7-eleven, inc - Southern Methodist University

advertisement

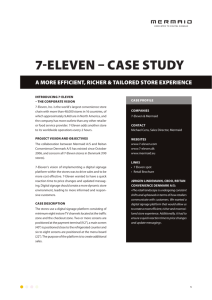

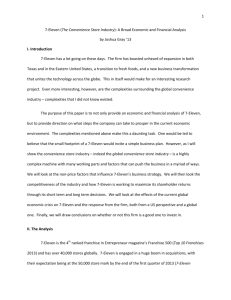

7-ELEVEN, INC. In mid-January, 2005, Jack Stout, the Asset Management Planning Manager at 7-Eleven, Inc., met with a group of marketing interns. The purpose of the meeting was to describe their internship project. Mr. Stout's primary responsibility was to formulate the strategy for where 7-Eleven, Inc. would open new convenience stores and close existing stores. In 2005, 7-Eleven, Inc. intended to open around 100 to150 new stores in its present core urban and suburban markets in the United States. Mr. Stout thought that the marketing interns would welcome the opportunity to identify markets for new 7-Eleven convenience stores and recommend specific store locations. Therefore, he proceeded to give an overview of 7-Eleven, Inc., the convenience store industry, and the internship assignment. The Company 7-Eleven, Inc. is the world’s largest operator, franchiser and licensor of convenience stores with over 27,500 units worldwide. The company’s total revenues were about $12.2 billion in 2004 principally from retail sales of merchandise and gasoline in its U.S. and Canadian stores. 7-Eleven operates and franchises more than 5,300 stores in the United States. About 60 percent of these stores are located in California, Florida, Maryland, New York, Texas, and Virginia. In addition, 7-Eleven operates and franchises about 500 stores in Canada. Area licensing agreements and joint ventures cover the operation of around 500 stores in Mexico and more than 10,600 stores in Japan. Figure 1 shows the distribution of 7-Eleven stores in the contiguous United States. 7-Eleven Business Model The 7-Eleven business model consists of five key elements: 1. 2. 3. 4. 5. A differentiated merchandising strategy; Utilization of 7-Eleven’s retail information system; Managed distribution; Providing a convenient shopping environment; and A unique franchise model The cooperation of 7-Eleven, Inc. in the preparation of this case is gratefully acknowledged. This case was prepared by the JCPenney Center for Retail Excellence, Edwin L. Cox School of Business, Southern Methodist University, under the supervision of Professor Roger A. Kerin. 1 Figure 1 7-Eleven Store Counts by State: January 2005 2 Note: State totals reflect both company-operated and franchised 7-Eleven stores, but exclude stores that are operated by third-party affiliates under the 7-Eleven brand by license agreement. Source: 7-Eleven, Inc. 2 Differentiated merchandising strategy. 7-Eleven offers a broad array of products, including many not traditionally available in convenience stores, to meet the needs of its customers. These products include high-quality fresh foods that are delivered daily to stores. In addition, the company sells a number of products that are developed specifically for its stores, such as 7-Eleven Go-Go Taquitos®, crispy grilled tortillas with spicy Mexican filling. The company’s merchandise assortment also features items specifically identified with 7-Eleven, including Slurpee® semi-frozen carbonated beverages, Café Select® coffee, Big Gulp® fountain beverages and Big Bite® hot dogs. 7-Eleven implements its merchandising strategy through a variety of means. It employs item-by-item inventory management to keep top-selling items in-stock. In addition, the company promotes new high-potential items. The company expects its franchisees and store managers to monitor customer buying patterns to maximize store sales by staying stocked on popular items, managing product assortment and merchandising effectively. 7-Eleven sells gasoline at more than 2,400 stores. Almost all offer CITGO-branded gasoline. Because gasoline sales contribute to increased store traffic, 7-Eleven sells gasoline at its stores wherever practical. The company expects that approximately half of its new stores opening in the United States and Canada in the foreseeable future will sell gasoline. Utilization of 7-Eleven’s retail information system. 7-Eleven was the first major convenience store chain in the United States to use an integrated set of retail information tools. Effective utilization of the system is the foundation of the company’s business model. The 7-Eleven retail information system features: A point-of-sale, touch-screen system with scanning and integrated credit, debit and stored value card authorization, supported by a centralized price book; Daily ordering, supported by five-day forward-looking weather forecasts, merchandise messages and historical sales information; Category management and item level sales analysis; Integrated gasoline and “pay-at-the-pump” functionality; Automated back-office functions, such as sales and cash reporting, payroll, gasoline pricing and inventory control, which are connected directly to the company accounting system; and The ability to make delivery adjustments and perform write-offs on a handheld unit. Managed distribution. 7-Eleven works with its vendors and distributors to provide daily delivery of fresh food and other items to its stores, to lower the cost of delivery, and to shift deliveries to off-peak hours. Vendors include independently-owned and operated bakeries and commissaries that provide daily deliveries of fresh foods, such as sandwiches, salads, and baked 3 goods, to its stores. In addition, the company uses 24 distribution centers in the United States and Canada to service approximately 4,900 of its stores. Each center serves about 200 stores, on average. These centers typically serve stores within a 90-minute drive. The distribution centers, which consolidate orders from multiple suppliers for daily distribution to individual stores, offer a number of advantages over other distribution systems, including: More frequent deliveries of time-sensitive and perishable products such as milk, bread and fresh foods; Off-peak, consolidated deliveries that allow store personnel to focus on store operations and reduce congestion in a typically small 7-Eleven store parking lot during peak sales times; More customized deliveries and improved in-stock levels; and Access to products that traditionally have not been available to individual convenience stores. Providing a convenient shopping environment. 7-Eleven seeks to provide its customers with a convenient, safe and clean store environment. The majority of 7-Eleven stores in the United States and Canada provide more than 6 million daily customers with 24-hour convenience, seven days a week. Over the last several years, the company has improved lighting inside and outside its stores, modernized store signage and installed canopies over the gasoline pumps. In 2004, around $80 million was spent for store maintenance and the replacement of store equipment. Figure 2 shows the exterior and interior of a 7-Eleven store which typically range in size from 2,400 to 3,000 square feet. Unique franchise model. More than half of the 7-Eleven stores in the United States are operated by independent franchisees. The company’s franchise model is different from most others because 7-Eleven owns or leases the stores and equipment used by its franchisees. In addition, the ongoing royalties that the company receives from its franchisees are based upon a percentage of store gross profit. 7-Eleven believes this model better aligns company interests with those of its franchisees and allows the company to provide consistency in the store environment and shopping experience for its customers. 7-Eleven also provides more support to its franchisees than most franchisors, including financing, bookkeeping, advertising, business counseling and other services. 7-Eleven Growth Strategy 7-Eleven has identified four avenues for future growth. They are: 1. 2. 3. 4. Increasing same-store merchandise sales. Expanding in existing markets. Providing greater convenience to customers. Increasing the value of 7-Eleven licenses and expanding internationally. 4 Figure 2 7-Eleven Store Exterior and Interior Source: 7-Eleven, Inc. 5 Increasing same-store merchandise sales. 7-Eleven seeks to increase same-store sales1 by developing and introducing new products. By using proprietary inventory management and retail information systems, 7-Eleven’s merchandising team, franchisees, and store managers are better able to increase same-store sales by optimizing the product assortment in each store. Allowing individual store operators to manage product assortment is part of 7-Eleven's Retailer Initiative strategy. Store managers and franchisees are trained in the principles of item-by-item management – removing slow-selling items and introducing new items every day based on local preferences. Expanding in existing markets. 7-Eleven’s store development efforts are focused on its existing markets to take advantage of population density and traffic. Typically, new stores are concentrated around the distribution centers, commissaries and bakeries that allow the company to operate more efficiently. Company management believes that the potential exists for significant expansion in present core urban and suburban markets, and plans to open approximately 100 to150 new stores in the United States during 2005. A location analysis for new stores considers population density, demographics, traffic volume, visibility, ease of access, locations of other 7-Eleven stores, and economic and competitor activity in an area. Providing greater convenience to customers. 7-Eleven continually seeks ways to improve customer convenience through innovative merchandising programs. One such innovative program is Vcom®, which is 7-Eleven’s proprietary self-service kiosk that offers check-cashing, money order, money transfer, bill payment and traditional ATM services and access to Verizon residential telephone services. Increasing the value of 7-Eleven licenses and expanding internationally. By continuing to develop its infrastructure, 7-Eleven offers an attractive financial opportunity to prospective licensees. Infrastructure development will also serve to strengthen the value of the 7-Eleven brand. 7-Eleven’s long-range plans include expanding into countries where it currently does not have a presence. For example, an area licensing agreement for China was developed in early 2004. 7-Eleven Products and Services 7-Eleven stores offer a wide array of products and services based on customer demands, sales potential, and profitability. Broadly speaking, 7-Eleven net sales are split between gasoline and merchandise (including services). Gasoline typically accounts for about 30 percent of company net sales. Merchandise (including services) accounts for about 65 to 70 percent of company net sales. 7-Eleven stores carry anywhere from 2,300 to 2,800 merchandise items. These items fall into nine general product categories. Figure 3 shows the merchandise (service) sales breakdown for 7-Eleven stores in the United States and Canada by product category. Of all U.S. retailers, 7Eleven sells the most USA Today newspapers, Sports Illustrated magazines, cold beer, cold single-serve bottled water, cold Gatorade, fresh-grilled hot dogs, single-serve snack chips and money orders. 7-Eleven also has the largest ATM network of any U.S. retailer. 1 Same-store merchandise sales refers to sales dollars generated only by those stores that have been open more than one year and have historical sales data to compare the current year’s sales to the same time-frame the previous year. 6 Figure 3 7-Eleven Merchandise Sales Breakdown for the Period 2001-2004 (Based on total store purchases) Product Category Year Ended December 31 2001 2002 2003 2004 Tobacco Beverages Beer/Wine Candy/Snacks Non-Foods Fresh Foods Dairy Other 27.0% 23.0% 11.3% 10.9% 8.0% 6.6% 4.8% 4.9% 28.1% 23.0% 11.2% 10.9% 7.6% 6.7% 4.5% 4.6% 29.4% 23.1% 11.4% 10.5% 7.0% 7.2% 4.4% 3.6% 29.1% 23.5% 11.2% 10.0% 6.9% 7.7% 4.4% 3.5% Total Product Sales Services 96.5% 3.5% 96.6% 3.4% 96.6% 3.4% 96.3% 3.7% 100.0% 100.0% 100.0% 100.0% Total Merchandise Sales 7-Eleven Merchandise Category Descriptions Tobacco includes cigarettes; chewing tobacco; cigars; pipe tobacco Beverages include fountain drinks; pre-packaged soft drinks (single-serve/multi-pack, bottles/cans); juices; non-carbonated beverages; bottled water; sport and energy drinks; frozen carbonated beverages (Slurpee); frozen non-carbonated beverages; coffee; tea; hot chocolate Beer/Wine includes beer (domestic/premium/import, bottles/cans, multi-pack/single-serve); wine; wine coolers; malt beverages; liquor Candy/Snacks include gum; candy; mints; chips; pretzels; crackers; pre-packaged bakery items (cookies, donuts, pastries, etc.); pre-packaged meat snacks; other pre-packaged food items Non-Foods include newspapers; magazines; health care; beauty supplies; personal hygiene; collectibles; batteries; film; electronics; cards/stationery; school/office supplies; apparel/accessories; soap; cleaning supplies Fresh Foods include fresh bakery (donuts, cookies, muffins, pastries); hot dogs; sausages; taquitos; hot sandwiches; cold sandwiches; deli wraps; salads; fruit (whole/prepared) Dairy includes milk (single-serve/take home sizes, variety of flavors and fat content); butter; cheese; sour cream; eggs; ice cream Other includes bread; packaged groceries; frozen groceries; ice; miscellaneous products Services include ATM services; check cashing; money orders; postage services; lottery; pre-paid cellular service; payphone service Source: 7-Eleven, Inc. 7 The Convenience Store Industry The U.S. convenience store industry consists of a few large companies, such as 7-Eleven, Inc., a moderate number of mid-sized, regional chains, and many smaller, independent operators. More than half of all U.S. convenience stores are classified as “one-store operators,” meaning that they are either owned or franchised by an individual. Conversely, only about one in seven U.S. convenience stores are owned and operated by a company that owns 500 or more stores. In 2004, about 131,000 individual convenience stores were operating in the United States. These stores posted an estimated combined sales revenue of about $400 billion. Competition The convenience store industry is highly competitive. In the area of general merchandise sales, convenience stores compete with national, regional, and local and independent retailers, including grocery and supermarket chains, grocery wholesalers and buying clubs, fast food chains, and variety, drug and candy stores, in addition to other convenience stores. In sales of gasoline, convenience stores compete with other convenience stores, food stores, service stations and increasingly supermarket chains, hyper-marts and other discount retailers. The rapid growth in the numbers of convenience-type stores opened by oil companies over the past several years has also intensified competition. Customers About 90 percent of U.S. adults (18 years or older) visit a convenience store at least once a year. The average number of visits per week for a 7-Eleven customer is 3.5. Twenty percent of customers visit a 7-Eleven store more than five times per week. 7-Eleven management believes that the characteristics of its customers are representative of convenience store customers as a whole. Figure 4 shows the profile of 7-Eleven convenience store customers. Almost 7 in 10 (69%) customers are male and white. A majority of customers (54%) are unmarried; 54 percent fall into the 25 to 44 age group; and 53 percent have attended or completed college. Almost three-quarters (72%) of 7-Eleven customers have an annual household income between $20,000 and $70,000. Almost 8 in 10 (78%) 7-Eleven store trip visits have a customer’s residence as the origin or destination. The distance from a customer’s residence to the 7-Eleven store visited is under 10 miles for 84 percent of customers. Nine in 10 customers travel less than 10 miles to a 7Eleven store. The time traveled to a 7-Eleven store is 10 minutes or less for 76 percent of customers. 8 Figure 4 Profile of 7-Eleven Convenience Store Customers (Customer Distribution by Share of Transactions*) Gender Male Female Marital Status 69% 31% Ethnicity White Hispanic African-American Asian Other 69% 13% 13% 4% 1% Age Under 18 18-24 25-34 35-44 45-54 55-64 65+ 4% 20% 29% 25% 15% 6% 2% Married Single Divorced/Widowed 46% 42% 12% Household Income Under $20,000 $20,000-$39,999 $40,000-$69,999 $70,000-$99,999 $100,000+ 15% 38% 34% 8% 5% Education Level Some High School or less High School Graduate Technical/Trade School Some College College Degree Post-Graduate Degree 6% 30% 10% 29% 21% 3% Distance–Home to 7-Eleven Shopped <1/2 Mile 25% 1/2 Mile to <1 Mile 13% 1 Mile to <2 Miles 12% 2 Miles to <5 Miles 24% 5 Miles to <10 Miles 10% 10+ Miles 16% Distance Traveled to 7-Eleven <1/2 Mile 28% 1/2 Mile to <1 Mile 15% 1 Mile to <2 Miles 15% 2 Miles to <5 Miles 25% 5 Miles to <10 Miles 7% 10+ Miles 10% Trip Route Home, 7-Eleven, Home Home, 7-Eleven, Work Other, 7-Eleven, Home Work, 7-Eleven, Home Home, 7-Eleven, Other Work, 7-Eleven, Work Other, 7-Eleven, Other Work, 7-Eleven, Other Other, 7-Eleven, Work Time Traveled to 7-Eleven 2 Minutes or Less 26% 3-5 Minutes 30% 6-10 Minutes 20% 11-15 Minutes 11% 16-20 Minutes 5% 21-30 Minutes 4% 31+ Minutes 5% 26% 14% 14% 13% 11% 10% 9% 2% 1% *Note: Some columns will not total to 100% due to rounding Source: 7-Eleven, Inc. 9 The Assignment (Report and Presentation Due Tue. April 19) Following the overview of 7-Eleven, Inc. and the convenience store industry, Mr. Stout outlined the assignment for the MBA’s. The assignment was to employ the SimmonsLocal® Market Service database and Microsoft MapPoint® software to examine selected 7-Eleven markets and recommend specific locations for new 7-Eleven convenience stores. Mr. Stout was particularly interested in store location opportunities in Austin, Texas, where there are currently 36 stores. Mr. Stout expected the students to prepare a detailed report that would: 1. 2. 3. Identify a specific location in the Austin market where a 7-Eleven store should be opened and explain the reasons for the selection. The location should be a specific street intersection. Describe the socio-economic profile of the likely customers at the specific locations. Compare and contrast this profile with that of convenience store customers. Recommend at least one new product category or service that the specified store locations should provide, in addition the product assortment typically carried by a 7-Eleven store. Explain the reasons for this recommendation. In preparing their report, the students could assume that the new store locations would offer CITGO-branded gasoline and be serviced by a 7-Eleven distribution center and independentlyowned bakeries and commissaries. The text portion of the report should not exceed 15 double-spaced pages using one inch margins and a 12-point type font size. Only those tables and figures used to summarize data relevant to the analysis and recommendations should be submitted with the report. They should be properly titled, clearly referenced in the text, and attached to the end of the report. 10