wheat farmers. Bread wheat production in Europe will be down significantly this year because of frost damage and dry conditions. Rainfall in Spain since late 2011 is well below normal and durum production there will likely fall by 60 percent compared to last year. “We want to demonstrate to these executives that the United States has a reliable supply chain for the high quality wheat and durum they need,” said van Lit. “They get to see that they can trust the products, the people and organizations that USW represents.” USW is the industry’s market development organization working in more than 100 countries. Its mission is to “develop, maintain, and expand international markets to enhance the profitability of U.S. wheat producers.” The activities of USW are made possible by producer checkoff dollars managed by 19 state wheat commissions and through cost-share funding provided by USDA’s Foreign Agricultural Service. For more information, visit www.uswheat.org or contact your state wheat commission. ### 1 3103 10th Street, North Suite 300 Arlington, VA 22201 Tel: (202) 463-0999 Fax: (703) 524-4399 2012 European Trade Team - Team Members Emilio Esteban Owner and General Manager, Emilio Esteban S.A., Spain Jesus Esteban General Manager, Emilio Esteban S.A., Spain Esteban Fernandez Vasallo General Manager, Esteban Fernandez Ramos E H S.A., Spain Mr. Victor Galindo Manager, Harinera Castellana S.A., Spain Juan Carbajo Molinos del Duero y Compania General de Harinas S.L., Spain Alberto Figna Manager, Agugiaro & Figna Molini S.p.A., Italy Goris van Lit Regional Director, Europe, U.S. Wheat Associates, Rotterdam, The Netherlands Heydi Langbroek Assistant Program Manager, U.S. Wheat Associates, Rotterdam, The Netherlands 2 3103 10th Street, North Suite 300 Arlington, VA 22201 Tel: (202) 463-0999 Fax: (703) 524-4399 Connecting Buyers and Sellers is Effective in Competitive EU Wheat Markets The USW European regional office in Rotterdam, The Netherlands, is responsible for carrying out activities in all countries of the European continent, Israel and the former Soviet Union. The region includes a sub-office in Moscow, Russia. Despite several record wheat crops over the past five years, Western Europe is a growing market for imported high protein spring wheat for blending and improving local crop milling and baking quality; and for durum wheat for both quality and quantity purposes. The internally and internationally negotiated rollback of EU domestic subsidy support programs allows imported wheat to compete more easily on a price basis. This trend will continue through already negotiated and future changes in the EU Common Agricultural Policy and in the World Trade Organization. Competition, especially with the Canadian Wheat Board, has always been fierce for this high quality wheat and durum cash market. The strategy to meet the competition with other exporters begins each crop year with the timely dissemination of information about U.S. wheat classes. Activities also demonstrate by example the competitive advantages of the U.S. marketing system. USW works directly with EU end-users and importers to help them deepen commercial links with U.S. export companies during activities in Europe and by facilitating visits to the United States, including through trade teams like the one taking place this month. Active membership in regional and international trade and industry organizations is also important to link prospective wheat buyers to the right exporters. USW programs like the Overseas Varietal Analysis (OVA) help assure that new varieties correspond well to EU quality requirements. Under OVA, international millers and bakers test new varieties and state wheat commissions use the results to develop recommended variety lists for farmers and set quality targets for U.S. wheat breeders, leading to increased demand for U.S. wheat. 3 3103 10th Street, North Suite 300 Arlington, VA 22201 Tel: (202) 463-0999 Fax: (703) 524-4399 U.S. Wheat Sales to Europe by Class All-Europe Europe Albania, Baltics Region, Bosnia, Bulgaria, Caucasus Region, Central Asian Region, Croatia, Cyprus, Czech Republic, European Union, FSU European Region, Hungary, Israel, Kazakhstan, Macedonia, Poland, Romania, Russia, Slovakia, Slovenia, Uzbekistan, Yugoslavia 1,000 Metric Tons Crop Year (June - May) HRW SRW HRS White Durum Total 2011/12 266.9 517.5 351.3 1.3 289.7 1,426.7 2010/11 447.9 91.7 790.5 0.0 464.0 1,794.1 2009/10 174.2 0.0 224.9 0.0 381.2 780.3 2008/09 369.4 77.6 586.8 0.3 287.3 1,321.4 2007/08 262.9 133.7 1,285.9 0.0 544.8 2,227.2 2006/07 152.0 44.5 439.5 2.1 276.2 914.2 2005/06 306.2 0.0 1,159.1 0.0 332.5 1,797.8 2004/05 509.4 17.0 1,348.2 0.0 262.2 2,137.0 2003/04 1,242.1 243.8 1,497.4 0.0 343.9 3,327.2 2002/03 386.0 16.0 952.2 14.0 302.0 1,672.2 Data current through May 24th, 2011 Source: USDA - FAS - Weekly Export Sales Report 4 3103 10th Street, North Suite 300 Arlington, VA 22201 Tel: (202) 463-0999 Fax: (703) 524-4399 Spain Europe 1,000 Metric Tons Crop Year (June - May) HRW SRW HRS White Durum Total 2011/12 0.0 439.1 95.7 0.0 0.0 534.8 2010/11 0.0 26.2 258.5 0.0 19.5 304.2 2009/10 0.0 0.0 134.8 0.0 0.0 134.8 2008/09 0.0 59.5 304.3 0.0 0.0 363.8 2007/08 0.0 97.9 572.5 0.0 13.2 683.6 2006/07 0.0 44.5 74.1 0.0 0.0 118.5 2005/06 0.0 0.0 420.9 0.0 26.8 447.7 Data current through May 24th, 2011 Source: USDA - FAS - Weekly Export Sales Report Italy Europe 1,000 Metric Tons Crop Year (June - May) HRW SRW HRS White Durum Total 2011/12 0.0 54.5 94.9 0.0 246.5 395.9 2010/11 7.9 46.5 298.8 0.0 362.3 715.6 2009/10 0.0 0.0 24.5 0.0 339.9 364.3 2008/09 0.0 0.0 101.4 0.0 280.7 382.1 2007/08 0.0 11.5 236.0 0.0 411.2 658.7 2006/07 0.0 0.0 262.1 0.0 273.5 535.7 2005/06 0.0 0.0 462.1 0.0 285.6 747.7 Data current through May 24th, 2011 Source: USDA - FAS - Weekly Export Sales Report 5