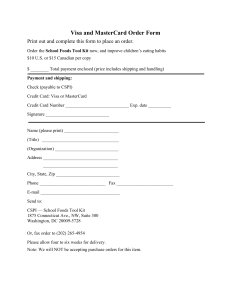

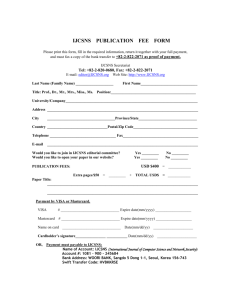

Table of Contents

advertisement

1 American Express Case Study Running head: American Express Case Study Marketing Case Study Analysis: American Express Company Lameka Fields Ariel Shead Nicole Outen Shavon Dempsey Marketing 3175 Dr. A Arora 2 American Express Case Study Table of Contents Executive Summary.................................................................................................................................................3 History and Background.........................................................................................................................................4 Corporate Culture....................................................................................................................................................5 Code of Conduct.....................................................................................................................................................5 Customer Analysis...................................................................................................................................................6 VALS......... ............................................................................................................................................................7 Product Market & Segmentation and Targeting.....................................................................................................8 Company Mission....................................................................................................................................................8 Competition & Competitive Market Analysis.........................................................................................................8 BCG Analysis..........................................................................................................................................................9 BCG Matrix...........................................................................................................................................................10 External Market Environment...............................................................................................................................11 PEST Analysis.......................................................................................................................................................11 S.W.O.T Analysis & Matrix..................................................................................................................................12 Marketing Plan Objectives.....................................................................................................................................13 Differential and Positioning...................................................................................................................................14 Marketing Strategy................................................................................................................................................14 Porter’s Strategy & Five Forces Model.................................................................................................................15 Marketing Mix.......................................................................................................................................................15 Implementation and Control.................................................................................................................................16 Financial Statistics................................................................................................................................................17 References.............................................................................................................................................................18 3 American Express Case Study Executive Summary American Express is the world’s largest credit issuer by purchase volume and the largest provider of travel services globally with assets totaling $153 billion,$30 billion in annual revenue and 62,500 employees worldwide (www.americanexpress.com, 2012). American Express processes millions of dollars of transactions daily. It operates through four segments: U.S. Card Services, International Card Services, Global Commercial Services and Global Network & Merchant Services (www.marketwatch.com, 2012). Its card services offer a variety of credit and charge card products and services to consumers and small businesses making up over 90% of its company’s value and its travel services business making up the rest (www.www.americanexpress.com, 2012). The Global Network & Merchant Services segment is responsible for managing merchant services globally, which includes signing merchants to accept Cards as well as processing and settling Card transactions for those merchants. It also offers merchants point-of-sale products, marketing information programs and services (www.marketwatch.com). A major factor threatening the company includes the most recent uncertainty in the U.S. employment and housing market which has caused consumer spending to be down and the deepening economic crisis in Europe has worried American Express stockholders (Johnson, 2012). Small business which is a major segment of American Express’ target market has been greatly impacted by economic downturn. Despite the sluggish economy loan performance has remained strong because many consumers have worked to pay off their bills rather than take on more debt (Johnson, 2012). To the company’s advantage it primarily lends to affluent customers, which has allowed it to maintain financial strength, unlike many counterparts in the financial sector industry. The rising global threat of economic and cybercrime fraud is a growing concern facing the financial sector as whole and American Express must be vigilant with this issue by assuring the security and integrity of it services and maintain the built confidence and trust it has established over the last 150 plus years of existence. 4 American Express Case Study American Express has a longstanding history of sustainability and longetivity, strong global presence and is a trusted brand leader in the financial and credit industry. It is a recognized global leader in customer service earning five consecutive J.D. Power and Associates awards for highest customer satisfaction among credit card companies (Young, 2012). History and Background American Express Company has unique beginnings that have played vital role in the company’s values and operations today. Since American Express’ 150 year inception “reinvention” has been the word used to help establish its brand, overcome challenges and meet the growing and unique needs of its customers (2012,www.americanexpress.com). American Express founded by Henry Wells in 1841 began it existences as a New York express and freight business, providing the safe transport of valuables (www.americanexpress.com, 2012). It then progressed into money orders and traveler's checks and there its travel service operations, including its credit card services emerged. Several key historical events challenged the company including major regulatory changes in the express and travel industries, competition after the Civil War, the Card Revolution of the 1950s, the International monetary crisis of 1971, and the Credit Card Wars: 1980s-90s (www.americanexpress.com, 2012). However the hallmarks of the American Express brand which are trust, integrity, security, quality and customer service have remained constant (www.americanexpress.com, 2012). Demonstrating a niche for global diversification and market development in early 1999 American Express formed a branch of American Express Financial Advisors in Japan. In 2000 it established a strategic position in the burgeoning Chinese economy by opening a headquarters in Beijing (www.americanexpress.com, 2012). 5 American Express Case Study Despite intensified competition American Express has enjoyed a reputation for innovation, profitability, and integrity (www.americanexpress.com, 2012). Corporate Culture American Express website proclaims that “As a company whose primary mission is to take care of customers, American Express has created a culture with service at its core. We dedicate extensive resources and effort to satisfying and surprising customers with thoughtful, creative and personalized solutions. You’ll find the same level of personal attention, respect and support for our people as well. We place great importance on doing what is right, what is best and what is innovative (“Working at American Express| Culture,” 2012).” American Express also places great emphasis on creating a comfortable, flexible environment for their employees, which includes those entering retirement and ones on maternity leave as well. American Express states “We strive to create an environment where people are respected, feel personally and professionally fulfilled, and look forward to coming to work. We empower our people to do the best job possible, while creating a life that’s truly extraordinary (“Culture| Work Environment, 2012).” Code of Conduct The American Express Code of Conduct is a fifty-three page document expressing the need for employees to remain integral throughout the company, especially since regulations are tightening. It also includes reliable information about who to report violations to when an employee suspects or witnesses a violation. Additional information centers around the brief outline and summary from the “Blue Box Values” in the document. “Customer Commitment- We develop relationships that make a positive difference in our customers’ lives. 6 American Express Case Study Quality- We provide outstanding products and unsurpassed service that, together, deliver premium value to our customers. Integrity- We uphold the highest standards of integrity in all of our actions. Teamwork- We work together, across boundaries, to meet the needs of our customers and to help our Company win. Respect for People- We value our people, encourage their development and reward their performance. Good Citizenship- We are good citizens in the communities in which we live and work. A Will to Win- We exhibit a strong will to win in the marketplace and in every aspect of our business. Personal Accountability- We are personally accountable for delivering on our commitments. The Result- By acting according to these values, we will inspire the loyalty of our customers, earn a sustainable leadership position in our business, attract and retain a highly talented and engaged workforce, and provide a superior return to our shareholders. This, in turn, will enable us to achieve our vision of becoming the world’s most respected service brand (Employee Code of Conduct, 2012).” Customer Analysis American Express distinguishes itself as the world’s premier credit card and financial service provider and contributes it success to it premium customer base and direct relationships with millions of consumers, businesses and merchants worldwide. American Express card members on average spend about four times more than those of MasterCard and three-and-a-half times more than Visa (Young & www.americanexpress.com, 2012). In 2009 personal card members spent on average $11,213 and have the highest credit ratings among the major card issuers (Young, 2012). 7 American Express Case Study Customers see American Express as business partners and not just the issuer of credit and see value in the products and services offered. “We earn the loyalty of our high-spending customers by providing them with industry-leading products, services, rewards and benefits” (www.americanexpress.com, 2012). VALS Leading in product innovation and technological advances, American Express cardholders would be typed on the highest level of the VALS framework as “innovators”. On the VALS types innovators are described as highly successful, sophisticated with an abundance of resources, receptive to new ideas and technology and enjoy a cultivating experience (www.strategicbusinessinsights.com, 2012). American express has a signature for offering a valuable product and rewarding experiences for it users. American Express also has extremely high value sets that model the company’s operation. The company has strong ideals and believes in providing excellent customers service, community responsibility and global leadership. Product development is highly involved in providing financial solutions and strategies for business owners. Therefore other levels of the VALS segment such as “thinkers”, “achievers”, “experiencers”, "believers”, “makers” and “strivers” can all be American Express’ target customer. 8 American Express Case Study Product Market & Segmentation and Targeting American Express has a brand and reputation that attracts customers and business partners from around the world. American Express strives to differentiate its brand from other credit card companies by making a commitment to provide a variety of products and services that offer flexibility, promote financial responsibility and support communities with common interests. A significant difference in the American Express’ product brand is the spend-centric model. Unlike traditional credit cards, revenue is driven by card member spending and the business from merchants rather than from lending fees and revolving credit balances (www.americanexpress.com, 2012). This places American Express in the unique position to focus on product development and lead as an innovator in the market place. Company Mission American Express has three operation principles that are used to guide the daily action of the company which are 1) offering superior value propositions to all customers 2) providing products, services, benefits and rewards that deliver more value than any competitor and 3) supporting the American Express brand by striving to always provide the world-class service and personal recognition that customers expect from the company (www.americanexpress.com, 2012). Vision We work hard every day to make American Express the world’s most respected service brand. Competition & Competitive Market Analysis In the financial service industry there are many competitors. The top competitor of American Express is cash. The company is still trying to figure out how to obsolete cash because there is always a need for cash in the world, but from a company aspect the top competitors would be J.P. Morgan Chase, Visa, and MasterCard. 9 American Express Case Study One of the biggest competitors of American Express next to cash would be J.P Morgan Chase which is an American multinational banking corporation of securities, investments and retail. It is the largest bank in the United States by assets and market capitalization. It is a major provider of financial services, with assets of $2 trillion. It is also ranked number 28 on the Interbrand Top Global Brands. The platform of “The Way Forward” keeps them relevant to customers and they continue to be a valued expert in the unstable markets (Interbrand, 2011). Next, Visa which is a global payments technology company that connects customers, businesses, and banks in more than two hundred countries worldwide. According to the Interbrand Top Global brands it ranks number 75. Visa’s brand idea is “Better Money for Better Living” which supports the company’s vision of being “The Universal Currency of Life.” They are also committed to innovation and continue to launch new products and services. They have built one of the world’s most advanced processing networks with the capabilities of handling more than 24,000 transactions per second securely. (Interbrand, 2011) Finally there is MasterCard, According to them they have been a leader in the global payments industry for over four decades. They have accepted commerce at an unsurpassed network of more than 28.5 million locations worldwide. MasterCard has also streamlined an intelligent approach to processing enabling efficient commerce on a global scale. This is the largest VPNs in the world which is based on an agile network with speed, integration and reliability. BCG Analysis American Express would be considered a cash cow. It continues to be a leader in the financial services industry being ranked number 23 on the Interbrand Survey. American Express customers on average spend up to 2-4 times as much as customers using competing cards; the average American Express cardholder spent $11,213 per year, excluding cards issued by affiliates. This allows American Express to charge a discount rate over twice as high as either of its main competitors (an average of 2.54%). American Express posted a net 10 American Express Case Study income of $4.1 billion from its total revenues of $27.8 billion. This was an increase from its net income of $2.1 billion and revenues of $24.5 billion (wikinvest). J. P. Morgan would be considered a star. The firm has a significant amount of international exposure, with operations in over 50 countries and clients in every major financial market in the world. JP Morgan Chase reported a full-year total revenue of $115.5B and a net income of $17.4 billion (wikinvest). There are more than 1.7 billion Visa branded cards in the global market. Visa would be considered a border line question mark and cash cow because they are continuing to grow and expand. Visa's operating revenue reached $8.1 billion, and its net income was $3 billion (wikinvest). MasterCard is the second largest electronic payments processor by purchase volume behind Visa in the world. MasterCard reported an income of $1,847 million, a 26% increase over the previous year's $1,463 million (wikinvest). They would be considered boarder line between dog and cash cow because they are still profitable and establishing position within the top financial services. BCG Matrix J.P. Morgan Chase V IS A American Express Master Card 11 American Express Case Study External Market Environment The top brand name credit cards that have been established have been around for decades. In the financial service market it is very competitive and it is hard for new entrants to enter and become leader. The market can be challenging at times because of the economical state and that may have a negative impact on the financial service industry. PEST Analysis Political: President Obama signed the Credit Card Act of 2009 into law May 22, 2009. Millions of credit card users will avoid interest rate increases on existing card balances and have more time to pay their monthly bills, greater advance notice of changes in credit card terms and the right to opt out of significant changes in terms on their accounts. The law has fundamentally changed the way credit card issuers market, bill and advertise credit cards. American Express along with many other card issuers warn it will drive up the price of and limit the availability of credit cards at a time when the country needs more spending to stimulate the economy. Economic: With the economy not being so stable it has had positive and negative effects on peoples borrowing habits. There has been a cut back with borrowing suggesting that people are concerned about the economy. Household are borrowing less and saving more. Some household have increased borrowing by deciding to go back to school. So the economy can have positive and negative influences on American Express. Social: Some American Express’ demographic and socio-economic characteristics are age, gender, marital status, the level of education, the number of dependents in the family, and monthly income. Technological: Technology has had a big influence in the credit card industry. In 2011, dealers saw the development of the new mobile technologies that promise to change the way they accept payments. Mobile 12 American Express Case Study processing has become very popular with many developing companies. American Express should make sure they are up to date with all the technology advances that are happening worldwide. S.W.O.T Analysis & Matrix Strengths: American Express has many strengths which them a competitive company. They developed many products and services over the years which show their diversity. They have travel cards to cater to their customers who travel extensively. With multiple fraud cases happening in the US they have established a Fraud protection program to protect their customer from having to experience this problem. American Express also is highly profitable because they target high income customers. Weaknesses: Like all companies American Express does have weaknesses. The financial credit crisis affected profits due to decrease in consumer spending. There is also an overall lack in consumer confidence because of the economic crisis. Opportunities: American Express could take advantage of some of their opportunities to increase profits for the company. They could market to new customers along with continuing to expand globally. Threats: In this industry there are threats that could negatively affect American Express. One threat that could affect American Express and its customers is the growing global rise of cybercrime and credit card fraud. There is also a lot of competition to compete with along with the new government regulations which can negatively affect the company’s bottom-line. 13 American Express Case Study SWOT MATRIX Opportunities Global expansion Diversify customers Threats Growing global threat of economic cybercrime & fraud Competition with other companies New government regulations Strengths Diversity Innovation Travel services & operations Brand loyalty Stability Fraud Protection Guarantee Target high income customers SO - Strategies Market to different customers Continue to innovate but also expand globally ST - Strategies Continue to provide security and protection to prevent fraud and cybercrime Be aware of government regulations and continue to build brand loyalty Weakness Financial Credit Crisis High membership & annual fees Consumer Confidence is low WO - Strategies Lower fees to appeal to new customers Continue to build consumer confidence WT - Strategies Continue to build customer loyalty by waiving or lower membership fee to prevent competitors from moving in on customer base Marketing Plan Objectives For 2012, American Express entered the prepaid debit card market wanting to eliminate fees and increase rewards promotions to court customers. They desire to see growth through customer focus and interaction. They plan to implement this through connecting with banks and partnering with social media sites such as Facebook. 14 American Express Case Study Differential and Positioning American Express's position is interesting. People might feel that it is lost on the perceptual map by being perceived as somewhat expensive and not widely available. However, you must use caution when interpreting these maps. American Express's target audience is more upscale than the other cards, particularly the Discover Card. Thus, "prestige" could be an important attribute for this segment but it was not investigated in this study. The lesson is that the map is only useful for a set of brands that are appealing roughly to the same target group. Profitability J.P. Morgan Chase American Express Lowliness VISA Prestige MasterCard Non Profitable Marketing Strategy American Express marketing strategy has shown a great deal of evolution from the days of “don’t leave home without it” to its global campaign featuring a new tagline – “WELCOME IN- the power of all of us” and new digital and cable broadcast brand campaign entitled the “Membership Effect”. The objective of this marketing strategy is to educate about the rewards, benefits and experiences of card membership. Encouraging existing and potential members 15 American Express Case Study to “unlock the possibilities and power” of the American Express card. The campaign also emphasizes a macro-marketing approach of working together to build community relationships, support small businesses and promote an eco-friendly lifestyle. Porter’s Strategy & Five Forces Model The Bargaining Power of American Express customer/buyers is high. There are many choices in the market place. One could always choose a product from the competition. Bargaining Power of Suppliers is moderate. This is due to the rapport American express had with its suppliers. Threats of substitutes are high, due to unwanted interest rates and fees. Therefore, customers choose substitutes like prepaid debit cards. Not to mention cash is still the leading threat to American Express. The potential of new entrants to the industry is low. Most consumers are familiar with the established brands in the market and are loyal to their brands because of customer rewards and other incentives. The rivalry amongst competitors exists with American Express, Discover, MasterCard, and Visa. They offer many similar items to increase brand awareness as well as attract and keep customers who are brand loyal. The overall value chain of American Express brings value to its product through brand loyalty and the service behind this product which establishes excellent customer relationships. This also gives them a fair competitive advantage. Marketing Mix American Express has over 22 personal charge, credit cards and small business charge card types that all offer unique features and flexibility to best meet customer needs. Features which include no pre-set spending limits, no annual fee, no interest and an array of rewards programs which include travel and flight, gas, and cashback benefits and rewards. 16 American Express Case Study Marketing Mix/4Ps Product Place • over 22 credit& • Apply online or by charge cards phone • Business Services • Direct mailing • Financial planning & management and Marketing tools Price Annual fees & Membership fees • Annual Percentage Rates (APR %) • Card agreements • Promotion • Special introductory rate offers • Specialized Membership Reward Programs • Other industry Partnerships Implementation and Control The major weakness facing the company is the financial credit crisis which affected American Express’ profit a great deal. During this time customers spent less and saved because of increased concern about the status of the economy. Customers need to be assured that they have financial stability before they will continue or began using credit to make purchases. American Express needs to continue to build their existing customer’s confidence and loyalty by ensuring stability and offering valuable products and services. American Express should continue its efforts to maintain positive relationships with it global partners as wells as gain new customers. 17 American Express Case Study Financial Statistics Dec 31 2008 Restated Dec 31 2009 Restated Dec 31 2010 Restated Dec 31 2011 Other Revenues 3,215.0 2,265.0 1,938.0 2,148.0 TOTAL REVENUES 22,567.0 19,024.0 25,375.0 28,850.0 Cost of Goods Sold 4,931.0 4,553.0 5,591.0 6,934.0 GROSS PROFIT 17,636.0 14,471.0 19,784.0 21,916.0 Selling General & Admin Expenses, Total 12,574.0 9,663.0 11,671.0 12,383.0 Other Operating Expenses 2,017.0 2,693.0 2,899.0 3,091.0 OTHER OPERATING EXPENSES, TOTAL 2,017.0 2,693.0 2,899.0 3,091.0 OPERATING INCOME 3,045.0 2,115.0 5,214.0 6,442.0 Currency Exchange Gains (Loss) -35.0 35.0 -4.0 48.0 Merger & Restructuring Charges -- -161.0 -98.0 -96.0 Other Unusual Items, Total 571.0 852.0 852.0 562.0 Legal Settlements 571.0 852.0 852.0 562.0 3,581.0 2,841.0 5,964.0 6,956.0 710.0 704.0 1,907.0 2,057.0 Earnings from Continuing Operations 2,871.0 2,137.0 4,057.0 4,899.0 EARNINGS FROM DISCOUNTINUED OPERATIONS -172.0 -7.0 -- 36.0 NET INCOME 2,699.0 2,130.0 4,057.0 4,935.0 NET INCOME TO COMMON INCLUDING EXTRA ITEMS 2,684.0 1,802.0 4,006.0 4,877.0 NET INCOME TO COMMON EXCLUDING EXTRA ITEMS 2,856.0 1,809.0 4,006.0 4,841.0 Currency in Millions of US Dollars EBT, INCLUDING UNUSUAL ITEMS Income Tax Expense As of: Graph provided by Investing.businessweek.com 18 American Express Case Study References American Express Company. (2012). Working at American Express Culture. American Express. Retrieved June 13, 2012, for http://careers.americanexpress.com/working/culture/index.html. American Express Company. (2012). Culture Work Environment. American Express. Retrieved June 13, 2012, for http://careers.americanexpress.com/working/culture/work-environment.html. Johnson, A. (2012). American Express says spending growth dips. Retrieved on June 13, 2012 from http://www.marketwatch.com/story/american-express-says-spending-growth-dips-2012-06-13-16485231 Young, R. (2012). Top 10 Common Stocks You Want to Own. Financials, manufacturing, railroad and energy stocks to buy. Retrieved on June 13, 2012 from http://www.investorplace.com/2012/03/top-10-common-stockscountdown-amex-pg-utx-eca-lmt-trow/ Positioning Guide for Market Brands. (2012).Retrieved on June 12, 2012 from http://healthandfitnessbay.blogspot.com/2011/09/positioning-decisions-guide-for.html http://www.marketwatch.com/investing/stock/axp/profile http://www.cardpaymentoptions.com/credit-card-processing/top-credit-card-processing-trends-for-2012/ http://www.usatoday.com/money/economy/story/2012-06-07/consumer-credit-april/55445348/1 http://www.govtrack.us/congress/bills/111/hr627 http://www.strategicbusinessinsights.com/vals/ustypes/innovators.shtml http://www.wikinvest.com/stock/Mastercard_ (MA) (Retrieved 12 June 2012) http://www.wikinvest.com/stock/American_Express_Company_ (AXP) (Retrieved 11 June 2012) http://www.wikinvest.com/stock/J_P_Morgan_Chase_ (JPM) (Retrieved 12 June 2012) http://www.wikinvest.com/wiki/Visa (Retrieved 12 June 2012) http://www.interbrand.com/en/best-global-brands/best-global-brands-2008/best-global-brands-2011.aspx http://www.mastercard.com/us/company/en/ourcompany/the_mastercard_story.html http://investing.money.msn.com/investments/stock-balance-sheet?symbol=AXP& http://investing.businessweek.com/research/stocks/financials/financials.asp?ticker=AXP:US&dataset=incomeSt atement&period=A&currency=nativeInvesting.money.msn.com