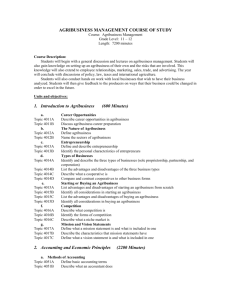

Introduction to Agribusiness Management Course of Study

advertisement

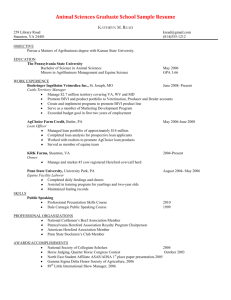

INTRODUCTION TO AGRIBUSINESS MANAGEMENT Nick Thompson Grades 10-12 COURSE DESCRIPTION: Students will begin the class with an introduction to Agribusiness including career opportunities and business operations. Students will also learn marketing, sales, and advertising as it applies to Agribusiness. The last part of the class allows students to explore Ag Economics, with an introduction to accounting, taxes, and credit MINUTES OF INSTRUCTION UNITS OF INSTRUCTION Introduction to Agribusiness Business Operations Management Agricultural Marketing, Sales & Advertising Economics Accounting Finance and Credit Taxes and Taxation Human Resources SAE Related Activities FFA & Leadership Related Activities TOTAL MINUTES 700 450 1400 850 1650 750 500 300 350 250 7200 Introduction to Agribusiness Management Course of Study Course: Introduction to Agribusiness Management Grade Level: 10-12 Length: 1 year Course Description: Students will begin the class with an introduction to Agribusiness including career opportunities and business operations. Students will also learn marketing, sales, and advertising as it applies to Agribusiness. The last part of the class allows students to explore Ag Economics, with an introduction to accounting, taxes, and credit. Units and Objectives: 1. Introduction to Agribusiness (700 min) a. Career Opportunities i. 4011A Describe career opportunities in agribusiness ii. 4011B Discuss agribusiness career preparation b. The Nature of Agribusiness i. 4012A Define agribusiness ii. 4012B Name the sectors of agribusiness c. Entrepreneurship i. 4013A Define and describe entrepreneurship ii. 4013B Identify the personal characteristics of entrepreneurs d. Types of Businesses i. 4014A Identify and describe the three types of businesses (sole proprietorship, partnership, and corporation) ii. 4014B List the advantages and disadvantages of the three business types iii. 4014C Describe what a cooperative is iv. 4014D Compare and contrast cooperatives to other business forms e. Starting or Buying an Agribusiness i. 4015A List the advantages and disadvantages of starting an agribusiness from scratch ii. 4015B Identify all considerations in starting an agribusiness iii. 4015C List the advantages and disadvantages of buying an agribusiness iv. 4015D Identify all considerations in buying an agribusiness f. Competition i. 4016A Describe what competition is ii. 4016B Identify the forms of competition iii. 4016C Describe what a niche market is g. Mission and Vision Statements i. 4017A Define what a mission statement is and what is included in one ii. 4017B Describe the characteristics that mission statements have iii. 4017C Define what a vision statement is and what is included in one 2. Business Operations Management (450 min) a. Business Plan i. 4251A Explain what a business plan is and the importance of one ii. 4251B Identify the parts of a business plan iii. 4251C Describe how to develop a business plan b. Agribusiness Management Concepts i. 4252A Define management ii. 4252B Discuss the atmosphere of agribusiness management c. Understanding Management and its Functions i. 4253A Describe what management is and its importance ii. 4253B Identify and describe managerial skills iii. 4253C Identify and explain the roles of management iv. 4253D List and explain the levels of management v. 4253E Identify and describe the functions of management d. Management Types e. Decision Making i. 4255A Explain the importance of making decisions in a business setting ii. 4255B Describe how to make decisions iii. 4255C Compare and contrast decision making by individuals or by groups 3. Agricultural Sales, Marketing, and Advertising (1400 min) a. Introduction to Marketing i. 4351A Define what a market is and what marketing is ii. 4351B Explain marketing functions iii. 4351C Describe marketing institutions iv. 4351D Explain integration and the types b. Types of Marketing i. 4352A Describe the two main types of marketing (consumer and business) ii. 4352B Explain how consumers make decisions iii. 4352C Describe how new products are introduced and adopted iv. 4352D Explain how business buyers make decisions v. 4352E Discuss institutional and government markets c. Commodity Marketing i. 4353A Name and describe the groups of agricultural commodities ii. 4353B Know what marketing channels are iii. 4353C Discuss the role of the government in commodity marketing d. Selling i. 4354A Describe how selling is a part of marketing ii. 4354B Describe the sales process e. Market Research i. 4355A Evaluate methods of marketing products or services ii. 4355B Research products and services design(s) iii. 4355C Identify market niches f. Marketing Plan i. 4356A List and explain the components to a marketing plan ii. 4356B Explain the benefits of a marketing plan iii. 4356C Explain the benefits of value-added products g. Advertising i. 4357A Describe what advertising is ii. 4357B Explain the importance of advertising iii. 4357C List and describe advertising avenues iv. 4357D Identify advertising challenges h. Pricing i. 4358A Define what price is ii. 4358B Describe how supply and demand determines price of a product 4. Economics (850 min) a. Basic Economics i. 4066A Define basic economics terms ii. 4066B Describe how basic economic factors affect management decisions b. Supply & Demand i. 4069A Define supply and demand ii. 4069B Explain how supply and demand determine price iii. 4069C Explain how supply and demand determine how much of a product is produced iv. 4069D Know the components to a supply and demand graph v. 4069E Interpret a supply and demand graph c. Utility and Satisfaction i. 4068A Define utility and satisfaction ii. 4068B Describe the different types of utility (time, place, and form) iii. 4068C Explain how utility relates to agribusiness management d. Inputs and Outputs i. 4067A Define inputs and outputs ii. 4067B Describe the importance of inputs iii. 4067C Explain the input-output relationship e. Opportunity Costs i. Explain the concept of opportunity costs 5. Accounting (1650 min) a. Methods of Accounting i. 4051A Define basic accounting terms ii. 4051B Describe what an accountant does iii. 4051C Compare and contrast the two methods of accounting (the cash method and the accrual method) iv. 4051D Describe the two bookkeeping systems (the single entry system and the double entry system) b. Checking Accounts i. 4052A Describe what a checking account is ii. 4052B List advantages and disadvantages of checking accounts iii. 4052C Accurately write a check and record transaction in checkbook ledger c. Savings i. 4053A Describe what a savings account is ii. 4053B List and explain the types of savings accounts iii. 4053C List advantages and disadvantages of savings accounts d. Budgets i. 4056A Explain the purposes of a budget ii. 4056B Compare and contrast the two types of commonly prepared budgets (income statement budget and cash flow budget) iii. 4056C List and explain the three formats of a income statement budget(enterprise, partial, and whole farm) iv. 4056D List the components to a cash flow budget e. Costs i. 4057A Define fixed costs and variable costs ii. 4057B Compare and contrast fixed costs and variable costs f. Assets and Liabilities i. 4058A Define assets and liabilities ii. 4058B Describe current and non-current assets iii. 4058C Describe current and non-current assets iv. 4058D Distinguish between assets and liabilities g. Analyzing Financial Performance i. 4059A Use financial measures as a management tool ii. 4059B Define profitability, solvency, and liquidity iii. 4059C Know ways to calculate profitability, solvency, and liquidity h. Cash Flow Statements i. 4061A Explain what a cash flow statement is and uses of one ii. 4061B Explain the benefits of cash flow planning iii. 4061C Identify the components of the cash flow statement iv. 4061D Determine cash flow from income and expense records i. Balance Sheets i. 4062A Explain what a balance sheet is ii. 4062B Identify the components and structure of the balance sheet iii. 4062C Complete a balance sheet from financial information j. Profit/Loss Statement i. 4063A Explain what a profit and loss statement is ii. 4063B Identify the components of a profit and loss statement iii. 4063C Explain how to use a profit and loss statement as a management tool k. Owner/Equity Statement i. 4064A Explain what an owner equity statement is ii. 4064B Identify the components and structure of the owner equity statement iii. 4064C Prepare an owner equity statement from financial information l. Inventory i. 4070A Define inventory and warehousing ii. 4070B Identify costs associated with warehousing iii. 4070C Describe how warehousing affects quality iv. 4070D Explain physical and perpetual inventories v. 4070E Identify costs associated with maintaining an inventory vi. 4070F Explain the importance of record keeping in warehousing and inventory 6. Finance & Credit (750 min) a. Value of Money Over Time i. 4054A Define interest ii. 4054B Explain the concept of time value of money and describe how money can grow over time iii. 4054C Describe compounding and demonstrate how to calculate the future value of money iv. 4054D Describe discounting and demonstrate how to calculate the present value of money b. Interest i. Discuss differences between interest rates and interest ii. Interpret interest rates for different types of loans iii. Calculate interest on loans c. Sources of Credit i. Determine needs for credit ii. Examine different places to obtain credit d. Types of Loans i. Know the difference between a secured loan, an unsecured loan, an equity loan, and a mortgage. e. Applying for a Loan i. Examine the needs for a loan ii. Determine what a feasible need for a loan is iii. Calculate a loan payment into a budget iv. Know how to fill out a loan application 7. Taxes and Taxation (500 min) a. Taxes i. Examine the needs for taxation ii. Determine the difference between a state and federal tax iii. Describe the differences between sales, property, income, and specialty taxes b. Depreciation i. 4065A Define depreciation ii. 4065B Explain the purpose of depreciation iii. 4065C Calculate depreciation by straight-line, accelerated cost recovery system, and modified accelerated cost recovery system 8. Human Resources (300 min) a. Employee Recruitment i. 4301A Explain how to develop a job description ii. 4301B Identify ways of recruiting employees iii. 4301C Identify locations to place job advertisement b. Employee Interviewing and Hiring i. 4302A Describe ways of evaluating prospective employees ii. 4302B Know what equal employment opportunity is and laws prohibiting discrimination c. Employee Relations i. 4303A Describe methods to improve employee relations ii. 4303B List causes of poor employee morale 9. Related FFA Activities (350 min) a. Broiler Contest b. Ag Skills Contest c. Outstanding Junior d. State FFA Degree 10. Related SAE Activities (250 min) a. Working on books on family farm b. Working for Agribusiness c. Broiler Contest (Profit and loss) d. Record keeping on 4-H Project