ACCTGN8 - MATRIX - Carren

advertisement

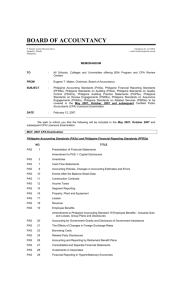

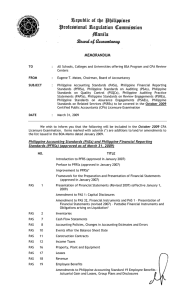

VISION The University of Baguio, in its pursuit of relevant and responsive education, envisions itself to be a leading institution of focused yet balanced learning. MISSION 1. The UB family is committed to create a dynamic academic environment conducive to the development of globally competitive professionals whose skills and talents are put to use. 2. Guided by the Divine Providence, UB provides relevant and responsive education where students enjoy focused yet balanced learning using up-to-date curricula and facilities. 3. Towards this goal, UB empowers its officers, faculty and employees who shall serve with the highest degree of professionalism, competence, integrity and dedication. GOALS In the pursuit of its noble vision and mission, the University of Baguio (UB) endeavors to: 1. Provide a globally competitive professional: 1.1. Who can pass all relevant tests needed in the practice of his/her profession; 1.2. Who is armed with the relevant skills, talents, abilities and knowledge needed for the optimum application of his/her chosen career; 1.3. Whose English and computer proficiency are second to none among graduates in North Luzon. 2. Provide moral and intellectual training that promotes the internalization of values founded on human rights; 3. Make itself a responsible instrument in promoting and developing social, political, economic, and environmental awareness towards achieving equity and social justice; 4. Provide programs that promote, develop and enhance mental, physical and spiritual fitness; and 5. Develop and enhance among its studentry, administrators, faculty, and employees, a strong sense of patriotism. Course Title: ACCTGN8 Description: Financial Accounting Standards Effectivity: Second Semester, SY 2012-2013 Date Revised November, 2012 1 Prepared by: Cheong, Carren M. F., CPA Approved by: Dr. Kareen B. Leon, CPA, MSBA, PhD Page 1 of 7 School of Business Administration and Accountancy ACCOUNTANCY PROGRAM OBJECTIVES: The Program endeavors to: 1. Provide globally competitive accounting professionals who are responsive to the needs of society. 2. Make available socially responsible and ethical accounting professionals. 3. Utilize a holistic approach on the teaching-learning process, resulting to physical and mental fitness of accounting graduates and students. 4. Develop and apply programs that imbibe and strengthen the value system of its faculty, students and administrators in terms of : love for God, love for country and love for family. 5. Create opportunities for increased awareness of accounting students on social, political and moral issues and subsequently equip them to help address such issues. Program Objectives P1. Provide globally competitive accounting professionals who are responsive to the needs of society. P2. Make available socially responsible and ethical accounting professionals. P3. Utilize a holistic approach on the teaching-learning process, resulting to physical and mental fitness of accounting graduates and students. P4. Develop and apply programs that imbibe and strengthen the value system of its faculty, students and administrators in terms of : love for God, love for country and love for family. P5. Create opportunities for increased awareness of accounting students on social, political and moral issues and subsequently equip them to help address such issues. 2 1 √ UNIVERSITY GOALS 2 3 4 5 √ √ √ √ 2. Program Outcomes and Relationship to College/ Program Objectives COLLEGE/ PROGRAM OBJECTIVES P1 P2 P3 P4 P5 √ √ √ √ √ √ √ √ √ Program Outcomes O1. Students graduate to become professionals imbued with high moral/ ethical standards. O2. Graduates are highly competitive with their acquired knowledge, skills and values in the practice of their profession. O3. Graduates are confident of their academic and industry preparations and the entry competencies learned to tackle the rigors of the business world. O4. Students can carry out researches that can be utilized in the community and in the business profession. O5. Students recognize their responsibility and accountability as professionals and as workers in the community. O6. Students become aware of and strive for their physical, mental and spiritual well-being. O7. Students are prepared to meet the needs and demands of global employment without losing the Filipino spirit. O8. Students become aware of their responsibility to the environment and participate actively in environmental programs. √ √ √ √ √ √ √ √ √ √ PROGRAM OUTCOMES O3 O4 O5 O6 O7 O8 √ 3. Course Objectives and Relationship to Program Outcomes Course Objectives O1 O2 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ C5. develop a system for higher learning designed specifically in preparation for the CPA Licensure Examinations. √ √ √ √ √ √ √ √ AFFECTIVE DOMAIN C6. develop the value of honesty, objectivity and perseverance. √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ COGNITIVE DOMAIN C1. know the concepts relating to accounting for financially distressed corporations, government and nonprofit organizations; C2. integrate and apply the generally accepted accounting principles to problem situations involving financial statements that are likely encountered in practice; C3. learn the basic processes that happen in the accounting systems of financially distressed corporations, government and nonprofit organizations; C4. integrate the application of the topics learned to situations most likely to be encountered in everyday life; C7. realize the contributions of accounting standards or GAAP to the development of a more socially responsible and morally upright professional accountant. C8. integrate the values of honesty and integrity in the preparation of financial reports for government and not-for-profit organizations; 3 C9. apply the qualities of neatness, accuracy, timeliness, and compliance with requirements in the preparation and submission of reports. PSYCHOMOTOR DOMAIN C10. apply the skills in the preparation of financial reports for financially distressed corporations, government and nonprofit organizations; C11. apply the skills in systematic problem solving. C12. solve accounting problems within the minimum speed required in the CPA Licensure Examinations; √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ C13. apply concepts and procedures of advanced accounting in meeting the requirement of the course such as quizzes, group work, case studies, and other problem solving activities. √ √ √ √ √ √ √ √ 4. Pre-requisite ACCTGN 7 Advanced Financial Accounting, Part 2 5. Co-requisite ACCTGN 9 Advanced Financial Accounting, Part 3 6. Course Description The course primarily deals with the study and interpretation of Philippine Financial Reporting Standards as issued by the Accounting Standards Council. The course provides an in-depth discussion of generally accepted accounting principles as set in the accounting standards. The course aims to organize the concepts and procedures in ways that focus on student motivation and understanding. The course is designed to equip the students with knowledge and technical skills needed for the CPA Licensure Examinations, as well as for their future jobs. 7. Course Coverage Learning Contents/ Topic Course Syllabus VMO Seat Plan Leveling of Expectations PHILIPPINE FINANCIAL REPORTING STANDARDS Preface To Philippine Financial Reporting Standards The Accounting Standards Council and Interpretation Committee Objectives of the ASC Scope and Authority of the PFRS Due Process Timing and Application of PFRS The Philippine Financial Reporting Standards Components No. of Hrs. 1 P 1 √ College Objectives P P P P 2 3 4 5 √ √ √ √ O 1 √ O 2 √ 17 √ √ √ √ √ √ √ 4 Program Outcomes O O O O O 3 4 5 6 7 √ √ √ √ √ √ √ √ √ √ O 8 √ √ Activity and Learning Approach Orientation Internalize the VMO Arrange students Requirements and Grading system Lecture-discussion, Board exercises, Recitations, Group Activity Evaluation Quiz, Assignments , Research, Case Analysis Learning Contents/ Topic No. of Hrs. College Objectives P P P P P 1 2 3 4 5 O 1 Program Outcomes O O O O O O 2 3 4 5 6 7 √ √ √ √ √ √ √ √ Activity and Learning Approach Evaluation O 8 √ √ √ √ √ √ √ √ √ Lecture-discussion, Board exercises, Recitations, Group Activity Quiz, Assignments , Research, Case Analysis √ √ √ √ √ √ √ √ √ Lecture-discussion, Board exercises, Recitations, Group Activity Quiz, Assignments , Research, Case Analysis PASs on financial statement preparation and presentation Framework for the preparation and presentation of financial statements PAS 1 Presentation of financial statements PAS 37 Provisions, contingent assets and contingent liabilities PAS 8 Accounting policies, changes in accounting estimates and errors PAS 10 Events after balance sheet date PAS 24 Related party disclosures PAS 7 Cash flow statement PFRS 8 Operating segments PAS 34 Interim reporting PFRS 5 Discontinued operations and Non-current assets held for sale PRELIMINARY EXAMINATION 3 12 PASs on financial statement elements PAS 2 Inventories PAS 16 Property, plant and equipment PFRS 6 Exploration for and evaluation of mineral resources PAS 36 Impairment of assets PAS 20 Government grants and disclosure of government assistance PAS 40 Investment property PAS 23 Borrowing cost PAS 38 Intangibles FIRST GRADING EXAMINATION PAS 28 Investment in associates PAS 39 Financial Instruments: recognition and measurement PAS 32 Financial Instruments: presentation PFRS 7 Financial Instruments: disclosure SIC 13 Jointly controlled entities 3 33 5 Learning Contents/ Topic No. of Hrs. College Objectives P P P P P 1 2 3 4 5 √ O 1 Program Outcomes O O O O O O 2 3 4 5 6 7 O 8 √ √ √ Activity and Learning Approach Evaluation Lecture-discussion, Board exercises, Recitations, Group Activity Quiz, Assignments , Research, Case Analysis PFRS 3 Business combinations PAS 27 Consolidated ad separate financial statements SIC 12 Consolidation – special purpose entities PAS 21 Effects of foreign currency exchange rates PAS 29 Financial reporting in hyperinflationary economies MIDTERM EXAMINATION PAS 17 Leases PAS 19 Employee benefits PAS 26 Accounting and reporting by retirement benefit plans PFRS 2 Share-based payments PAS 18 Revenue PAS 11 Construction contracts SIC 7 Introduction of the euro PAS 12 Income taxes PAS 33 Earnings per share PASs on non-commercial accounting PFRS 4 Insurance Contracts PAS 41 Agriculture PAS 30 Financial statements of banks and similar financial institutions PFRS 1 First time adaptation of Philippine Financial Reporting Standards SICs and IFRIC New Pronouncements (IFRS 7,8,9,10,11,12,13) FINAL EXAMINATION 3 33 √ √ √ √ √ √ √ √ √ 3 Grading System: For Professional Board Examination Subjects: the cut-off score is 70%. The highest possible grade is ninety-nine (99); the lowest passing grade is seventy-five (75); and the lowest failing grade is sixty-five (65). First grading Class standing = 70 % ; Exam = 30 % Midterms Class standing = 60 % ; Exam = 40 % ( Tentative Midterm Grade x 2 + First Grading ) / 3 = Midterm Grade 6 Finals Class standing = 50 % ; Exam = 50 % ( Tentative Final Grade x 2 + Midterm Grade ) / 3 = Final grade References: Ballada. Auditing Theory: Audit and Assurance Services, Domdane Publishers, Manila, 2005. Cabrera. Applied Auditing 2009 Edition, GIC Enterprises & Co. Inc., Recto, Manila. Evangelista. IFRS Made Easier, 2006 Edition, GIC Enterprises and Co., Manila, 2006. Hall & Singleton. Information Technology Auditing and Assurance 2nd Edition, Thomson South Western, New York, 2005. Philippine Accounting Standards and Philippine Financial Reporting Standards. Volume 1. Philippine Accounting Standards and Philippine Financial Reporting Standards. Volume 2. Philippine Standards on Auditing and Philippine Auditing Practice Statements. Volume 1. Philippine Standards on Auditing and Philippine Auditing Practice Statements. Volume 2. Philippine Standards on Auditing and Philippine Auditing Practice Statements. Volume 3. http://www.iasplus.com http://www.picpa.com.ph http://www.skousen.swcollege.com http://www.sec.gov.ph http://www.carren.wikispaces.com http://www.dlsu.edu.ph http://accounting.swlearning.com http://stice.swlearning.com www.mhhe.com Syllabus Evaluation Committee: Rhadvic F. Estoque, CPA, MBA Program Chair, BSBA Accountancy Dr. KAREEN B. LEON, MSBA, CPA , PhD Dean, School of Business Administration and Accountancy 7