ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE

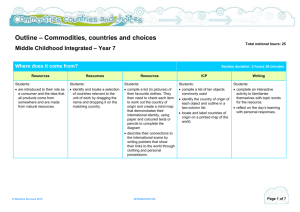

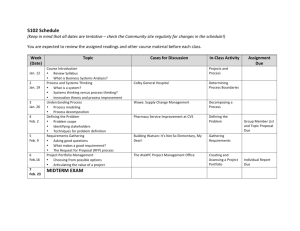

advertisement

ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE OUTLINE – Week Content Area 1 Introduction Jan 6 to Jan 10 Financial systems and fundamental principles 2 Jan 13 to Jan 17 3 Jan 20 to Jan 24 106765094 This course outline is not in sequential order per syllabus, but rather is task based. Unit Content Recommended Activities Assessment Resources Overview of course and assessment requirements. Discuss file organization Course Expectations Classroom rules Powerpoint - financial of teenagers Nature and purpose of documents What is Money? Functions of Money Characteristics of Money Other methods of payment Powerpoint – Characteristics of money. for recording and communicating of personal financial information e.g. Money literacy Recording, processing and communicating financial information Importance of personal financial Financial planning, control and Evaluating financial information for planning, coordinating, controlling and investing Importance of personal financial planning, including short and long- term goal-setting Interpretation of information relevant to personal financial management, planning, including short and longinvestment. term goal-setting Goal setting and planning. What is income – Introduction? What is budgeting and expenditure? What are savings and investments? How are they different? Financial management Earning an income Minimum wage rates What is taxation? What are some of the different kinds for example pay slips and other of taxes in Australia and Vietnam? media. Why is taxation important? Prepare personal budgets. Hand out Tax Scales and Tax guide Interpretation of information relevant – part A to personal financial management Handout on Pay slips e.g. Pay slips, 25 February 2013 Task 3 Part A Filing Issued Accounting and Finance Unit 1A, Westone – chapter 1 – “What is money” Handout Task 2 Part A Investment Investigation Issued 5% Accounting and Finance Unit 1A, Westone – chapter 2 – “Income” Task 1 Part A Income Investigation Issued Accounting and Finance Unit 1A, Westone – chapter 2 – “Income” Task 2 Part A Due in Accounting and Finance Unit 1A, Westone – chapter 4 – “Taxation” Page 1 ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE OUTLINE – Week Content Area 4 Evaluating financial information for planning, coordinating, controlling and investing Feb 17 to Feb 21 5 Feb 24 to Feb 28 6 106765094 Unit Content Activities factors affecting financial decision making e.g. The importance of compounding interest versus simple interest Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 2 & 5 Ed's story Ed's workings Ed's annual budget Nature and purpose of documents Activities from Westone Financial institutions The role of financial institutions that Activities from Westone Evaluating financial information for planning, coordination, control and investment Recommended Assessment Resources Importance of personal financial Financial goals planning, (including short- and long- Budgets term goal setting), and the financial Example budget – How Ed did it Financial institutions Financial systems and fundamental principles Mar 03 To Mar 07 This course outline is not in sequential order per syllabus, but rather is task based. for recording and communicating of personal financial information e.g. Cheques, bank and credit card statements, automatic teller machine (atm), eftpos slips and internet receipts meet the personal needs of individuals, for example banks and credit unions Systems and types of bank accounts and sources of borrowing for personal financial management e.g. Types of credit cards. Interpretation of information relevant Activities from Westone to personal financial management Handout on Bank Reconciliations e.g. bank statements, Credit Card In class exercises statements, EFTPOS and other Handout on bank statements, media Preparation of personal reconciliation statements. EFTPOS and other media Task 1 Part A due in Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 3 & 5 Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 5 & 6 bank 25 February 2013 Page 2 ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE OUTLINE – This course outline is not in sequential order per syllabus, but rather is task based. Week Content Area Unit Content 7 Financial systems and fundamental principles Types Mar 11 To Mar 14 8 Mar 17 to Mar 21 9 Mar 24 to Mar 28 106765094 Evaluating Financial Information – For planning, coordinating, controlling and investing Activities Assessment of taxation affecting Hand out - Personal Tax guide produced by the ATO individuals e.g. Income tax, GST, capital gains and fringe benefits such as cars, mobile phones Maintenance of personal financial records for personal income tax and calculation of tax payable Assessable income Allowable deductions Union fees, Professional associations Donations Uniform and Motor vehicle expenses Tax offsets of documents PowerPoint – Insurance associated with personal Handout on Definitions for insurance financial information e.g. Dollarsmart exercises Cheques, application for bank account or credit card, mobile phone. The importance of proper disclosure e.g. Reading fine print on contracts, providing accurate financial information Sources of youth debt: credit cards, mobile telephone contracts, rent and student fee loans Implications of personal credit ratings. Preparation 25 February 2013 Recommended Resources Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 4 Task 4 Closed Book Test 15% Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 6 Page 3 ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE OUTLINE – This course outline is not in sequential order per syllabus, but rather is task based. Week Content Area 10 Recording, processing and communicating financial information The importance of proper disclosure Hand out - Personal Tax guide e.g. Reading fine print on contracts, produced by the ATO providing accurate financial information. Role and benefits of insurance e.g. Car, travel insurance. Recording, processing and communicating financial information Preparation of personal budgets Identity and function of government agencies in relation to personal finance e.g. Department of Consumer and Employment Protection Factors affecting personal financial decision making e.g. Influence of media, peer group pressure, beliefs and values. Mar 31 to Apr 04 11 Apr 07 to Apr 11 12 Apr 14 to Apr 18 13 Apr 21 to Apr 25 14 Apr 28 to May 02 106765094 The role and influence of governments and other bodies Unit Content Activities Assessment Recommended Resources Task 1 Part B Investigation Issued 15% Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 2 Dollarsmart exercises Task 3 In class Essay 5% Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Units 2-8 Dollarsmart exercises Task 5 In class Test 20% Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Units 2-8 Recording, processing and communicating financial information Investment options available to Activities from Westone individuals e.g. Superannuation, share market, property, cash deposits and long-term investments The concept of security on investment risk of return security on borrowings Explain the relationship between risk and rate of return e.g. interest rates Recording, processing and communicating financial information Investment options available to Activities from Westone individuals e.g. Superannuation, share market, property, cash deposits and long-term investments Sources of financial advice e.g. Banks, media, and financial advisors. 25 February 2013 Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 9, 10 & 11 Task 2 Due to be Handed in Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit 9, 10 & 11 Page 4 ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF COURSE OUTLINE – This course outline is not in sequential order per syllabus, but rather is task based. Week Content Area Unit Content Activities 15 May 5 to May 12 Recording, processing and communicating financial information Case study on budgeting and debt “To the Max” case study management. “Drivers Seat” case study Case study – lending, budgeting and insurance 16 EXAMS Assessment Task 6 In-class Test 15% Recommended Resources Accounting and Finance Unit 1A, WestOne Services, West Perth, Western Australia, 6005 Unit content This unit includes knowledge, understandings and skills to the degree of complexity described below. Recommended time to be spent on content areas is specified in brackets. Financial institutions and systems (10–15%) Financial institutions The role of financial institutions that meet the personal needs of individuals e.g. Banks (include internet and phone banking), credit unions, retail stores and telecommunications companies. Financial systems and fundamental principles Nature and purpose of documents for recording and communicating of personal financial information e.g. Cheques, bank and credit card statements, automatic teller machine (ATM), eftpos slips and internet receipts Systems and types of bank accounts and sources of borrowing for personal financial management e.g. Types of credit cards The concept of security on investment risk of return security on borrowings explain the relationship between risk and rate of return e.g. interest rates the importance of proper disclosure e.g. reading fine print on contracts, providing accurate financial information role and benefits of insurance e.g. car, travel insurance sources of youth debt: credit cards, mobile telephone contracts, rent and student fee loans implications of personal credit ratings. Recording, using and evaluating financial information Recording, processing and communicating financial information (50–60%) Preparation of documents associated with personal financial information e.g. Cheques, application for bank account or credit card, mobile phone Preparation of personal budgets 106765094 25 February 2013 Page 5 ACCOUNTING AND FINANCE YEAR 11 – UNIT 1AACF Preparation of personal bank reconciliation statements Maintenance of personal financial records for personal income tax and calculation of tax payable including only: Assessable income (limited to salaries and wages and interest) Allowable deductions (limited to union fees, professional associations, donations and uniform and motor vehicle expenses) Tax offset (limited to health insurance). Evaluating financial information for planning, coordinating, controlling and investing (10–20%) Interpretation of information relevant to personal financial management e.g. Pay slips, bank statements, eftpos and other media Importance of personal financial planning, (including short- and long-term goal setting), and the financial factors affecting financial decision making e.g. The importance of compounding interest versus simple interest Investment options available to individuals e.g. Superannuation, share market, property, cash deposits and long-term investments Sources of financial advice e.g. banks, media, and financial advisors. Government and the community (10–15%) The role and influence of governments and other bodies Types of taxation affecting individuals e.g. income tax, GST, capital gains and fringe benefits such as cars, mobile phones Identity and function of government agencies in relation to personal finance e.g. Department of Consumer and Employment Protection. The influence of social, environmental and ethical factors Factors affecting personal financial decision making e.g. Influence of media, peer group pressure, beliefs and values. 106765094 25 February 2013 Page 6