Legal Forms of Companies

different types of companies in England, the U.S., and Austria, starting a company,

advantages and disadvantages of company forms, how companies develop and change

over time, public corporations and the stock market, describing company

development, inside versus outside sources of information

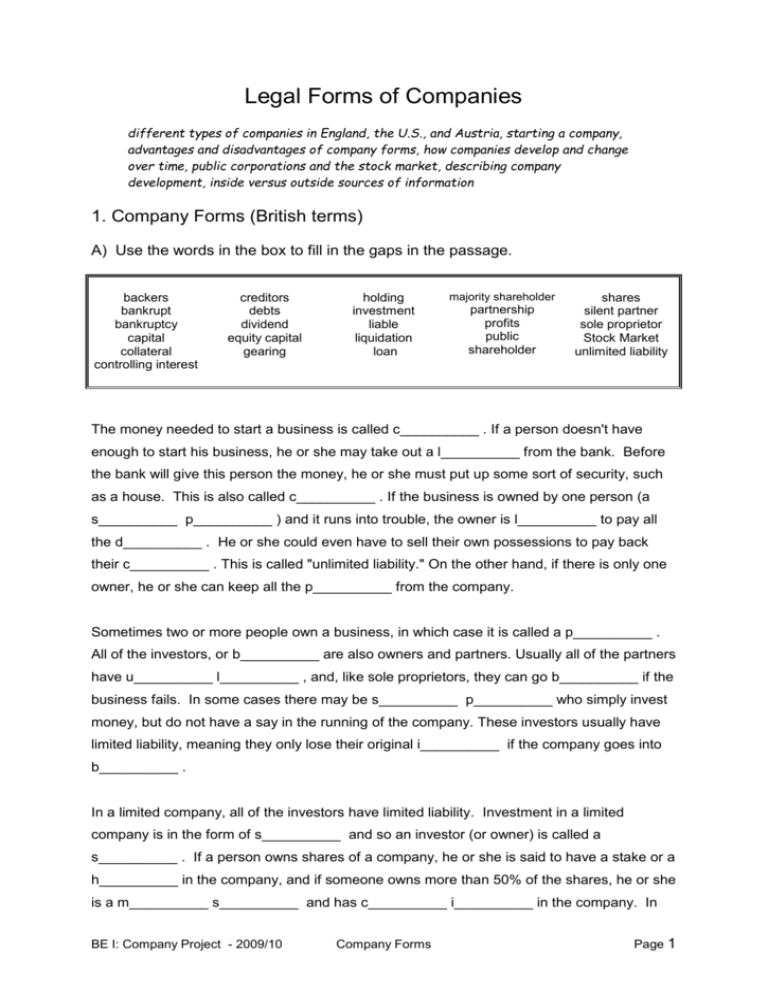

1. Company Forms (British terms)

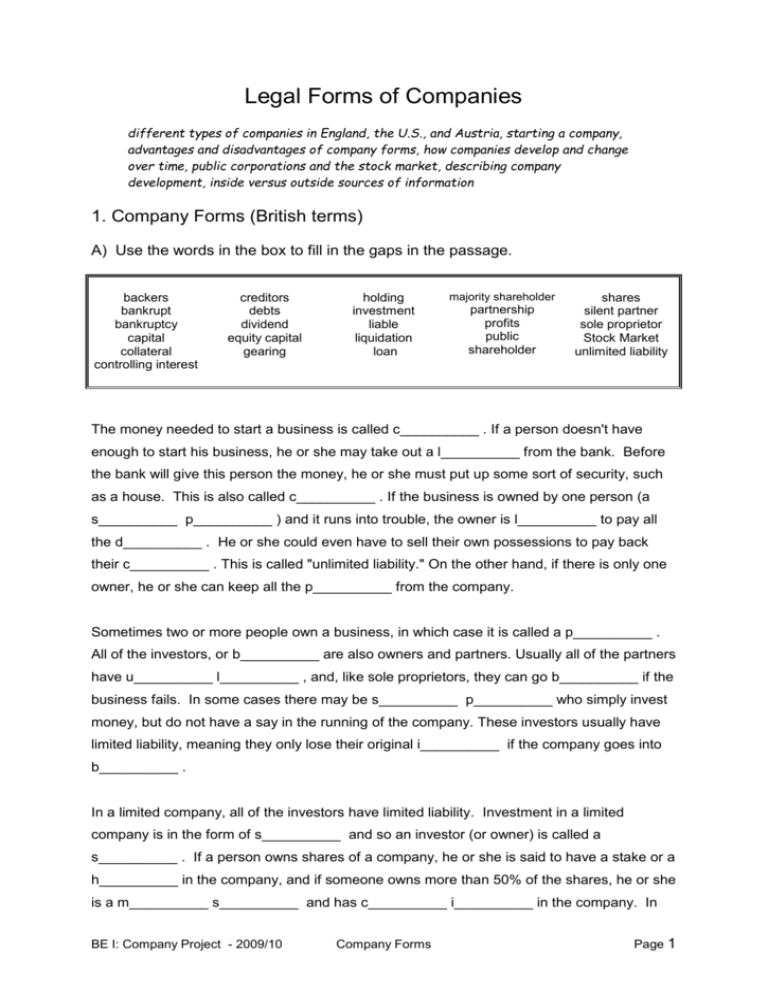

A) Use the words in the box to fill in the gaps in the passage.

backers

bankrupt

bankruptcy

capital

collateral

controlling interest

creditors

debts

dividend

equity capital

gearing

holding

investment

liable

liquidation

loan

majority shareholder

partnership

profits

public

shareholder

shares

silent partner

sole proprietor

Stock Market

unlimited liability

The money needed to start a business is called c__________ . If a person doesn't have

enough to start his business, he or she may take out a l__________ from the bank. Before

the bank will give this person the money, he or she must put up some sort of security, such

as a house. This is also called c__________ . If the business is owned by one person (a

s__________ p__________ ) and it runs into trouble, the owner is l__________ to pay all

the d__________ . He or she could even have to sell their own possessions to pay back

their c__________ . This is called "unlimited liability." On the other hand, if there is only one

owner, he or she can keep all the p__________ from the company.

Sometimes two or more people own a business, in which case it is called a p__________ .

All of the investors, or b__________ are also owners and partners. Usually all of the partners

have u__________ l__________ , and, like sole proprietors, they can go b__________ if the

business fails. In some cases there may be s__________ p__________ who simply invest

money, but do not have a say in the running of the company. These investors usually have

limited liability, meaning they only lose their original i__________ if the company goes into

b__________ .

In a limited company, all of the investors have limited liability. Investment in a limited

company is in the form of s__________ and so an investor (or owner) is called a

s__________ . If a person owns shares of a company, he or she is said to have a stake or a

h__________ in the company, and if someone owns more than 50% of the shares, he or she

is a m__________ s__________ and has c__________ i__________ in the company. In

BE I: Company Project - 2009/10

Company Forms

Page 1

other words, he or she is the boss. Some or all of the profits of a limited company are paid

out to the shareholders in the form of a d__________ .

There are both private and p__________ limited companies. In private limited companies

(which have the abbreviation "ltd." after their names,) a shareholder can only sell his or her

shares when the rest of the shareholders agree. In public limited companies (abbreviation:

"plc"), shares are bought and sold freely on the S__________ M__________ . Besides the

money they get from selling shares (called share capital or e__________ c__________ ),

limited companies can also borrow capital from banks or other institutions (called loan

capital). The ratio of a company's loan capital to equity capital is known as its g__________

. A highly geared company has a large proportion of loan capital. When a limited company

fails, it goes into l__________ , meaning all its assets are sold off to pay creditors.

B) Fill in the chart using the information from above.

Type

Sole

Proprietorship

plc

Abbreviation

(2 – 50)

Number of

Owners

partners

Who owns it

limited

Liability of

owners

Owners'

earnings

profit after

tax

If the business

fails . . .

If an owner

sells . . .

C) Now answer the questions in complete sentences:

a)

b)

c)

d)

e)

How can a sole proprietor protect his/her private assets in the case of bankruptcy?

How realistic is it that a public limited company has a majority shareholder?

What advantage can equity capital have over loan capital?

What is the interest rate for loans right now?

What is the difference between “bankruptcy” and “liquidation”? Are these the only

two options for a failing company?

f) When a company goes into liquidation, what all can be sold to pay off creditors?

BE I: Company Project - 2009/10

Company Forms

Page 2

2. Setting Up a Limited Company

The diagram below shows you how ABC Ltd. was set up.

Roger

$20,000

Margaret

$55,000

ABC Ltd.

$100,000

(20,000 x $5)

Mike

$15,000

Frank

$10,000

(Profit after first year:

$20,000)

Now make complete sentences about ABC Ltd using the words below. Include

names, numbers and specific information in your sentences. In order to make sure

you use an appropriate level of language, there is an added rule: you may not use

any of the following verbs in your sentences – to be, to exist, to have, to get, to

make, to do, to give, to put, or to take.

a) investors, equity capital

b) majority shareholder, stake, controlling interest

c) shares, nominal value (or "face value", or "par value")

d) profit, dividend per share

e) return, investment

BE I: Company Project - 2009/10

Company Forms

Page 3

3. Advantages and Disadvantages

Scrambled up on the next page are 24 positive and negative aspects of the four

different types of companies. First decide whether each one is an advantage or a

disadvantage, and then which type of company it applies to. (Some points can be

applied to more than one type of company, but there is a best answer. When you

are finished you should have three advantages and three disadvantages for each

company type.)

Advantages

Disadvantages

Sole Proprietorship

Partnership

Private Limited Company

Public Limited Company

1. Shareholders have limited liability.

2. Finances are

confidential

5. They have continuity - the board of 6. Freedom to do as

directors continues to run the

he or she likes in

business whoever dies or retires.

running the

business.

BE I: Company Project - 2009/10

3. There is no continuity of

business if a partner dies

or goes bankrupt

4. Shares can not

normally be sold to the

public - this limits the

capital.

7. Management can become 8. Any losses are shared

impersonal, inflexible or

among the partners.

inefficient and more staff can

be expensive.

Company Forms

Page 4

9. Limited capital

10. More capital

restricts new projects or available

expansion plans.

13. Capital is still limited for

large scale business.

11.Management and ownership can 12.Possible disagreements

be separate. Shareholders can

between partners - personal or

exercise some control in the annual professional.

general meetings.

14. The company has a

legal identity and can be

treated like a person under

the law.

15. Management can be criticized

and hindered by shareholders who

do not fully understand a

situation.

17. Unlimited liability. If the business 18. A lot of information that the

fails, the owner is responsible for all company would like to keep

the debts and may lose his or her

confidential must be made public

own possessions.

21. Easy to set up. No complex

legal problems.

16. With so much

capital. large scale

projects and

investments can be

undertaken.

19. Owner keeps

all of the profits.

20. Carefully audited

accounts must be

kept for annual

inspection.

22. Owner tied to the business. 23. They can provide more

After business hours there can capital than partnerships.

still be a lot of work to be

done.

24. With legal,

accountancy and

government fees, they

are very expensive to

set up.

BE I: Company Project - 2009/10

Company Forms

Page 5

4. American and Austrian Forms of Companies

A) Unlike the British or the Austrians, Americans do not emphasize the distinction

between private and public companies. All limited companies are called

"corporations" and get the abbreviation "inc.", which is short for "incorporated".

Listen to the explanation and write the American equivalent of the British

companies listed below.

British

American

Austrian

sole proprietorship

partnership

limited partnership

private limited company

public limited company

B) Do you know any other forms of business in Austria? In other countries? List

them below and be prepared to explain what they are to the class. Fill the

abbreviations into the chart above in the same row as their nearest equivalent.

5. Problem Solving

In a small group read the situations below and then discuss what type of business

should be set up in each case. There is not one right or wrong answer. Be prepared

to justify your decision to the class.

a) You and your spouse (husband or wife) want to open up a grocery shop in a

small village. There is already one store, owned by an old lady. Your bank will

lend you all the money you need.

b) Two couples, one with young children want to buy a small hotel, which all the

adults will work in.

c) You want to sell fruit and vegetables at a stall in the market. You need $1000

starting capital which your parents will lend to you.

d) Two small partnerships would like to merge their companies and expand.

They will need an influx of capital to start off with.

BE I: Company Project - 2009/10

Company Forms

Page 6

6. Company Development (and History)

Readings:

"Harley-Davidson History Overview" http://www.h-dmedia.com/100_mediasite/history/at_a_glance.asp

"Harley-Davidson Turns 100"

http://www.cbsnews.com/stories/2003/08/28/national/printable570603.shtml

As companies grow and expand, their legal form also usually changes to meet the

needs of the new financial and market situations. The two articles below give

accounts of how the company developed over the last 100 years. Read them to do

the tasks below

a) Using both articles, summarize the development of the company in terms of legal

form since its foundation in 1903. (Although the form is often not explicitly

mentioned, try to identify the legal forms based on content of this unit.)

b) In what years was or has Harley-Davidson been listed on the Stock Exchange?

c) The first article above is from an official HD website, the second comes from an

outside source, CBS News Online, and therefore there is a big difference in both

wording and content. Find passages with more critical content in the second

article that is left out of the first.

d) What impression of the company does each of these articles create?

Readings

from CBS News Online

Harley-Davidson Turns 100

MILWAUKEE, Aug. 25, 2003

Harley-Davidson Inc., the iconic motorcycle maker whose bikes call to mind James Dean,

"The Wild One" and leather-clad easy riders cruising down the open road, has reached its

centennial, surviving the Depression and near-bankruptcy to become an American success

story.

Along the way the company has collected thousands of fans who love the freedom-of-theroad lifestyle and the bike's classic chrome-and-metal look, dependability and a distinctive

engine rumble known to Harley riders as "potato, potato, potato."

Harley-Davidson is also celebrating a 46 percent share of the North American heavyweight

motorcycle market, an impressive showing for the company that William Harley and Arthur

Davidson started in a wooden shed.

BE I: Company Project - 2009/10

Company Forms

Page 7

"When they're buying a Harley, they're buying an image and a lifestyle first, and a

motorcycle second," Tim Conder, an industry analyst with A.G. Edwards & Sons Inc.

brokerage firm, said of Harley buyers.

But analysts say Harley has to do more to ensure another 100 years of success.

Aging baby boomers form Harley-Davidson's customer base; the median age of Harley

buyers is 46, compared with an industry average of 38. Nine percent are women, and only

16.5 percent of Harley's revenue comes from outside the United States.

"Harley will rightly argue they have plenty of boomers left. But in the long term, the most

critical issue of Harley is whether buyers will start looking at Harley as the old guy's bike,"

said Don Brown, an independent motorcycle analyst in Irvine, Calif.

Market share figures point out the company's potential weaknesses. Although Harley

dominates the North American heavyweight market, it comes in second to Honda in the

overall U.S. market, according to the Motorcycle Industry Council. Younger riders and those

overseas prefer the faster Japanese sports bikes that cost less than the $15,000-plus price

tags most Harleys carry.

But for Harley fans, owning one of the bikes - known affectionately as "hogs" - has been a

transcendent experience.

"Getting your first Harley is like having your first love, sometimes more," said George Miller,

a 46-year-old Harley rider who works at a Houston refinery.

The company and its hefty motorcycles have left indelible marks on American culture - giving

rise to the rebellious motorcycle culture immortalized in the movies "The Wild One" in 1953

and "Easy Rider" in 1969. That has helped feed a side business of merchandise, including

leather jackets, that bear the famed black, white and orange Harley-Davidson logo.

The company worked to clean up its rough-and-tumble image in the 1980s, but chief

executive officer Jeffrey Bleustein said it still has drawing power.

"It certainly doesn't hurt if there's a little bit of naughty in the image," he said. "We wouldn't

want to be too sterile."

Harley's first century wasn't always easy. The company overcame the advent of the

automobile, the Depression and two World Wars to emerge in 1953 as America's only major

motorcycle maker. But then came a flood of inexpensive imports mid-century and a merger

with American Machine and Foundry Co. in 1969. Harley's quality soured, and AMF put the

company up for sale in 1980.

Bleustein and 12 executives bought Harley in 1981, and began fixing its finances and quality.

At the company's urging, the government imposed five-year tariffs in 1983 on imported

heavyweight motorcycles. That helped, but Harley squeaked by bankruptcy in 1985 after it

finessed new financing.

"You consider in 1981, we were beg, borrowing and stealing every penny we could get to

invest in this company, not knowing where our future might take us," said Willie G. Davidson,

chief styling officer and grandson of a founder. "That's an amazing success story."

To attract new customers, Harley two years ago introduced the sleek V-Rod, its first bike

with a liquid-cooled engine, said Bob Simonson, an industry analyst with William Blair and

Co.

BE I: Company Project - 2009/10

Company Forms

Page 8

Harley is now launching a second bike into the V-Rod's family and is redesigning its

Sportster family of entry-level, lower-priced bikes in an appeal to younger riders and women.

The company also has a subsidiary, Buell Motorcycle, that makes sports bikes, but it only

accounted for 4 percent of Harley's bike shipments last year, according to company figures.

"We are going to continue to give attention to what is our classical product line because it's

classical," Bleustein said. "But at the same time we'll see a lot of other activities that are

geared toward reaching out to other new customers."

© MMIII The Associated Press. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed.

from the Harley-Davidson Website

Harley-Davidson Historical Overview

1903

William S. Harley and the Davidson brothers - Walter and Arthur - handcraft their first three

motorcycles in Milwaukee, Wis. William A. Davidson later joins the enterprise.

1909

Introduction of the first Harley-Davidson® V-Twin engine.

1917-1918

Production of 17,000 military motorcycles to serve the U.S. Allied forces in World War I.

1930s

Harley-Davidson and Indian are the sole U.S. motorcycle manufacturers to survive the Great

Depression.

1941- 1945

Nearly all of Harley-Davidson's manufacturing output supports the World War II effort of the

U.S. and its Allies, with more than 90,000 motorcycles used by the Allied forces.

1947

To meet the exploding, postwar demand for motorcycles, Harley-Davidson acquires a

second manufacturing plant - the Capitol Drive facility in Wauwatosa, Wis.

1965

Privately-held family ownership ends with the first public stock offering.

1969

Merger with American Machine and Foundry (AMF). 14,000 motorcycles produced annually.

1973

Motorcycle final assembly moves to York, Pa., to meet growing demand.

1981

Thirteen members of Harley-Davidson's senior management purchase the company from

AMF in a leveraged buyout and implement new quality management and manufacturing

methods.

BE I: Company Project - 2009/10

Company Forms

Page 9

1982

Harley-Davidson successfully petitions the U.S. federal government for tariffs on imported

Japanese motorcycles flooding the U.S. market.

1983

Harley Owners Group (H.O.G.) is established.

1986

Return to public ownership, Harley-Davidson stock begins trading at $11 per share at its

Initial Public Offering. The Motor Company regains its top position in the U.S. super

heavyweight market.

1987

At the request of Harley-Davidson, tariffs on Japanese motorcycles end one year ahead of

schedule. Harley-Davidson is listed on the New York Stock Exchange under the symbol HDI.

1993

Harley-Davidson Financial Services is founded.

1995

Harley-Davidson formalizes its unique Partnership relationship with its unionized workforce.

1998

Harley-Davidson acquires Buell Motorcycle Company, opens a new powertrain plant outside

of Milwaukee in Menomonee Falls, Wis. and builds a new final assembly plant in Kansas

City, Mo. More than one hundred thousand motorcycle enthusiasts come to Milwaukee to

celebrate the Company's 95th birthday.

1999

The Twin Cam 88™ powertrain is introduced on the Dyna and Touring models. Stock splits

for the fifth time since 1986.

2002

Harley-Davidson kicks-off the 100th Anniversary Celebration with the Open Road Tour, the

world's largest rolling birthday party. Open Road Tour stops in 2002 include Atlanta,

Baltimore, Los Angeles, Toronto and Dallas/Ft. Worth.

2003

The Open Road Tour resumes in 2003 with stops in Sydney, Tokyo, Barcelona and

Hamburg. The events resume in the United States with the Ride Home: four journeys across

the United States to Harley-Davidson's home in Milwaukee. Upon arrival in Milwaukee, the

Celebration begins with three days of celebration and special events in and around

Milwaukee. Everything culminates on August 31, 2003 with the Party, the official birthday

celebration in Milwaukee that will launch Harley-Davidson into the next 100 years.

BE I: Company Project - 2009/10

Company Forms

Page 10