MERGER OF A HOLDING COMPANY WITH ITS WHOLLY OWNED

advertisement

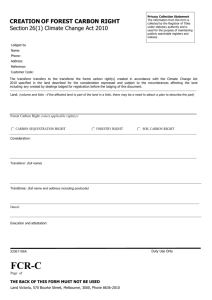

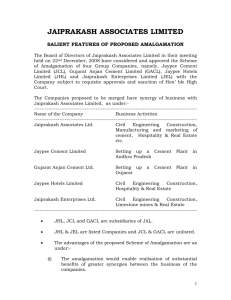

STANDARD OPERATING PROCEDURE FOR THE MERGER OF A WHOLLY OWNED SUBSIDIARY WITH ITS HOLDING COMPANY Dated : March 14th 2006 Page 1 of 28 1 LIST OF RELEVANT STATUTORY PROVISIONS 1.1 1.2 1.3 1.4 The Companies Act, 1956 ( Companies Act) The Companies Court Rules ,1959 ( Court Rules ) The Indian Stamp Act , 1899 ( Indian Stamp Act) The Listing Agreement with the Stock Exchanges ( Listing Agreement) 2 EXTRACT FROM RELEVANT LEGAL PROVISIONS A. The Companies Act, 1956, and The Companies (Court) Rules 1959. All the Forms are given as Annexures in Exhibit A below: 2.1 Section 391 a. Section 391(1) of the Companies Act empowers the court to consider an application for approval of scheme of compromise or arrangement between the company and its creditors or members. The terms “ compromise or arrangement” being very wide in scope includes within its ambit amalgamation or merger of two companies. An application for such an amalgamation is required to be made by means of a summons in Form 33 and Affidavit in Form 34. Upon the hearing of the summons , the Judge shall give such directions as he thinks fit for conducting the General Meeting of the Creditors/Members regarding, fixing the time and date of meeting, appointing Chairman, fixing the quorum,etc. This shall be given in Form 35. Sub-section (2) of section 391 says that at the meeting, the compromise or arrangement has to be approved by 3/4th of the total number of creditors or members attending the meeting personally or by proxy. 391(3) provides that the Court’s order has to be filed with the Registrar of Companies within 30 days of getting court’s order. Sub-section (4) requires the certified Court’s order to be annexed to every copy of the Memorandum of the Company that is issued after the court’s order has been filed with ROC. Section 392. Section 392(1) states that a High Court has the right to supervise the carrying out of compromise or arrangement, and also to make necessary modifications for the proper working of the compromise or arrangement. Subsection (2) provides that If the court is satisfied that a compromise is not fair and just, and cannot be made better even after modifying it, then it may make an order for winding up of the company. The Notice of meeting shall be in Form 36 and shall be sent to all the creditors/members individually 21 clear days before the date of meeting. It shall be accompanied by a Proxy form which shall be in Form 37. The notice of meeting shall be advertised in such newspapers and in such manner as the Judge may direct. This advertisement shall be made in Form 38. b. c. d. e. f. 2.2 g. h. i. j. 2.3 k. Section 393. Section 393(1) provides that along with the Notice of Meeting, a statement explaining the terms of the arrangement, material interests of any director, Page 2 of 28 l. m. n. o. p. q. r. s. t. Managing Director or any manager and the effect on those interests, should be sent to the creditors/members. If the notice is given by advertisement, then a statement will be included as to when and how the aforesaid statement will be made available to the creditors/members. Where it is advertised in the above manner, the creditor/member applying for such statement as indicated in the notice shall be given a copy free of charge. Subsection (5) says that a Director, MD, or manager, every trustee for debentureholders shall provide all the relevant details about themselves as may be necessary for the purpose of this section. The Chairman of the meeting shall within 7 days of the meeting shall report the result of the meeting to the Court in Form 39. Within seven days of filing the above report, the Company has to present a petition to the Court for confirmation of compromise or arrangement. This petition shall be in Form 40. The Court shall sanction the Compromise with certain modifications that he may deem fit for the proper working of the compromise. The Order shall be in Form 41. Section 394(1) gives the scope of Court’s order : The court may by an order make provisions for all or any of the following matters:i. Transfer of whole or part of assets and liabilities of transferor company. ii. Share allotment by the transferee company to shareholders of transferor co iii. Continuation of legal proceedings which are currently against transferor co iv. The dissolution, without winding up, of the transferor company. v. Handling persons who dissent from the compromise. vi. Other incidental matters as the courts thinks necessary to make the arrangement more effective. The court shall not sanction the scheme unless the Registrar or CLB or Official Liquidator confirms to the Court that the affairs of the company have not been carried on in a manner prejudicial to public or members’ interests. An Order made under Section 394 shall be in Form 42 with such variations as the circumstances may require. Subsection (3) says that within 30 days of Court’s order, such certified true copy shall be filed with the Registrar. Voting by Proxy shall be permitted provided the proxy form is duly filled in by the person entitled to vote and filed at the company’s regtd office within 48 hours before the meeting. B. The Indian Stamp Act 1899. a. Section 3 of Indian Stamp Act charges a levy of stamp duty on execution of an instrument. “Instrument” includes every document by which any right or liability is, create transferred, limited, extended, extinguished or recorded.” Article 23 of Schedule I of Indian Stamp Act 1899 provides for payment of stamp duty on a conveyance. “Conveyance” includes a conveyance on sale and every instrument by which property, whether movable or immovable, is transferred inter vivos and which is not otherwise specifically provided for by Schedule I. Certain States have amended the Article to pay stamp duty on Merger of two companies as it involves a court’s order which would fall under the scope of “Instrument”. Irrespective of the above, a Merger of a holding company with its wholly owned subsidiary company invokes Notification 1 given on 16-1-1937 provides that: b. c. d. Page 3 of 28 e. f. Instruments evidencing transfer of property between companies limited by shares as defined in the Indian Companies Act 1913 in cases:i. Where at least 90% of the issued share capital of the transferee company is in the beneficial ownership of the transferor company, or ii. Where the transfer takes place between a parent company and a subsidiary company one of which is the beneficial owner of not less than 90% of the issued share capital of the other, or iii. Where the transfer takes place between two subsidiary companies of each of which not less than 90% of the share capital is in the beneficial ownership of a common parent company: Provided that in each case, a certificate is obtained from the officers appointed by the Government , that the above conditions are fulfilled. The above notification was designed to facilitate reconstruction of a company or amalgamation of two companies which are more or less under the same ownership so that they should be able to re-arrange the affairs of the company easily without being over-burdened with the responsibility of paying stamp duty. From the above explanations, it is clear that when a merger takes place between a holding company and its subsidiary wherein more than 90% of the share capital is held by the parent company, they are exempt from paying stamp duty. C. The Listing Agreement with the Stock Exchanges (Listing Agreement) a. Clause 36 of the Listing Agreement requires the Company to keep the Stock Exchange informed of any kind of material events that take place in the Company, in order to enable the public and the shareholders to evaluate the position of the company. An event that has to do with the performance of the company and any price sensitive information will also have to be intimated to the Stock Exchange. One of the items being Merger, Acquisition, de-merger, amalgamation, restructuring, scheme of arrangement, spin-off or setting divisions of the company, etc. The above information should be made public immediately. Other than the above, the company should also provide all the relevant information that is asked for by the Stock Exchange. b. c. d. 3. SEQUENCE OF EVENTS 3.1 The Merger of a Wholly Owned Subsidiary Company with its holding Company would involve the following steps : STEP NO. 1 2 3 4 5 6 7 8 9 STEPS TO BE FOLLOWED Getting in-principle approval of the Board. Drafting the Scheme of Amalgamation. Board Approval. Approval of High Court. Approval of notice by Registrar of High Court. Shareholders’ approval. High Court’s Order. Post-Merger Activities. Exemption from payment of stamp duties. Page 4 of 28 10 Withdrawal of scheme not permissible. 3.2 The tasks and Processes under every step is given as Exhibit A below. EXHIBIT A: 1. Getting In-Principle approval of the Board. 1.1 Give notices to Directors then present in India and to all other directors to their Indian postal address, reasonable time before the date of Board meeting. Annexure-A 1.2 On the fixed day, hold the Board meeting and pass a Board Resolution approving the proposed Merger. Annexure-B 1.3 Immediately after passing the Board Resolution, the stock exchange has to be informed about the proposed merger and the approval of the Board for the same. Annexure-C 1.4 A press release about intimation to the Stock exchange has to be given. A copy of the letter to Stock Exchange should be attached. 2. 2.1 Drafting of the Scheme of Amalgamation. A rough draft scheme of amalgamation has to be prepared. Normally, it is prepared by the Asst.Company Secretary or any person who is entrusted by the Company Secretary for this purpose. Basic information of the transferor company should be collected in order to prepare this rough draft scheme. 2.2 Preparation of final scheme of amalgamation. A final scheme of Amalgamation has to be prepared by the companies. Annexure-D In order to Prepare a scheme of amalgamation, the following points will have to be taken into account. 1. Particulars about transferee and transferor companies. 2. Appointed Date. 3. Main terms of transfer of assets and liablities from transferor to transferee company . 4. Effective date when the scheme will come into effect. 5. Conditions as to carrying on the business activities by transferor between the appointed date and effective date. 6. Share Capital of the Transferor and Transferee Companies. 7. Status of employees of the transferor company from effective date and the status of PF, Gratuity fund, super annuity fund or any other fund existing for the benefit of employees. Page 5 of 28 8. Misc Provisions covering Income-tax dues, contingencies, Sales tax, Central Excise, Customs, Service tax,etc. 9. Enhancement of borrowing limits of the transferee company upon the scheme coming into effect. 10. Transferor and Transferee companies give assent to change in the scheme by the court or other authorities. 11. Qualification attached to the scheme which require approval of different agencies,etc. 12. Statement to bear costs,etc in connection with the scheme by the transferee company. 3. 3.1 Board’s Approval. The Directors have to be intimated about the forth coming Board Meeting wherein final approval of the merger will be given. The final scheme of amalgamation should be sent to all the Directors along with the Agenda, reasonable time before the board meeting. 3.2 On the fixed date and time, Hold the Board Meeting and pass the Board resolution approving the merger. Annexure-E. 4. Approval of High Court. 4.1 Both the companies have to file an application to the High Court to fix the date, time and venue for holding the General meeting of the Shareholders/Creditors. The Court may dispense with the meeting of the transferor company since its entire shareholding is held by the Transferee company itself. 4.2 Where the number of creditors are few in number, a written consent from them approving the merger can be obtained. In that case, the creditors meeting of the transferor company may also be dispensed with, if so ordered by the High Court. 4.3 The Companies (or a Director whosoever is authorized) have to file an application with the High Court, which shall be made by a Judge’s summons in form no.33 (Annexure-F) supported by an affidavit in form no.34. (Annexure-G) 4.4 The Following documents shall be submitted along with Judge’s Summons:- a. b. A true copy of the MoA of both Companies. A true copy of the Company’s latest audited Balance Sheet of the transferee company. Copy of Board Resolution which authorizes the Director to make the application to the High Court. c. 4.5 A copy of the application made to the concerned High Court shall also be sent to the Regional Director of the region. Although such notice is supposed to be Page 6 of 28 sent by the High Court, normally, the company sends it without waiting for the Court to send it. 4.6 After hearing the summons, the High Court shall give directions fixing the date, time , venue and quorum for the members’ meeting and appoint a Chairman to preside the meeting. Court’s directions will be given in Form 35. 5. 5.1 Approval of Notice by Registrar of High Court. After getting directions from the Court, the transferee and the transferor companies shall get the notice calling the meeting of members, approved by the Registrar of High Court. 5.2 This notice shall be submitted to the Registrar in Form 36, together with the scheme of Arrangement. (Annexure-H) 5.3 Form of Proxy in Form 37 (Annexure-I) shall also be submitted and got approved. Later it should be signed by the Chairman who will be appointed by the High Court. Shareholders’ Approval. Once the notice is signed by the Chairman, it can be distributed to the Members 21 clear days before the date of meeting. Along with notice, the following documents have to be sent to the shareholders. They are: 6.2 A statement setting forth the terms of amalgamation and its effects, any material interests of the Manager, MD or directors in any capacity, effect of amalgamation on those interests. A copy of the proposed scheme of amalgamation. A form of proxy. Attendance Slip.(Annexure-J) 6. 6.1 6.3 This notice has to be advertised in Form 38 (Annexure-K) in two newspapers, one in English and one in the Regional Language of the State. It should be published not less than 21 clear days before the date fixed for the meeting. 6.4 If the company is listed, then 3 copies of the notice along with all other enclosures shall be sent to the stock Exchange where the company is listed. 6.5 The Chairman should file an affidavit to the Court atleast 7 days before the meeting regarding compliance of issuance of notices to members well within the stipulated time limit. 6.6 Hold the General Meeting as directed by the High Court and get the special resolutions passed approving the merger. (Annexure-L). Page 7 of 28 6.7 The special resolutions so passed shall be filed with the Registrar of Companies in Form 23 within 30 days of passing the resolution. 6.8 A copy of the proceedings of the meeting shall also be sent to the concerned Stock Exchanges. 6.9 The chairman of the General Meeting is required to submit to the court within 7 days from the date of meeting, a report in Form 39,(Annexure M) setting out therein the number of persons who attended either personally or by proxy, and the % of shareholders who voted in favour of the resolution. 7. 7.1 High Court’s order confirming the scheme. Both the companies should make a joint petition to the High court for approving the scheme of amalgamation. It should be made in Form 40 (Annexure-N). The Court will fix a date for hearing of the Petition. 7.2 The notice of the hearing shall be advertised in the same newspapers in which notice of meeting was advertised, not less than 10 days before the date fixed for the hearing. 7.3 The Court will give a notice of petition to the Regional Director, Company Law Board and will take into consideration, his representations. 7.4 If there are no objections from any side, then the court may pass an order approving the scheme in Form 41 or 42. 7.5 This Court’s order shall be filed with the Registrar of companies within 30 days after the date of the Court’s order in Form 21 (Annexure-O) under Central Government’s General Rules and Forms 1956. 7.6 Court’s order shall be given effect to only after the order has been filed with the Registrar. 8. 8.1 Post Merger Activities. Dissolution of transferor company: Section 394(1)(iv) has vested power in the High Court to order dissolution of the transferor company without winding up, provided that the Official Liquidator has made a report to the Court that the affairs of the Company have not been conducted in a manner prejudicial to the interests of its members or to public interest. 8.2 Transfer of assets and liabilities. Section 394(2) vests power in the High Court to order for the transfer of any property or liabilities from transferor company to transferee company. 8.3 Treatment of shares in transferor company. Page 8 of 28 Since all the shares of transferor company are held by the transferee company only, the entire holding stands cancelled. 8.4 Court’s order to be annexed to MOA of transferee company. As per Section 394(4) of the Companies Act, 1956, after the certified copy of the Court’s order sanctioning the scheme of amalgamation is filed with the Registrar, it should be annexed to every copy of the Memorandum issued by the transferee company. 8.5 Preservation of books and papers of transferor company. Section 396A of the Companies Act requires that the books and papers of the transferor company should be preserved and not be disposed of without prior permission of the Central Government. 8.6 Other post merger secretarial Obligations. Other secretarial formalities include: Filing of returns with ROC. Transfer of investments of transferor company in the name of the transferee company. Intimating banks and Financial Institutions. Creditors and Debtors about the transfer of assets, liabilities of transferor co in the name of transferee co. 9. Exemption From Payment of Stamp Duty Notification 1 given on 16-1-1937 says that: In exercise of the powers under Clause(A) of section 9 of the Indian Stamp Act 1899, stamp duty is remitted on instruments evidencing transfers of property between companies limited by shares in cases:where at least 90% of the issued share capital of the transferee company is in the beneficial ownership of the transferor company. where the transfer takes place between a parent company and a subsidiary company one of which is the beneficial owner of not less than 90% of the issued share capital of another. where the transfer takes place between two subsidiary companies of each of which not less than 90% of the share capital is in the beneficial ownership of a common parent company. Provided in each case, a certificate is obtained by the parties from the officer appointed in this behalf by the local Government concerned that the conditions above prescribed are met. This notification of reduction and remission was designed to facilitate reconstruction of a company or amalgamation of two companies which are more or less under the same ownership so that they should be able to re- Page 9 of 28 arrange their affairs without being over-burdened with liability for payment of stamp duty. Therefore, keeping this notification in mind, it is clear that no stamp duty needs to be paid on a merger between a holding company holding more than 90% of the share capital of the transferor company/subsidiary company. 10. Withdrawal of Scheme not permissible. Once the scheme for merger has been approved by requisite majority of shareholders and creditors, the scheme cannot be withdrawn by subsequent meeting of shareholders. ANNEXURES Annexure A – Notice Convening the Board Meeting XYZ ltd. Place, Date. To Shri _______, Place. Dear Sir, This is to inform that the next meeting of the Board of Directors of the Company will be held at the Registered Office/****** of the company at ___________, on _________, the _____day, 2006, at ________a.m/p.m., to consider the businesses as mentioned in the board document. You are requested to make it convenient to attend the meeting. A copy of the Board Document is enclosed for your perusal. Yours faithfully, For _______________ltd, Secretary. Page 10 of 28 Annexure-B --Board Resolution approving the merger. “RESOLVED THAT – The proposal for merger between the company and XYZ company, which is a wholly owned subsidiary of the company with effect from _______________, be and is hereby approved”. “RESOLVED FURTHER that Mr.______, Company Secretary of the company be and is hereby authorized to do all formalities for preparing the scheme of amalgamation and make an application to the High Court, and other associated work relating to this merger”. Annexure –C - Intimation to Stock Exchange. Sample Letter: To, The Stock Exchange, XXXXX. Sub: Intimation about merger of _________ with _________. Dear Sir, The Company has a proposal of merging ___________ltd, which is our wholly owned subsidiary with our company ___________ltd, into one single company. The Board has given its approval for the proposed merger. Yours Faithfully, Secretary. Annexure-D - Scheme of Amalgamtion. Sample Scheme of Amalgamation Of __________________ltd with Page 11 of 28 _____________________ltd. PART I PREAMBLE. 1. Transferor company was incorporated on __________________- under the companies Act 1956 and having its registered office at __________. The transferor company is engaged in the business of ____________________________________________________. 2. The Transferee company was incorporated on __________________ under the companies Act 1956 and having its registered office at ___________________________. The transferee company is engaged in the business of ______________________________________. 3. The transferor company is a wholly owned subsidiary of the Transferee company and both the companies are engaged in the business of __________________________________. 4. In order to achieve the following objectives, it is proposed to merge the above mentioned companies into one single company. Hence this scheme of amalgamation has been propounded. LIST THE OBJECTIVES…. To avoid un-necessary duplication of costs of administration, distribution, ……………[according to the facts of the case] A. PART II Definitions. 9 TRANSFEROR COMPANY. “The transferor company means ________________________ltd, a company registered under the companies Act 1956 and having its registered office at _____________________. 10 TRANSFEREE COMPANY. “The Transferee company” means ___________________ ltd, a company registered under the Companies Act 1956, and having its registered office at ________________. 11 ACT “The Act “ means the Companies Act 1956. 12 APPOINTED DATE Page 12 of 28 “The Appointed Date” means the commencement of business on ___________ or such other date as the Hon’ble High Court of Karnataka may direct. 13 BOARD “Board” or “Board of Directors” of the company concerned and includes any committee thereof. 14 EFFECTIVE DATE “The Effective Date” means the date on which a certified copy of the order of the High Court of Karnataka at Bangalore sanctioning this Scheme is filed with the Registrar of Companies in the state. 15 SCHEME “The Scheme” means this scheme of Amalgamation in its present form or with any modification(s) approved or directed by the shareholders in general meetings and / or the High Court of the State. 16 SHARE CAPITAL 1. The present Authorized, Issued, Subscribed and Paid up Share capital of the TRANSFEREE COMPANY is as stated below: Authorized: Issued, Subscribed and Paid up: 2. The present Authorized, issued, subscribed and paid up share capital of the TRANSFEROR COMPANY is as stated below: Authorized: Issued, Subscribed and Paid up: All the Equity Shares issued by the Transferor company as above, are held by the Transferee company and its nominees. Accordingly, the Transferor company is a wholly owned subsidiary of the transferee company. PART III THE SCHEME.(To be finetuned as per the facts of the case) 1. TRANSFER OF UNDERTAKINGS. Page 13 of 28 1.1 With effect from the “Appointed Date” and subject to the provisions of this scheme in relation to the mode of transfer and vesting, the entire undertakings and the entire business and all the movable and immovable properties , real or personal, corporeal or incorporeal of whatsoever nature and wheresoever situate belonging to or in the ownership, power or possession and/or in the control of or vested in or granted in favour of or enjoyed by the Transferor company including but without being limited to fixed assets, capital work-inprogress, current assets, debts, receivables, investments, powers, authorities, allotments, approvals, consents, licences, permissions and registrations and other statutory licenses, and brand, registrations, contracts, engagements, arrangements, rights, title, interest, quotas, benefits and advantages of whatsoever nature and wheresoever situated, software, technologies, trade names and other industrial or intellectual property rights of any nature whatsoever and licenses in respect thereof, privileges, liberties, easements, advantages, exemptions, benefits, leases, leasehold rights, licences, tenancy rights, quota rights, permits, approvals, authorizations, right to use and avail of telephones, telexes, facsimile connections and installations, utilities, electricity, power lines, communication lines and other services, reserves, deposits, provisions, funds, benefits of all agreements, subsidies, grants, salestax, turnover tax, excise and all other interests arising to the Transferor company and any accretions or additions thereto after the Appointed date (hereinafter collectively referred to the “Said Assets”) shall without any further act instrument or deed be transferred to and vested in the transferee company pursuant to the provisions of section 394 of the said Act for all the estate, right, title and interest of the Transferor Company therein, so as to become the properties of the transferee company therein. 1.2 The transfer/vesting , as aforesaid, shall be, subject to existing charges/hypothecation/mortgage (if any as may be subsisting) over or in respect of the Said Assets or any part thereof. Provided, however, that any reference in any security documents or arrangements to which any of the Transferor Company is a party, to such assets of the Transferor company, offered or agreed to be offered as security for any financial assistance, or obligations, to the creditors of the Transferor Company, shall be construed as references only to the assets pertaining to the undertaking of such Transferor Company as are vested in the Transferee company by virtue of the subclause(1.1) hereof. 1.3 The transferee company may, at any time after coming into effect of this scheme in accordance with the provisions hereof, if so required under any law or otherwise, execute deeds of confirmation in favour of the creditors of the Transferor company or in favour of any other party or any writings, as may be necessary, in order to give formal effect to the above provisions. The transferee company shall under the provisions of the scheme be deemed to be authorized to execute any such writings on behalf of the Transferor Company and to implement or carry out all such formalities or compliances referred to above on the part of the Transferor Company to be carried out or performed. Page 14 of 28 2. TRANSFER OF DEBTS AND LIABILITIES. With effect from the said Appointed Date, all debts, liabilities, duties and obligations of the Transferor Company (hereinafter referred to as the “said Liabilities” and any accretions and additions or discretions thereto after the Appointed Date shall without any further act or instrument or deed stand transferred and vested in or be deemed to be transferred to and vested in the Transferee company so as to become as and from that date, the debts, liabilities duties and obligations of the Transferee Company. PROVIDED ALWAYS that nothing in this clause shall or is intended to enlarge the security for any loan, deposit or other indebtedness created by the Transferor Company prior to the “Appointed Date” which shall be transferred to and vested in the Transferee Company by virtue of the amalgamation and the Transferee Company shall not be required or obliged in any manner to create any further or additional security therefore after the “Appointed Date” or otherwise. 3. LEGAL PROCEEDINGS All suits, actions and proceedings by or against the Transferor Company pending and/or arising on or before the effective Date shall be continued and be enforced by or against the Transferee Company as effectively as if the same had been pending and/or arising against the Transferee Company 4. CONDUCT OF BUSINESS TILL EFFECTIVE DATE. With effect from the appointed Date up to the date on which this Scheme finally takes effect [viz the Effective Date]- 4.1 The Transferor company shall carry on and be deemed to have carried on all its business and activities and shall be deemed to have held and stood possessed of and shall hold and stand possessed of all the said assets for and on account of and in t rust for the Transferee Company; 4.2 All the profits or incomes accruing or arising to the Transferor Company or expenditure or losses arising or incurred by the Transferor Company shall for all purposes be treated and be deemed to be and accrue as the profits or incomes or expenditure or losses of the Transferee company, as the case may be; The Transferor Company shall also be entitled, pending the sanction of the scheme, to apply to the Central Government, State Government, and all other agencies, departments and statutory authorities concerned, as are necessary for such consents, approvals and sanctions, which the Transferee company may require. Page 15 of 28 The Transferor Company shall declare or pay any dividend out of the profits for the period commencing from the “Appointed Date” only with the prior written consent of the Transferee Company. The Transferee Company shall not make any modification to their capital structure either by an increase (by issue of right shares, bonus shares, convertible debentures or otherwise), decrease, reclassification, subdivision or re-organization or in any other manner, whatsoever, except by mutual consent of the Board of Directors of the Transferor company and the Transferee Company. 5. CONTRACT, DEEDS, BONDS AND OTHER INSTRUMENTS. Subject to the provisions of this Scheme all contracts, deeds, bonds, agreements, arrangements and other instruments of whatsoever nature to which the Transferor Company is party or to the benefit or which the Transferor Company may be eligible, and which are subsisting or having effect immediately before the Effective Date, shall be in full force and effect against or in favour of the Transferee Company, as the case may be, and may be enforced by or against the Transferee Company as fully and effectually as if, instead of the Transferor Company, the Transferee Company had been a party or beneficiary thereto. The Transferee Company shall enter into any Tripartite Arrangements, confirmations or novations to which the Transferor Company will, if necessary, also be a party in order to give formal effect to the provisions of this Clause, if so required or becomes necessary. 6. CONCLUDED MATTERS. The transfer of the said assets and the said liabilities of the Transferor Company to the Transferee Company and the continuance of all the contracts or proceedings by or against the Transferee Company shall not affect any contract or proceedings relating to the said assets or the said liabilities already concluded by the Transferor Company on or after the Appointed Date. 7. TREATMENT OF SHARES OF THE TRANSFEROR COMPANY. Since the Transferor Company is a wholly owned subsidiary of the Transferee Company, upon the scheme being sanctioned by the Hon’ble High Court of ___________ at _________ and the transfers having been effected as provided hereinabove all the Equity Shares, held by the Transferee Company and its nominees in the Transferor Company shall be cancelled and extinguished. Accordingly, there will be no issue and allotment of Equity shares of the Transferee Company to the Shareholders of the Transferor Company upon this scheme becoming effective. Page 16 of 28 8. DISSOLUTION OF TRANSFEROR COMPANY. Upon this Scheme being sanctioned and becoming finally effective the Transferor Company shall be dissolved without winding up. 9. 9.1 EMPLOYEES. All employees of the Transferor Company in service on the date immediately preceding the date on which this Scheme finally takes effect i.e. the Effective Date, shall become the employees of the Transferee Company on such date without any break or interruption in service and on the terms and conditions not less favourable than those subsisting with reference to the Transferor Company as on the said date. 9.2 It is expressly provided, that as far as the Provident Fund, Gratuity Fund, Superannuation Fund or any other special Fund created or existing for the benefit of the employees of the Transferor Company are concerned, upon the Scheme becoming finally effective, the Transferee Company shall, stand substituted for the Transferor Company for all purposes whatsoever related to the administration or operation of such Schemes or Funds or in relation to the obligation to make contributions to the said Funds in accordance with provisions of such Schemes or Funds as per the terms provided in the respective Trust deeds. It is to this end and intent that all the rights, duties, powers and obligations of the Transferor Company in relation to such Funds shall become those of the Transferee Company. It is clarified that the services of the employees of the Transferor Company will be treated as having been continuous for the purposes of the aforesaid Funds or provisions. 10. ACCOUNTING TREATMENT IN THE BOOKS OF TRANSFEREE COMPANY. 10.1 All assets, liabilities including reserves of the Transferor Company shall be recorded in the books of account of the Transferee Company at their existing carrying amount and in the same form in accordance with the applicable Accounting Standards issued by the Institute of Chartered Accountants of India 10.2 Upon the coming into effect of this scheme, an amount representing the excess of the value of the assets over the liability of the Transferor Company after making such adjustments as the Board of Directors of the Transferee Company may decide shall be reflected as the General Reserve in the Books of the Transferee Company. Page 17 of 28 10.3 Goodwill, arising if any, shall be fully adjusted against the balance in the profit and loss Account of the Transferee Company on Amalgamation. 11. TREATMENT OF ADVANCE TAX PAID BY THE TRANSFEROR COMPANY. All taxes (whether direct or indirect) that might have been paid by the Transferor Company (whether before or after the Appointed Date) during the period when the merger has not become effective shall be deemed to be the corresponding tax paid by the transferee Company and credit in respect thereof shall be given to the Transferee Company accordingly. 12. APPLICATION TO THE HIGH COURT OF THE STATE The Transferor Company and the Transferee Company hereto shall, with all reasonable despatch, make applications/petitions under Sections 391 and 394 and other applicable provisions of the said Act to the High Court of Karnataka at Bangalore for sanctioning the Scheme and for dissolution of the Transferor Company without winding up under the provisions of law. 13. 13.1 MODIFICATIONS/AMENDMENTS TO THE SCHEME. The Transferor Company (by its Directors) and the Transferee Company (by its Directors) may assent from time to time on behalf of all persons concerned to any modifications or amendments of this Scheme or of any conditions or limitations which the Court and /or any other authorities under law may deem fit to approve of or impose and to resolve all doubts or difficulties that may arise for carrying out the Scheme and to do and execute all acts, deeds, matters and things necessary for putting the Scheme into effect. 14. 14.1 SCHEME CONDITIONAL ON APPROVALS/SANCTIONS. The approval of and agreement to the Scheme by the requisite majorities of such classes of persons of the Transferor Company and the Transferee Company as may be directed by the High Court of Karnataka at Bangalore on the applications made for directions under Section 391 of the said Act ; 14.2 The sanction of the High Court of Karnataka at Bangalore being obtained under Sections 391 and 394 of the said Act in favour of the Transferor Company and the Transferee Company and to the necessary Order or Orders under Section 394 of the said Act, being obtained. 14.3 In the event of any of the said sanctions and approvals not being obtained and/or the scheme not being sanctioned by the High Court and/or the Order or Orders not being passed, as aforesaid, on or before Page 18 of 28 ____________ or within such further period or periods, as may be agreed upon between the Transferor Company and the Transferee Company through their respective Boards of Directors, the Scheme of Amalgamation shall become null and void and each party shall bear and pay its respective costs, charges and expenses for and/or in connection with the Scheme. 15. EXPENSES CONNECTED WITH THE SCHEME. All costs, charges and expenses of the Transferor Company and the Transferee Company respectively in relation to or in connection with this Scheme and of and incidental to the completion of the amalgamation of the said undertaking of the Transferor Company in pursuance of the Scheme shall, except as specifically provided herein, be borne and paid by the Transferee Company. Annexure-E Board Resolution (Giving final approval). Board Resolution approving the merger. “RESOLVED THAT – a. The draft specimen scheme of arrangement be and is hereby approved. b. Such steps be taken as may be necessary and expedient to carry into effect the schemes of arrangement between the subsidiary and its members on such terms and conditions as may be approved by the members of the subsidiary company and accepted by the High Court, to which this Company would be a party. c. The Board of Directors be and is hereby authorized to take such steps as may be necessary or expedient to carry into effect the amalgamation of the subsidiary company with the company on such terms and conditions as may be approved by the Board of both companies and accepted by the High Court. d. The Directors of the Company be and are hereby authorized severally to sign all documents and papers which are required to be signed for carrying into effect the said scheme of arrangement.” e. Mr.___________ and Mr._____________are hereby authorized to take all necessary steps to file an application with the High Court for convening the General meeting, etc”. Annexure-F Summons for directions to convene a meeting. Form 33: Summons for directions to convene a meeting under section 391. Page 19 of 28 Company Application No. ………of 20….. ………………Applicant(s). Summons for directions to convene a meeting under section 391. Let all parties concerned attend the Judge in Chambers on ………..(day), the …….day of ……..20…. at ……….o’clock in the ……… noon on the hearing of an application of the above named company(or of the applicant(s) above named) for an order that a meeting or (separate meetings) be held at ……….of ( here enter creditors or class of creditors, eg: debenture holders other secured creditors, unsecured creditors, etc. Or the members or class of members eg: preference share holders, equity share holders , of which class or classes the meetings have to be held) of the above company, for the purpose of considering, and if thought fit, approving, with or without modification, a scheme of compromise or arrangement proposed to be made between the company and the said(mention the creditors or members) of the said company. And that directions may be given as to the method of convening, holding and conducting the said meeting(s) and as the notices and advertisements to be issued. And that a Chairman (or Chairmen) may be appointed of the said meeting(s), who shall report the result thereof to the Court. Advocate for the applicant(s). Registrar. The affidavit of ………….will be used in support of summons. Annexure-G Affidavit in support of summons. FORM 34: Affidavit in support of summons Company Application No. ……….of 20…. ………………Applicant(s) Affidavit in support of summons. I,…………. Of etc, solemnly affirm and say as follows:i. I am the managing director/secretary/a director /………/of the said company (or an auditor of the said company authorized by the directors to make this affidavit, or liquidator of the said company in liquidation). ii. The company was incorporated on ………… The document now produced and shown to me is printed copy of MOA and AOA of the said company, and also contains copies of all the special resolutions which have been passed and are now in force. iii. The registered office of the company is situated at ……………… iv. The capital of the company is Rs.----------------divided into ………..(set out the classes of shares issued and the amounts paid up on each share). v. The objects of the company are set out in the MOA annexed hereto. They are briefly ( set out the main objects in brief). Page 20 of 28 vi. vii. viii. ix. x. xi. xii. The company commenced business of ……………….and has been carrying on the same since…………… Set out reasons for the proposed arrangement. Copy of the scheme of arrangement should be marked as an exhibit and annexed to the affidavit. Set out the class of creditors or members with whom the compromise or arrangement is to be made. It is necessary that a meeting(s) of the creditor(s)/ member(s) should be called to consider and approve the proposed compromise or arrangement. It is suggested that the meeting may be held at the registered office of the company or such place as may be determined by the Court on such time, date as directed by the Court, and that a Chairman may be appointed for the meeting. It is suggested that notice of the proposed compromise or arrangement be published once in …..newspaper in such manner as court may direct. It is prayed that necessary directions may be given as to the issue and publication of notices and the convening, holding and conducting of the meeting(s) proposed above. Solemnly affirmed, etc. (Sd) X.Y………….. Before me (Sd)………………. Commissioner of Oaths. Annexure-H Notice Convening Meeting. Form 36 Company Application No.___ of _____. __________Applicants. Notice convening Meeting. To The Shareholders of _____________ltd. Take notice that by an order made on __________, the Court has directed that a meeting of the shareholders of the company be held at ____________________________, on __________________________, for the purpose of considering and if thought fit approving, with or without modification, the scheme of amalgamation whereunder the company known as _____________________________ is proposed to be merged with the Applicant company. Page 21 of 28 Take further notice that in pursuance of the said order a meeting of the shareholders of the company will be held on the ________________ at __________ at ______________________, when you are requested to attend. Take further notice that you may attend and vote at the said meeting in person or by proxy provided that a proxy form in the prescribed form, duly signed by you is deposited at the registered office of the applicant company, not later than 48 hours before the meeting. The Court has appointed Mr.___________,Chairman , failing him Mr.___________, director of the company as Chairman of meeting. The statement under sec 393 of the Companies Act 1956, proxy form and copy of the scheme of amalgamation are enclosed. Dated this the______________. Chairman appointed for the meeting. Annexure-I Form of Proxy. Form 37. IN THE HIGH COURT OF KARNATAKA AT BANGALORE Original Jurisdiction In the matter of Companies Act 1956 And In the matter of sections 391 and 394 of the Companies Act, And In the matter of ________________ltd And In the matter of scheme of amalgamation of ___________ltd with _________ltd Company Application No.______of ___. ______________ltd, Regd Office: APPLICANT Form of Proxy. I, the undersigned equity shareholder of the above company hereby appoint__________________ of ___________________, failing him __________________ of ____________________ as my proxy, to act for me at the meeting of the shareholders of the company to be held at ___________________ on Page 22 of 28 _____________________ for the purpose of considering and if thought fit, approving with or without modification, the scheme of Amalgamation whereunder the company known as ___________ltd, is proposed to be merged with the Applicant company and at such meeting and any adjournment thereon to vote, for me and in my name, the said scheme of Amalgamation either with or without modification as my proxy may approve. Dated this the _____day of _____. Signature: Address: Annexure-J Attendance Slip.] ________________________LIMITED Regd Office:__________________________________________ ATTENDANCE SLIP: I/We hereby record my/our presence at the Court Convened Meeting of the Shareholders of the Company held at the registered office of the Company situated at ___________________________________ at ______P.M on ___________, the ______________2006. NAME(S) OF THE SHAREHOLDER(S)/PROXY (IN BLOCK LETTERS) FOLIO NO. / CLIENT NO. DP ID NO. NO. OF SHARES HELD SIGNATURE OF THE SHAREHOLDER(S) / PROXY Page 23 of 28 Annexure-K Notice Convening Meeting of Creditors/Shareholders. Form No.38 Company Application No.____of 2006. ___________Applicant. Notice convening Meeting of Creditors/Shareholders. Notice is hereby given that by an order, dated the ___________, the court, has directed a meeting to be held of [mention class] of the said company for the purpose of considering , and if thought fit, approving with or without modification, the compromise or arrangement proposed to be made between the said company and [mention class of creditors/members] of the company aforesaid. In pursuance of the said order and as directed therein, further notice is hereby given that a meeting of [class of creditors/members] of the said company will be held at ______on______day___________, the ______day of 2006, at _____o’clock in the ______________noon at which time and place the said [class] are requested to attend. Copies of the said compromise or arrangement, and of the statement under section 393 can be had free of charge at the registered office of the company or at the office of its advocate Shri__________ at_________. Persons entitled to attend and vote at the meeting may vote in person by proxy, provided that all proxies in the prescribed form are deposited at the registered office of the company at ________not later than 48 hours before the meeting. Forms of Proxy can be had at the registered office of the company. The court has appointed _______________ and failing him_______________, as chairman of the said meeting. The above mentioned compromise or arrangement, if approved by the meeting, will be subject to the subsequent approval of the Court. Dated this _________day of 2006. Chairman appointed for the meeting. ANNEXURE-L Special Resolution approving merger. Special Resolution: Page 24 of 28 “RESOLVED that subject to the sanction of the High court at __________ of the annexed scheme of arrangement between the company _________ltd and its members with or without modification as may be directed by the Court, approval be and is hereby accorded to the scheme of arrangement whereby the subsidiary company ______________ltd will stand absorbed by the company and their rights, obligations, assets, liabilities and the entire undertaking will be vested in the company from the appointed day if not amended by the said High Court” RESOLVED FURTHER that the Board of directors of the company be and is hereby authorized to implement the scheme once sanctioned by the High Court and to do everything that may be necessary in connection therewith. ANNEXURE-M Report by Chairman. Form No.39 Company Application No._____ of 2006. Report by Chairman. I,________, the person appointed by this Hon’ble Court to act as Chairman of the meeting of (class) of the abovementioned company , summoned by notice served individually upon them and by advertisement dated the ________day of ______2006 and held on the ______day of __________2006 at __________do hereby report to this Hon’ble Court as follows: 1 2 3 The said meeting was attended either personally or by proxy by (state the number of members/creditors) of the said company entitled together to (total value of debts, or debentures, where the meeting was of creditors, and value of shares for meeting of members). The compromise or arrangement was read out and explained by me to the meetings and the question submitted to the said meeting was whether the [class of creditors/members] of the said company approved of the compromise or arrangement submitted to the meeting and agreed thereto. The said meeting was unanimously of the opinion that the compromise or arrangement should be approved and agreed to/or the result of the voting upon the said question was as follows: The undermentioned [class of creditors/members] who attended the meeting voted in favour of the proposed compromise or arrangement being adopted and carried into effect:____________________________________________________________ Name of creditor Address Value of debts(or No.of (or Member) value of pref shares votes Page 25 of 28 or equity shares held ____________________________________________________________ 1. 2. 3. ____________________________________________________________ Similar table for people who voted against the proposed compromise or arrangement. Dated this_____day of 2006. Chairman. ANNEXURE-N Petition to Sanction Compromise or Arrangement. Form 40. Company Petition No.______ of 19__ _________ltd (in liquidation by its liquidator____) Petitioner. Petition to sanction compromise or arrangement. The petition of___________, (in liquidation, by its liquidator) the petitioner abovenamed is as follows:i. The object of this petition is to obtain sanction of the Court to a compromise or arrangement whereby (set out the nature of compromise or arrangement). ii. The company was incorporated under the Companies Act 1956, with a nominal capital of Rs.________ divided into _________shares of Rs.___________ each of which_________ shares were issued and Rs.________ was paid up on each share issued. iii. The objects for which the company was formed are as set forth in the Company’s memorandum of Association. Set out the Principal Objects of the company. iv. Set out the nature of the business carried on by the company. Also state the advantages/benefits sought to be achieved by the compromise or merger. v. The compromise or arrangement was in the following terms:[Here, set out the terms of the compromise or arrangement]. vi. By an order made in the above matter on ____2006, the petitioner was directed to convene a meeting of (set out the class of creditors/members)of the company for the purpose of considering and if thought fit, approving with or without modifications, the said compromise or arrangement and the said order directed that Mr.________, failing him , Mr._____ should act as the Chairman of the said meeting and should report the result thereof to this Court. Page 26 of 28 vii. viii. ix. x. xi. xii. Notice of the meeting was sent individually to the (class of creditors/members) as required by the order together with a copy of the compromise or arrangement and of the statement required by section 393 and a form of proxy. The notice of the meeting was also advertised as directly by the said order in (set out the newspapers). On the ____2006, a meeting of (class of creditors/members) of the company duly convened in accordance with the said order, was held at _________ and the said chairman , acted as the Chairman of the meeting. The said chairman has reported the result of the meeting tot his Hon’ble High Court. The said meeting was attended by (class of creditors/members and the total value of their (debts, debentures, shares) is Rs.________. The said compromise or arrangement was read and explained by the said Chairman to the meeting and it was resolved unanimously [or by a majority of______votes against _________votes) as follows: Here set out the resolution as passed. The sanctioning of the compromise or arrangement will be for the benefit of the company. Notice of this petition need not be served on any person. The petitioner therefore prays: 1. that the said compromise or arrangement may be sanctioned by the court so as to be binding on all the (class of creditors/members)of the said company and on the said company. 2. Or such other order may be made in the premises so to the court shall deem fit. ANNEXURE-O Notice of Court’s Order. Form 21. Notice of the Court’s/CLB’s Order. Registration No. of the Company______ Nominal Capital______ THE COMPANIES Act, 1956 Notice of the Court’s/ Company Law Board’s Order [pursuant to section 394(1)] Name of the Company. Name of the Court/Company Law board with location. Date of passing the Order. Section of the Companies Act under which order passed. An authenticated copy of the order is attached. Page 27 of 28 Signature________ Name_____________ Designation_______ Dated this________day of 2006. Page 28 of 28