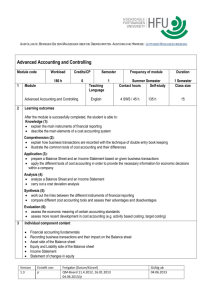

teaching schedule for cost accounting & budgeting

advertisement

TEACHING SCHEDULE FOR COST ACCOUNTING & BUDGETING Cavendish University Uganda Year Three Semester Three Program Bachelor of Business Administration Title Cost Accounting Reference BBA 121 Lecturer Jimmy K. Kigozi, 0772-441728. E-mail: nyaituga02@yahoo.com Module description: This 14 week module deals with the collection, compilation, analysis and processing of cost data for use by management in decision making Modes of Delivery : a) Lectures: A session on/discussion of the key concepts regarding the topic, with illustrations and reactions from the students. b) Tutorials: Brainstorming, role-plays, guided imagery and consensus-building sessions using in-class methods of inquiry and participatory learning. c) Case Studies: A description of a situation in an organizational context over a particular period of time, used to transfer knowledge and develop analytical skills. Objectives: The Module Objectives include. 1. To understand the business objectives stated and measurable targets of how to achieve business aims. 2. To enable students acquire the requisite abilities to integrate theoretical concepts with practical skills leading to effective application of Business Ethics in the Corporate Environment. 3. To provide students with an approach to ethical considerations of business operations at both local and international level. 4. To understand the concept of social responsibility since businesses award societies in the due course of their operations. Learning outcomes: 1. To impart knowledge of cost data collection, allocation and analysis 2. To create awareness and appreciation of costing techniques, concepts and standards 3. To equip students with the tools analytical skills necessary for analysis and interpretation of costing information for management use 4. To enable students understand the role and limitations of management accounting theory. To enable students practice costing accounting in working environments and contribute to successful decision making Methods of Delivery Methods of Assessment 1) Lecture: A session on the key concepts regarding the topic, with a) 1 course work constituting 25% illustrations and reactions from the students of the final mark 2) Tutorial: Brainstorming, role-plays, guided imagery and consensus b) Class attendance and –building sessions using in-class methods of inquiry and participation in tutorial exercises participatory learning – 25% of the final marks 3) Case studies/Presentations: description of a situation in an c) End-of-semester Exam organizational constituting 50% of the final context over a particular period of time, used to transfer knowledge mark. and develop analytical skills and how they are applied in day to day life. Semester 2 Year 1 Module Aim: Rationale: The module aims at providing students with in depths understanding and mastery of complex accounting concepts and practical techniques in determination, analysis and allocation of costs The module is a useful tool for budgetary planning and control, variance analysis for management decision making. Key Resources/ Remarks Week 1 Week 2 Week 3 Introduction and Overview Major Purposes of Accounting Systems Management Accounting, Financial Accounting Cost Accounting Planning and Control Decisions Cost information The Value Chain of Business Functions. Key Management Accounting Guidelines Ethical Considerations Relevant and irrelevant costs Costs and Cost Terminology Direct and Indirect Costs Cost Behaviour Patterns (Variable & Fixed Costs) Total Cost and Unit Costs Financial Statements Cost Flows Measurement of Costs 1. Cost Accounting; A Managerial Emphasis By C.T.Horngren et al (International ed) . 2.Theories and problems of cost accounting by James A and Ralph P 3.Managing Costs and resources by Brammer and Penning A 4. Accounting for Non Specialist by Wiley 5. Management and Cost Accounting, 7 ed by Colin Drury (2008 Week 4 Week 5 Decision theory Cost-Volume profit Analysis CVP Assumptions and terminology Essentials of CVP Analysis The Break-Even Point Using CVP for decision making Cost Drivers Performance measurements Concepts of Job costing Systems Job Costing Systems Process Costing Systems Job Costing in Manufacturing Actual costing and Normal Costing Week 6 Material Costing and Control Purchasing function/ procedure Responsibilities of a Purchasing Manager Storekeeping Classifications of materials Stock-taking methods Stock control and re-order levels Pricing closing inventory Week 7 Budgets and Forecasts Advantages of Budgeting Budgeting Cycle Cash Budgets Direct manufacturing labour budgets Budgeted direct and indirect costs Budgeted Statement of Cash Flow Week 8 Week 9 Week 10 Week 11 Management control systems Labour Cost Control Evaluating Management Control Systems Labour remuneration methods Costing Overheads Procedure for allocating overheads Procedure of apportioning overheads. Absorption costing Activity-based costing By-products and Joint products Transfer Pricing Transfer Pricing methods Comparison of methods Market-based prices Cost- based transfer prices Negotiated Transfer prices International Trade Agreements Cost volume Profit/break even analysis Inventory Management Week 12 Week 13 Decentralization accounting Benefits of Decentralisation Costs of decentralisation Comparison of Benefits and Costs End of Module evaluation and review 1.Text Books Bibliography 1. Cost Accounting; A managerial emphasis, by C.T. Horngren et al 2.Theories and problems of cost accounting by James A and Ralph P 3.Managing Costs and resources by Brammer and Penning A 4. Accounting for Non Specialist by Wiley 5. Management Accounting for business by Thomson 6. Corporate Finance Principles and practices by Denzil Watson and Antony 7. Management accounting for Decision makers by Peter et al 8. Accounting for Non Accounting Learners by Dyson J R 2. Journals/Newspapers/Magazines/ periodicals Newspapers/journals /magazines can be very useful sources of financial issues for both public and private sector. Specialist periodicals provide current articles on developments in related topics. the Financial Times, The Economist, The Guardian, The Independent . The Monitor and The New Vision. Weekly Observer and the East African. Specialist journals such as Management Accounting Quarterly (institute of Management Accountants), Management Today (Chartered Institute of Management), Strategic Finance (Institute of Management Accountants) Magazines such ACCA Students magazine and ACCA BPP Study Packs 3.Websites Most professional Accounting Bodies such as CIMA,ICA, CIPFA, AAT have their own websites for members only. www.aat.co.uk Association of Accounting Technicians www.bized.ac.uk learning materials and a wide range of company information www.cipfa.org.uk Chartered Institute of Public Finance and Accountancy www.cimaglobal.com Chartered Institute of Management Accountants www.companies-house.gov.uk Companies House home page www.guardian.co.uk an example ofa a broadsheet papers website containing financial information www.icaew.co.uk Institute of Chartered Accountants of England and Wales www.icsa.org.uk Institute of Chartered Secretaries and Administrators www.marksandspencer.com/ the company an example of a company website containing information on its published accounts www.thetimes100.co.uk a series of company case studies 4. Lecture Notes/handouts.