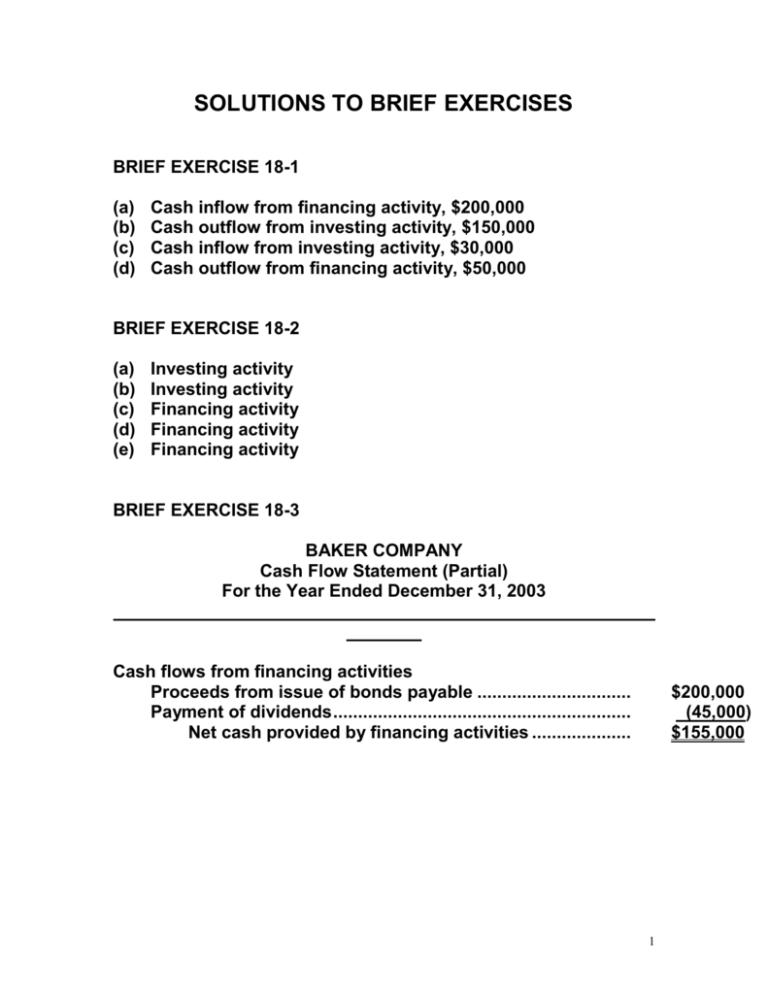

SOLUTIONS TO BRIEF EXERCISES

advertisement

SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 18-1 (a) (b) (c) (d) Cash inflow from financing activity, $200,000 Cash outflow from investing activity, $150,000 Cash inflow from investing activity, $30,000 Cash outflow from financing activity, $50,000 BRIEF EXERCISE 18-2 (a) (b) (c) (d) (e) Investing activity Investing activity Financing activity Financing activity Financing activity BRIEF EXERCISE 18-3 BAKER COMPANY Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Cash flows from financing activities Proceeds from issue of bonds payable ............................... Payment of dividends ............................................................ Net cash provided by financing activities .................... $200,000 (45,000) $155,000 1 BRIEF EXERCISE 18-4 DRESSMART.COM, INC. Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Net income ........................................................................ Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ............................. $280,000 Accounts receivable decrease ............... 350,000 Accounts payable decrease ................... (310,000) Net cash provided by operating activities ......... $2,500,000 320,000 $2,820,000 BRIEF EXERCISE 18-5 STERLING ENGINEERING CO. Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income ........................................................................ Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ............................. $60,000 Loss on sale of capital assets ................ 9,000 Net cash provided by operating activities ......... $250,000 0 69,000 $319,000 2 BRIEF EXERCISE 18-6 HARDEN COMPANY Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Net income ...................................................................................... Adjustments to reconcile net income to net cash provided by operating activities: Decrease in accounts receivable........................ $75,000 Increase in prepaid expenses ............................. (12,000) Increase in inventories ........................................ (30,000) Net cash provided by operating activities ...................... $220,000 33,000 $253,000 BRIEF EXERCISE 18-7 Original cost of equipment sold ................................................... Less: Accumulated amortization ................................................ Book value of equipment sold ..................................................... Less: Loss on sale of equipment ................................................ Cash received from sale of equipment ........................................ $22,000 ( (5,500) 16,500 ( (4,900) $11,600 BRIEF EXERCISE 18-8 Receipts from Sales = customers revenues + Decrease in accounts receivable - Increase in accounts receivable $460,000 = $470,000 – $10,000 Increase in accounts receivable BRIEF EXERCISE 18-9 Cash payment for income tax = Income tax + Decrease in income tax payable 3 expense – Increase in income tax payable $95,000 = $90,000 + $5,000 Decrease in income tax payable BRIEF EXERCISE 18-10 + Increase in prepaid expenses – Decrease in prepaid expenses Cash Operating And payments for expenses, = + Decrease in accrued expenses operating excluding expenses amortization payable – Increase in accrued expenses payable $91,000 = $100,000 – $6,600 Decrease in prepaid expenses – $2,400 Increase in accrued expenses payable 4 BRIEF EXERCISE 18-11 ($ in millions) (a) Cash current debt coverage $558.2 0.96 times $581.6 (b) Cash return on sales $558.2 72% $771.6 (c) Cash flow per share $558.2 $666.2 $52.5 ($1.97) 28.2 (d) Cash total debt coverage $558.2 0.63 times $884.6 *BRIEF EXERCISE 18-12 (a) (b) (c) (d) (e) (f) (g) (h) (i) 8,000 (given) 9,000 14,000 (given) 3,000 35,000 (given) 31,000 (given) 20,000 120,000 40,000 5 SOLUTIONS TO EXERCISES EXERCISE 18-1 1. 2. 3. 4. Noncash investing and financing activities, (d) Financing activities, (c) Operating activities, (a) Financing activities, (c) 5. 6. 7. Investing activities, (b) Financing activities, (c) Operating activities, (a) EXERCISE 18-2 (a) (b) (c) (d) Investing activity Financing activity Investing activity Noncash investing activities (e) Financing activity (f) Operating activity (g) Financing activity (h) Operating activity (i) Noncash investing and financing activity (j) Operating activity (k) Operating activity (loss); Investing activity (cash proceeds from sale) (l) Operating activity EXERCISE 18-3 PESCI COMPANY Cash Flow Statement (Partial) For the Year Ended July 31, 2003 Net income ......................................................................................... $195,000 Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ............................................... $45,000 Increase in accounts receivable ............................... (15,000) Increase in accounts payable ................................... 8,000 Decrease in prepaid expenses.................................. 4,000 Loss on sale of equipment ........................................ 5,000 0 47,000 6 Net cash provided by operating activities ......................... 7 $242,000 EXERCISE 18-4 INVEST.COM INC. Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income ............................................................................. Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ................................... $30,000 Increase in accounts receivable .................. (21,000) Decrease in inventory ................................... 15,000 $163,000 Decrease in prepaid expenses 5,000 Increase in accrued expenses payable ....... 10,000 Decrease in accounts payable ..................... (7,000) Net cash provided by operating activities .............. 0 32,000 $195,000 8 EXERCISE 18-5 DUPRÉ CORP. Cash Flow Statement (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income ............................................................ Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ................................... $24,000 Loss on sale of equipment ........................... 0 4,000 Net cash provided by operating activities Cash flows from investing activities Sale of equipment ................................................. Purchase of equipment ........................................ Construction of equipment .................................. Net cash used by investing activities ..... $ 57,000 028,000 85,000 $11,000* (70,000) (53,000) (112,000) Cash flows from financing activities Payment of cash dividends .................................. (14,000) *Cost of equipment sold....................................... Accumulated amortization ................................. Net book value..................................................... Loss on sale of equipment ................................. Cash proceeds .................................................... $45,000 030,000 15,000 004,000 $11,000 Cash....................................................................... Accumulated Amortization .................................. Loss on Sale of Equipment .................................. Equipment ..................................................... 11,000 30,000 4,000 45,000 9 EXERCISE 18-10 (a) VÉFOUR COMPANY Cash Flow Statement For the Year Ended December 31, 2003 Cash flows from operating activities Net income ............................................................ Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense ................................... Increase in accounts receivable .................. Decrease in inventory ................................... Decrease in accounts payable ..................... Gain on sale of land ...................................... Net cash provided by operating activities $125,000 $24,000 (9,000) 9,000 (13,000) (5,000) Cash flows from investing activities Sale of land ........................................................... Purchase of equipment ........................................ Net cash used by investing activities ..... $30,000 (60,000) Cash flows from financing activities Payment of cash dividends .................................. Redemption of bonds ........................................... Issue of common shares ...................................... Net cash used by financing activities .... $(60,000) (50,000) 050,000 (30,000) (60,000) Net increase in cash..................................................... Cash, January 1 ............................................................ Cash, December 31 ...................................................... 41,000 0 22,000 $ 63,000 EXERCISE 18-10 (Continued) (b) 1. 006,000 131,000 Cash current debt coverage 10 $131,000 3.2 times $34,000 $47,000 2 2. Cash return on sales $131,000 13.4% $978,000 3. Cash total debt coverage $131,000 0.6 times $184,000 $247,000 2 11 EXERCISE 18-11 Reitmans La Senza Cash Current Debt Coverage Cash Return on Sales Cash Flow per Share Cash Total Debt Coverage $32,548 $65,521 $32,548 $477,730 $33,810 8,764 $32,548 $65,689 = 0.50 times = 6.8% = $3.86 = 0.50 times $24,784 $50,576 $24,784 $354,279 $3,584 9,338 $24,784 $106,480 = 0.49 times = 6.9% = $0.38 = 0.23 times In terms of liquidity, both Reitmans and La Senza appear to be in a similar position since their cash current debt coverage ratios are relatively the same. With regards to profitability, both companies are generating similar cash returns on sales. However, Reitman’s shareholders appear to be enjoying a better cash flow per share. However, cash flow per share is difficult to compare between companies because of differences in the number of shares and share structure. Looking at solvency, Reitmans appears to be in a stronger position with significantly more cash generated for total debt coverage. 12 13