Payroll Frequently Asked Questions What is the Social Security FICA

advertisement

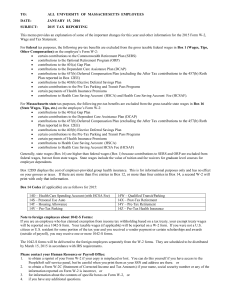

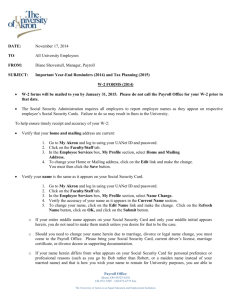

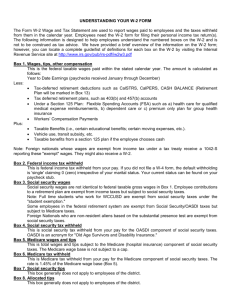

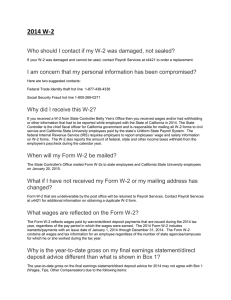

Payroll Frequently Asked Questions What is the Social Security FICA wage base for 2010? The Social Security (OASDI/EE) wage base for 2010 is $106,800.00. There is no limit on wages subject to Medicare taxes (MED). How are my federal taxes calculated? Marital status and the number of dependents determine federal taxes for most wages. Payroll uses a tax table provided by the Internal Revenue Service to calculate the tax to withhold from your wages. Employees can increase or reduce their federal tax by completing a W4 form electronically. The W4 form is located on Campus Connection, under, For Employees, Employee Self Service, Payroll, and Compensation, W-4 tax information. How can I get Direct Deposit? Direct deposit is available to all employees. With direct deposit, your paycheck is deposited into your bank account. This is the fastest way to receive your payment. You can sign up for direct deposit on Campus Connection, under, For Employees, Employee Self Service, Payroll, and Compensation, Direct Deposit. W-2 Frequently Asked Questions What is the W2? Form W2 is the Wage and Tax statement issued by DePaul University (employer) to all employees. The form reports all taxable wages and income tax withheld for the calendar year (January 1 to December 31). What other tax forms will I receive from DePaul? International students, faculty, and staff may also receive a 1042–S tax form. Why does the year to date gross wages on my paycheck not match box 1 wages on my W2? The wages in box 1 include only taxable wages. You must subtract all pre-tax deductions such as medical, dental, vision, childcare, flexible spending, and 403(b) deferrals. In addition, if you had any taxable tuition, life insurance or other taxable benefits you must add this to your wages to get the W-2 box 1 wages. How much tax did I actually pay? The amount of federal income tax withheld from your earnings for the calendar year is reported in box 2. The state taxes withheld from your earnings for the calendar year is reported in box 17. What is Advance EIC payment (box 9)? Advanced earned income credit allows an eligible employee with a qualified dependent ( child or children) with income under the maximum limit established by the Internal Revenue Service to receive a monetary amount with every scheduled payroll check versus applying for a tax credit once a year when the individual files a federal income tax return. Eligible employees must complete a W5-Earned Income Credit Form and submit it to the Payroll Department. The W5 will remain valid throughout the calendar year (January 1 to December 31) that it is completed in and must be renewed every year to continue participation in the program. What is Code E in box 12? Code E is the elective deferrals you made to your 403(b) plan in the calendar year. Under IRS section 403(b), the IRS allows employee paid deductions for the purpose of retirement to be excluded from federal taxable wages. What is imputed income? The IRS requires that certain employer provided benefits be reported as taxable income. Examples are taxable tuition and a portion of group term life insurance. What is Code C in box 12? Code C is the taxable cost of group-term life insurance. If your employer- paid life insurance is over the $50,000 limit, the amount over the limit is taxable and reported in boxes 1, 3, and 5. This is considered imputed income. What do I do if my address is wrong on my W-2? An incorrect address does not invalidate your W-2 and does not require a corrected W-2. However, you should correct your address in Campus Connection. The W-2 uses your mailing address; to correct the address sign into Campus Connect, under, Demographic Portfolio, addresses, mailing address and enter the correct information. How do I request a reprint of my W-2? To request a copy of your W-2 for years prior to 2009, e-mail the Payroll Department, including your name, employee ID number, and your address, The Payroll Department will print a copy of your W-2 and mail it to you. The 2009 W-2’s are in PDF format and you can print a copy by following this path in Campus Connection, Employee Self Service, For Employees, Payroll and Compensation, W-2. What do I do if I think my W-2 is incorrect? Please e-mail or call the Payroll Department and they will review your information. Once your information has been reviewed, you will be contacted.