Word Review

advertisement

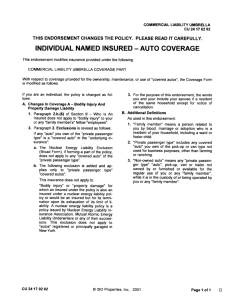

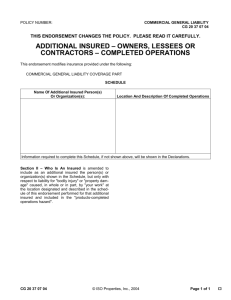

REVIEW SUMMARY FOR PERSONAL AUTO INSURANCE CHAPTER 1 Demographics Affected by Auto Industry Autos virtually reconstructed the landscape of America. Autos gave rise to suburban lifestyle. People could live away from the rush of the city but still enjoy the conveniences of city life. Shoppers looking for a change of scenery from the downtown department stores could head out to the mall. The fast food industry would not exist, as we know it today, without autos. The impact of the automobile continues. Automatic Teller Machines are replacing drive-thru tellers. The arrival of the automobile brought more than just mobility; it spawned an entirely new lifestyle and opened new business opportunities. Driving is Hazards The year 1963 brought traffic death to an all-time high of 40,804. While many of these fatalities were due (as expected) to driver error, a very large portion were caused by mechanical defects or, even more significantly, design defects. Origins of Personal Auto Insurance In the beginning, auto policies were liability policies that were used to insure liability arising out of collision with horses. This beginning was followed by an era of total confusion as the industry saw each company design its own unique policy. Every company had its own policy, rating manual and their own way of providing auto coverage. 1 Since these were new policies, the law of large numbers (loss statistics become more predictable as the number of similar exposures to loss increase) was not prevalent. By the end of the 1920's, the insurance companies realized that the use of one standard automobile policy, by all those insurers marketing auto insurance, would be in the best interests of both themselves and the consumer. This idea developed into the drafting of the Basic Standard Automobile Policy, completed in 1935. The Standard Auto Policy stood for 20 years. The following years saw the introduction of two other Standard Auto Policies. The Comprehensive Automobile Policy (1940) and the Family Automobile Policy (1956). In the late 1970's, the states began to mandate clearer language in policies and requested insurance companies to become more contemporary. The Personal Auto Policy was introduced. The Personal Automobile Policy was developed by Insurance Services Office (ISO), the largest insurance rating and advisory organization in the United States. Nature of Automobile Insurance Problem With the popularity of the automobile came many problems. Millions of motorists are injured or disabled each year. The high cost of medical expense, pain and suffering, the unexpected death of a family member and damage to or loss of an automobile has a profound impact on the family. In addition, society must deal with the problem of compensating innocent automobile accident victims for their bodily injuries or property damage caused by negligent drivers. High Frequency of Automobile Accidents American motorists are smashing into each other at an alarming rate. Example: in 1993 motorists were involved in 36 million motor vehicle accidents. 2 Most fatal accidents are due to two major causes: (1) improper driving, (2) alcohol. High Costs of Automobile Accidents The economic costs of motor vehicle accidents are staggering. The economic loss includes the cost of property damage, medical costs, lost productivity, emergency services, legal and court costs, public assistance programs and insurance administration expenses. The cost of Automobile Insurance Claim Settlements and court awards has also increased sharply in recent years. Irresponsible drivers are another part of the overall automobile insurance problem. Substantial-underwriting losses experienced by automobile insurers are another part of the overall problem. The problem is that some uninsured drivers cause accidents that injure other people and cannot pay for the injuries or property damage they have caused. Drunk Drivers There is wide spread drug and alcohol abuse in the United States and drunk drivers are estimated to be involved in about half of all fatal automobile accidents. Drunk drivers are also responsible for a disproportionate number of non-fatal automobile accidents. High-Risk Drivers High-risk drivers are motorists who habitually violate traffic laws. 3 Availability and Affordability of Automobile Insurance A final part of the problem is that some groups are unable to purchase automobile insurance contracts at affordable premiums. Both automobile insurers and society have enacted insurance plans that make automobile coverages available to the high-risk groups. 4 CHAPTER 2 Insurance Basics: Law and Liability It is important to remember that Automobile Insurance deals with both issues of law and liability. Insurance exists because the world is filled with uncertainty. Some of these uncertainties can lead to financial loss. Loss Exposures A Loss Exposure exists if there is a possibility of a loss occurring and if each an occurrence would cause a financial loss. Techniques for Treating Loss Exposures * * * * * avoidance Loss Control Retention Transfer Other-Than-Insurance Insurance Avoidance To avoid the auto loss exposure, one must not drive or own a car! Loss Control 1. loss prevention (lowering the frequency of loss). 2. loss reduction (lowering the severity of the losses). 3. a combination of 1 and 2. Retention Retention means keeping or absorbing all or part of the financial impact of a loss. 5 Transfer Other-Than-Insurance Transfer Other-Than-Insurance occurs when the loss exposure of one person or organization is assumed by another, usually through a contract such as a "Hold Harmless Agreement". Insurance Insurance is a system that enables a person, business or organization to transfer a Loss Exposure to an insurance company. By transferring their Loss Exposure to insurance companies, insureds exchange the possibility of a large loss for the certainty of a much smaller, periodic premium. The transfer is accomplished through Insurance Policies. Sharing the Cost of Losses Sharing, like transfer, is another element of insurance. Each insured pays its insurance premium to the insurance company that "pools" the premium into a loss fund. The total cost of losses is spread among all insureds insurance companies who predict future losses and expenses to determine how large a pool of funds will be necessary. They can do this because of the Law of Large Numbers, the foundation of insurance operations. The Law of Large Numbers enables insurance companies to improve the predictability of losses by pooling a large number of similar independent exposure units. Benefits of Insurance The most obvious benefit of purchasing insurance is that it provides payments for losses and reduces uncertainty. Although there are numerous types of insurance to protect the needs of individuals, we will focus on two which are pertinent to our subject matter: Property Insurance and Liability Insurance. 6 Property Insurance covers accidental losses resulting from damage to property of the injured. Liability Insurance Can involve three parties: the insured, the insurance company and someone who is injured or whose property is damaged by the insured. Auto Liability Insurance covers losses due to the insured's liability for bodily injury to others or damage to property of others caused by an auto accident. The legal costs of defending the insured are also covered. LAW AND LIABILITY Nature of the Law It is the legal system that enforces obligations. Laws exist in a civilized society to enforce certain standards of conduct. An important distinction exists in the American Legal System between criminal Law and Civil law. Criminal Law Certain kinds of conduct so endanger the public welfare that society makes laws to prohibit them. Civil Law Actions that are not necessarily crimes can still cause considerable harm to other people. Civil Law serves to settle disputes and to repress wrongs against individuals. Civil Law enforces rights. People are more willing to make agreements of contracts with one another when they know that those contracts are, in fact, enforceable. 7 Sources of Law There are essentially four sources of law. Constitutional Law, Statutory Law, Common Law and Administrative Law. Constitutional Law The constitution specifies the structure of the federal government and outlines the respective powers of the legislative, executive and judicial branches of the government. Our courts interpret the Constitution to decide Constitutional issues that may arise. Statutory Law Legislatures at national, state, and local levels enact laws or statutes to deal with perceived general problems. Common Law In contrast, the Common Law has evolved in the courts by the force of custom. Common Law principles guided judges not only in England but also in the English colonies in America. Administrative Law Final sources of the law are the numerous federal, state and legal governmental agencies that have regulatory powers derived from Statutory Law. Elements of a Liability Loss The factors involved in a Liability Loss include: * a legal basis for a claim of one party against another. * a definite injury or harm to the party making the claim. 8 * some conduct by one party for which the other party is responsible. * an agreement of the parties or a judgment of the court concerning the form or the amount of the restitution owed to the injured party. Torts Tort Law is that branch of Civil Law that deals with wrongs other than Breaches of Contract. Tort Law provides three possible standards for a finding of legal liability: if a tort is intentional, the liability for the consequence follow, if a tort is unintentional, negligence may be grounds for a finding of legal liability. Finally, some activities are so inherently dangerous that Absolute Liability for any resulting injury may exist even though no harm is intended and no Negligence is involved. Intentional Torts Deliberate acts that cause harm to another person. Absolute Liability Some activities are so inherently dangerous that Absolute Liability for any of these actions that result in an injury may exist even though no harm is intended and no negligence is involved. Negligence The greatest numbers of liability cases arise from Negligence. Negligence occurs when one fails to exercise the appropriate degree of care. 9 Elements of Negligence A liability judgment based on Negligence depends on four elements: 1. 2. 3. 4. Duty To Act that is owed to another person. A Breach of that Duty. The occurrence of an Injury. An Unbroken Chain of Events leading to that injury. Responsibility of Negligence Individuals, business firms and other organizations may be held responsible for the negligence. Generally one expects the person whose conduct is negligent to be responsible for the consequences. Vicarious Liability Exists when one is held liable for the actions of another person. Such situations extend liability to include not only the actual wrongdoer but also a person or organization responsible for the wrongdoer. Vicarious Liability often arises in business situations from the relationship between employer and employee. Since an employer could be Vicariously Liable for the acts of the employee, an injured party might bring suit against both the employee and the employer. Absolute Liability Although most cases arise from Negligence, liability under Tort Law is not entirely limited to cases of injury caused by deliberate or negligent conduct. In these inherently dangerous situations, there is Absolute Liability for any injury regardless of the intent or the carefulness of the person held liable. 10 Strict Liability A similar but slightly different concept often applies in cases of injury involving defective products. Contracts Contract Law enables an injured party to seek restitution because the other party has breached a duty voluntarily accepted in a contract. Statutes Liability may also exist because of a specific Statute. Automobile Liability Laws Specific statutes now modify many of the Common Law Principles of Negligence that apply to the Common Law Principles of Negligence. Damages For a Liability Loss to occur there must be some definite harm sustained by another person. Bodily Injury Bodily injury is a physical injury to a person. Property Damage Property Damage Losses occur when a person causes direct or indirect damage (such as loss of the use of property) to another person's property. 11 CHAPTER 3 The Insurance Contract and The Personal Auto Policy Automobile Insurance cannot prevent automobile accidents from occurring but it can sure help take the "sting" out of the potential financial loss. Let's take a closer look at contracts and their use in providing protection through the Personal Auto Policy. The Contract In order to form a legally enforceable contract, an offer must be accepted; the parties must give genuine assent, the parties must be competent, the contract must be for a legal purpose and the contract must involve consideration. An Insurance Policy is a written document that contains words expressing the agreements of the parties to the Insurance Contract. Special Characteristics of Insurance Contracts a a a a a conditional contract contract involving the exchange of unequal amounts contract of utmost good faith contract of adhesion contract of indemnity Conditional Contract An Insurance Policy is a conditional contract because the insurer has to perform only under certain conditions. Because they are conditional, Insurance Contracts involve an exchange of unequal amounts. This often times is referred to as aleatory. 12 The premium paid by the insured for a particular policy does not equal the amounts paid by the insurer to, or on behalf of, the insured. Because insurance involves an intangible promise, it requires complete honesty and disclosure of all relevant facts between the parties. This is the reason insurance contracts are considered contracts of utmost good faith. An insurance company may be released from a contract on the grounds of Concealment, Misrepresentation or Breach of Warranty. Concealment Is the failure to disclose information that could and should have been given. A misrepresentation is a false statement of a material fact. Breach of Warranty A warranty is a statement that someone holds to be true. Contracts of Adhesion The wording in Insurance Contract are drafted by the Insurance Company. The insured has little choice but to "take it or leave it". That is, the insured must adhere to the contract drafted by the insurer. Contracts of Indemnity Most Property and Liability Insurance Policies are Contracts of Indemnity. With a Contract of Indemnity, the amount paid by the insurer depends on the amount lost by the insured. 13 INSURANCE CONTRACTS General Provisions of Insurance Contract Certain matters must be addressed in every Insurance Policy in order to define the coverage provided. These are critical elements in the content of any Insurance Policy. Content of Insurance Policies An Insurance Policy specifically defines the coverage it provides. Since no Insurance Policy covers every single contingency, the policy must describe its limitations, restrictions and exclusions as clearly as possible. Names of Insurance Company and Insured An Insurance Policy must identify the parties to the agreement. The name of the insurer and the names of the insureds are usually shown in the first sheet of paper that forms a part of the policy. This sheet may be called the declaration's page. Policy Period Insurance Policies usually provide coverage for a specified period of time. Consideration The insured's consideration is the payment of premium, and the insurer's consideration is its promise to make payments if an insured loss occurs. The policy declaration page normally shows the premium amount. Definitions Many policies contain a separate section labeled "definitions". 14 Insuring Agreements and Exclusions An Insurance Policy contains specific statements regarding the nature of the insurer's promise. An Insuring Agreement is the statement in which the insurer agrees to provide coverage. The insurer's promise is then limited by Exclusions, which eliminate some of the things that would otherwise be covered by the broad insuring agreement. Insurance Policies contain Exclusions for several reasons. Limits and Valuation Provisions An insurance policy must specify exactly how to determine the amounts the insurer must pay if a loss does occur. Duties of Insurer and Insured Both insurer and insured must fulfill certain duties for the insurance to function as intended. Dispute Resolution Last in the question of what to do if there is a disagreement between the insurer and the insured. PERSONAL AUTO POLICY AND ITS ORGANIZATIONAL FORMAT Property Insurance Characteristics In the Auto Physical Damage section, three degrees of coverage may be available: All Risks All Risks excluding Collision specified causes of loss (with or without Collision) 15 Liability Insurance Characteristics Liability Insurance differs from Property Insurance in many ways. Liability Insurance claims involve three parties, the insurer, the insured and a "third party". Liability Insurance covers claims against an insured arising out of the insured's legal liability for a covered activity or situation involving covered expenses or damages, provided the event that "triggers" coverages occured during a covered time period. Most liability insuring agreements make essentially the same broad promise: to pay damages for which an insured becomes legally responsible and to which the coverage applies. The insurer also promises to pay related defense costs. Eligible Vehicles The Personal Auto Policy is designed to insure only certain types of motor vehicles. The vehicle must be owned, or leased for a minimum of six months, by an individual or by a husband and wife residing in the same house. An eligible vehicle is a four-wheel vehicle. Thus, a private passenger automobile, station wagon, or jeep owned by the insured is eligible for coverage. Summary of Coverages The Personal Auto Policy consists of a declaration page, an agreement and definition page and six separate parts. The six parts are: Part Part Part Part Part Part A - Liability Coverage B - Medical Payment Coverage C - Uninsured Motorists Coverage D- Coverage for damage to your auto E - Duties after an accident or loss F - General Provisions 16 Declarations The declarations page provides information about the insured, a description of the insured automobile, a schedule of coverage and other important details. Rating Information The rating class in which the vehicle is placed and any applicable credits and discounts are shown. Agreements and Definitions The first page of the Personal Auto Policy contains the insuring agreement and definitions of several terms used throughout the policy. 17 CHAPTER 4 PART A – LIABILITY COVERAGE and PART B – MEDICAL PAYMENTS COVERAGE We will begin our examination of the Personal Automobile Policy by reviewing the first two parts of the policy. Part A - Liability Coverage Part B - Medical Payment Coverage PART A - LIABILITY COVERAGE It provides protection against legal liability arising out of the ownership or operation of an automobile. Keep in mind that Part A only pays for damage the insured causes to others. It does not pay for the insured's own injuries or damage to the insured's car. Insuring Agreement In the insuring agreement, the company agrees to pay for Bodily Injury or Property Damage for which the insured is legally responsible because of an automobile accident. The liability limit is written as a single limit that applies to both Bodily Injury and Property Damage. The insurer also agrees to defend the insured and pay all legal defense costs. The defense costs are in addition to the policy limits. Insured Persons The following four groups are insured for Liability Coverage under the Personal Auto Policy: the named insured and any family member. any person using the named insured's covered auto. 18 any persons or organizations but only for legal liability arising out of an insured person's use of a covered auto on behalf of that person or organization. any person or organization legally responsible for the named insured's or family member's use of any automobile or trailer. Supplementary Payments The following supplementary payments are paid in addition to the liability limits and legal defense costs: bail bonds premiums on appeal bonds and bonds to release attachments interest accruing after a judgment loss of earnings other reasonable expenses Liability Coverage Exclusions A lengthy list of exclusions applies to the Liability Coverage under the Personal Auto Policy. Exclusions simply identify types of losses that are not covered by the policy. The major exclusions are: Intentional Injury Property Owned or Transported Property Rented, Used or in the Care of the Insured Bodily Injury to an Employee of a Covered Person Public or Livery Conveyance Garage Business Exclusion 19 Other Business Use Using a Vehicle Without Reasonable Belief or Permission Nuclear Energy Liability Loss Motorized Vehicles with Fewer Than Four Wheels Vehicles Furnished or Available for Regular Use Vehicle Furnished or Available for Regular Use of Any Family Member Limit of Liability The Personal Auto Policy also states that regardless of the number of insureds involved in an accident, the Limit of Liability for the policy will not be increased. The most any claimant can recover for one accident is the limit stated in the declarations. Out-of-State Coverage If the accident occurs in a state that has a Financial Responsibility Law, or similar law that requires higher liability limits than the limits shown in the declarations, the Personal Auto Policy automatically provides the higher required limits. The Personal Auto Policy also has a provision that applies when more than one automobile policy covers a liability claim. If there is other applicable Liability Insurance to an owned vehicle, the insurer pays only its pro rata share of the loss. Compliance with Financial Responsibility Law Many states have Financial Responsibility Laws that require proof of financial responsibility after an accident occurs. When the Personal Auto Policy is used to demonstrate proof of Financial 20 Responsibility, the Personal Auto Policy will comply with the law to the extent required. PART B - MEDICAL PAYMENTS COVERAGE Medical Payments Coverage is an accident benefit that can optionally added to the Personal Auto Policy. This benefit pays the medical expenses up to a certain specified limit of insureds that are injured in an automobile accident. Insuring Agreement The insurer will pay all Reasonable and Necessary Medical and Funeral Expenses incurred by an insured because of bodily injury caused by an accident. The company will pay only those expenses incurred within three years from the date of the accident. Medical Payments Coverage applies without regard to fault. Insured Persons Two groups of persons are considered insured persons for Medical Payment Coverage. They are (1) the named insured and family member, and (2) any other person while occupying a covered auto. Medical Payments Exclusions Numerous coverage. exclusions also apply to medical Vehicles with Fewer Than Four Wheels Vehicles Used as a Residence or Premises Injury during the Course of Employment Vehicle Furnished or Available for Regular Use 21 payments Using a Vehicle Without Reasonable Belief of Permission Vehicle Used in the Business or Occupation of an Insured Bodily Injury from Nuclear Weapons or War Limit of Liability The Limit of Liability for Medical Payments Coverage is stated in the declaration. This limit is the maximum amount that will be paid to each injured person in a single accident regardless of the number of injured persons, claims made, vehicles or premiums shown, or vehicles involved in the auto accident. Other Insurance If other automobile Medical Payments Insurance applies to a covered auto, the company pays its pro-rata share based on the proportion that its Limit of Liability adheres to the total of applicable limits. 22 CHAPTER 5 PART C – INSURED MOTORIST COVERAGE and PART D – COVERAGE FOR DAMAGE TO YOUR AUTO PART C – UNINSURED MOTORISTS COVERAGE The Uninsured Motorists Coverage is designed to meet the problem of Bodily Injury caused by an uninsured motorist. The Uninsured Motorist Coverage pays for Bodily Injury of a covered person who is injured by an uninsured motorist, a hit-and-run driver or by a driver whose insurer is insolvent. Insuring Agreement The insurer agrees to pay compensatory damage that the insured person is legally entitled to recover from the owner or operator of an uninsured motor vehicle because of Bodily Injury caused by an accident. Insureds The groups that are considered insureds under the Uninsured Motorist Coverage: (1) the named insured and family members, (2) any other person occupying a covered auto, and (3) any person legally entitled to recover damages. Uninsured Vehicles The Uninsured Motorists Coverage clearly specifies the types of vehicles that are considered uninsured vehicles. Uninsured Motorists Exclusions 1. No Uninsured Motorist Coverage on vehicles. There is no coverage for bodily injury sustained by any person who occupies or 23 is struck by a motor vehicle or trailer owned by the named insured or family member if that vehicle does not have Uninsured Motorists Coverage under the policy. 2. Settling the claim without insurer's consent. The Uninsured Motorists Coverage does not apply if a Bodily Injury Claim is settled without the insurer's consent. 3. Public or Livery Conveyance. 4. Using a vehicle without belief of permission. 5. Cannot benefit Workers’ Compensation Insurer. 6. Punitive damage not paid. Limits of Liability The minimum amount of Uninsured Motorists Coverage available under The Personal Auto Policy is equal to the amount required by the Financial Responsibility or Compulsory Insurance Law of the state in which the named insured's covered auto is principally garaged. The Limit of Liability for Uninsured Motorists Coverage is shown in the declarations and is the maximum amount that will be paid for all damages resulting from any one accident. Other Insurance If other insured motorists coverage applies to the loss, the Personal Auto Policy pays only its pro-rata share of the loss. Arbitration If the insurer and the insured cannot agree as to whether the insured is entitled to recover damages, or on the amount, the dispute may be settled by Arbitration. 24 PART D – COVERAGE FOR DAMAGE TO YOUR AUTO Part D of the Personal Auto Policy provides Physical Damage Insurance for the damage or theft of a covered auto. Insuring Agreement In the Insuring Agreement, the insurer agrees to pay for any direct and accidental loss to a covered auto or to any non-owned auto, including its equipment, minus any applicable deductible shown on the declarations page. Two coverage options are available: a covered auto can be insured for (1) Collision Loss and (2) loss caused by Other-Than-Collision. Collision Loss Collision is defined as the upset of a covered auto or a NonOwned Auto or the impact with another vehicle or object. Collision losses are paid regardless of fault. Other-Than-Collision The Personal Auto Policy makes a distinction between a Collision Loss and any Other-Than-Collision loss. Under Part D, loss caused by any of the following is considered Other-Than-Collision: missiles or falling objects fire theft or larceny explosion or earthquake windstorm hail, water or flood malicious mischief or vandalism riot or civil commotion contact with a bird or animal breakage of glass 25 Non-Owned Auto As noted, the Part D coverage also applys to a Non-Owned Auto. A Non-Owned Auto is any private passenger auto, pickup, van or trailer that is not owned by, or furnished or made available for the regular use of the named insured or any family member while such a vehicle is in the custody of, or being operated by, the named insured or any family member. Deductible A deductible is used for Part D in order to reduce small claims, hold down premiums and encourage the insured to be more careful in protecting his/her property from damage or theft by requiring the insured to share all losses. Transportation Expenses If a covered auto is stolen, the insurance company will pay up to $15 per day to a maximum of $450 for transportation expenses the insured may incur. Exclusions Twelve exclusions apply to the Part D coverage. Public or Livery Conveyance Wear and Tear, Freezing, and Mechanical and Electrical Breakdown Radioactive Contamination or War Electronic Equipment Government Destruction or Confiscation Camper Body or Trailer not Shown in the Declarations 26 Non-Owned Auto Used Without a Reasonable Belief of Permission Awnings and Cabanas Radar Detection Equipment Customized Equipment Non-Owned Auto Used in the Automobile Business Non-Owned Pickups and Vans Used in Any Other Business Limit of Liability The insurer's Limit of Liability for a Physical Damage Loss to a covered automobile is the lower of (1) the actual cash value of the damaged or stolen property or (2) the amount necessary to repair or replace the property. Payment of Loss The insurer has the option of paying for the loss in money or repairing or replacing the damaged or stolen property. Appraisal In some cases, the named insured and the insurer cannot agree on the amount of the loss. In the event of a disagreement on the amount of loss, either party may demand an appraisal of the loss. 27 CHAPTER 6 PART E – DUTIES AFTER AN ACCIDENT OR LOSS and PART F – GENERAL PROVISIONS Part E of the Personal Auto Policy outlines a number of duties the insured must perform after an accident or loss. The following general duties must be met after an accident or loss in order to have protection under the policy. 1. The insurer must be promptly notified of how, when and where the accident or loss occurred. 2. The insured must cooperate with the insurer in the investigation, settlement or defense of any claim or suit. 3. The insured must promptly submit to the insurer copies of any notices or legal papers received in connection with the accident or loss. 4. The insured must agree to submit to a physical examination at the insurer's expense. 5. The insured must authorize the insurer to obtain medical reports and other pertinent records. 6. The insured must submit a proof of loss when required by the insurer. Additional Duties for Uninsured Motorists Coverage In addition to the general duties, a person seeking benefits under Part C - Uninsured Motorists Coverage must perform the following two additional duties: 28 Notify the Police Submission of Legal Papers Additional Duties for Physical Damage Three additional duties are required if the insured is seeking benefits under Part D- Coverage for Damage to Your Auto. Prevent Further Loss Notify the Police of a Stolen Auto Inspection and Appraisal PART F – GENERAL PROVISIONS Bankruptcy of the Insured The insurer is not relieved of any obligations under the policy even if the insured declares bankruptcy or becomes insolvent. Change in the Policy The terms of the policy cannot be changed except by an endorsement issued by the insurer. The Liberalization Clause states that if the insurance company makes a change in its policy form which provides broader coverage without a premium change, that change will automatically apply to the insured's policy on the date the change goes into effect in the insured's state. Fraud There is no coverage for any insured that makes fraudulent statements or engages in fraudulent conduct in connection with any accident or loss for which a claim is made. 29 Legal Action against the Insurer No legal action can be brought against the insurer until the insured has fully complied with all of the policy terms. Insurer's Right to Recover Payment This provision is essentially a Subrogation Clause. Policy Period and Territory The Personal Auto Policy applies only to accidents and losses that occur within the policy period and within the policy territory. The policy period is stated in the declarations. The policy territory includes the United States, its territories or possessions, Puerto Rico and Canada. Termination The Personal Automobile Policy also contains a provision that applies to termination of the policy by either the insured or insurer. Non-Renewal Rather than cancel, the insurer may decide not to renew the policy. If the insurer does not renew, the named insured must be given at least 20 days notice before expiration of the policy period. Automatic Termination Under this Provision, if the named insured does not accept the insurer's offer to renew, the policy automatically terminates at the end of the current policy period. 30 Transfer of Insured's Interest in the Policy This provision is essentially an Assignment Clause. The named insured's rights and duties under the policy cannot be assigned to another party without the insurer's written consent. Two or More Auto Policies If two or more auto policies issued by the same insurer apply to the same accident, the insurer's maximum Limit of Liability is the highest applicable Limit of Liability under any one policy. 31 CHAPTER 7 Endorsements to the Personal Auto Policy Additional coverages are available by an appropriate Endorsement to the Personal Auto Policy. They may be used to change information in the declarations, to add, delete or modify coverages, exclusions or policy provisions. Although all Endorsements change the policy, not all Endorsements require a premium adjustment. General Endorsement This form is known as a "Blank" or "Manuscript" Endorsement because it includes blank space for typing in whatever changes is being made to the policy. Change Endorsement When it is necessary to add an Endorsement after a policy is in effect, in most cases the Change Endorsement must also be issued. Suspension of Insurance Endorsement This Endorsement states, that premiums will be refunded if the suspension exceeds a specific period of time but it does not have a place to indicate how long the insurance will be suspended. Split Liability Limits Endorsement This Endorsement modifies the Limit of Liability Provision by specifying that Separate Limits apply to each person and to each accident, as well as, to Bodily Injury Losses and Property Damage Losses. 32 Split Uninsured Motorists Limits Endorsement It changes the uninsured motorist limit from a single limit to Split Limit that is used when state law requires Split Limits or when Split Limits are preferred by the insured. Under-Insured Motorists Coverage Endorsement Under-Insured Motorists Coverage is important in those situations where a negligent driver has liability limits that are insufficient to pay the insured's damages. Miscellaneous Type Vehicle Endorsement Many people own motor homes, motorcycles, recreational and other vehicles that are ineligible for coverage under an Endorsement Personal Auto Policy. To meet the special needs of vehicle owners, the Miscellaneous Type Vehicle Endorsement can be added. The Miscellaneous Type Vehicle Endorsement can be used to provide the same coverage found in the Personal Auto Policy including Liability, Medical Payments, Uninsured Motorists, Collision and Other-Than-Collision Loss. A Passenger Hazard Exclusion Can also be activated as part of the Miscellaneous Type Vehicle Endorsement. Extended Non-Owned Coverage Endorsement The Personal Auto Policy excludes Liability and Medical Payments Coverage for vehicles furnished or made available for the regular use of the named insurance and the family members. These exclusions can be eliminated by adding the Extended NonOwned Coverage Endorsement to the Personal Auto Policy. Mexico Coverage Endorsement The Personal Auto Policy does not cover driving in Mexico. However, the Mexico Coverage Endorsement can be added to the 33 Personal Auto Policy to extend Personal Auto Policy benefits to a covered person who is involved in an accident within 25 miles of the United States border or on a trip of 10 days or less. Snowmobile Endorsement Snowmobiles can be insured by adding the Snowmobile Endorsement to the Personal Auto Policy. Physical Damage Endorsements Part D - Coverage for Damage to Your Auto can also be broadened by adding certain endorsements to the Personal Auto Policy. Some of the more widely used Physical Damage Endorsements are: Extended Transportation Expense Coverage Towing and Labor Costs Coverage Electronic Equipment and Tapes Stated Amount Covered Property Coverage Customized Equipment Loss Payable Clause Endorsement Additional Insured-Lessor 34 CHAPTER 8 Automobile Insurance and the Law: Compensation of Accident Victims Under the United States legal system, persons who are injured or incur Property Damage are entitled to compensation and damages. Here we will discuss the laws and methods of compensating accident victims. Tort Liability System Based On Fault A “tort” is a legal wrong for which the law allows a remedy in the form of money damages. Negligence Negligence is a failure to exercise the standard of care required by law to protect others from harm. Before an injured automobile accident victim can collect damages, he or she must prove Negligence and establish fault on the part of the other driver. The dollar amount of damages awarded to an accident victim depends on several factors. There are 3 types of damages that may be awarded: Special Damages General Damages Punitive Damages 35 Types of Laws With respect to accidents, there are 2 basic types of Financial Responsibility Laws: (1) Security Type Laws and (2) Security and Proof Laws. Financial Responsibility Laws Financial Responsibility Laws that require motorists to provide proof of financial responsibility equal to certain minimum amounts. If the proof of financial responsibility is not provided, both the driver's license and vehicle registration are suspended. Security Type Laws Under a Security Type Law, a motorist involved in an accident involving Bodily Injury or Property Damage over a certain amount must provide proof of financial responsibility at least equal to certain minimum amounts. Proof of financial responsibility is normally provided by having Automobile Liability Insurance at least equal to certain minimum limits. Unsatisfied Judgment Funds Five states (New Jersey, Maryland, Michigan, North Dakota and New York) have unsatisfied judgment funds that compensate accident victims who have exhausted all other means of payment. Under-Insured Motorists Coverage The Under-Insured Motorists Coverage applies when the negligent driver has Liability Insurance at the time of the accident but the limits carried are less than the limits provided under the Under-Insured Motorists Coverage. 36 No-Fault Automobile Insurance As of 1993, there were 27 states that had some form of NoFault Automobile Insurance Law in operation. The Meaning of No-Fault No-Fault Insurance means that in the event of an automobile accident, each party collects from his or her own insurer regardless of fault. It is not necessary to establish fault and prove negligence in order to collect. In addition, a pure No-Fault Law places some restrictions on the Right-to-Sue the negligent driver who caused the accident. Automobile Insurance for High-Risk Drivers: The Shared Market High-Risk Drivers frequently have difficulty obtaining automobile insurance in the standard markets. These drivers can obtain Automobile Insurance in the Shared Market. The Shared Market refers to plans in which automobile insurers participate to make coverage available to drivers who cannot obtain coverage in the standard market. Several plans are specifically designed for High-Risk Drivers: Automobile Insurance Plan Joint Underwriting Association Reinsurance Facility Specialty Insurers 37 CHAPTER 9 Underwriting and Rating Personal Auto Insurance Automobile insurers are in business to make a profit. Accomplishing this objective requires effective underwriting and appropriate rating. Underwriting refers to the selection and classification of profitable insureds. Class rating commonly used in private passenger Automobile Insurance means the same underwriting class and charging each person the same rate. Rating Terms A rate is the cost for a unit of insurance. Automobile rating is the process of determining base rates and applicable rating factors and then calculating individual coverage premiums and the total premium for the policy. Separate premiums are determined for each of the four major Personal Auto Coverages. These separate premiums must then be added to obtain the total premium. Rate Regulation Automobile insurers, however, do not have unlimited freedom to charge any price they desire for the coverage they provide. The rating laws can generally be classified into the following categories: Prior Approval Laws Under a Prior Approval Law, the rates must be approved by the State Insurance Departments before they can be used. File and Use File and use simply means the company files the policy and rates with the State and immediately begins marketing the product without prior approval from the State. 38 Open Competition Laws Under an Open Competition Law (also called a No-Filing Law), rates do not have to be filed with the State Insurance Department and insurers can charge rates based on their own experience and market conditions. Mandatory Rates Under this type of law, rates are set by some state agency or rating bureau and all licensed insurers are required to use these rates. Selection of Insureds As noted earlier, the basic objective underwriting is to select profitable insureds. of automobile Primary Rating Factors The major or primary factors for determining the cost of Automobile Insurance are: territory age, sex and marital status use of the automobile good student discount driver education Secondary Rating Factors type of automobile number of vehicles driving record Other Factors deductibles liability limits other available discounts and credits 39 CHAPTER 10 Personal Auto Policy Case – Insurance A Guide to Auto Two things make it difficult to shop for Auto Insurance: companies can charge widely different prices for similar coverage and the quality of service is impossible to judge until one is unfortunate enough to be in an accident. The reasons Automobile Insurance tends to be expensive are: 1. today's cars are getting complex and quite expensive to repair. 2. streets are getting more congested, so people tend to bump into each other more often. 3. in some cities theft is rampant. 4. medical costs are out of sight. 5. there's more litigation and higher settlements in injury cases. 6. badly designed No-Fault Laws encouraged litigation rather than discourage it. 7. more buyers have been choosing small or sports cars, which generate more collision and injury claims than big cars. 8. By law, insurance companies are allowed to exchange price information thus lessening competition, and, 9. In some states, inept regulation has forced even good drivers into Assigned-Risk Pools, where they are charged extra for their coverage. 40 CHAPTER 11 Insuring Other Vehicles The Personal Auto Policy provides adequate coverage for private passenger cars and pickups that are not used for business purposes. There are other types of vehicles that require discussion. Motorcycles Coverage for motorcycles is usually found in the Specialty Insurance Company market. Due to the added risks associated with motorcycle operation, most insurers would rather not offer coverage on motorcycles. Recreational and Customized Vehicles The term "recreational vehicles" is a very broad area. Although standard policies, such as Homeowners and the Personal Auto Policy do make some provisions for covering some recreational vehicles, many of these vehicles are often covered under NonStandard Policies that are issued by Specialty Insurers. Snowmobile A Snowmobile Endorsement can be used to provide offpremise Liability Coverage under Homeowners Policies for specified snowmobiles provided they are not subject to motor vehicle registration. Other Snowmobile Coverages Some Specialty Insurers offer policies specifically designed to provide Liability and Physical Damage coverage for snowmobiles and other recreational vehicles. 41 Miscellaneous Type Vehicle Endorsement The Miscellaneous Type Vehicle Endorsement can be used to provide both Liability and Physical Damage Coverage for motorcycles, motor homes, golf carts and other miscellaneous vehicles. Coverage on Pickup Camper Bodies, Campers, Trailers, Travel Trailers, Motor Homes Many insurance companies modify Automobile Policies to meet the needs of owners of the above vehicles. Such policies provide Physical Damage Coverage on the following: the vehicle permanent equipment furniture and equipment used with the vehicle Classic and Antique Autos Antique automobiles are usually over 25 years old while classic cars may be less than 25 year olds but possess special value because of unique styling or mechanical features. Liability Coverage for Antique and Classic Cars does not present any special problem. There could be problems when the insured attempts to have Physical Damage Coverage on the Antique and Classic Auto. These problems stem from the fact that these cars generally are appreciating in value rather than depreciating. A solution to this problem would be to use the Personal Auto Policy Stated Amount Endorsement to establish the vehicle value. Mini Bikes and Mopeds Mini bikes are small editions of the motorcycle, they are designed for off-road use. 42 There is no coverage for either mini bikes or mopeds under the unendorsed Personal Auto Policy. If it is not endorsed to the Personal Auto Policy, the best method of insuring mini bikes and mopeds is to obtain Motorcycle Coverage. 43