Berkshire Hathaway Annual Meeting

advertisement

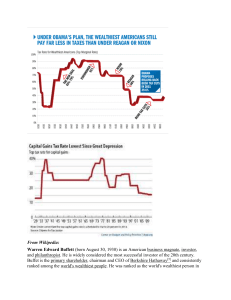

Berkshire Hathaway Annual Meeting May 1, 2010 (Notes taken by Professor David Kass, Department of Finance, Robert H. Smith School of Business, University of Maryland) A one hour humorous film was shown in which there were a series of commercials for Berkshire products and numerous comedy routines. The highlight of the movie begins by Warren Buffett receiving a phone call at corporate headquarters from the CEO of his Boston-based Jordan Furniture. The CEO has promised his customers that any furniture they have purchased this year will be free if the Boston Red Sox win the World Series. But, first they must beat the New York Yankees in the final game of the season. Does Buffett have any suggestions? Buffett responds that he is currently tied up (playing solitaire), and will get back to the CEO if he thinks of something. After several unrelated humorous scenes, the final game between the Red Sox and Yankees is being broadcast. The Red Sox have a 4-3 lead with two outs in the bottom of the ninth inning, but the Yankees have the bases loaded and Alex Rodriguez (A-Rod) coming to the plate. The Red Sox manager then calls to the bullpen for his secret weapon, Warren Buffett. The number on the back of Buffett’s Red Sox uniform is “1/16”. Buffett’s first three pitches bounce in front of home plate for a 3-0 count on A-Rod. The catcher (Berkshire Hathaway board member Ron Olson) goes to the mound after each pitch to offer encouragement to Buffett. Buffett then throws two strikes, for a 3-2 count. On the next pitch, A-Rod swings and misses for strike 3 and the Red Sox win. Buffett is the hero, and in a post-game interview refers to his 98 mph fastball, “which looked slower on TV” since his pitches “were being broadcast in slow motion”. Warren Buffett (age 79) and Charlie Munger (age 86) then walk on stage and sit down. Buffett says “Charlie can hear and I can see, that’s why we work together”. First quarter earnings for Berkshire Hathaway (BRK) are then projected on a screen. But, Buffett cautions that focusing on quarterly earnings is not good for investors, and it is very bad for managers. The format for asking questions was the same as that introduced at last year’s meeting. Half of the questions were selected by three business journalists: Andrew Ross Sorkin (The New York Times), Becky Quick (CNBC), and Carol Loomis (Fortune). Shareholders had e-mailed 1500-2000 questions to the journalists, who then selected 29 questions relating to Berkshire and its operations. The journalists, who were seated on stage, alternated with shareholders in the audience in the asking of the questions. 40,000 shareholders were in attendance for the annual meeting, setting a new record. (This is compared to previous records of 35,000 in 2009, 31,000 in 2008, 27,000 in 2007, and 24,000 in 2006.) Questions were asked in the following order: (1) Loomis: What is your reaction to the SEC lawsuit against Goldman Sachs (GS), its effect on your GS investment, and what advice do you have for GS based on your experience at Salomon? Buffett: There were four losers in the Abacus transaction. GS lost money because they could not sell a piece. The main loser was a large European bank, ABN Amro. They guaranteed the credit of another company, ACA. Berkshire guarantees credits in similar fashion. In Abacus, ABN guaranteed $900 million and was paid 17 basis points. They received $1.6 million for $900 million of insurance coverage. ACA went broke, so ABN Amro had to pay the $900 million. ACA started out as a municipal bond insurer. When profits were squeezed, they found new places to insure, including structured credits. Berkshire went into the municipal bond business when others got into trouble, we got paid more, and we stayed away from CDO’s or RMBS. We did insure something. It will help you understand Abacus. This deal (slide projected on screen of portfolio of US state municipal bonds) we did insure. A large investment bank (Lehman) came to us with 2 this list of states including $1.1 billion for Florida and $200 million for California for us to insure that they will pay for the next ten years. We looked at the list and we had to decide a) do we know enough, and b) what premium to charge. We insured $160 million for 10 years. On the other side, someone is insured that we will pay if the states don’t pay. We didn’t come up with this list. There are four possible reasons we were shown this trade: Lehman might own it and simply want insurance, Lehman might be negative on it and this is a method to short, they might have a customer wanting protection, or they might have a customer negative on it and wanting to short it. We don’t care why they wanted the insurance, it was our job to insure the bonds. If they told me that Ben Bernanke was on the other side of the trade, it wouldn’t matter. We did with the bonds what ACA did. With a list of 120, ACA only accepted 50, then negotiated for 30 more. In Abacus it was a mutual negotiation. Unfortunately, all of the bonds went south very quickly. It wasn’t clear this would happen in early 2007. In retrospect, the Abacus deal was a dumb insurance decision. Munger: This was a 3-2 decision by SEC commissioners where they usually decide unanimously. I would have voted with the minority. Buffett: With respect to our investment in GS, the lawsuit has probably helped our investment. We have invested $5 billion in 10% Preferred Stock. They can call them at 110% of par. If we got that $5.5 billion in we’d put it in short term securities, which might earn $20 million versus the $500 million we now receive. Recent developments have delayed the calling of our preferred. So we will continue to get $500 million per year instead of $20 million. We love the investment. The allegation alone causes the company to lose reputation. The press has hurt the company and morale. It isn’t mortal. GS had a situation with Penn Central railroad that hurt 40 years ago. There was a Boesky connection that was painful at the time. But an allegation of something doesn’t fall into the category of permanent damage. My advice is “get it right, get it fast, get it out, get it over”. An allegation has been made. Perhaps it turns into something more serious. But I do not see anything in Abacus that looks any different than our list of municipal bonds. The allegation does not meet my criteria of losing reputation. Munger: I agree with all of that. But every business should decline some business that is otherwise acceptable or legal. Standards shouldn’t be what is legal, but it should be different. Every investment bank took skuzzy customers. There were too many skuzzy customers and too many skuzzy deals. Buffett: Should we have done our deal? Munger: I think it was a closer case than you do. Buffett: We insure about $140 billion of municipal bonds. We aren’t bigger because we think the premiums aren’t the right price. We think much is wrong with Wall Street. But our experience with GS goes back 44 years. We’ve bought more businesses through them than anyone else. We trade with them as well. We don’t use them as investment advisors. We make our own decisions. When we trade, they could be selling or buying for their own account. They don’t owe us a rationale or reasoning, nor do we owe them. They are acting in a non-fiduciary capacity when they are trading with us. If working on a transaction or financing, that is different. We have had a lot of very satisfactory business with GS. The first bond issue we did was 1967, on slide 2, an offering of Diversified Retailing Corp., $5.5 million. We were having trouble raising the $5.5 million. I called Gus Levy (GS) and Al Gordon (Kidder, Peabody). They came through for us. (2) Audience: What’s good and bad about the proposed financial reform legislation? Munger: No one knows what Congress will do. The regulatory system should be changed to be less permissive. J.P. Morgan would hate to give up its large derivative trading desk. If it was up to me, I would make Paul Volcker look like a sissy. I would reduce the activities permitted if you used the government guarantee. The complexity in the system is ridiculous and counterproductive. We need a new version of Glass-Steagall that drastically limits what both commercial and investment banks are allowed to do. 3 (3) Quick: What is the impact of proposed derivative regulation on Berkshire, will collateral changes affect the $63 billion of derivatives at Berkshire and will it require keeping more than $20 billion of cash on hand? Buffett: If Berkshire was found to be dangerous to the system by the Secretary of the Treasury, then we would be required to post collateral on past contracts. The chances of us being chosen as a danger to the system are unlikely. We have 250 contracts, which is about 1% of what other institutions have. We had 23,000 positions at Gen Re, now we have fewer than 100. If we are required to post collateral on past contracts we will comply. But we would want to be compensated. We would be due substantial money. There was one price for collateralized, and another for uncollateralized. If I rent an unfurnished house for $100,000, I may rent it furnished for $120,000. We elected to forgo about $1 billion in past contracts because we did not have collateralization. Under the proposed legislation, we would not have to put up one dime. If necessary, we could place our Coca-Cola stock as collateral. But we will still own it and receive fat dividends. (4) Audience: How are you preparing Berkshire for currency failures (Greece)? What are your thoughts about the Euro? Buffett: We have a lot of net worth in Euro assets, but also substantial liabilities in Euro as well. We have no dramatic exposures in any currency. Munger: We are generally agnostic with respect to the relative values of currencies. Buffett: Greece is sovereign but cannot print its own currency. They have the Euro. The events of the last few years make me more bearish on all currencies holding value over time. As long as the US borrows in dollars, there is no possibility of default. If the world will not take US dollar debt, then we will have a problem. You do not default when you print your own currency. Munger: Sovereign debts will not be a problem if countries can grow GDP at 3% per annum per person. But if growth stops, there will be enormous social strains with serious consequences. (5) Sorkin: If Lloyd Blankfein had to leave Goldman Sachs (GS), who would you like to run GS? Were you aware of the Wells notice received by GS, was it material, and would you have disclosed it? Have you been contacted regarding the Galleon investigation? Buffett: We were not contacted by the SEC about Galleon. If you regard a Wells notice as material, you report it. If I had received something about Abacus, it would have been immaterial. Munger: I would not have regarded it as material. If every company reported everything of low probability (of being material), reports would run to hundreds of pages. You do not want to give blackmail potential to people. Buffett: I do not know what percentage of Wells notices are material. Who do I want running GS? If Lloyd had a twin brother, I would go with him. I’ve never given it a thought on who else should run GS. There is plenty of stuff we don not like on Wall Street, but it is not specific to GS. Munger: There are plenty of CEO’s I’d like to see dismissed in the US. Lloyd Blankfein is not one of them. 4 (6) Audience: Question relating to automobile insurance and new technology with respect to automobile safety. Buffett: Lots of things have been done to make cars safer. Everybody has an interest in bringing down fatalities. GEICO has an active safety program. The insurance industry is working to make cars safer. (7) Loomis: Won’t foundation selling of Berkshire stock create downward pressure on it price? Buffett: I give away 1.5% of the outstanding shares of Berkshire annually. If they sell 1.5% annually, then you have 1.5% of shares sold annually. Contrast that with 100% of Berkshire shares outstanding that are trade on average each year. If 1.5% of shares moves Berkshire’s price down, it deserves to move down. Munger: This was perhaps constructive in getting Berkshire into the S&P 500. Buffett: Now 7% of shares are held in index funds. It has led to some extraordinary buying. If none of the stock had been given away, I do not know if the stock would be higher or lower. (8) Audience: What is the biggest challenge facing the U.S. economy? What are the implications of that for investing globally over the next decade? Munger: Berkshire’s attitude is to concentrate on what we know. We prefer to do more in responsible countries. Buffett: We love that Burlington Northern is in the U.S. I would be perfectly content to limit investments to the US alone. But I would rather have the whole world. Opportunities will be ample. I would not run from the U.S. (9) Quick: How did the four CIO candidates perform last year? Did they use leverage? Buffett: They did not distinguish themselves in 2008. In 2009 they did well. It is not the same four people as last year. None use leverage. Munger: One achieved a return of 200% without using leverage. Buffett: The list of four will move around but the portfolio manager positions are far less urgent than who is the next CEO. If I die tonight, there will be a new CEO within 24 hours. The directors can wait one or two months to decide on a new CIO. The board and the new CEO can decide on the CIO. Munger: I am quite optimistic that the culture of Berkshire will last a long, long time and outlast the life of the founder. (10) Audience: Question about earning high rates of return from the purchase of capital intensive businesses. Buffett: We are putting big money in big businesses with good economics. We think the capital intensive businesses we have bought are good and working well. We are better off paying out cash (as dividends) only if we cannot translate it into more than $1 of present value. In our judgment we did well (investing in a capital intensive business) with BNSF, but the scorecard will only come in 10 to 20 years. In MidAmerican Energy we have purchased a capital intensive business. But it will not be a Coca-Cola, which does not need much capital. 5 (11) Sorkin: Why did you invest in Harley Davidson debt at 15% during the financial crisis, rather than its equity at $14, which now is at $33? Buffett: I’m not sure you would have asked that when we did the deal. I do not know if Harley Davidson (HD) stock is worth $20 or $30. But I like a business where customers tattoo HD’s name on their chest. I thought I knew they would not go out of business. I knew enough to lend them money, but not enough to buy their shares. The HD paper could now be sold for 135. I love the GS 10% preferred and warrants. But if Goldman had offered us 12% non-callable preferred with no warrants, I might have taken that. Junior securities do better, but senior securities help you sleep better. We could do things when others are paralyzed. (12) Audience: How do you change the culture of an organization? Buffett: It is easier to build a new culture than to change one. At Salomon, I changed a culture, but I would not grade myself an A+. Munger: My failure rate (at his old law firm) is 100%. I could move out, but could not change the culture. (13) Loomis: Will National Indemnity be able to grow after Ajit Jain? Ajit has maximized the advantages at National Indemnity. He has 30 people. It would be a huge loss for Berkshire if anything happened to Ajit. Berkshire has, in my view, become the premier insurance organization in the world. I do not know how we can increase it significantly unless through some large acquisition – but there is nothing on the horizon. (14) Audience: Why aren’t you investing in India? Buffett: In insurance there are distinct restrictions on what we can do in India. I have agreed to visit India next March because of our Iscar business there. We do not rule out India. Posco has big plans for India. Munger: The India government is causing paralysis through endless due process. Planning, approvals, and zoning are hard. The wise founder of modern Singapore said that China will grow faster than India because their government causes less paralysis. Buffett: My preference is insurance which I understand. Both China and India limit how much we can own. Why put my managerial talent to work on something where we only own 20% vs. 100%? People in India will be living much better in 20 years. (15) Quick: What is the outlook for inflation? Buffett: There has been a lot of inflation. I was born in 1930 and the dollar is down 90% since then, but we have done okay. I think prospects for inflation around the world have increased. Situations that governments have been forced into or allowed to embrace may cause it. I do not see any way countries running high debt to GDP over time do not have diminution of currency over time. I would bet on higher inflation, and maybe a lot higher. Munger: I agree. 6 (16) Audience: What can be done to educate children with respect to financial management and to prevent future financial mayhem? Buffett: We will see financial mayhem from time to time. People do crazy things. Some of the problems were caused by the prevailing conventional wisdom taught in business schools. Getting good financial habits early in life is important. If we get 2-3% of kids with better habits, it will be good for the world. Munger: I admire McDonald’s, which I think has succeeded better as educators than a university where I recently spoke. McDonald’s has had a constructive effect on its employees. They teach marginal people responsibility. Come to work on time, move up the ladder, get a paycheck, and many go on to higher paying jobs. Buffett: Lucky if parents teach you, but anything that brings it into a broader teaching environment I’m for. (17) Sorkin: Buffett has said that his assistant is paying a higher tax rate than he does. The implication is that taxes should be higher on higher income people. But the bulk of your estate will never be subject to taxation. How should the tax system be changed? Buffett: A wealth tax is like a property tax. If you want to give all of your money away, it is a terrific tax dodge. If government continues to spend 25% of GDP, we cannot keep taxation at 15% of GDP. You couldn’t have two better guys than Erskine Bowles and Alan Simpson (Deficit Reduction Commission). But after the end recommendation for higher taxes and lower expenditures, they will be less popular than they are today. I do not think you can raise total taxes by taxing lower income people higher. I will never sell a share of Berkshire. I have everything in life that I need and I will always have enough. We can always give away the rest. You could argue that it would be better if I gave all that money to the federal government instead of charity, but not many people in this room would agree. (18) Audience: What are the key metrics you look for on inflation? Buffett: If inflation gets going it creates its own dynamics and is very hard to stop. We saw it in the 1970’s until Volcker came in with a sledge hammer. The prime rate was at 21% and U.S government bonds at 15%. If we continue today’s policies, something like that could be possible. We have the power to control our future. We do it through elected representatives. Munger: If you are the best painter or the best brain surgeon, you will always command your share of the economy around you. Talent is a terrific asset to deal with inflation. (19) Loomis: With respect to NetJets, what errors were committed, what was learned, and how can this be prevented in the future? Buffett: We make mistakes, and our managers do to. The biggest mistake was buying planes at prices that were too high relative to what they could later be sold for. We didn’t prepare for what was happening (severe recession). A good part of the writedowns were planes that were too high (cost). Operating costs got out of line with recurring revenues. I stayed in textiles for 20 years. Then I woke up. Charlie was telling me it was lousy in year one. It was a big mistake. NetJets last year posted a $711 million loss. It is now operating with a decent profit, with well over $50 million pretax profit in Q1. The new business plan has not affected an iota of safety or service, but got things in line. Dave Sokol turned that place around like no one could. Munger: I believe that episode should be reviewed in context. If we buy 30 big businesses and let the managers run them without interference, we have been right 95% of the time. It is not a big failure record, 7 and it does not suggest we should be less easy with the remarkable performance of managers who have joined us. Buffett: This doesn’t change our management strategy. We let managers do their stuff. And we will keep doing it. (20) Audience: Since BYD is a technology company, why did we invest in it? How did you increase your circle of competence to include BYD? Buffett: Charlie gets the credit. Munger: Berkshire would not have made the investment in BYD if it had come along 5-10 years earlier. The old men are continuing to learn. Berkshire would have lower potential if we stayed the way we were. I wasn’t sure I could get Warren to do this. Dave Sokol was asked to go to China, and the both of us helped the Chairman with the “learning process”. (21) Quick: How do you determine management compensation plans at Berkshire? Buffett: I try to figure out if I owned the entire business, what I would pay them. This is not rocket science. The 70 businesses we have each have different economics. We do not set a Berkshire standard compensation plan. BNSF needs lots of capital, others can be run by a chimpanzee, while still others with Alfred P. Sloan as CEO could not run them well. I try to figure out the best strategy – and we find managers that stay with us. I spend time on it, and it takes ability to differentiate. A human relations department would be a disaster, and they would be telling them all sorts of different metrics. It requires common sense and interaction with managers. We agree on a measure of what they are adding to the company. Munger: We have different systems from GE and the Army, and it works for us. Practically nobody is like us. It works, and make us peculiar. Buffett: We have mangers who earn tens of millions of dollars annually. Everyone wants to be treated fairly. It is ridiculous to put a cost of capital on each business. The real thing is to pay managers for widening the moat that differentiates our business from competitors. I cannot think of a manager who has left us over compensation. Munger: It is amazing how simple it has been, how little time it has taken, and how well it has worked. Headquarters is typically hated in the field. We do not want an imperial headquarters with charges imposed everywhere. We charge for credit, but that is it. Most headquarters charge for costs. (22) Audience: How do you deal with ethics violations in your subsidiaries? Do you get involved? Buffett: We have a complaint hotline and I get letters. Alleged bad behavior will get investigated. Important transgressions have come to our attention. We encourage that. Munger: We care more about that than business mistakes. Buffett: A letter goes out every 2 years, it is 1 ½ pages. It asks managers who I should consider to put in charge if they were no longer available and the reasons why I should choose that person. I also remind them that if the only reason you are doing something is because the other guy is doing it, then don’t. We can cure any problem if we hear about it soon enough. With 260,000 people, I hope we hear about them fast. We care very much to protect the reputation of Berkshire. We have all the money in the world, but we do not have enough reputation. 8 Munger: Averaged out, our reputation is good. That is precious to us. The ideal is not to make as much money as can be legally made. We celebrate wealth only when it is fairly won and wisely used. (23) Sorkin: Question about Rate of Return Regulation. Buffett: Burlington Northern is regulated by the Surface Transportation Board which allows a 10 ½% return on invested capital including debt. Electric utilities are regulated by the states and often get 12% return on equity which is virtually a guaranteed return. Railroads have more downside risk. You want railroads to invest more than depreciation. 10.5% is inducement enough. Munger: Railroads in the U.S. have been totally rebuilt in the last 30-40 years. Tracks and bridges have been improved, and the average train is twice as long and twice as heavy. A system of wise regulation and wise management has allowed this. That was not always the case. (24) Audience: Question about insurance and risk. Buffett: The major insurance risks we face are from earthquakes and hurricanes. We also own 20% of Swiss Re. We paid out $3 billion relating to Hurricane Katrina, and $2 billion as a result of 9/11. Our current risk is down from a few years ago because we have taken on less business as a result of rates that have been unattractive. If rates improve, we would take on additional risks with a worst case liability of $5 billion. Munger: Our competitive advantage is the capacity to endure fluctuating annual results. Buffett: We have a permanent and substantial advantage by taking business from others who want to smooth earnings, while we are willing to take the lumps. (25) Loomis: What useful function do derivatives serve? Why not make derivatives illegal? Munger: Derivatives can be useful in hedging risks in farming. Is there a net benefit from derivatives? My own view is if we banned most derivatives, the world will be a better place. Buffett: Burlington Northern has hedged diesel contracts. In 1982 Wall Street allowed the speculation in S&P 500 futures. 95% of these contracts are gambling. The S&P 500 contract is taxed as 60% long term capital gain, and 40% short term, even if you hold it for 60 seconds. LUNCH BREAK (26) Audience (Whitney Tilson): How do we encourage short sellers to speak out? Buffett: There is nothing wrong with people speaking out as long as they are held responsible for the statements they make. Munger: To some extent you are criticizing the wrong people. The accountants who allowed the bad accounting should be held responsible. The accountants let this happen, and they get very little criticism. That is a mistake. 9 (27) Quick: At my local Dairy Queen (DQ), why do they sell Pepsi and not accept American Express? Buffett: 99% of the 6000 DQ outlets are franchised. At DQ we do not tell the franchisees what to do. Most franchisees serve Coke, the enlightened ones. The whole idea of Berkshire is that mangers are responsible for their businesses and we do not tell them what to do. (28) Audience: If one day I apply to be a manager to Berkshire company, what should I work on now? What should I do to become your successor? Buffett: Managers of our subsidiaries hire their own people. I make no decisions about who gets hired. There is the occasional resignation. We have had 10 -12 of those over 25 years. We have 21 people total at headquarters. Special people stand out. To advance generally in an organization, you want to think and work like the owner. (29) Sorkin: With respect to retained earnings, you use a 5 year rolling average and pledge to distribute earnings that cannot be effectively used. As of year end, average annual earnings in the last 5 years is $5900 per share vs. a $2500 gain in value. Are you considering a distribution? I think I know the answer, but wanted to ask. Buffett: Every dollar left in the business right now has $1.30 of market value. (30) Audience: Can you help create jobs? Buffett: We will hire people when we have something for them to do. Society owes some minimal living standard to people looking for work. But I do not think Berkshire should be the social safety net. (31) Loomis: Why is the car insurance business not expanding globally? Why not in China and India? Buffett: In China and India we can only own a 24.9% stake. So we would rather have our managers work hard on 100% than 24.9%. We have gone from a 2.5% to 8% market share in the U.S. with GEICO. We do not think we can build those advantages in other markets in any reasonable time. There are still lots of opportunities in the U.S. (32) Audience: What is the most important thing you have learned from China? Munger: China has some very unusual people in BYD. Buffett: Sprite outsells Coke 2:1 in China. It has an amazing economy. Growth will last a long time. They have major resources in land and minerals. The potential for China is huge. Charlie and I are going over there at the end of September. (33) Quick: In Berkshire’s annual reports, look-through earnings and unaudited financials are no longer included. Why has it changed? Buffett: Too much information obfuscates. I am writing it (annual report) to my two sisters. They are very intelligent and interested people, but not familiar with the lingo. I want them to understand how I am thinking about the business. Munger: Details can change as facts change. Undistributed earnings of shares we own but do not control are much less important than they used to be. They are not more than 15% of reported earnings. They used 10 to be a much higher percentage. People understand that Coca-Cola and American Express are not included in earnings. (34) Audience: What about Roth IRA conversions? Munger: I have an IRA which I am going to convert to a Roth IRA. (35) Sorkin: What is the outlook for the newspaper industry? Buffett: When money at newspapers came from advertising (it was on average about 75%), they used to be the only game in town. Circulation is down a lot at newspapers. Nothing looked more bullet proof than daily newspapers 40 years ago, and that has melted away. It is not the essential place to get information. You looked for stocks, weather, and sports. Advertisers were there because it was the best and only microphone. The problems are self-reinforcing. .Subscribers leave and advertisers leave too. Munger: Independent newspapers became dominant in their towns. The world was better because they were strong, because they kept the government in check – they were called the fourth estate. We are losing something that we have no substitute for. Buffett: Our newspaper (Buffalo News) hit 300,000 circulation at its peak on a Sunday, and it is now down to 100,000. Philadelphia was down 40,000 in a single year. The advertisers do no need you. Your ability to price evaporates. Munger: Politicians are not behaving better as newspapers are weakening. We are going to miss the newspapers’ power. (36) Audience: Should I run a business instead of being a value fund manager? Buffett: Asset gathering can be more important than asset managing. There will always be opportunities to outperform. People still make the same mistakes. Charlie has a company called the Daily Journal Company. I own 100 shares. I got their annual report. In 2009 they bought $15 million of stock, and it is now worth $45 million. They sat on cash for a long time, but opportunities come around. You have to be prepared to grab them. Money management – it is easy to scale up. It would have been harder for me to work as a plant manager. (37) Loomis: Should investors be concerned about municipal bond defaults? Buffett: Harrisburg. PA recently defaulted on a bond. Assured Guaranty is now paying the interest. I think it is hard for the federal government to turn away a state having fiscal difficulties. Not sure how to tell the governor of State X that you are going to turn him down after you have supported GM. I thought I was being paid fairly 1.5 years ago (municipal bond insurance premiums), but not now. So we will let someone else do it (insure municipal bonds). (38) Audience: In 2008 you recommended buying U.S. stocks. What is your opinion on the stock market going forward? What is a reasonable rate of return? Buffett: I write articles on the general level of the stock market rarely, only 4 or 5 times in 40 years. It turned out I was premature in October 2008. But I felt it would be better than owning bonds or holding cash. I thought I would eventually be alright. I have no idea what the stock market will do this week or next year. I do think I would rather own equities than cash or a 20 year bond over the long term. This is 11 partly because I am unenthusiastic on alternatives. I think these will be a modest positive real return over time. Munger: Equities are the best of a bad lot of available opportunities. I think you are right, and people should get used to ordinary real returns –not exciting and less than in the past. Buffett: We do like owning businesses. They do beat holding cash or 5, 10, or 20 year bonds. (39) Quick: With respect to the ratings agencies, you have sold some of your stake in Moody’s. Has the investment case changed? Buffett: The ratings agencies have a wonderful business. Good pricing power, no capital required. People will need ratings agencies. They succumbed to the same mania that infected everyone. It is hard to think contrary to the crowd. They could not see a world where residential housing country wide could collapse. Incentives may have been bad, but also it is just difficult to think contrary to the crowd. You can’t shop pricing. We, however, have never paid attention to ratings. If we can’t do it ourselves, we don’t do it. If the business model does not change (a backlash could lead to legal remedies), it is a good business. Munger: Ratings agencies in their present form and present incentives have been a wonderful influence for many decades. Cognition faltered and drifted with the stupidity of the times. Part of it was asininity of American business education and their over belief in models. I have not heard a single apology for their huge contribution to our present difficulties. (40) Audience: What are the consequences of oil running out? Buffett: Do not give up on humans’ ability to innovate to face of problems that seem insoluble. We haven’t really started. If you could pick a point in time to be born, I would pick today. Munger: We can get ahead without the oil if we have to. We are an advanced civilization. (41)Sorkin: How would you rate Kraft’s top management? Any comments on the CEO’s compensation of $23 million? Buffett: I didn’t like the Cadbury or pizza deals. We get mad when other people do dumb things with our money. They sold the pizza business for $3.75 billion, but received only $2.5 billion after tax. Pizza was earning $280 million pretax in the prior year. In 2009 it earned $340 million pretax for sales that were growing faster than Cadbury’s. Kraft had already shown that they knew how to do tax efficient deals like Post Cereal. The present price of Kraft is still well below the price of its constituent pieces like Kool-Aid, Jello, and Oscar Meyer brands if they were sold separately. In terms of compensation, we have a system that is rational. Many companies have different systems. Munger: People at the top of a business think they are smarter about strategy. They often tire of fierce competitors in the business they are in and dream of something else where competition is imagined to be less. So, they want to do a deal. Buffett: And they will have lawyers, consultants, investment banks and others who get paid for deals, telling them to do a deal. 12 (42) Audience: Question about the Financial crisis and integrity. Munger: The crisis was started by lack of integrity. Fortunately, some of those responsible are now gone. Integrity is important. But everyone mouths integrity even when it is lacking. Professing it is not the same as doing it. Buffett: Everyone else doing it is the problem. In 1993 stock options were going to be expensed. The Accounting Standards Board backed off. And the Senate voted 88-9 in support. The Accounting Standards Board suggested doing it in one of 2 ways, with the first way preferred (expensing options through the income statement). 498 companies chose #2. Only 2 companies chose the preferred way. I spoke to many CEO’s and they said “I can’t do it because the other guy isn’t doing it. I would be penalizing my shareholders if I report less than I can earn.” A recent study showed how rare it is to find a 4 in the third digit of EPS. Many find that 1/10 of a cent to round it up. We try to find ways to avoid inducing that behavior. Munger: The best cure is for people who make decisions to bear the consequences. (43) Loomis: Any advice for a person who was too scared to take advantage of buying opportunities during the financial crisis? Buffett: If you are scared when others are scared, you will not make money in securities. When you own a farm or an apartment, you do not look at quotes. We love it when stocks go down. Then we buy more. What counts is buying a good business at a decent price and forgetting about it for a long, long time. (44) Audience: Question about solar energy panels on the roof of a home. Munger: Solar solutions are coming because they are so obviously needed. I never pass on an opportunity to not put them in, because they will get cheaper. (45) Quick: Question about Berkshire’s portfolio. Buffett: The degree of undervaluation in our portfolio is not great. I regard our portfolio as reasonably valued. We have a lot of businesses and we did not waste a lot of money at the top of the market. (46) Audience: Can you explain your optimism? Munger: There will be solutions to our energy problems in the near future. I am optimistic about the culture that pervades Berkshire. I get pleasure seeing people rise through hard work, rising rapidly in China and India. There are problems, but it is much easier to be happy when expectations are lower. I am optimistic, and if I can be optimistic when I am nearly dead, surely the rest of you can handle a little inflation. (47) Sorkin: Is your increased media exposure the best use of your time? Is it good for shareholders? Buffett: Probably not. But there are a lot of things I do that aren’t. I play 12 hours of bridge a week, and that isn’t good for shareholders either. If you want a record of things, I would much rather have a record on Charlie Rose where people can go back to it. I like the idea of being judged by my own words, rather than someone trying to write a few words summarizing me. I prefer TV. I like the accuracy of the reporting. Because TV isn’t perfect, you have to be careful on a broadcast. Charlie Rose did an interview and taped me on a Friday morning. During the taping they were showing great railroad scenes, including a montage 13 of railroad movies with Marilyn Monroe in Some Like It Hot and with Grace Kelly. Then he asked me some question and I said I would have paid more for Burlington Northern if they included Marilyn Monroe and Grace Kelly. But the recording ran 106 minutes (for a one hour show) and they took out the montage of Marilyn Monroe and Grace Kelly, but left in my response. It looked like I came up with this out of the blue! (48) Audience: How does Berkshire retain loyal shareholders? Buffett: If you want shareholders to be in synch with you, you have to let them know exactly what kind of institution you plan to run. We want people who think like we do. We try to advertise what we are and we try to deliver. We think we have the best shareholders who want to buy the business and partner with us and we’ll treat them like partners. In turn they give us comfort. Munger: Warren and I started managing money for family and friends. Then we morphed into a public company. That is how we treat them still (as family and friends). Buffett: We also do not have an investor relations department. (49) Loomis: Question about low interest rates. Buffett: This has been a very difficult environment for savers receiving low interest rates. I’m very sympathetic for people living on a fixed income. Munger: In some sense the reality of our situation is depressing. Stocks are up because fixed income returns are so lousy. Buffett: We’ll see what happens when interest rates go up. (50) Audience: Question about valuing a business and margin of safety. Buffett: Ben Graham taught me how to value certain types of businesses, but the selection of companies dried up. Charlie taught me about durable competitive advantage. Knowing how big your circle of competence is, is less important than knowing where the edges are. Which companies are hard to compete with? Remember margin of safety. 6-7 years ago I looked at Korean stocks and I could see a number of businesses that met my margin of safety. I bought several and diversified. Munger: You have to keep learning because the world keeps changing and competitors keep learning. You have to go to bed wiser than when you got up. I never took a business class, except for accounting. (51) Quick: Which of your businesses have the best returns on capital? How important is the capital in a business? Buffett: You could run Coca-Cola with no capital. There are a number of businesses that operate on negative capital. Great magazines operate with negative capital. Subscriptions are paid up front, they have limited fixed investments. There are certain businesses like this. Blue Chip Stamps – it got float ahead of time. There are a lot of great businesses. Apple does not need much capital. See’s needs little capital but it can’t get large - we can’t get people eating 10 pounds of boxed chocolate every day. Great consumer businesses need relatively little capital. Where people pay you in advance (magazines, insurance), you are using your customers’ capital. But the rest of the world knows this, so these businesses get expensive. It can be competitive to buy them. Business Wire – it doesn’t require capital. Many service companies require little capital. When successful, they can be something. Charlie, if you could own one business in the world, what would it be? 14 Munger: You and I got into trouble many decades ago for this, naming the most fabulous business. High pricing power, a monopoly – we don’t want to name it publicly! (52) Audience (Glenn Tongue): What is your outlook on additional company acquisitions by Berkshire? Is your phone ringing? Buffett: The hurdle now is $75 million or $100 million pretax., so we do not receive many calls. If we get three or four a year, that is good. We are as interested as ever. We wrote a big check and gave shares for Burlington Northern. I would love it if Monday morning a deal came in. Munger: We get offered things from people who would not sell to anyone else. Buffett: When I heard from ISCAR, I had not heard from them before. They wanted to sell to Berkshire or nobody. Another business we own, the competitor wanted to buy them, to dismantle something the owner spent 30 years building. It was probably worth more to the competitor. The other option was a leveraged buyout firm. They call them private equity now. But he didn’t want his place as a piece of meat to be resold. They want a permanent home. We are ready to act when it happens. If it is a $10 billion deal, I’ll do it. (53) Sorkin: What shareholder questions have not been asked but should be? Munger: I think it is quite interesting that we got into BYD. It is surfing along on the developing edge of new technology. We have bragged about avoiding that, yet here we are. We have shown capability of learning. I think BYD will work out very well. I think it will give pleasure to shareholders, and I think they will solve significant problems of the world. BYD tries harder and is more self-disciplined. It is a pleasure to associate with those types of people , and we have found our own kind, except they are better. The Burlington Northern deal was better for their shareholders than ours, but we also thought it was good for our shareholders. Buffett: Can you keep using all the capital you are generating for a long time? There comes a point where it gets hard. In 10-12 years, capital accumulated and generation of capital will make it hard to generate more than $1 for a dollar. There will come a time when we cannot intelligently use 100% of the capital we generate internally. Then we will do whatever is best for shareholders. Munger: I think we will get into Berkshire on the investment side people who have some promise of being decent approximations of Warren, with some abilities Warren lacks. We will get people in on the investment side sooner than many think. (54) Audience: Question about how to build a business. Buffett: There is nothing like following your passion. The common factor (of Buffett’s managers) is they love what they do. You have to find that in life. It was dumb luck my Dad was in the securities business. I got entranced with that. If you find something that turns you on, you will do well in it. There isn’t that much competition. There will not be many who run faster than you in the race you elect to run. If you haven’t found it yet, keep looking. We have 70 managers and some didn’t go to high school. Mrs. B didn’t do a day of school in her life. Nebraska Furniture Mart today has 78 acres, $400 million of sales, and is the largest furniture store in the U.S., with $500 million of capital paid in. In her 90’s she invited over to her house for dinner, which was very unusual. The couches and tables in her house – they all had price tags – it made her feel at home! 15 (55) Loomis: What is your philosophy? Munger: Pragmatism. It’s just that simple. We have had enough good sense when something is working well, keep doing it. The fundamental algorithm of life: repeat what works. (56) Audience: Thank you for all of your effort in planning this meeting. Does our country need high speed passenger rail? Buffett: It is non-economic when competing with auto and air. If it becomes a huge project of government then maybe it will work. But it will not happen with money that wants a return. (57) Quick: What would be the impact on Berkshire of a Chilean size earthquake in Los Angeles or San Francisco? Buffett: The fire following the 1906 San Francisco earthquake caused much of the damage. I think of $250 billion as a worst case of damage from am earthquake. We would have 3-4% of all earthquake insurance on $250 billion, or $10 billion of exposure. Our pretax earnings are more than that. Everyone else will be gasping, but we will be okay. (58) Audience: What would be Berkshire’s exposure in a global financial meltdown? Buffett: Government could and would step in. If we talk about a massive nuclear attack, who knows. But if we have something huge (financially), it will not be because of our insurance business. Berkshire can withstand it. Things will work out in the U.S. unless the system is destroyed. Land does not go away. People do not become less innovative. The productive resources are still here. Munger: I’m not worried about it. Buffett: Huge amounts of debt will not do us in. MEETING ADJOURNED Professor David Kass Department of Finance Robert H. Smith School of Business 4412 Van Munching Hall University of Maryland College Park, Maryland 20742-1815 dkass@rhsmith.umd.edu