Has the “Golden Rule” Lost its Aura? Revisiting Multimarket

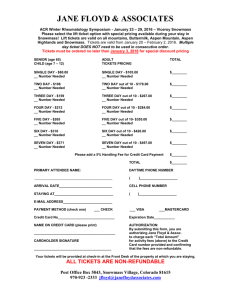

advertisement

Has the “Golden Rule” Lost its Aura? Revisiting Multimarket Contact under Asymmetric Pricing in the U.S. Domestic Airline Industry (COMPLETED RESEARCH) Ramnath K. Chellappa Raymond Sin V. Sambamurthy [ram@bus.emory.edu] [rsin@ust.hk] [sambamurthy@bus.msu.edu] Goizueta Business School, School of Business and Eli Broad Graduate School of Emory University Management Management 1300 Clifton Road Hong Kong University of Michigan State University Atlanta GA 30322 Science & Technology, Hong East Lansing, MI 48824 Kong Abstract Extant research suggests that tacit collusion or the “golden rule” of refraining from aggressive pricing in jointly contested markets is an integral feature of the US airline industry. Our research revisits this past wisdom in the presence of airlines that pursue a distinctly different pricing strategy. Amongst airlines, Southwest and JetBlue largely practice an Everyday Low Price (EDLP) price-format which can be best characterized as a portfolio-level pricing strategy while most others engage in some form of temporal fare promotions. In a first study using both posted and transacted airline prices, we examine the impact of asymmetric pricing strategies on the understanding of multimarket contact (MMC). By first ignoring these differences in pricing strategy, we 1 are able to replicate extant results, i.e. the golden rule appears to be followed throughout this sector even in today and for purely online tickets. We then separately identify multimarket contact of a focal firm with like and asymmetric firms and develop both carrier-route and route-level measures of MMC. Our results confirm that the impact of MMC on prices is rendered insignificant (or less significant) when accounting for the presence of this alternative pricing strategy. Subsequently we differentiate between MMC with similar carriers and those with EDLP carriers. Our findings show that while tacit collusion appears to take place when MMC occurs between non-EDLP carriers, MMC with EDLP carriers actually lowers prices in the marketplace. Further, it also appears that EDLP airlines avoid MMC with each other. Our findings argue that any tacit collusion from mutual forbearance is a possibility only when both firms in contact are likely to employ price changes; when there is asymmetry in the pricing rationale there is no scope for tacit collusion. We conclude with a call to include such asymmetries in pricing mechanisms for other industry contexts as well in newer gametheoretic formulations of MMC. 1. Introduction While general economic theories on pricing and competition suggest that firms may compete on the basis of price (Bertrand), quantity (Cournot) quality (vertical differentiation), or consumers’ preferences (horizontal differentiation), a different stream of literature emerges and points out that a different dynamic exists in the competition among firms that compete in more than one market. For example, Burger King 2 competes with McDonalds in Austin as well as in Houston. This type of competition is known as “multimarket competition”. Extant research in this area suggests that rational firms will not undercut multimarket competitors in a given market as they will foresee a response from their competitors in other markets leading to mutual forbearance, a form of tacit collusion, and higher prices. Such behavior is purportedly observed in a number of industry contexts, such as the cell phone, software, and airline industries (Evans and Kessides 1994; Busse 2000; Chellappa et al. 2010). The airline industry, in particular, has received revived interest among academic researchers due to innovations in information technology (IT). Advancements in IT and the ubiquity of the Internet have enabled airlines to not only execute sophisticated pricing algorithms, but the lowered menu costs have also allowed airlines to run promotions and push them to consumers through their own websites or online travel agents. Extant research suggests that tacit collusion or the “golden rule” of refraining from aggressive pricing in jointly contested markets is an integral feature of the US airline industry. Our research revisits this past wisdom in the presence of airlines that pursue a distinctly different pricing strategy. Amongst airlines, Southwest and JetBlue largely practice an Everyday Low Price (EDLP) format which can be best characterized as a portfolio-level pricing strategy while most others engage in some form of temporal fare promotions. In a first study using both posted and transacted airline prices, we examine the impact of asymmetric pricing strategies on the understanding of multimarket contact (MMC). By first ignoring these differences in pricing strategy, we are able to replicate extant results, i.e. the golden rule appears to be followed 3 throughout this sector even today and in electronic markets. We then separately identify multimarket contact of a focal firm with like and asymmetric firms and develop both carrier-route and route-level measures of MMC. Our results confirm that the impact of MMC on prices is rendered insignificant (or less significant) when accounting for the presence of this alternative pricing strategy. Subsequently we analyze MMC with similar non-EDLP carriers and those with EDLP carriers. Our findings show that while tacit collusion appears to take place when MMC occurs between non-EDLP carriers, MMC with EDLP carriers actually lowers prices in the marketplace. Further, it also appears that EDLP airlines avoid MMC with each other. Our findings argue that any tacit collusion from mutual forbearance is a possibility only when both firms in contact are likely to employ price changes; when there is asymmetry in the pricing rationale there is no scope for tacit collusion. We conclude with a call to include such asymmetries in pricing mechanisms for other industry contexts as well in newer gametheoretic formulations of MMC. 2. Data and Method In this section, we first discuss the nature of our data and explain the econometric model employed in this study. We then discuss the operationalization of various multimarket contact measures and conclude with a discussion of the variables used in our econometric analysis. 4 2.1 Data Our data is collected from two primary sources. First, we obtained prices and detail descriptions of airline tickets from online travel agents and individual airlines’ websites. This raw data on offered tickets was gathered using web-based spiders that we developed using Curl, and later processed by a parser that we wrote in Perl and other database scripting languages. In addition to the set of all major U.S. carriers and online travel agents, a list of the top 500 U.S. domestic routes – which account for over 86% of all domestic passenger enplanements in the U.S. – was provided as input to the spiders. The spiders were sent out on a daily basis in the third quarter of 2004 to collect price and other attribute information for tickets requiring one- to four-week advance purchases, including weekday as well as weekend departures and returns. Our agents operated in parallel and submitted identical reservation requests to all online travel agents and airlines’ websites simultaneously in order to minimize price variations that may arise from the timing of ticket requests. We restrict our attention to only coach class, non-refundable, roundtrip tickets. Further, to control for any price difference that may be attributed to differences in flight duration or the number of connections on any given route, we consider flights that have at most one stop between an origin and a destination. As a result, 46,854 observations – approximately 4.15% of the full sample – have been eliminated. Our final data set includes 1,083,515 unique tickets and final prices, including taxes and fees, offered by fourteen network carriers. 5 Second, we constructed a comparable dataset on purchased tickets using the Origin and Destination Survey (DB1B) for the corresponding routes and carriers in the same quarter of 2004. DB1B is a 10% sample of all airline tickets sold by reporting carriers, including origin, destination and other itinerary details of passengers transported. After restricting our attention to only coach class, non-refundable roundtrip tickets with at most one stop on each way, the resulting number of observations for purchased tickets is 142,595. Further, we used the Air Carrier Statistics (Form 41 Traffic and 298C Summary Data) provided by the U.S. Bureau of Transportation Statistics to assemble data on airlines’ operational details, as well as information on the respective markets (e.g. origin-destination distance, hub information, etc.). We also collected information on market share and the number of competing airlines in each origin-destination pair from DB1B in the second and third quarters of 2004. We then merged this dataset that contains detailed information on airlines and markets with the pricing data on offered tickets (collected online) and purchase tickets (based on DB1B), respectively. This yielded a complete profile of all relevant variables at the ticket level, allowing us to control for various market- and airline-specific factors in our examination of the effects of multimarket contact on airline pricing. We subsequently created two subsets of data, one that consists of only observations from HILO airlines while the other consists of only observations from EDLP airlines, from the full sample to perform additional analyses that complement our main investigation. 6 Table 1 summarizes the operationalization of variables included in this study; and Tables 2 and 3 report descriptive statistics for our data. 2.2 Model Our baseline model is a replication of the model employed by Evans and Kessides (1994), and is of the following form: ln pricekm m km Xkm ~ N 0, ~ N 0, Zm k m km (1) where pricekm is the average fare charged by airline k on route m, Xkm are variables that vary by the airline’s identity within a given route, and Zm are route characteristics. The three-part error structure consists of a carrier effect k , a route effect m that is common to all carriers on an observed route, and a white-noise error that is specific to the observation at the carrier-route level km . Consistent with extant empirical studies on airline pricing where the dependent variable is at the carrier-route level (e.g. Borenstein (1989), Borenstein and Rose (1994), Hayes and Ross (1998)), Chellappa et al. (2011)), and a Hausman test on random-effects specification, we treat the airline effects as fixed while the route effects as random. The variables that we include in the X vector are: directkm , the percentage of tickets offered by airline k on route m that are direct flights; hubkm , a variable that indicates if at least one endpoint airport on the observed route is a hub for airline k; 7 and RTsharekm , the market share of airline k on route m. We include the following variables in the Z vector: ln distancem , the natural logarithm of distance (in miles) between the origin and destination airports on the observed route; ln distancem square of ln distancem 2 , the to capture the non-linear effects of distance on prices due to economies of scale from fuel efficiency on long-distance flights; RTherfm , the Herfindahl index for route m; and EDLPmktm , a variable that indicates if at least one of the airlines that operate in the observed market is an EDLP carrier. Finally, our measure of multimarket contact is included in either the X vector or the Z vector, depending on the unit of measurement. We estimate our model using both the measures proposed by Evans and Kessides (1994) – MMCEKm , a route level measure included in the Z vector – and by Baum and Korn (1996) – MMCBKkm , a carrier-route level measure included in the X vector – respectively. We compute the additional measure at the carrier-route level in order to explore the implications of multimarket contact at the same level as the dependent variable. This approach is not only consistent with that in extant literature that studies multimarket contact in various contexts (Feinberg 1985; Pilloff 1999; Coccorese and Pellecchia 2009; Chellappa, Sambamurthy et al. 2010), but is also recommended by Gimeno and Jeong (2001) based on an extensive review of existing research on multimarket competition. In particular, Gimeno and Jeong observe that while the multimarket construct can be operationalized at different levels of analysis (e.g. markets, firms-in-markts, dyadic pairs of firms), it is necessary to “align analyses 8 with the level of dependent variables” (p. 363). The operationalization of the multimarket contact measures employed in this study is presented in the Appendix. 3. Results Table 4 is a replication of Evans and Kessides’s (1994) model using prices of both offered tickets (spider data) and purchased tickets (DB1B data). The signs of the coefficient estimates of the variables are largely consistent with those reported in Evans and Kessides; the only exceptions are the estimates of the Herfindahl index for purchased tickets, which are negative as opposed to positive. A negative sign suggests that prices increase with intensity of competition, which may be attributed to tacit collusion posited in the theory of multimarket contact. Notice that the coefficient estimates for the multimarket contact variables are positive and significant. The results are robust for both types of tickets, and for multimarket contact measured at both the route level MMCEKm and the carrier-route level MMCBKkm . In sum, when we employ the same set of variables that are considered in Evans and Kessides, the conclusion that we draw on the effects of multimarket contact on firm’s pricing are largely consistent with those reported in prior literature. Table 5 presents the coefficient estimates of a modified model, which includes the EDLP market identifier, on the same sets of data. We can make two key observations from the results: First, the EDLPmktm indicator variable is negative and highly significant; this suggests that prices of tickets in markets where EDLP carriers operate are lower than those in other markets. Second, both multimarket contact measures for 9 offered tickets become insignificant once EDLPmktm is introduced. For purchased tickets, even though the coefficients for MMCEKm and MMCBKkm remain positive and significant, the magnitudes of these coefficients are approximately 40% smaller compared to those reported in Table 4. These two results indicate that airlines’ pricing behaviors vary significantly with markets characterized by different competitive environments, which are largely defined by the presence of EDLP airlines. Do these results imply that the traditional understanding of the relationship between multimarket contact and pricing is no longer applicable? Or do they simply point towards the possibility that multimarket contact can have different implications on how firms set prices depending on the type of competitors with whom they engage in multimarket contact? In the subsequent analysis, we aim to shed light on this issue by decomposing the multimarket contact measure into separate components according to the types of competitors that an airline come into contact with. Table 6 presents the coefficient estimates of the model that incorporates two decomposed MMC measures defined at each level, and focuses only on HILO observations. The decomposition is based on the type of firms with whom that an airline engages in multimarket contact. At the route level, MMCEKm is broken down into eMMCEKm , which calculates only the contacts between HILO airlines and EDLP airlines; and hMMCEKm , which calculates only the contacts among HILO airlines. Likewise, MMCBKkm is broken down into eMMCBKkm and hMMCEKm accordingly. As with the previous models, we conduct the analysis using both offered tickets and purchased tickets. 10 Two very interesting observations emerge from this model: First, the coefficient estimates for both eMMCEKm and eMMCBKkm are negative and significant; and the result is robust with respect to both offered tickets and purchased tickets. This suggests that, other things being constant, when a HILO airline engages in multimarket contact with an EDLP carrier, it actually lowers its prices as opposed to charging higher prices that implies tacit collusion. In fact, extant research suggests that EDLP is a deliberate pricing strategy that is not reactive to competitors’ pricing (Sin et al. 2009); further, the presence of EDLP firms in a market changes not only the overall distribution of prices at the market level but also the distributions of prices of individual competing firms (Chellappa, Sin et al. 2011). In other words, while a HILO carrier may ideally want to engage in tacit collusion with EDLP airlines, it really has no choice but to lower its own price to battle with this type of competitors. Second, with the exception of offered tickets, hMMCEKm and hMMCBKkm are both positive and significant. This suggests that a HILO airline charges higher prices when engaged in multimarket contacts with other airlines that employ similar pricing strategies. The second result is highly consistent with findings reported by existing literature. 3.1 Discussion and conclusions A main goal of this research is to examine the impact of multimarket contact on prices. Whilst there is much research in the airline industry on this subject, two fundamental factors that can potentially influence prices – presence of EDLP airlines and the shift towards electronic markets, have not been accounted for. 11 From our analysis, we can conclude that if the presence of asymmetric pricing strategies is ignored, then we shall observe that the results are similar to that of extant research even for online prices, i.e., multimarket contact will lead to higher online prices. However, the moment we identify the differences in airlines’ pricing strategies in this assessment, we see fundamentally different results. We observe that when network airlines meet EDLP carriers, the prices are reduced. Essentially our research underscores the tension between firms’ ability to practice their adopted pricing strategy and the dictates of the market. 12 Appendix: Table 1: Description of Variables Factor Variable Related Literature Explanation Ticket Direct flights (Evans and The percentage of tickets offered by airline k on route m that Kessides 1994) are direct flights. Characteristic Directkm (Borenstein 1989; Borenstein 1991; An indicator variable equals to 1 if at least one of the endpoint Berry et al. 1997; airports on a given route is a hub for the observed airline; 0 Hayes and Ross otherwise. Hub hubkm Airline 1998) Characteristics (Borenstein 1989; Market Share RTsharekm Borenstein and The observed carrier’s share of passengers on the observed Rose 1994; Evans route. and Kessides 13 1994; Baum and Korn 1996) (Borenstein 1989; Evans and Kessides 1994; Market distance Non-stop distance (in miles) between the origin and the Berry, Carnall et destination airports on the observed route. distancem al. 1997; Hayes Market and Ross 1998; Characteristics Stavins 2001) (Borenstein 1989; Borenstein and Herfindahl Index Rose 1994; Evans Herfindahl index for all passengers on the observed route. RTherfm and Kessides 1994) 14 Average Route (Evans and Route level measure of multimarket contact, based on Evans Kessides 1994) and Kessides (1994). (Baum and Korn Carrier-route level measure of multimarket contact, based on 1996) Baum and Korn (1996). (Chellappa, Sin et An indicator variable equals to 1 if at least one EDLP airline al. 2011) (Southwest or JetBlue) operates in the market; 0 otherwise. Contact Multimarket MMCEKm Contact Multimarket Measures Contact MMCBKkm EDLP market Price-format EDLPmktm 15 Table 2: Descriptive Statistics on Offered Tickets (N=2,064) MEAN STD Min pricekm distancem Max Correlation Matrix 377.28 139.93 101.13 1200.79 1.00 1173.58 629.32 148.00 2586.00 0.34 1.00 directkm 0.22 0.34 0.00 1.00 -0.20 -0.34 1.00 hubkm 0.34 0.47 0.00 1.00 -0.03 -0.15 0.65 1.00 RTsharekm 0.23 0.29 0.01 1.00 -0.14 -0.15 0.71 0.60 1.00 RTherfm 0.49 0.20 0.00 1.00 -0.14 -0.47 0.13 0.11 0.05 1.00 MMCEKm 130.94 50.04 0.00 268.00 0.17 -0.30 0.10 0.06 -0.03 0.08 1.00 MMCBKkm 0.56 0.17 0.00 0.98 0.09 -0.16 0.07 -0.04 -0.05 0.03 0.73 1.00 EDLPmktm 0.19 0.39 0.00 1.00 -0.29 0.02 0.00 0.01 0.08 0.09 -0.53 -0.48 1.00 Table 3: Descriptive Statistics on Purchased Tickets (N=2,057) MEAN STD pricekm distancem Min Max Correlation Matrix 315.82 99.23 64.00 956.00 1.00 1173.05 627.97 148.00 2586.00 0.35 1.00 directkm 0.30 0.39 0.00 1.00 0.05 -0.30 1.00 hubkm 0.34 0.47 0.00 1.00 0.20 -0.15 0.61 1.00 RTsharekm 0.23 0.29 0.01 1.00 0.17 -0.15 0.74 0.60 1.00 RTherfm 0.49 0.20 0.00 1.00 -0.20 -0.47 0.11 0.11 0.05 1.00 16 MMCEKm 130.85 49.96 0.00 286.00 0.18 -0.29 0.05 0.06 -0.03 0.08 1.00 MMCBKkm 0.56 0.17 0.00 0.98 0.14 -0.16 0.04 -0.03 -0.05 0.03 0.73 1.00 EDLPmktm 0.19 0.39 0.00 1.00 -0.32 0.02 0.03 0.01 0.09 0.09 -0.53 -0.48 1.00 Table 4: Estimates of model, omitting the EDLP market identifier Independent Route Level MMC Carrier-Route Level MMC variables Offered Purchased Purchased tickets Offered tickets tickets tickets -1.7698* 2.5660*** -2.0884** 2.5834*** (1.0470) (0.7805) (1.0530) (0.7861) 1.9393*** 0.5891** 2.0802*** 0.6089** (0.3207) (0.2383) (0.3217) (0.2402) -0.1224*** -0.0257 -0.1343*** -0.0285 (0.0243) (0.0180) (0.0243) (0.0181) 0.0151 0.0742*** 0.0221 0.0825*** (0.0247) (0.0204) (0.0247) (0.0204) 0.0159 0.0378** 0.0176 0.0393*** (0.0136) (0.0150) (0.0136) (0.0151) 0.0588 0.3773*** 0.0439 0.3567*** (0.0385) (0.0382) (0.0385) (0.0382) -0.0004 -0.1349** -0.0682 -0.1681*** (0.0734) (0.0547) (0.0717) (0.0544) INTERCEPT ln distancem ln distancem 2 directkm hubkm RTsharekm RTherfm 17 0.0010*** 0.0014*** (0.0002) (0.0002) -- -- -- -- 0.1463*** 0.3255*** (0.0510) (0.0461) MMCEKm MMCBKkm EDLPmktm N -2LL -- -- -- -- 2064 2057 2064 2057 -418.9 -426.7 -416.5 -417.3 Table 5: Estimates of model, including the EDLP market identifier Independent Route Level MMC Carrier-Route Level MMC variables Offered Purchased Purchased tickets Offered tickets tickets tickets -1.4154 2.7967*** -1.4602 2.8861*** (1.0111) (0.7563) (1.0128) (0.7597) 1.8698*** 0.5458** 1.8928*** 0.5310** (0.3093) (0.2307) (0.3093) (0.2320) -0.1171*** -0.0224 -0.1190*** -0.0219 (0.0234) (0.0174) (0.0234) (0.0175) 0.0126 0.0744*** 0.0137 0.0789*** (0.0246) (0.0203) (0.0245) (0.0203) 0.0190 0.0416*** 0.0195 0.0426*** (0.0135) (0.0149) (0.0135) (0.0149) INTERCEPT ln distancem ln distancem 2 directkm hubkm 18 0.0453 0.3539*** 0.0423 0.3408*** (0.0384) (0.0381) (0.0382) (0.0379) 0.0542 -0.0995* 0.0448 -0.1073** (0.0712) (0.0532) (0.0703) (0.0531) 0.0002 0.0009*** (0.0002) (0.0002) -- -- -- -- 0.0193 0.1978*** (0.0529) (0.0486) RTsharekm RTherfm MMCEKm MMCBKkm -0.2382*** -0.1638*** -0.2485*** -0.1852*** (0.0358) (0.0269) (0.0328) (0.0253) 2064 2057 2064 2057 -456.9 -457.2 -467.1 -463.9 EDLPmktm N -2LL Table 6: Estimates of model with decomposed MMC measures (HILO observations only). Independent Route Level MMC Carrier-Route Level MMC variables Offered Purchased Purchased tickets Offered tickets tickets tickets -0.6865 3.8925*** -0.0716 4.3154*** (1.1308) (0.8657) (1.1382) (0.8672) INTERCEPT 19 1.6648*** 0.2570 1.4512*** 0.1236 (0.3435) (0.2620) (0.3458) (0.2629) -0.1037*** -0.0035 -0.0875*** 0.0062 (0.0259) (0.0197) (0.0260) (0.0197) 0.0855*** 0.0507** 0.0821*** 0.0513** (0.0276) (0.0220) (0.0275) (0.0220) 0.0116 0.0368** 0.0098 0.0360** (0.0138) (0.0156) (0.0138) (0.0156) 0.0074 0.4414*** 0.0213 0.4468*** (0.0425) (0.0424) (0.0423) (0.0422) 0.1772** -0.0433 0.1759** -0.0466 (0.0774) (0.0586) (0.0770) (0.0583) -0.0065*** -0.0051*** (0.0013) (0.0010) -- -- -0.0001 0.0005*** (0.0002) (0.0002) -- -- -- -- -0.1638*** -0.1749*** (0.0428) (0.0350) 0.0869* 0.1439*** (0.0446) (0.0406) ln distancem ln distancem 2 directkm hubkm RTsharekm RTherfm eMMCEKm hMMCEKm eMMCBKkm -- -- hMMCBKkm N -2LL 1940 1933 1940 1933 -446.1 -362.8 -460.3 -387.0 20 21 Multimarket Contact Measures 1. Average Route Contact (Evans and Kessides, 1994): 1 MMCEKm fm fm 1 / 2 Dkm D jm where akj akj Dkm D jm k j k 1 m k,j indicate the identity of two firms. Hence akj calculates the total number of akj Dkm Djm is contacts between k and j across all markets. The numerator, k j k 1 the total number of cross-market contacts between pairs of firms that are active in market m. In the denominator, fm is the number of firms that are active in market m. fm fm 1 / 2 is the number of firm pairs in market m. 2. Firm-in-market Level Multimarket Contact (Baum and Korn, 1996): Dkm D jm j k m MMCBKkm Dkm N mmc j s.t. Dkm Djm 1 m m where m denotes the observed (focal) market in a set of potential markets M, Dkm Djm is an indicator variable set equal to 1 if firm k (j) is active in market m and to 0 otherwise. Dkm The numerator Djm counts the total number of contacts j k m between firm k and firm j across all markets, in which both firms meet at least once outside the focal market. For firms that firm k encounters only in the Dkm observed market, Djm equals 1, hence their contacts with firm k will m be excluded from the calculation of MMCBKkm . 22 Dkm denotes the total number of markets in which firm In the denominator, k m operates. This is a proxy measure of “firm size”. N mmc denotes the number of firms that are active in market m which also contact firm k in markets outside the focal market. In other words, MMCBKkm is a relative measure of multimarket contact, which is scaled by the size of firm k and the number of competitors; it measures the relative importance of market m to firm k, taking into account the potential influence that firm i’s competitors may have on its cross-market performance. Instrumental Variable Approach It is reasonable to expect that an airline’s share of passenger on a route RTshare , as well as the Herfindahl index constructed from this variable RTherf , to be endogenous to the price that it charges; a Hausman specification test rejects exogeneity for RTshare and RTherf . We resolve this issue by using instrumental variable and the two-stage least square approach. Following Borenstein (1989) and Borenstein and Rose (1994), we use the geometric share of enplanements of an observed carrier at the endpoints of a given route as the instrument for its market share, and later use it to construct the instrument for RTherf . The geometric enplanement share of the observed airline i on a given route is defined as follows: 23 ENPi1 ENPi 2 GENPSH i (2) ENPj 1 ENPj 2 j where j indexes all airlines; ENPj 1 and ENPj 2 are airline j ’s average daily passenger enplanements at the two endpoint airports on the observed route during the second quarter of 2004. In other words, GENPSHi is defined as the observed carrier’s geometric mean of passenger enplanements at the endpoints of a route divided by the sum of the geometric mean of each carrier’s enplanements at the endpoint airports across all carriers on the observed route. We construct the instrument for RTherf using the square of the fitted value RTshare from the first-stage regression, plus a rescaled sum of squares of the shares of all other carriers: IRTherf 2 RTsharei RTherf 1 RTsharei2 RTshare 2 2 1 RTshare i (3) where i indexes the observed airline. The rationale behind the second term in IRTherf is that the concentration of traffic on a route that is not served by the observed airline is exogenous to the price of the observed airline; for example, Delta’s price on the Boston–LaGuardia Airport route does not affect the division of passengers between American and United. The rescaling ensures that the part in a Herfindahl index that is calculated for passengers who do not travel on the observed carrier remains unchanged. We then use IRTherf as the excluded exogenous variable in the first-stage regression of RTherf that generates RTherf . 24 References Baum, J. A. C. and H. J. Korn. 1996. Competitive Dynamics of Interfirm Rivalry. Academy of Management Journal 39(2)255-291. Berry, S., M. Carnall and P. T. Spiller. 1997. Airline Hubs: Costs, Markups and the Implications of Customer Heterogeneity. NBER Working Paper #5561. Borenstein, S. 1989. Hubs and High Fares: Dominance and Market Power in the U.S. Airline Industry. The RAND Journal of Economics 20(3)344-365. Borenstein, S. 1991. The Dominant-Firm Advantage in Multi-Product Industries: Evidence from the U.S. Airlines. Quarterly Journal of Economics 106(November). Borenstein, S. and N. L. Rose. 1994. Competition and Price Dispersion in the U.S. Airline Industry. The Journal of Political Economy 102(4)653-683. Busse, M. R. 2000. Multimarket Contact and Price Coordination in the Cellular Telephone Industry. Journal of Economics and Management Strategy 9(3)287320. Chellappa, R. K., V. Sambamurthy and N. Saraf. 2010. Competing in Crowded Markets: Multimarket Contact and the Nature of Competition in the Enterprise Systems Software Industry. Information Systems Research 21(3). Chellappa, R. K., R. G. Sin and S. Siddarth. 2011. Price-Formats as a Source of Price Dispersion: A Study of Online and Offline Prices in the Domestic US Airline Markets Information Systems Research 22(1). Coccorese, P. and A. Pellecchia. 2009. Multimarket Contact and Profitability in Banking: Evidence from Italy. Journal of Financial Services Research 35(3)245-271. 25 Evans, W. N. and I. N. Kessides. 1994. Living by the "Golden Rule": Multimarket Contact in the U.S. Airline Industry. The Quarterly Journal of Economics 109(2)341-366. Feinberg, R. M. 1985. "Sales-at-Risk": A Test of the Mutual Forbearance Theory of Conglomerate Behavior. Journal of Business 58(2)225-241. Gimeno, J. and E. Jeong. 2001. Multimarket Contact: Meaning and Measurement at Multiple Levels of Analysis. Multiunit Organization and Multimarket Strategy. J. A. C. Baum and H. Greve. JAI Press, London. Hayes, K. J. and L. B. Ross. 1998. Is Airline Price Dispersion the Result of Careful Planning or Competitive Forces? Review of Industrial Organization 13(5)523541. Pilloff, S. J. 1999. Multimarket Contact in Banking. Review of Industrial Organization 14(2)163-182. Sin, R. G., R. K. Chellappa and S. Siddarth. 2009. Strategic Implementation of "Everyday Low Price" in Electronic Markets: A Study of Airline Pricing on the Internet. Proceedings of the 14th Conference on Information Systems and Technology, San Diego. Stavins, J. 2001. Price Discrimination in the Airline Market: The Effect of Market Concentration. Review of Economics and Statistics 83(1)200-202. 26