DAV Model United Nations Conference 2012 Committee

advertisement

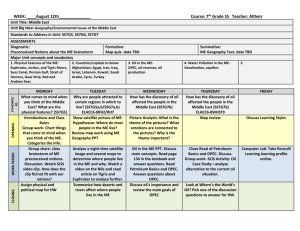

DAV Model United Nations Conference 2012 Committee: Organization of Petroleum Exporting Countries DAV Model United Nations 2012 Conference OPEC Study Guide Executive Board Bharat Seth| Hisham Ahmed Rizvi 1 ORGANIZATION OF PETROLEUM EXPORTING COUNTRIES The Organization of Petroleum Exporting Countries is a permanent intergovernmental organization founded in Baghdad at the Baghdad conference held from September 10th-14th 1960. The organization was initially formed by 5 countries namely, Iran, Iraq, Venezuela, Saudi Arabia and Kuwait. Over the years various other countries have joined as well as left the organization. These include: 1. Qatar- 1961 2. Indonesia- 1962 (suspended its membership from January 2009, as it became a net importer of oil) 3. Libya- 1962 4. United Arab Emirates- 1967 5. Algeria- 1969 6. Nigeria- 1971 7. Ecuador- 1973 (suspended its membership from December 1992- October 2007) 8. Angola- 2007 9. Gabon- 1975-1994 For the first 5 years of its existence the OPEC headquarters were in Geneva, Switzerland, This was later shifted to Vienna, Austria on September 1st, 1965. OPEC's objective is to co-ordinate and unify petroleum policies among Member Countries, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry1. 1 http://www.opec.org/opec_web/en/about_us/24.htm 2 MANDATE The complete mandate of the OPEC is outlined in the OPEC statute. The statute of the OPEC was originally approved and signed on January 16th 1961, at one of the first ever OPEC conferences in Caracas. Till date the statute has been amended 14 times, the last one occurring in December 1997. The statute outlines, the OPEC’s: 1. 2. 3. 4. 5. Objectives Membership Conditions and the obligations of each member Organs and their powers The structure and powers of the Secretariat Various Financial and other provisions The Organs that form the OPEC are: 1. The Conference: It is the topmost decision making body of the OPEC and is considered a ‘supreme authority’. 2. The Board of Governors: This body manages all affairs of the organization and is responsible for the implementation of the OPEC’s decisions 3. The Secretariat: This body carries out the executive functions of the organization At DAVMUN 2012, we will be simulating the OPEC Conference. The Mandate for which along with the Objectives of the OPEC are given below. 3 Organization and objectives Article 1 The Organization of the Petroleum Exporting Countries (OPEC), hereinafter referred to as “the Organization”, created as a permanent intergovernmental organization in conformity with the Resolutions of the Conference of the Representatives of the Governments of Iran, Iraq, Kuwait, Saudi Arabia and Venezuela, held in Baghdad from September 10 to 14, 1960, shall carry out its functions in accordance with the provisions set forth hereunder. Article 2 A. The principal aim of the Organization shall be the coordination and unification of the petroleum policies of Member Countries and the determination of the best means for safeguarding their interests, individually and collectively. B. the Organization shall devise ways and means of ensuring the stabilization of prices in international oil markets with a view to eliminating harmful and unnecessary fluctuations. C. Due regard shall be given at all times to the interests of the producing nations and to the necessity of securing a steady income to the producing countries; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on their capital to those investing in the petroleum industry. Article 3 The Organization shall be guided by the principle of the sovereign equality of its Member Countries. Member Countries shall fulfill, in good faith, the obligations assumed by them in accordance with this Statute. Article 4 If, as a result of the application of any decision of the Organization, sanctions are employed, directly or indirectly, by any interested company or companies against one or more Member Countries, no other Member shall accept any offer of a beneficial treatment, whether in the form of an increase in oil exports or in an improvement in prices, which may be made to it by such interested company or companies with the intention of discouraging the application of the decision of the Organization. Article 5 The Organization shall have its Headquarters at the place the Conference decides upon. Article 6 English shall be the official language of the Organization. 4 The Conference Article 10 The Conference shall be the supreme authority of the Organization. Article 11 A. the Conference shall consist of delegations representing the Member Countries. A delegation may consist of one or more delegates, as well as advisers and observers. When a delegation consists of more than one person, the appointing country shall nominate one person as the Head of the Delegation. B. Each Member Country should be represented at all Conferences; however, a quorum of three-quarters of Member Countries shall be necessary for holding a Conference. C. Each Full Member Country shall have one vote. All decisions of the Conference, other than on procedural matters, shall require the unanimous agreement of all Full Members. The Conference Resolutions shall become effective after 30 days from the conclusion of the Meeting, or after such period as the Conference may decide unless, within the said period, the Secretariat receives notification from Member Countries to the contrary. In the case of a Full Member being absent from the Meeting of the Conference, the Resolutions of the Conference shall become effective unless the Secretariat receives a notification to the contrary from the said Member, at least ten days before the date fixed for publication of the Resolutions. D. A non-Member country may be invited to attend a Conference as Observer, if the Conference so decides. Article 12 The Conference shall hold two Ordinary Meetings a year. However, an Extraordinary Meeting of the Conference may be convened at the request of a Member Country by the Secretary General, after consultation with the President and approval by a simple majority of the Member Countries. In the absence of unanimity among Member Countries approving the convening of such a Meeting, as to the date and venue of the Meeting, they shall be fixed by the Secretary General in consultation with the President. Article 13 The Conference shall normally be held at the Headquarters of the Organization, but it may meet in any of the Member Countries, or elsewhere as may be advisable. Article 14 A. the Conference shall elect a President and an Alternate President at its first Preliminary Meeting. The Alternate President shall exercise the responsibilities of the President during his absence, or when he is unable to carry out his responsibilities. B. the President shall hold office for the duration of the Meeting of the Conference, and shall retain the title until the next Meeting. C. the Secretary General shall be the Secretary of the Conference. Article 15 The Conference shall: 1. Formulate the general policy of the Organization and determine the appropriate ways and means of its implementation; 2. Decide upon any application for membership of the Organization; 3. Confirm the appointment of Members of the Board of Governors; 4. Direct the Board of Governors to submit reports or make recommendations on any matters of interest to the Organization; 5. Consider, or decide upon, the reports and recommendations submitted by the Board of Governors on the affairs of the Organization; 6. Consider and decide upon the Budget of the Organization, as submitted by the Board of Governors; 7. Consider and decide upon the Statement of Accounts and the Auditor’s Report, as submitted by the Board of Governors; 8. call a Consultative Meeting for such Member Countries, for such purposes, and in such places, as the Conference deems fit; 9. Approve any amendments to this Statute; 10. Appoint the Chairman of the Board of Governors and an Alternate Chairman; 11. Appoint the Secretary General; and 12. Appoint the Auditor of the Organization for a duration of one year. Article 16 All matters that are not expressly assigned to other organs of the Organization shall fall within the competence of the Conference. 5 BROAD ORGANIZATIONAL HISTORY 1. The 1960s: OPEC’s formation by five oil-producing developing countries in Baghdad in September 1960 occurred at a time of transition in the international economic and political landscape, with extensive decolonization and the birth of many new independent states in the developing world. The international oil market was dominated by the “Seven Sisters” multinational companies and was largely separate from that of the former Soviet Union (FSU) and other centrally planned economies (CPEs). OPEC developed its collective vision, set up its objectives and established its Secretariat, first in Geneva and then, in 1965, in Vienna. It adopted a ‘Declaratory Statement of Petroleum Policy in Member Countries’ in 1968, which emphasized the inalienable right of all countries to exercise permanent sovereignty over their natural resources in the interest of their national development. Membership grew to ten by 19692. 2. The 1970s: OPEC rose to international prominence during this decade, as its Member Countries took control of their domestic petroleum industries and acquired a major say in the pricing of crude oil on world markets. On two occasions, oil prices rose steeply in a volatile market, triggered by the Arab oil embargo in 1973 and the outbreak of the Iranian Revolution in 1979. OPEC broadened its mandate with the first Summit of Heads of State and Government in Algiers in 1975, which addressed the plight of the poorer nations and called for a new era of cooperation in international relations, in the interests of world economic development and stability. This led to the establishment of the OPEC Fund for International Development in 1976. Member Countries embarked on ambitious socio-economic development schemes. Membership grew to 13 by 19753. 2 3 http://www.opec.org/opec_web/en/about_us/24.htm http://www.opec.org/opec_web/en/about_us/24.htm 6 3. The 1980s: After reaching record levels early in the decade, prices began to weaken, before crashing in 1986, responding to a big oil glut and consumer shift away from this hydrocarbon. OPEC’s share of the smaller oil market fell heavily and its total petroleum revenue dropped below a third of earlier peaks, causing severe economic hardship for many Member Countries. Prices rallied in the final part of the decade, but to around half the levels of the early part, and OPEC’s share of newly growing world output began to recover. This was supported by OPEC introducing a group production ceiling divided among Member Countries and a Reference Basket for pricing, as well as significant progress with OPEC/non-OPEC dialogue and cooperation, seen as essential for market stability and reasonable prices. Environmental issues emerged on the international energy agenda4. 4. The 1990s: Prices moved less dramatically than in the 1970s and 1980s, and timely OPEC action reduced the market impact of Middle East hostilities in 1990– 91. But excessive volatility and general price weakness dominated the decade, and the South-East Asian economic downturn and mild Northern Hemisphere winter of 1998–99 saw prices back at 1986 levels. However, a solid recovery followed in a more integrated oil market, which was adjusting to the post-Soviet world, greater regionalism, globalization, the communications revolution and other high-tech trends. Breakthroughs in producer-consumer dialogue matched continued advances in OPEC/nonOPEC relations. As the United Nations-sponsored climate change negotiations gathered momentum, after the Earth Summit of 1992, OPEC sought fairness, balance and realism in the treatment of oil supply. One country left OPEC, while another suspended its Membership5. 5. The 2000s: An innovative OPEC oil price band mechanism helped strengthen and stabilize crude prices in the early years of the decade. But a combination of market forces, speculation and other factors transformed the situation in 2004, pushing up prices and increasing volatility in a well-supplied crude 4 5 http://www.opec.org/opec_web/en/about_us/24.htm http://www.opec.org/opec_web/en/about_us/24.htm 7 market. Oil was used increasingly as an asset class. Prices soared to record levels in mid-2008, before collapsing in the emerging global financial turmoil and economic recession. OPEC became prominent in supporting the oil sector, as part of global efforts to address the economic crisis. OPEC’s second and third summits in Caracas and Riyadh in 2000 and 2007 established stable energy markets, sustainable development and the environment as three guiding themes, and it adopted a comprehensive long-term strategy in 2005. One country joined OPEC, another reactivated its Membership and a third suspended it6. AGENDA: Impact of Economic Crises and Political Conflicts on Oil Investments Understanding the Agenda The agenda at hand has 3 basic aspects, which must be used to understand and deliberate on it. These are: 1. Economic Crises- Wider economic crises that are characterized with a rapid deceleration of growth or negative growth can occur due to various reasons. With today’s capitalistic world economic outlook, such wider economic crises are generally caused due to fluctuations and shocks in the financial world, currency markets, flawed or discriminatory economic policies and shocks in the supply of essential commodities. Financial crises can be divided into various types, these include: Banking crises Speculative Bubbles and Crashes International Financial crises 2. Political Crises- Political Crises in the context refer to political upheavals which do not only threaten international political peace and security 6 http://www.opec.org/opec_web/en/about_us/24.htm 8 but also economic security. Various zones across the world are characterized by their social and political volatility, constantly changing governments, coups, sectarian violence, interventions etc. Such crises have various undesirable effects on the international community. Firstly, the sociological effect, being that the people in the region of conflict are caught in the crossfire between the belligerent parties, Secondly, and the more relevant given the context, the economic potential of the region is heavily undermined, as the development and existence of present economic resources is stopped or destroyed. 3. Oil Investments- Oil investments refer to investment in all oil related assets, be it investment by individuals into the shares of oil companies or investment by nations into oil infrastructure for exploration, extraction and refinement. Individual understanding of the terms along with their collective understanding is a must. By collective understand, we mean how the three aspects are interlinked and what the implied issue at hand is. The agenda can also be considered as “How Oil Investments, are effected by various economic and political upheavals that take place in society today”. As such, we will be dealing with the effects of crises such as the subprime mortgage crisis, the East Asian currency crisis, the European sovereign debt crisis, The Libyan and Syrian civil war, The IsraelPalestine issue etc on OPEC policies, how it effects the organization, on international world markets and on other international organizations 9 Case Studies To understand the OPEC response to economic and political crises, it is a must to analyze its reactions in previous crises that have taken place. 1. 1973 oil crisis The 1973 oil crisis can be assumed to have been fueled, in part, by the Arab nations present in the OPEC along with Egypt, Syria and Tunisia, called OAPEC (Organization of Arab Petroleum Exporting Countries). On October 16, 1973, OPEC announced a decision to raise the posted price of oil by 70%, to $5.11 a barrel7. The following day, oil ministers agreed to the embargo, a cut in production by five percent from September's output, and to continue to cut production over time in five percent increments until their economic and political objectives were met8. October 19, US President Richard Nixon requested Congress to appropriate $2.2 billion in emergency aid to Israel, including $1.5 billion in out-right grants. George Lenczowski notes, "Military supplies did not exhaust Nixon's eagerness to prevent Israel's collapse. ... This [$2.2B] decision triggered a collective OPEC response." Libya9 immediately announced it would embargo all oil shipments to the United States.10 Saudi Arabia and the other Arab oilproducing states quickly followed suit, joining the embargo on October 20, 1973.11 At their meeting in Kuwait the OPEC oil-producing countries, proclaimed the oil boycott that provided for curbs on their oil exports to various consumer countries and a total embargo on oil deliveries to the United States as a "principal hostile country".12 The embargo was thus variously extended to Western Europe and Japan. Though United States was the initial target of the embargo, it was later expanded to the Netherlands.13 Price increases were also imposed. Since short term 7 Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Schuster, 2008), p. 587. 8 Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Schuster, 2008), p. 589 9 Lenczowski, George (1990). American Presidents and the Middle East. Duke University Press. p. 130. ISBN 978-0-8223-0972-7. 10 "Significant Events in U.S.-Libyan Relations". 2001-2009.state.gov. Retrieved 2012-08-07 11 Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Schuster, 2008), p. 590. 12 Lenczowski, p130 13 Frum, David (2000). How We Got Here: The '70s. New York:Basic Books. p. 318. ISBN 978-0-46504195-4. 10 oil demand is inelastic, demand falls little when the price is raised. Thus, oil prices had to be raised dramatically to reduce demand to the new lower level of supply. Anticipating this, the market price for oil immediately rose substantially, from $3 a barrel to $12.14 The world financial system, which was already under pressure from the breakdown of the Bretton Woods agreement, was set on a path of recessions and high inflation that persisted until the early 1980s, with oil prices continuing to rise until 1986. Independently, the OPEC members agreed to use their leverage over the world price setting mechanism for oil to stabilize their real incomes by raising world oil prices. Industrialized economies relied on crude oil, and OPEC was their predominant supplier. The OPEC member nations drastically cut down crude oil supply thereby raising worldwide oil prices and effectively increasing their own revenues. The price of oil had quadrupled by 1974. 2. 1979 energy crisis The 1979 energy crisis occurred along with and immediately after the Iranian revolution. After nationwide protests, the Shah of Iran had to step down and leave the country. Ayatollah Khomeini soon took over. During the revolution, the Iranian oil sector was negatively affected, effectively stemming the flow of oil of oil from Iran to the rest of the world. Under the new regime, Oil production was severely curtailed and exports suspended. Even when exports were resumed, the volume was much lower than the original pre revolution volume, which led to an increase in oil prices throughout the world. Saudi Arabia and other OPEC nations increased oil production to offset the shortage present in the world market. A loss of 4% was reported in terms of production. 3. Iraqi invasion of Kuwait 14 Frum, David (2000). How We Got Here: The '70s. New York:Basic Books. p. 318. ISBN 978-0-46504195-4. 11 One could say that OPEC quota policy, and the non adherence or the apparent non adherence of which, partly led to this particular instance of a country annexing another country in modern times. The reasons for Iraq to invade the country of Kuwait in 1990 were linked to the repayment of the debt by Iraq to Kuwait; as Kuwait had funded Iraq in the Iran-Iraq war, accusations by Iraq of slant drilling methods used by the Kuwaitis to steal Iraqi oil from Rumaila oil field; and the insistence of Kuwait, in the OPEC, to keep increase their oil production quota, which prevented an increase in oil prices and hence prevented Iraq from generating much needed revenue from its own oil reserves. This revenue was desperately required by Iraq to prop up its failing economy after the Iran-Iraq war. Given all these factors and many more, tensions rose between the two, once allied countries which ultimately led to an invasion of Kuwait by Iraq. Consequentially, operation desert strom was launched by an allied group of western nations to oust Iraq from Kuwait which was successful. However the Iraqis, in retreat followed a scorched earth policy and destroyed every usable natural resource in Kuwaiti territory. Primarily Kuwaiti oil fields were set on fire which had adverse impacts on the environmental conditions present in the Persian Gulf and Kuwaiti economy. Average monthly prices of oil rose from 17$/ barrelto 36$/ barrel of oil. 4. 2003 Iraq War Iraq holds the world's second-largest proven oil reserves and with increasing exploration, it is expected to enlarge them beyond 200 billion barrels. Many leading critics of the Iraq war tend to claim that the US lead invasion was primarily aimed for the annexation of oil resources and for political dominance at the heart if which lies the debate of ‘petroleum politics’. Please read the section on ‘Petrodollar warfare’ for more details. Organizations such as the Global Policy Forum (GPF) have asserted that Iraq's oil is "the central feature of the political landscape" there, and that as a result of the 2003 invasion, companies expect to gain most of the lucrative oil deals that will be worth hundreds of billions of dollars in profits in the coming 10 decades." According to GPF, U.S. influence over the 2005 Constitution of Iraq has made sure it "contains language that guarantees a major role for foreign companies." 12 5. Apart from the above mentioned crises, oil and its role as an essential commodity for nations, gives it almost limitless power to affect an entire region’s or the entire world’s economic growth and conditions. Many economic crises in 21st century have been effected oil prices and in turn have affected the oil industry. Taking the subprime mortgage crisis as an example, In a speech given by Dr. Ibibia Lucky Worika “The OPEC Reference Basket recorded prices in 2008, that were both extremely high at $141/b and as low at $33/b. Inevitably, this did not create a good investment climate. Consequently, projects were either delayed or suspended in both OPEC and non-OPEC Member Countries, as governments worked to find ways to put the economy back on track. The latter, as we know, has been largely through the monetary and fiscal stimulus packages implemented across the globe - which have certainly helped economies return to growth. For its part, OPEC's decision to adjust production by 4.2million b/d at its Conference in Oran, Algeria in 2008 went a long way in helping to stabilize the oil market.” Prices of oil went up as well as down, which as stated above had a negative impact on oil investments in general. An eroding dollar decreased oil revenues for many OPEC and non- OPEC members. Within this period of uncertainty, there was also an environment rife with speculating as to whether to shift to a different currency to which oil can be pegged to. Internal rifts within the OPEC In the June 2011 OPEC meeting in Vienna, negotiations broke down while discussing the production quotas in the backdrop of the protracted conflict in Libya. OPEC's Gulf Cooperation Council members: UAE, Saudi Arabia, Qatar and Kuwait proposed an increase which would boost actual supply by 1.5 million barrels per day, but the suggestion was rejected by the other member nations. Since December 2008, OPEC’s output ceiling was 24.84 million barrels per day. However, the actual output is estimated at 26.23 million barrels per day (hence an excess of 1.39 million barrels per day). The proposed increase in output ceiling will have two effects: (i) It will legitimize the excess 1.39 million barrels of crude oil being produced per day by the OPEC member nations. 13 (ii) It will help ease the excess demand that has been predicted for the future due to the ongoing oil shocks that continue to occur due to the Arab Spring. Particularly, Iran and Venezuela oppose any increase in production capacity. Even if they agree to increase quotas, they will not accept any increment other than enough to ‘legitimize’ the current output which exceeds the current OPEC ceiling. Regardless of OPEC policy, Saudi Arabia is planning to lift oil output sharply this month to rein in high fuel prices. The fighting in Libya has taken 1.3 million barrels off the world market, and the turmoil in Yemen and Syria has subtracted an additional 300,000 barrels. Saudi Arabia plans to counteract any shortages that may arise in the crude oil market by expanding production. It should be noted that Saudi Arabia is by far the largest producer and exporter in the OPEC, and is the only member that has considerable spare production capacity, giving it a predominant power in OPEC. There has also been an increasing rift within the OPEC member and some feel that it has been a cause for the growing deadlock, the Saudi Arabia and Iran conflict being a prime example. For example, Whistleblower wikileaks reported that Saudi Arabia urged USA to attach Iran citing its nuclear weapons as a matter of growing concern, Saudi Arabia and Iran remain conflicted on the Israel-Palestine issue etc. Moreover, tensions are running high between Saudi Arabia and Iran. Saudi Arabia and other gulf country’s decision to send troops to Bahrain to quell disturbances have been opposed by Iran. In Bahrain, a Sunni monarchy is being protested against by mostly Shiite protester. While the Saudi troops bolster the Sunni monarchy, Iran continues to support the Shiite protesters (in verbal policy statements). Many have argued that Iran, which holds the OPEC presidency currently, deliberately blocked Saudi efforts at the group’s meeting in Vienna to raise official production quotas. Since many countries including Iran already are exceeding the quotas, the failure to increase them was seen as largely a politically charged motive. Delegates’ Take While researching on the agenda delegates must try and incorporate the various past crises that the OPEC has had to face as an organization and how these have affected the oil markets. An immediate conclusion of a careful analysis is that many OPEC members are vulnerable to oil shocks arising through protracted 14 political conflicts, as either their own country is the location for such a conflict or the conflict is occurring in either a neighbouring country or a primary trading partner. These conflicts stem the flow of oil exports which can create shortages in the international oil markets and thus artificially increase prices. The OPEC as an organization has to hedge its risks from such conflicts as they cannot be completely eliminated. The Organization as a whole has to take steps to ensure the safety of its oil infrastructure even during such situations. Economic Crises are a little harder to mitigate as the reasons for their onset is usually unknown. The wider economic community only realises the presence of such a crisis once it has been wrecking havoc on various markets around the world for a good 4 months or so. If we take the subprime mortgage crisis as an example, the United States only realised its presence after a full year. The OPEC has to formulate ways and means to protect its assets and resources from crisis and ensure availability of credit to continue operations. Another factor that can be seen is that, the unity amongst the members of the organization is not ideal. There are various rifts within the organization relating specifically to production quotas and artificial price setting. To maintain a strong stand in front of the international community, the organization has to appear united. Thus discussion on these rifts is very important. Policies such as the scorched earth policy and the oil weapon policy have to be looked into as viable or not. Delegates must also understand the need for the maintenance of oil investments and how their presence can be ensured despite various economic and political crises. 15 Agenda: Energy conservation and long term sustainability of OPEC Energy Conservation – Introduction & Brief History Energy conservation may be defined as “efforts made to reduce energy consumption through increased efficient energy use, in conjunction with decreased energy consumption and/or reduced consumption from conventional energy sources”. Though energy conservation is a phenomenon known from time immemorial, and very well practised ever since man started utilising energy itself, yet it erupted on to the main stream global stage in the early 1970s due to a series of incidents directly involving certain OPEC countries. Before the 1970s, the world enjoyed a steady supply for oil resources from OPEC countries to fuel its energy demands. But the situation changed in the early 1970s15. Firstly, On August 15, 1971, the United States unilaterally pulled out of the Bretton Woods Accord taking the US off the Gold Exchange Standard16 (whereby only the value of the US dollar had been pegged to the price of gold and all other currencies were pegged to the US dollar), allowing the dollar to "float". Shortly thereafter, Britain followed, floating the pound sterling. The industrialized nations followed suit with their respective currencies. In anticipation of the fluctuation of currencies as they stabilized against each other, the industrialized nations also increased their reserves (printing money) in amounts far greater than ever before. The result was a depreciation of the value of the US dollar, as well as the other currencies of the world. Because oil was priced in dollars, this meant that oil producers (and majority OPEC members) were receiving less real income for the same price. The OPEC issued a joint communique stating that, from then on, they would price a barrel of oil against gold. This led to the "Oil Shock"17 of the mid-1970s which made the people apprehensive towards the “assurance of a steady supply of oil resources” and made them look for alternative approaches to fulfil their energy demands and needs. 15 http://www.opec.org/opec_web/en/about_us/24.htm http://www.britannica.com/EBchecked/topic/237339/gold-exchange-standard 17 http://www.guardian.co.uk/environment/2011/mar/03/1970s-oil-price-shock 16 16 Secondly, in the Yom Kippur War of 197318, United States of America and other western countries openly sided with Israel and angered leading Arab states like Saudi Arabia and Iran, both of which were and continue to remain major exporters of oil and key players at OPEC. This was followed by an oil embargo on western countries aimed as a retaliatory move for their support of Israel. Iran stopped providing oil to the United States and Western Europe. Also, King Feisal of Saudi Arabia imposed an oil embargo against the West. In doing so, the oil pricing for the United States went from 3 dollars a barrel to 12 dollars a barrel19, spurring gas rationing. U.S. stations put a limit both on the amount of gas that could be dispensed, closed on Sundays, and limited the days it could be purchased based on license plates. Effect of the price rise was felt long after the embargo was lifted and the economies took a long time to normalise. Prices continued to rise after the Embargo ended. The Oil Embargo of 1973 had a lasting effect on the United States. The embargo also forced America and various other world economies who were indirectly hit by the embargo to re-evaluate the cost and source of energy, which previously received little consideration in the economic set ups. Western governments went into a conservation phase and started implementing policies that would limit the use of energy, especially conventional sources of energy like oil and petroleum. In western countries like USA, to help reduce consumption, in 1974 a national maximum speed limit of 55 mph (about 88 km/h) was imposed through the Emergency Highway Energy Conservation Act20. Such was the impact of this embargo that President Nixon established the Energy Department as a Cabinet Office in his administration. Also factories in USA were asked to shift their energy supply to coal instead of oil. The crisis also prompted a call for individuals and businesses to conserve energy, most notably a campaign by the Advertising Council using the tag line "Don't Be Fuelish." Governments started running energy conservation campaigns and many newspapers carried full-page advertisements that featured cut-outs which could be attached to light switches, reading "Last Out, Lights Out: Don't Be Fuelish."21 18 http://www.historylearningsite.co.uk/yom_kippur_war_of_1973.htm http://www.wtrg.com/prices.htm 20 http://www.presidency.ucsb.edu/ws/index.php?pid=4332 21 http://www.webcitation.org/5jWimLA89 19 17 One of the most lasting effects of the Oil Embargo of 1973 was an economic recession throughout the world. Unemployment flew to the highest percentage on record while inflation did the same. Although the embargo only lasted one year, oil prices had quadrupled and a new era of energy conservation began. Thirdly, the energy crisis in USA and other western countries during 1979 also played a pivotal role in expanding interest for energy conservation. The 1979 (or second) oil crisis in the United States occurred in the wake of the Iranian Revolution22. Amid massive protests, the Shah of Iran, Mohammad Reza Pahlavi, fled his country in early 1979 and the Ayatollah Khomeini soon became the new leader of Iran. Protests severely disrupted the Iranian oil sector, with production being greatly curtailed and exports suspended. When oil exports were later resumed under the new regime, they were inconsistent and at a lower volume, which pushed prices up. Saudi Arabia and other OPEC nations, under the presidency of Dr. Mana Alotaiba increased production to offset the decline, and the overall loss in production was about 4 per cent. However, a widespread panic resulted, added to by the decision of U.S. President Jimmy Carter to order the cessation of Iranian imports23, driving the price far higher than would be expected under normal circumstances. Oil imports fell sharply, and long lines once again appeared at gas stations and convenience stores in various parts of the world, just as they did in 1973. The world realised that higher dependence on conventional sources such as oil as well as over and inefficient utilisation could prove fatal and disastrous. Energy efficiency, which for long had remained a mere technical aspect of designing equipment, systems, and buildings, metamorphosed into "energy conservation," which emerged as a distinct field of interest, rather than continuing to be a subsidiary engineering issue. The energy crisis led to greater interest in renewable energy and spurred research in solar power and wind power. It also led to greater pressure to exploit North American oil sources, and increased the West's dependence on coal and nuclear power. This included increased interest in mass transit systems such as subways, trams etc. 22 http://www.iranchamber.com/history/islamic_revolution/islamic_revolution.php/ http://www.history.com/this-day-in-history/iranian-students-storm-us-embassy-in-tehran-leading-to-oilembargo 23 18 Various countries reacted differently to the energy crisis and adopted varied pro-conservation policies. In Australia, heating oil ceased being considered an appropriate winter heating fuel. This often meant that a lot of oil-fired room heaters that were popular from the late-1950s to the early-1970s were considered outdated. Gas-conversion kits that let the heaters burn natural gas or propane were introduced. The Brazilian government implemented a very large project called "Proálcool" (pro-alcohol) that mixed ethanol with gasoline for automotive fuel. To supplement Israel's over-taxed power grid, Harry Zvi Tabor, the father of Israel's solar industry, developed the prototype for a solar water heater now used in over 90% of Israeli homes. Slowly and gradually, the world started shifting to alternative sources of energy. OPEC’s stand on energy conservation and environmental protection OPEC’s response to this surge in energy conservation and overall environmental protection has been an enthusiastic yet cautious and diplomatic one. It supports environmental interests, but also upholds its prime objective of ensuring economic prosperity and a steady demand of oil products for its member countries. OPEC has long advocated responsible stewardship of the environment and energy conservation to meet demands of future generations, but also advocates the strategy that oil will always be central to functioning of world economy. With the long-term outlook suggesting fossil fuels will continue to provide the bulk of global energy needs, and with the world increasingly requiring its energy to be cleaner and safer, OPEC recognizes that stakeholders everywhere have an important role to play in global environmental efforts. OPEC has also initiated studies and programmes to reduce gas flaring, which has long been recognized as an environmentally damaging activity. OPEC Member Countries have already invested billions of dollars over the last few decades to pursue flared-gas recovery projects. These have included either reinjecting associated gas into oil reservoirs or ‘monetizing’ associated gas through 19 liquefaction. The net result has been a 50% reduction of the amount of gas flared from each barrel produced since the early 1970s. And OPEC has 2 continued to seek opportunities to form partnerships with other stakeholders — most recently becoming an active participant in the Global Gas Flaring Reduction Partnership (GGFR) sponsored by the World Bank. The targeted use of funds to support on-going efforts to achieve cleaner and more efficient technologies in the energy field is also supported by OPEC. At the Third OPEC Summit held in Riyadh, Saudi Arabia, in November 2007, Member Countries highlighted the importance of financing and promoting R&D collaboration in the petroleum industry so as to able to produce efficient fuel types and conserving energy. OPEC advocates a broad reconsideration of the scope and use of “green taxes” in developed countries. Too often, these taxes are levied solely on oil products and account for around 70% of the final price of products such as gasoline and diesel. Instead, OPEC believes that a more equitable approach must be adopted that can service the interests of the environment as well as oil producing nations. OPEC is also concerned that many of the environmental policies now being proposed and adopted do not have the full support of the scientific community. There is still considerable debate about the impact of global warming, and how it can best be addressed. OPEC supports further research into these important issues which have a direct bearing on energy conservation and environmental protection. OPEC is concerned that some countries may impose environmental and taxation policies that are harmful to those who rely on fossil fuels for a substantial part of their income. OPEC is worried about discriminatory oil taxes because of its commitment to provide a stable petroleum market. OPEC is also spending heavily to improve the environmental impact of oil, by locating sources of higher quality oil and gas, by developing cleaner fuels for consumers, and by reducing the impact of its activities through safer, cleaner drilling, transportation and refining processes. OPEC also participates in many international meetings in order to remind governments and others who are debating energy conservation and 20 environmental protection that they must consider the needs of developing countries, especially those that rely on their income from oil. OPEC supports the cause of energy conservation, but is not ready to compromise the economic interests and well-being of its member states. Many of the concerns advocated by OPEC have been discussed in detail in the next part of this guide. Further Reading: http://www.opec.org/opec_web/static_files_project/media/downloads/press_ro om/OPEC_Environmental_position.pdf Potential threats to long term sustainability of OPEC Declining OPEC Reserves OPEC's ability to control the price of oil has diminished somewhat since the Gulf War due to the subsequent discovery and development of large oil reserves in Alaska, the North Sea, Canada, the Gulf of Mexico, the opening up of Russia, and market modernization. As of November 2010, OPEC members collectively hold 79% of world crude oil reserves and 44% of the world’s crude oil production, affording them considerable control over the global market, but not like the one they held before. The next largest group of producers, members of the OECD and the Post-Soviet states produced only 23.8% and 14.8%, respectively, of the world's total oil production. Further, market concerns that OPEC members have little excess pumping capacity have time and again sparked speculations that OPEC’s influence on crude oil prices is beginning to slip, and that it may no longer be able to meet the world’s oil demands. Reduced oil investments In recent times, there has been an apprehensive attitude towards oil investments fuelled by lack of steady demand for oil, conservative policies of governments and a lack of investor confidence in oil to give timely returns. The OPEC has also adopted a cautious approach to bringing on new oil, but at the risk of a widening gap between supply and demand. In 2007, Saudi Arabia, the world's leading exporter, had signalled it might not have to boost potential output above its targeted 12.5 million barrels per day (bpd) if consumers meet 21 their goals of greater energy efficiency and reduced dependence on oil. This cautious approach is seen as a direct sign of not having any assured steady demand of oil, and thereby refraining from making heavy investments in oil. Consumer countries often ask OPEC to invest at a faster rate, but they simultaneously talk of drastically reducing their oil imports and pursue a highly petrophobic energy agenda. If the oil producers don’t invest to increase their capacity in time, sooner the consumers shall be met with a shortfall of oil. History has taught OPEC that hefty supplies trigger a price collapse, while global recessionary periods destroy demand, forcing OPEC to mothball production and international oil firms to run fields at a loss. All OPEC members fear running on ‘idle capacity’. Consumer nations have repeatedly called on OPEC to make more oil available and demand for the group's crude is expected to climb to 49 million bpd by 2030. Boosting its exports to that level could require oilfield investment of up to $500 billion. But the trend to move away from oil towards alternatives could limit these oilfield investments, while at the same time the alternatives will not be able to fulfil the energy needs of the world. Oil investments and investor confidence have a direct bearing on the revenues of oil producers, which in turn reflect on oil investments by these producers, forming a cyclical relationship. If oil producers receive lower incomes they must spend less money and import fewer goods from oil consumers. If investors are unsure about the risks and the likely returns from petroleum investments they may not make those investments. If we do not invest enough money and invest in time, then the world could face a shortage of oil supplies and a downward spiral in the global economy. However, if oil producers continue to receive reasonable prices and stable demand, they will maintain their production and invest far enough in advance to meet the growth of demand. All in all, the reduction in oil investments is hurting the economic health of OPEC member states and threatening long term sustainability of OPEC itself, because without investments there might not be any oil resources in the future (or maybe too little), and without oil there will be no OPEC. Further Reading: http://www.reuters.com/article/2007/05/15/us-opecrenewables-idUSL1554002720070515 22 Oil Taxes – The politics of profit This graph illustrates the inter-country variations in the price of one litre of oil across the G7 countries during 2010. The price variations, however, are not due to differences in crude oil prices but rather to the widely varying levels of oil taxes (shown in red) in those major oil consuming nations. These can range from relatively modest levels - in the USA and Canada - to very high levels in Europe. In the UK, for example, the government earned US $1.15 (or around 65%) from the US $1.78 retail price of a litre of pump fuel in 2010, while oil producing countries (including OPEC) earned only US $0.51 (or around 29%) of this total pump fuel price. One very persistent threat to the financial, economic and political sustainability of OPEC and its member states is that from oil taxes imposed by various oil importers around the globe. Oil taxes imposed on oil imports often yield three results. They lower the overall consumption of oil in a particular area because of relatively increased prices, aid the efforts of governments in energy conservation by reduced consumption and reduce the profit margins of oil producers. 23 OPEC supports sustainable economic development, which requires steady supplies of energy at reasonable prices. Many countries have already introduced heavy taxes on oil products. In some countries, the price that motorists pay for gasoline is three or four times higher than the price of the original crude oil. Taxes account for up to 70 per cent of the final price of oil products in some countries. As a result of these taxes, some of the oil- consuming countries (especially those in Europe where taxation levels are highest) receive much more income from oil than OPEC does. OPEC members are apprehensive that many of the 'green' taxes that are currently levied on oil do not specifically help the environment. Instead, they reach government coffers to be spent on other things. Taxes might lead to instability in the oil industry, creating problems for many countries and industries. Although OPEC does try to maintain stability and invest in a timely manner in oil resources, its efforts to guarantee the security of oil supplies can be undermined - or supported - by the actions of oil consumers and economic policies of oil importers. Oil production and extraction is a long term process and requires timely investments. Oil facilities require many millions of dollars of investment, and the investors try to earn a reasonable return on their capital. If oil producers do not invest enough money and don’t do it far enough in advance, then the world could face a shortage of oil supplies in future. But to be able to invest in oil resources, producers need to have an assured and steady demand, and also earn considerable profits from the export of oil, both of which are undermined by oil taxes, and are making various OPEC members apprehensive towards increasing oil supplies or investing in new oil resources. If there is no investment in expanding oil production capacity before it is needed, the world could face sudden price shocks, leading to serious global economic problems. Oil consumers need steady supplies of oil, and oil producers rely on steady demand. If demand changed suddenly it would have a major impact on the profitability of oil producers and the economies of many countries around the world. A downturn in oil demand could force oil production to slow down or stop. This could physically damage the oil fields, reducing the amount of oil that can be recovered in future. The oil installations could also be damaged. Some 24 facilities, such as those operating in the oceans, are very difficult and expensive to shut down. OPEC is worried about discriminatory oil taxes because they have direct threat to a stable petroleum market24. There is a need to invest in oil exploration and development in order to have production capacity available as demand rises in the years ahead. Discriminatory governmental policies supporting alternative sources of energy and energy conservation In recent years there has been a drastic shift in environmental policies formed by industrialised countries that limit the use of fossil fuels in order to reduce emissions of carbon dioxide. Though the policies sound very promising, in most cases they are levied primarily on oil products, depicting the attitude of governments towards reducing consumption of oil in their desire to serve environmental concerns. Also by levying high taxes on oil imports they attempt to gain more revenue. Yet studies have shown that OECD members could cut their carbon dioxide emissions by 12 per cent by 2010 and still maintain their tax revenues25, if they adopted a pro rata tax system that levies tax on all forms of energy according to their carbon content. OPEC members have time and again expressed concerns that some countries may impose environmental policies that are harmful to those who rely on fossil fuels for a substantial part of their income. Some countries with high oil taxes actually subsidise domestic coal production, yet coal produces more carbon dioxide than oil. Carbon dioxide is one of the greenhouse gases which contribute to global warming. OPEC is also concerned that many of the environmental policies now being proposed and adopted do not have the full support of the scientific community. There is still considerable debate about the impact of global warming, and how it can best be addressed. OPEC supports further research into these important issues. Discovery of new Non-OPEC oil reserves and other alternatives 24 25 http://www.opec.org/opec_web/en/press_room/178.htm http://www.opec.org/opec_web/en/press_room/178.htm 25 Large new, conventional and unconventional reserves in North America, and elsewhere, are questioning the dominant role of OPEC in meeting the global oil thirst. The abundance of resources and the more ‘balanced’ geographical distribution of unconventional resources have reduced the much-hyped concerns over ‘energy security’ which once served as the undercurrent driving energy policies and dominated the global energy debate. A few years ago, much of the global energy debate was based on the premise of acute resource scarcity and its economic and political ramifications. However, things appear radically changed today. Rather than supply scarcity, oil supplies remain at comfortable levels, even given rising demand from fastgrowing nations. Consequently, the pressure on OPEC nations to raise their output capacity had substantially reduced. The debate on energy policy has been turned upside down recently by growing oil and natural gas supplies. And all this makes the demand security, so very essential for major investment in the sector, still more missing. That subsequently makes spending on aggressive energy programs unlikely. Unconventional oil developments are dominated by oil sands in the United States and Canada with 2011 global production amounting to 2.3 million bpd or 26 equivalent to production of non-OPEC member Norway. And in the meantime, rising conventional output from Brazil and Iraq are also contributing significantly to the emerging global energy landscape. Tight oil is a form of light crude oil held in shale deep below the earth’s surface that is extracted with hydraulic fracturing, or “fracking,” using deep horizontal wells. OPEC expects global output of this non-conventional oil to rise 3.4 million bpd by 2015, still dominated by oil sands, to 5.8 million bpd by 2025 and to 8.4 million bpd by 2035 when tight oil would be playing a much bigger role. In 2035, OPEC expects the United States and Canada to still be dominating unconventional oil production with 6.6 million bpd, but China could be producing 1.1 million bpd of its own unconventional oil by then. OPEC estimated in a recent report that global reserves of tight oil could be as high as 300 billion barrels, well above current estimates of Saudi Arabia’s conventional reserves of around 265 billion barrels. And shale gas too is supplementing the emerging picture. A technology-led surge in North American shale gas production has created a global gas glut over the last few years, reducing the US reliance on Middle Eastern gas imports, forcing exporters to look for new buyers and cut their revenues. All this also carries immense connotations in geopolitical terms. It could change many equations. The US shale gas boom has virtually eliminated the need for US liquefied natural gas imports for at least two decades. And interestingly it has reduced Russia’s influence over the European natural gas market and diminished the petro-power of gas producers in the Middle East. Canada is one of the kingpins of this new resource wave in North America. The chairman of the Canadian Society for Unconventional Resources (CSUR) Dan Allan admits unconventional oil and gas are to have a major impact on the global scenario, “I don’t see any indication that the train is going to stop. Unconventional will become conventional and it will be the dominant force for the foreseeable future.” Further reading: http://peakoil.com/geology/new-oil-reserves-pose-threat-toopec-dominance/ 27 Questions to consider 1. Is Energy conservation a threat to OPEC’s existence? How can it be used for the betterment of OPEC member state’s economies? 2. Will investments in ‘green’ alternatives of energy come at the cost of investments in oil? 3. In the current surge of energy conservation and availability of unconventional sources of energy, how can viability of oil be maintained? 4. To what extent are the taxes imposed on oil imports and consumption by the governments justified? 5. How can oil investments be increased? Will the world be able to survive without oil, in the absence of significant oil investments? 6. Are the alternatives to oil really reliable and environment friendly? 7. How can a steady demand for oil resources for all OPEC members be ensured in the coming times? 8. In the changing times, how can OPEC maintain its geopolitical and economic clout on the global stage? 28