Corporate Finance I

advertisement

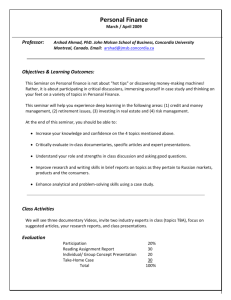

Corporate Finance March / April 2009 Instructor: Contact info: Arshad Ahmad, PhD arshad@jmsb.concordia.ca Text: Berk, J., & DeMarzo, P. (2007) Corporate Finance. Pearson. ISBN: 0-201-74122-9 Other: Ahmad, A. (2007) Corporate Finance: Financial Decisions, Time Value, Investment Techniques. Permachart. A financial calculator is required for this course. Objectives & Learning Outcomes: To welcome you in discovering the exciting discipline of corporate finance! To encourage you to work with financial information and to participate in making financial decisions. To get a deep understanding of the fundamental concepts and to think critically about controversial issues in financial management. The course also provides opportunities to practice, problem solve and apply concepts. At the end of this course, you should be able to: Understand the terminology and basic concepts underlying financial management. Develop a conceptual framework for foundation topics including valuation, investment, financing and risk management. Problem-solve and improve your analytical skills that address fairly complex financial management issues. Identify major & minor problems in case settings & apply tools and concepts to real world issues. Increase your confidence to participate in financial decisions. Evaluation Participation Assignment 1 Assignment 2 Case 1 Case 2 Final Exam Total 10.0 10.0 10.0 15.0 15.0 40.0 100.0 1 Course Schedule Date Chapter (BD Text) Topics MARCH 14 17 21 Review(Ch.1, 4 & 5) 1: The Corporation; 4: Time Value of Money; 5:Interest Rates Practice Problems in class Handout 8: Valuing Bonds 8.1 Cash Flows, Prices & Yields 8.2 Dynamic Behavior of Bond Prices 8.3 The Yield Curve 8.4 Corporate Bonds 9: Valuing Stocks 9.1 Prices, Returns & Investment Horizon 9.2 Dividend-Discount Model 9.3 Total Payout & Free-Cash Flow 9.4 Valuation Based On Comparables 6: Investment Rules 6.1 NPV 6.2 Alternative Decision Rules 6.3 Mutually Exclusive Opportunities 6.4 Selection with Resource Constraints 7: Capital Budgeting 7.1 Forecasting Earnings 7.2 Free Cash Flow & NPV 7.3 Analyzing the Project Mini Case on Relevant Cash Flows Handout Review Assignment Case Discussion ASSIGNMENT 1 DUE CASE 1: The Super Project DUE 2 Date Chapter (BD Text) Topics APRIL 21 10: Capital Markets & The Pricing of Risk 23 14: Capital Structure In A Perfect Market 28 10.5 Common vs Independent Risk 10.6 Diversification 10.7 Estimating Expected Returns 10.8 Risk & the Cost of Capital 10.9 Capital Market Efficiency 14.1 Equity vs Debt Financing 14.2 Modigliani-Miller I 14.3 Modigliani-Miller II 14.4 Capital Structure Fallacies 14.5 MM: Beyond Propositions 15: Debt & Taxes 15.1 The Interest Tax Deduction 15.2 Valuing The Interest Tax Shield 15.3 Recapitalizing 15.5 Optimal Capital Structure with Taxes 18: Capital Budgeting & Valuation with Leverage 18.1 Overview 18.2 The Weighted Average Cost of Capital 18.3 The Adjusted Present Value Method 18.4 The Flow-To-Equity Method 18.5 Project-Based Costs of Capital 18.6 APV With Other Leverage Policies 18.7 Other Effects of Financing ASSIGNMENT 2 DUE 30 Review Chapters Closure & CASE 2: Fojtasek Companies DUE 3 Evaluation Details Participation – 10% For each lecture, you will be asked to identify at least three concepts, terms or issues related to the required reading. You are also encouraged to ask questions and contribute to class discussion 2 Assignments (Individual or Group Activity) - 20% Each assignment will consist of 30 percent theory and the remainder will be problem solving. The format will include true/false, multiple choice and open ended questions and will simulate the final exam. 2 Cases (Group Activity) 30% A case report consists of defining the problem, conducting analysis, and arriving at a conclusion(s) for action. The length of the report is 3 pages, 12 font, double spaced. There are no limits to appendices. Case Reports must use the following format: Introduction & Problem Statement: Summarize and highlight events and information from the case that provides a context for your problem statement and analysis. Identify the main issue or central problem that you will address as well as other related issues. Max length: ½ page. Analysis: Specify any assumptions to proceed with case information. Using case information only, develop arguments supported by calculations. Demonstrate deep understanding of the issues. Present evidence to back up and substantiate decisions that you have undertaken. Determine and weigh alternative courses of action. Max length: 2 pages. Conclusions: Summarize how you have addressed the main problem and related issues. Detail follow up and recommendations. Max length: ½ page. Important: Imagine your report will be submitted to a client or a superior in the organization. It should follow professional report writing standards and avoid unnecessary jargon. Final Exam 40% The Final Exam will be 3 hours long and will consist of 30 percent theory and the remainder (70 percent) will be problem solving. The format will include true/false, multiple choice and open ended questions. 4 ARSHAD AHMAD, Ph.D. Dr. Arshad Ahmad is an Associate Professor in the Department of Finance at Concordia University in Montreal, Canada. Dr. Ahmad has led his faculty in numerous pedagogical innovations. He was the first to introduce an elective web based course in Personal Finance, which today attracts over 500 students each semester. He was also the first to design business courses using theory-based models from cognitive and instructional science. For his PhD thesis, he validated an open learning model that earned him the George L. Geis best dissertation award in higher education. Winner of several teaching awards, Dr. Ahmad was awarded a 3M National Teaching Fellowship in 1992 for teaching excellence and educational leadership. For the past six years, he has been Coordinator of the Fellowship Program. Dr. Ahmad has also produced a rich variety of learning materials that include three textbooks, several supplements, case studies, video series, CD ROMs, web-course frameworks, and other devices on the world wide web. For his expertise in Corporate Finance, Interdisciplinary Curriculum design, Technology Integration, Pedagogy and Professional Development, Dr. Ahmad has been invited to give seminars and workshops to Universities & Colleges across Canada. He has also worked extensively in both the public and private sector Institutions in the US, Germany, France, Latvia, Lithuania, Slovenia, Serbia, Trinidad & Tobago, China, and Pakistan as a trainer, consultant and seminar leader. Arshad Ahmad, Ph.D. Associate Professor 3M Teaching Fellow & Program Coordinator Concordia University 1455 deMaisonneuve West Montreal, Que. H3G 1M8 (514) 848-2424 extension 2928 email:arshad@jmsb.concordia.ca 5