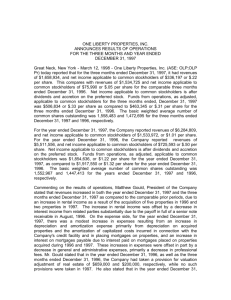

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

advertisement