ASSIGNMENT #1

advertisement

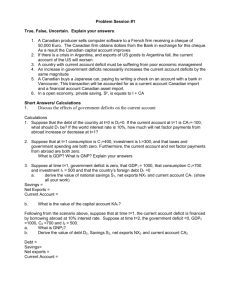

Problem set #1 True, False, Uncertain. Explain your answers: 1. 2. A Canadian producer sells wheat to a French firm receiving a cheque of 10,000 Euro. The Canadian firm obtains dollars from the Bank in exchange for this cheque. As a result the Canadian Financial account improves If there is a crisis in Argentina, and exports of Canadian goods to Argentina fall, Canadian balance of payments will worsen. 3. If national saving exceeds investment, there will be a current account surplus. 4. It is impossible for each nation to have a balance of payment surplus 5. China has a large trade surplus. This must mean that China’s policy is to subsidize exports and/or be protectionist against imports? 6. A country with current account deficit must be suffering from poor economic management Short Answers 1. How might Canada’s future interest rates be tied to its international payments balance 2. Discuss the effects of government deficits on the current account 3. "The balance of payments is seldom in balance in practice." Discuss 4. How is the balance of payments linked to national saving and investment? 5. How are the following transactions entered into the Canadian balance of payments? i. The Canadian government sends $20,000 worth of food aid to Africa. ii. A Canadian firm exports $100,000 worth of goods to the United Kingdom, payable in 3 months. iii. A Canadian.tourist in London spends $5000 for food and hotels. Calculations 1. Suppose that the debt of the country at t=0 is D0=0. If the current account at t=1 is CA1=100, what should D1 be? If the world interest rate is 10%, how much will net factor payments from abroad increase or decrease at t=1? 2. Suppose that at t=1 consumption is C1=400, investment is I1=300, and that taxes and government spending are both zero. Furthermore, the current account and net factor payments from abroad are both zero. a. What is GDP? What is GNP? Explain your answers 3. Suppose at time t=1, government deficit is zero, that GDP 1 = 1000, that consumption C1=700 and investment I1 = 500 and that the country’s foreign debt D1 =0 a. derive the value of national savings S1, net exports NX1 and current account CA1 (show all your work) Savings = Net Exports = Current Account = b. What is the value of the capital account KA + FA? Following from the scenario above, suppose that at time t=1, the current account deficit is financed by borrowing abroad at 10% interest rate. Suppose at time t=2, T =0, G=0, GDP 2 =1000, C2 =700 and I2 = 500. c. What is GNP2? d. Derive the value of debt D2, Savings S2, net exports NX2 and current account CA based on the GNP2 Debt = Savings= Net exports = Current Account =