Phô lôc I - Tãm t¾t kÕt qu Dù ¸n trªn c së so s¸nh víi khung logic Dù

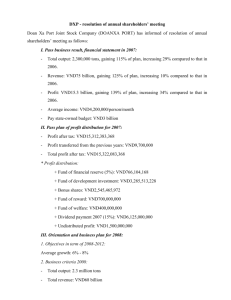

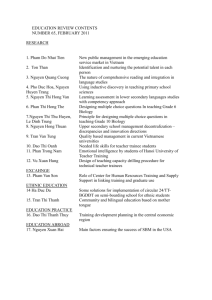

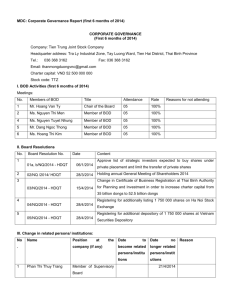

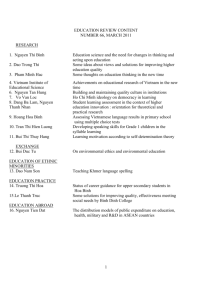

advertisement

APPENDIX I: SUMMARY OF RESULTS ACHIEVED BY KY ANH CREDIT-SAVINGS PROJECT (ON THE BASIS OF THE PROJECT LOGIC FRAME) Objective Purposes Content The living conditions of Ky Anh women is improved Indicator Outcomes/comments 1. Ky Anh women’s At the end of the project in credit-savings March 2003: project is 1.1. the project is strengthened, implemented in 10 expanded and communes with 2000 targeted to the poor member- borrowers 1.2. 90% of poor women in the project sites join the project 1.3. 95% borrowers pay loans from the incomes generated with these loans 1.4. 90% of credit-savings stakeholders increase net income (through increase in assets) from the loans. As of 30/6/02, the project was implemented in 10 communes with 3,351 members According to collected data, currently the project reach 73% the households located in the project’s area (against the project’ target of 90%). Though not yet achieving the set objective, it has been a great achievement of the project. It is actually extremely difficult to reach the target of 90%. The expansion of scope under limited resources would be inconsistent with the financial sustainability purpose set by the project. Besides this, the project is facing strong competition from other financial institutions such as VBARD, the Bank for the poor which are trying to extend services to the poor at much lower interest rates. Only 45% of the poor surveyed said that they repaid loans with income directly generated from these loans. The project applied the mode of installment repayment so borrowers usually utilize petty incomes from other sources to repay monthly dues of interest and principal. Most interviewees said that the monthly repayments are actually what the a paying for a large sum of saving which they have since they receive the loan. Besides, grace period is too short for borrowers to pay their monthly interest and loans with the incomes generated from the loans in the initial months of the loan cycle (normally, duration of time that a borrower needs for an agricultural production to generate cash income is four months). In general, the purposes of living condition improvement and income increase with loans were achieved. In the field survey, almost (90%) of the member-borrowers confirmed their income increase, but the level of increase was very different amongst different communes. Content 2. Enhancement of the capability of women's union staffs and borrowers Indicator 2.1. 100% of the credit-savings project staffs having skills in managing and handling the project and knowledge on gender and other social sciences 2.2. 100% of the credit-savings group members understanding the project 3. Sustainable creditsavings model in Ky Anh is acknowledged and introduced around the district and province 3.1. Model and methods of the credit-saving project are described in writing and introduced to other financial institutions such as the Bank for the poor, VBARD. 3.2. Increase of 20% of poor women having chances to get access to bank loans in Ky Anh Outcomes/comments Capability of the Ky Anh Women’s Union staff was improved considerably in the following areas: (i) ability to manage a credit-saving program; (ii) skills in social activities (communication, contact, group leadership, management…). The objective of improving the capacity of the Ky Anh Women’s Union staff has been achieved. It is could be stated that 100% of the project personnel were capable of handling the project under the current operation mechanism of the project. The Women’s Union staff could improve their knowledge on gender and organization of group activities. The results of the project were the basis for the Union’ staffs to persuade local authorities to include gender issue into training agenda at the district level. However, due to the complexity of credit saving programs (in relation to credit and savings activities) and that Ky Anh Women’s Union staffs working on the project on a part time basis, the transfer of the project to Ky Anh Women’ Union was a big challenge for its staff. 100% of the project members surveyed understood the purposes, conditions of participation, group regulation and credit regulations… Most of the project members efficiently used their loans. About 91% of the persons surveyed insisted that their income increased noticeably. This was reaffirmed by the high rate of repayment within the project (99,2% according to the report of Ky Anh Women’s Union). The Ky Anh Women‘ Union made a great effort to compile meterials on the project and model. However, introduction of other financial institutions such as VBARD and the Bank for the poor was not made at a high level. Amongst the interviewees, about 29,3% could borrow from banks before they participated in the project (please refer to the section Impacts of the project on borrowers in this report). A number of members who borrow from banks increased by 6.7% after 5 year the Project is implemented. This increase is lower than the set target which is 20%. But, the figure of 36% of members being able to borrow from formal bank after participating in the Project is very meaningful in the market credit conditions of Ha Tinh. Activities Content 1.1. Surveys are conducted communes in which the Project is covering or or will cover 1.2. Adjusting the project in order to match the ability of borrowers in repayment 2.1. Organising training courses for project staff and members-borrowers according to suggested needs 2.2. Improvement of project management staffs to manage and carry out accounting works. Indicator Surveys on the living conditions of members were conducted in 10 poor communes. Members are classified according to the criteria of the project based on criteria of household classification by the Ministry of Labour, Social Affairs and War Invalids (these criteria are used for the project-end assessment) Bookkeeping system and interest of credit and savings are revised adequately Outcomes/comments Up to now, in the 10 communes where the project is being implemented, the project has completed surveys and household classification. Conducting surveys and household classification of 10 communes was carried out with good results obtained with the methodogy highly suitable to the local conditions. The survey and the used methodologies could be replicated in other similar credit savings projects. 100% of credit savings group members are trained for group management and development skills. 100% of staffs trained for credit-savings management and experience of other credit-savings models (in the province and nationwide). 100% of members borrow. The Women’s Union participates in training courses organised as explained above. Training of staffs was especially paid attention to under the project. Almost 100% of the project staffs from the ditrict to the grassroot levels were trained for appropriate contents such as credit, acconting (depending on which tasks), group management, leadership skills, communications... The training was extended to all the group leaders, but remained limited. Ky Anh Women‘s Union was active in training and communication activities. Through meetings, conferences and different social events in the province, the union actively introduced the projects, the models, lessons learnt in the implementation of the project. Bookkeeping system has not been efficient. At the level of commune, bookkeeping workload carried by commune staffs and, especially by group leaders were too heavy and cumbersome. System of report forms was not standardized, for example, assets balance sheet at the district level. Content 2.3. Providing main techniques business skills, agriculuture extension knowledge for borrowers 3.1. Monitoring and assessing and adjusting the project; meantime, summing up and drawing lessons for further projects. 3.2. Sharing the experience of the project with VBARD, the Bank for the poor, committees of reduction poverty and relevant offices of the Ky Anh district and Ha Tinh province Indicator Organising assessment of the project and seminar once/y (commune and district) Outcomes/comments Credit-savings activities were not closely related to agricultural extension services and technical guidance. Within the project, only some training courses for members were organized on agriculture extension. Attempts to help members apply technologies into breeding production were limited. This is the point that needs to be paid higher attention to in the coming time. Annual assessment of the project was conducted well. Workshops in the frame of the project were aimed at evaluating the project, especially the workshop taking place in Noveber-2000 was very meaningful. Workshops were profoundly prepared and participation of the project’s beneficiaries was well-organised through workshops. Ky Anh Women‘s Union staff exerted a great effort to disseminate on their creditsavings model at district and provincial conferences in which staffs from VBARD and the Bank for the Poor also participate. Content 3.3. Building a strategy to link with formal credit institutions in Ky Anh such as VBARD and the Bank for the Poor, or people’s credit funds, social organisations in the district and province. 3.3. Building a strategy to link with formal credit institutions in Ky Anh such as VBARD and the Bank for the Poor, or people’s credit funds, social organisations in the district and province. 3.4. Linkage with the Bank for the poor to build a cooperation project for expanding the Ky Anh credit savings model. Indicator Established and strengthened relationships between Oxfam and Ky Anh Women’s Union, and the province and other credit organisations performing in the area Outcomes/comments It is a point that has not gained adequate focus under the frame of the project. Ky Anh Women’s Union said that this would be the priority of the Union in the coming time. Linkage with banks is very meaningful in credit extension and saving mobilisation from members. Linkage under the project is chiefly with commune social organisations and local authorities. Linkage activities with formal financial institutions were limited. As discussed above, this issue needs to be focused in the implementation of the project in the future. Content 3.5. Co-ordinating with the activities of DFID and the provincial Women’s Union 3.6. Assessment of outcomes in coordination with credit organisations within Ha Tinh province and the provincial Women’s Union Assessment of Ky Anh credit-savings project Indicator Outcomes/comments Dissemination of the new model was directly carried out through channels such as conference, workshops in the province, district and communes. Ky Anh Women’s Union staff were active in disseminating and advertising this model. They were invited to present at some provincial conferences and workshops. This was the encouraging achievements of the project. Assessment of the outcomes were conducted quite well, but this process was limited just within the organisations of the provincial and district Women’s Union. Moreover, linkage with credit organisations in the area was limited. Implemented Appendix2. Financial Sustainablity analysis of Credit and Savings Program in Ky Anh Province Case 1 Break-even point analysis Case 1 commune 6 months Hypothesis Project starting time 1. No. of members 2. No. of group leaders and vice group leaders 3. No. of WU staff working for project 1.Sources of fund a. Fund needed for commune activity b. Current rotating fund in the commune a. Equipments b. Training at the district and commune level c. Total (a+b+c) 3. Administration cost a. Ratio of district management fee to total outstanding per month b. Salary and administration at the commune level c. Reward fund Case 2 Case 3 Case 1 commune 6 months 1 commune 6 months 6 months 300 300 300 60 60 60 3 3 3 177,049,19 0 181,549,19 0 177,049,19 0 150,000,000 154,500,000 c. Total outstanding loan 2. Equipment and training cost 1 150,000,000 263,414,635 267,914,635 263,414,635 Cost: Month Office and travel cost 270,000 Salary for three WU staff 180,000 Group leaders 300,000 Vice group leaders 150,000 Current contributio n rate 0.26% 40% 5% 5,400,000 675,000 0.26% 40.0% 5.0% 5,400,000 796,721 33.9% 5.0% 0.26% Total 5,400,000 1,185,366 22.8% 5.0% Cost 900,000 6 months d. Mamagement fee to district e. Growth fund f. Risk management fund * Risk management fund /Total outstanding loan Total cost 4. Income from credit activity Income from intended interest 17% 33% 5% 2,708,853 5,258,361 1,770,492 17.0% 33.0% 11.1% 4,030,244 7,823,415 5,268,293 17.0% 33.0% 22.2% 0.5% 1.0% 13,500,000 100.00% 15,934,427 100.00% 2.0% 23,707,317 100.00% 15,934,427 0 Break-even point analysis Case 1 2 Case 3 Case 1 commune 6 months 1 commune 6 months 6 months 300 60 60 60 3 3 3 138,666,670 Current Case 300 143,166,670 c. Total outstanding loan 0 300 138,666,670 5,400,000 23,707,317 0 1 commune 6 months Hypothesis Project starting time 1. No. of members 2. No. of group leaders and vice group leaders 3. No. of WU staff working for project 1.Sources of fund a. Fund needed for commune activity b. Current rotating fund in the commune 2. Equipment and training cost 17.0% 33.0% 5.0% 13,500,000 5. Net income (3-4) Case 2 2,295,000 4,455,000 675,000 143,606,56 0 148,106,56 0 143,606,56 0 213,658,540 218,158,540 213,658,540 Cost: Month a. Equipments b. Training at the district and commune level c. Total (a+b+c) 3. Administration cost a. Ratio of district management fee to total outstanding per month b. Salary and administration at the commune level c. Reward fund d. Mamagement fee to district e. Growth fund f. Risk management fund * Risk management fund /Total outstanding loan Total cost 4. Income from credit activity Income from intended interest 5. Net income (3-4) Case 3 Hypothesis Project starting time 1. No. of members 2. No. of group leaders and vice group leaders 3. No. of WU staff working for contributio n rate Office and travel cost Salary for three WU staff Group leaders Vice group leaders 0.28% 40% 5% 17% 33% 5% 4,380,000 675,000 2,295,000 4,455,000 675,000 0.26% 32.4% 5.0% 17.0% 33.0% 5.0% 0.26% Total 22.8% 5.0% Cost 17.0% 33.0% 22.2% 4,380,000 646,230 2,197,180 4,265,115 1,436,066 27.5% 4.1% 13.8% 26.8% 9.0% 4,380,000 961,463 3,268,976 6,345,659 4,273,171 0.5% 12,480,000 1.0% 92.44% 12,924,590 81.11% 2.0% 19,229,269 12,480,000 12,924,590 0 Break-even point analysis Case 1 1 commune 6 months 6 months 4,380,000 100.00% 0 Case 2 Case 3 Case 1 commune 6 months 1 commune 6 months 6 months 300 300 300 60 3 60 3 60 3 180,000 300,000 0 730,000 19,229,269 0 250,000 project 1.Sources of fund a. Fund needed for commune activity b. Current rotating fund in the commune c. Total outstanding loan 2. Equipment and training cost a. Equipments b. Training at the district and commune level c. Total (a+b+c) 3. Administration cost a. Ratio of district management fee to total outstanding per month b. Salary and administration at the commune level c. Reward fund d. Mamagement fee to district e. Growth fund f. Risk management fund * Risk management fund /Total outstanding loan Total cost 4. Income from credit activity Income from intended interest 5. Net income (3-4) 120,000,000 88,524,600 131,707,330 124,500,000 120,000,000 93,024,600 88,524,600 136,207,330 131,707,330 Cost: Month Office and travel cost 270,000 Salary for three WU staff 180,000 Group leaders Vice group leaders 0 Current contributio n rate 0.32% 40% 5% 17% 33% 5% 0.26% 0.26% Total 22.8% 5.0% Cost 17.0% 33.0% 22.2% 2,700,000 675,000 2,295,000 4,455,000 675,000 20.0% 5.0% 17.0% 33.0% 5.0% 2,700,000 398,361 1,354,426 2,629,181 885,246 33.9% 5.0% 17.0% 33.0% 11.1% 2,700,000 592,683 2,015,122 3,911,708 2,634,147 0.6% 10,800,000 80.00% 1.0% 7,967,214 100.00% 2.0% 11,853,659 10,800,000 0 7,967,214 0 11,853,660 0 100.00% 450,000 6 months 2,700,000 List of interviewee Project Management Board No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Name Mai Tung Lam Su Huu Ly Thieu Dinh Duy Nguyen Thi Tuyet Anh Tran Thi Tuyet Ho Thi Lue Pham Thi Huong Tran Thi Sang Pham Thi Thu Hang Hoang Thi Minh Pham Thi Nga Pham Van Trien Le Thi Ba Hoang Thi Hieu Nguyen Thi Huong Tran Thi Cu Dam Thi Thanh Bui Thi Hai Hoang Thi Chuyen Mai Thi Nguyet Le Thi Luan Nguyen Thi Kim Tien Pham Thi Huyen Le Thi Quy Tran Thi Nhung Nguyen Thi Huyen Nguyen Thi Hai Tran Thi Van Thieu Thi Mai Nguyen Thi Anh Le Thi Lan Position Chairman, Ky Anh People’s Comittee Director, Ky Anh VBP Secretary, Ky Anh People’s Committee Chairwoman, Ky Anh WU Vice Chairwoman, Ky Anh WU Ky Anh WU staff Ky Anh WU staff/Project Accountant Ky Anh WU staff/Project Treasurer Ky Anh WU staff Ky Anh WU staff Ky Anh WU staff Chairman, Ky Hung People’s Committee Chaiworman, Ky Hung WU Project Accountant Project Treasurer Chaiworman, Ky Dong WU Project Accountant Project Treasurer Chaiworman, Ky Ninh WU Project Accountant Project Treasurer Chaiworman, Ky Hoa WU Project Accountant Project Treasurer Chaiworman, Ky Lam WU Project Accountant Project Treasurer Chaiworman, Ky Long WU Chaiworman, Ky Khang WU Chaiworman, Ky Giang WU Chaiworman, Ky Phu WU Borrowers No. 1 2 3 4 5 6 7 8 9 10 11 12 13 Name Address Vinh Loi village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Ban Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Tran Thi Hoa Nguyen Thi Huong Nguyen Thi Toan Tran Thi Thai Le Thi Hoa Tran Thi Bang Nguyen Thi Binh Vo Thi Dien Mai Thi Phuong Tran Thi Duyen Nguyen Thi Tuyn Le Thi Xoan Tran Thi Tiem 12 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 Nguyen Thi Hoa Tran Thi Thia Tran Thi Hung Le Thi Mai Dau Thi Dung Le Thi Hue Nguyen Thi Cuc Nguyen Thi Tuyen Pham Thi Lan Dang Thi Lanh Nguyen Thi Anh Le Thi Hue Le Thi Tam Mac Thi Hieu Tran Thi Quyet Nguyen Thi Thuyet Ho Thi Dien Tran Thi Lieu Nguyen Thi An Nguyen Thi Tuyet Tranh Thi Thinh Bui Thi Lam Le Thi Khai Nguyen Thi Ninh Tran Thi Hoa Mai Thi Hien Nguyen Thi Hong Nguyen Thi Hoa Nguyen Thi Lieu Tran Thi Loi Tran Thi Nhung Tran Thi Luyen Le Thi Hue Nguyen Thi Tan Dang Thi Nghe Mai Thi Tam Mai Thi Hien Hoang Thi Binh Duong Thi Nhuy Mai Thi Le Le Thi Lai Tran Thi Dung Nguyen Thi Chin Le Duc Ngon Nguyen Thi Tho Hoang Thi Thieu Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Tan Hai village, Ky Ninh, Ky Anh Xuan Hai village, Ky Ninh, Ky Anh Vinh Loi village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh 13 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 Hoang Thi Thuy Nguyen Thi Ly Truong Thi Sang Nguyen Thi Huong Nguyen Thi Vinh Nguyen Thi Cuc Tran Thi Lien Le Thi Loan Nguyen Thi Huong Nguyen Thi Tram Pham Thi Nguyet Le Thi Luan Nguyen Thi Hoang Vo Thi Van Mai Thi Nguyet Nguyen Thi Hieu Nguyen Thi Tuong Nguyen Thi Hoa Tran Thi Kieu Vo Thi Tu Pham Thi Hien Nguyen Thi Hien Hoang Thi Hang Le Thi Thanh Tran Thi Lu Nguyen Thi Phuong Doan Thi Thuy Dao Thi Thanh Le Thi Huong Dang Thi Sanh Dao Thi Huong Nguyen Thi Nhan Dao Thi Tuyen Dang Thi The Nguyen Thi Hue Le Thi Lan Dao Thi Xuyen Le Thi Viet Nga Le Thi Tuyn Hoang Thi Thuan Hoang Thi Thuyn Tran Thi Hoa Le Thi Huan Le Thi Nhu Hoang Thi Hong Nguyen Thi Tuyen Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Thang Loi village, Ky Ninh, Ky Anh Tan Giang village, Ky Ninh, Ky Anh Tan Thuan village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Tam Hai village, Ky Ninh, Ky Anh Xuan Ha village, Ky Ninh, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 4, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh 14 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 Le Thi Thuy Le Thi Nguyet Dao Thi Minh Nguyen Thi Hong Nguyen Thi Hoa Nguyen Thi Lai Nguyen Thi Phuong Dao Thi Lan Hoang Thi Canh Le Thi Nghia Nguyen Thi Chinh Dao Thi Hanh Ha Thi Canh Dang Thi Lai Dao Thi Van Pham Thi Sen Dao Thi Dien Kieu Thi Hue Nguyen Thi Phuong Nguyen Thi Dien Duong Thi Nhu Le Thi Thuan Nguyen Thi Thuyet Pham Thi Nhung Le Thi Bich Truong Thi The Nguyen Thi Nguyet Le Thi Quy Dao Thi Nghia Nguyen Thi Lan Hoang Thi Khanh Tran Thi Hang Dao Thi Hanh Hoang Thi Lich Le Thi Chinh Nguyen Thi Duong Hoang Thi Tien Bui Thi Hien Doan Thi Thanh Truong Thi Thanh Nguyen Thi Duc Phan Thi Khuyen Le Thi Huong Nguyen Thi Suong Nguyen Thi Chung Dao Thi Thanh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 2, Ky Hoa, Ky Anh Vilalge No. 1, Ky Hoa, Ky Anh Vilalge No. 9, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh Vilalge No. 3, Ky Hoa, Ky Anh 15 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 Nguyen Thi Vinh Bui Thi Pha Nguyen Thi Ly Ho Thi Dung Thai Thi Hue To Thi Tho Dau Thi Hau Dao Thi Vang Nguyen Thi Dien Ngo Thi Thuy Nguyen Thi Duc Nguyen Thi Lan Nguyen Thi Hieu Nguyen Thi Uy Le Thi Thanh Nguyen Thi Xoan Tran Thi Khanh Nguyen Thi Thuan Nguyen Thi Nhi Vo Thi Duyen Tran Thi My Tran Thi Quyen Tran Van Mao Hoang Thi Lieu Nguyen Thi Hanh Ho Thi Nang Nguyen Thi Nga Ngo Thi Ly Thieu Thi Nhuy Cao Thi Luc Tong Thi Viet Nguyen Thi Nga To Thi Nga Tran Thi Nhuan Nguyen Thi Bang Nguyen Thi Tan Bui Thi Lu Thieu Thi Lai Nguyen Thi Luc Nguyen Thi Nhinh Nguyen Thi Luc Dang Thi Hue Nguyen Thi Xuan Tran Thi Thanh Nguyen Thi Hien Tran Thi Chinh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 6, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 8, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 7 Ky Dong, Ky Anh Vilalge No. 7, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 1, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 3, Ky Dong, Ky Anh Vilalge No. 3, Ky Dong, Ky Anh Vilalge No. 3, Ky Dong, Ky Anh Vilalge No. 3, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh 16 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 Nguyen Thi Tin Nguyen Thi Huong Bien Thi Minh Nguyen Thi Khan Tran Thi Ngoc Tran Thi Lan Nguyen Thi Mai Hoang Thi Dinh Tran Thi Y Nguyen Thi Hoe Nguyen Thi Chau Nguyen Thi Chung Nguyen Thi Hieu Nguyen Thi Chinh Nguyen Thi Thao Truong Thi Ngoc Nguyen Thi Luyen Nguyen Thi Chuong Tran Thi Chuong Nguyen Thi Moi Nguyen Thi Duan Tran Thi Phu Nguyen Thi Nhan Tran Van Khanh Nguyen Thi Quyen Nguyen Thi Tan Nguyen Thi Cuc Nguyen Thi Luan Nguyen Thi Nham Nguyen Thi Thuy Tran Thi Dinh Nguyen Thi Phan Hoang Thi Hue Tran Thi Nhung Nguyen Thi Thanh Tran Thi Mai Le Thi Thuan Pham Thi Toan Nguyen Thi Ly Ha Thi Thao NguyenThi Canh Vo Thi Tuyen Pham Thi Ngai Hoang Thi Nghien Chu Thi Tuong Truong Thi Nhuan Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 6, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 10, Ky Dong, Ky Anh Vilalge No. 6, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 9, Ky Dong, Ky Anh Vilalge No. 4, Ky Dong, Ky Anh Vilalge No. 4, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 2, Ky Dong, Ky Anh Vilalge No. 6, Ky Dong, Ky Anh Hai Ha village, Ky Lam, Ky Anh Bac Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Hai Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh 17 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 Nguyen Thi Nhung Ho Thi Van Vu Thi Nhan Vo Thi Toan Nguyen Thi Xuan Nguyen Thi Bao Nguyen Thi Huyen Le Minh Thieu Thi Thuong Nguyen Thi Nghiem Phung Thi Sen Nguyen Thi Cay Nguyen Thi Cuong Nguyen Thi Moi Nguyen Thi Hong Nguyen Thi Hoe Nguyen Thi Huong Dinh Thi Lan Nguyen Thi Lien Mai Thi Huong Nguyen Thi Ly Nguyen Thi Hoi Nguyen Thi Mai Dang Thi Thuong Nguyen Thi Nam Tran Thi Viet Nguyen Thi Ly Le Thi Hieu Nguyen Thi Hoa Le Thi Sy Mai Thi Huan Cao Thi Ly Nguyen Thi Lien Nguyen Thi Hoa Nguyen Thi Lien Tran Thi Thin Nguyen Thi Hanh Nguyen Thi Van Nguyen Thi Tinh Nguyen Thi Hien Nguyen Thi Hong Nguyen Thi Thuan Bui Thi Thuong Nguyen Thi Hao Nguyen Thi Thuong Vo Thi Bay Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Dong Ha village, Ky Lam, Ky Anh Hai Ha village, Ky Lam, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tran Phu village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh 18 290 291 292 293 294 Pham Thi Thu Phung Thi Lam Duong Thi Tan Tran Thi Lien Nguyen Thi Lan Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Tan Ha village, Ky Hung, Ky Anh Non-borrowers No. 1 2 3 4 5 Name Le Thi Hoa Vo Thi Hue Nguyen Thi Linh Tran Thi Lien Nguyen Thi Nhung Address Lac Vinh village, Ky Lac, Ky Anh Lac Vinh village, Ky Lac, Ky Anh Lac Vinh village, Ky Lac, Ky Anh Lac Vinh village, Ky Lac, Ky Anh Lac Vinh village, Ky Lac, Ky Anh 19 20