DP 1392-11 - Institute for Research on Poverty

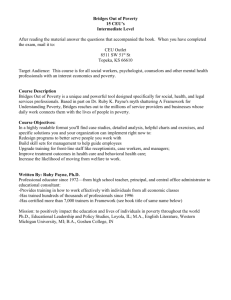

advertisement