Financial Opportunities Available to California Small Businesses

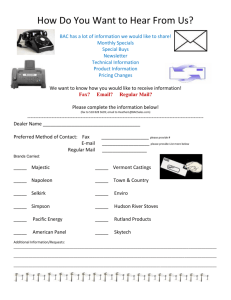

advertisement