Textiles Monitor December 2013

advertisement

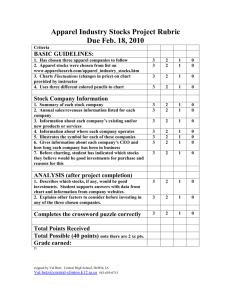

GREAT AMERICAN GROUP ADVISORY & VALUATION Textiles and Apparel Monitor SERVICES December 2013 - Volume 12 In this Issue: Introduction 1 Overview 2 Recent Appraisal Trends 2 Monitoring Points 3 Pricing Trends 4 Reference Sheet 7 Monitor Information 8 INTRODUCTION While overall economic growth has been less than impressive in 2013, cautious optimism persists in the textiles industry. Possibly the most important development in the domestic textiles market has been the narrowing of the gap between U.S. and Chinese production costs. According to a recent study by the Boston Consulting Group, the gap between U.S. and Chinese production costs will decline to only 5% by 2015. The waning cost gap is due to rising pay among Chinese workers and the declining cost of U.S. energy based on domestic gas and oil fracking innovations. Boston Consulting Group also predicts that American production costs will be between 8% and 18% lower than those of major industrial countries such as Germany, Japan, the U.K., France, and Italy. Trend Tracker Textiles Apparel NOLVs Consistent Mixed Sales Trends Increasing Increasing Gross Margin Consistent Consistent Inventory Increasing Increasing Pricing Mixed Mixed Market Prices Commodity Quarter Year Cotton Decreasing Increasing Synthetics Decreasing Consistent Recent figures suggest that after-tax profits in the U.S. textiles industry for the second quarter of 2013 totaled $505 million, which is a 31% year-over year increase. Within the textile mills segment, after-tax profits as a percentage of sales climbed nearly 5% versus the second quarter of 2013, indicating higher margins. NOLVs Textiles: NOLVs were consistent based on Economic consulting firm Global Insight estimates that earnings for textile mills will be up approximately 75% in 2013 compared to 2012. However, 2014 is likely to see far more modest improvement of between 2% to 7% from this year. It is also likely that the textiles industry will at least keep pace with the overall state of the economy. However, major advancement is unlikely. With the cost of materials and energy likely remaining relatively consistent, production per employee rising, and import levels flattening, the domestic market is poised to remain stable in 2014. particularly within the home furnishings sector. Apparel: Sales increased due to better domestic demand and company-specific factors. offsetting factors, including higher demand and inventory levels and flat gross margins. Apparel: NOLVs were mixed based on company-specific factors. Sales Trends Textiles: Sales increased due to higher demand, Gross Margin Textiles and Apparel: Gross margins remained consistent due to flat raw material prices, as recent declines had not yet impacted margins. Inventory Textiles and Apparel: Inventory increased due to higher demand from customers, in addition to company-specific factors. 1 OVERVIEW The adjacent figure illustrates the producer price index, which denotes the selling prices received by domestic producers for their output, for textile mills versus textile product mills. Textile mills include a variety of processes such as yarn spinning; primary textile products manufacturing; intermediate yarn processes such as carding, combing, texturing, twisting; fabric and thread weaving and braiding; and production of nonwoven fabrics and textile finishing for both cotton and synthetic fibers. Textile product mills include carpet and rug mills; curtain and drapery mills; various household textile product mills; canvases; cordage mills; and other downstream textile processes and products. Producer Price Indexes Textile Mills versus Textile Product Mills November 2012 through October 2013 129.0 128.5 128.0 127.5 127.0 126.5 126.0 125.5 125.0 Textile Mills Textile Product Mills RECENT APPRAISAL TRENDS TEXTILES GA has witnessed NOLVs for textile companies largely holding steady in recent months, with minor fluctuations as a result of specific occurrences at individual companies. The overall revenue trends were mostly positive, with some companies referencing slightly improved consumer demand as the reason for the uptick and others pointing to the improved home-building, construction, and renovation markets; these factors also resulted in increasing inventory levels. With input costs fluctuating less than prior years, those large swings in gross margin of appraisals past have had less of an impact this year, and indeed this most recent quarter. As always, even in relatively stable markets, individual companies have occurrences and shifts unique to them, which can have a meaningful impact on NOLVs. The age of a company’s inventory, the levels of slow-moving inventory, or overall mix can shift quickly, and these metrics should continue to be monitored. APPAREL GA has appraised a number of apparel companies in recent months, and while swings in NOLVs were modest, within two points of those from the prior appraisal, the overall outlook was largely positive, as GA witnessed some sales trend improvements in the double-digits, particularly with companies in the industrial or specialty apparel markets. The fluctuations GA witnessed were driven largely by specific changes at these companies, often related to the age or velocity of inventory. While it depends on the end-market being served, apparel can often be an industry where the age of inventory can change quickly based on factors such as consumer preference. Due to product introductions and upticks in consumer demand, GA observed rising inventory levels among apparel companies in the third quarter. Domestic suppliers of apparel, especially consumer apparel, often have large concentrations of sales within a few top customers. These relationships should continue to be monitored, as any deterioration can have a substantial impact on a company’s NOLVs. 2 MONITORING POINTS Monitoring Point Impact Monitor current input costs such as Depending on the cost methodology of a company, including the frequency with which it cotton, polyester, and nylon versus updates standards, the spread between the cost of inventory and current market prices can lead to large swings in the value of the underlying collateral. Currently, prices remain the current cost of inventory. relatively low, which could result in gross margin expansion in the coming months. Monitor international markets and A variety of international concerns may impact demand and pricing within the textiles their impact on the domestic textile industry. Most recently, issues over the conditions of international apparel operations have surfaced, which could impact demand for domestic apparel. In addition, the slowing industry. progress of the Chinese economy has impacted demand and market pricing for textile products. Monitor gross margin and pricing to Increases in pricing can often take a quarter or longer to take effect, while rising input costs customers. take effect more quickly, especially for producers earlier in the supply chain, such as fiber and fabric producers and yarn weavers. This lag leads to compression in gross margin and declining recovery values for finished goods. As stated, recent declines have lessened the risk of such margin shifts. Monitor downstream and upstream Market factors, such as improved retail activity, higher production levels, and lower overseas activity, as well as production inventories, could relieve pricing pressures on inputs such as cotton, while continuing to capacity and export demand. drive up the cost of oil-based synthetics. Monitor weeks of supply and inventory aging. Despite increased production and upticks in consumer demand, companies may continue to carry inventory with high weeks of supply, which would maintain minimal demand. Monitor oil prices. As the major feedstock for the majority of synthetic fibers, increases could negatively impact gross margins for polyester producers. Monitor weather conditions for cotton crops. Should cotton growers experience poor growing conditions, it could result in a lack of supply, driving up cotton prices. Conversely, improved weather conditions could result in oversupply, which would drive down prices for cotton. Monitor inventory levels and inventory mix. Factors such as inventory levels and inventory mix are often unique to specific companies, but industry-wide trends may emerge, which could significantly impact companies’ performance. 3 PRICING TRENDS COTTON As stated, the cost of materials, cotton included, is expected to remain relatively consistent in the coming year. Supply, while lower than last year, remains relatively high, creating little impetus for price surges in 2014. Cotton prices have shown a gradual downward slope since averaging $0.93 per pound on the Cotlook “A” pricing index in June, falling to an average of less than $0.90 per pound in October. By early December, the Cotlook “A” index fell to approximately $0.86 per pound. While U.S. raw cotton production declined from 3.8 million tons last season to only 2.9 million tons for 2013-2014, overall world stocks—a measure of production versus consumption—are estimated to total 1.7 million tons, down from 3.2 million tons in the prior season. As mentioned in the prior Textiles and Apparel Monitor, the projected global cotton output for 2013 has been bolstered by a substantial Indian cotton crop. Indian production rose 85,000 tons for the year, offsetting declines in China and Australia, among others. Conversely, Indian consumption figures declined 30,000 tons for 2013-2014. The Cotlook index represents the average of the five cheapest quotations for principal upland cottons traded on the international market: Monthly Average Cotlook "A" Index Pricing Trend November 2012 through October 2013 $ per Pound $0.96 $0.94 $0.92 $0.90 $0.88 $0.86 $0.84 $0.82 $0.80 4 PRICING TRENDS SYNTHETIC FIBERS Synthetic fiber prices have declined since the prior Textiles and Apparel Monitor. At the time of the prior monitor, DAK Americas implemented a $0.03 per pound increase for polyester staple fiber products as of September 1, 2013 after a $0.03 per pound increase implemented on August 1, 2013. The selling price increase was based on rising paraxylene (“PX”) prices during July and August. However, since then, PX prices declined steadily in September and October before stabilizing in November. PX pricing has been soft based on weaker downstream demand. Nylon pricing has followed a similar downward trajectory to that of polyester, triggered by supply-demand dynamics, particularly in Asia. While prices for caprolactam, a major feedstock of nylon, remained buoyant from August through mid-October, prices have since declined. Further dragging down polyester pricing, the cost of purified terephthalic acid (“PTA”) has declined gradually since midAugust based on softer demand and lower feedstock prices. Overall, pricing for polyester staple fibers has declined based on weak market fundamentals in the Chinese market. 5 PRICING TRENDS APPAREL As stated in prior monitors, few industries will benefit from a “re-shoring” of industry more than the apparel sector. Reports suggest that apparel imports have levelled off and will continue to remain flat over the next year. With the cost of manufacturing rising in Asia and the U.S. boasting higherthan-ever worker productivity, the domestic apparel industry is poised for modest growth after years of downturn. Recent data indicates that after-tax profits for the apparel industry in the second quarter of 2013 demonstrated a 14% year-over-year improvement. As a percentage of sales, aftertax profits climbed from 8.2% in the second quarter of 2012 to 9.3% this year. While production levels and profits may be set to escalate in 2014, it remains to be seen if domestic consumption follows suit. Despite a rise in per capita income and an upward trend in population growth, the health of apparel demand may be largely determined by larger macroeconomic factors. In October, the National Retail Federation predicted that holiday retail spending would increase nearly 4% this year, a sentiment that was echoed by financial service firm Deloitte. However, predictions have been scaled back since the government shutdown, and expectations are now mixed. In general, prevailing sentiment suggests a more modest increase this season, with estimates now in the 2% to 3.5% range. The figure below illustrates the apparel producer price index, which denotes the selling prices received by domestic producers for their output. As is demonstrated in the graph below, U.S. customers continue to pay a premium for American-made apparel. In addition, decreasing material costs have not yet impacted the price of apparel received by domestic manufacturers. Apparel Producer Price Index November 2012 through October 2013 111.0 110.5 110.0 109.5 109.0 108.5 108.0 Producer Price Index 6 TEXTILES AND APPAREL REFERENCE SHEET Pricing trend changes for October 2013 versus September 2013 and the third quarter of 2013 are as follows: % Change Commodity Cotton From September 2013 From Q3 2013 Average (1%) (3%) (5%) (5%) 2% 3% Synthetic Fiber Feedstocks Crude Oil Natural Gas 7 MONITOR INFORMATION The Textiles and Apparel Monitor relates information covering most textile and apparel products, including industry trends, market pricing, and their relation to the valuation process. GA provides our customer base with a concise document highlighting the textiles and apparel industry. Due to the commodity nature of certain textile products, as well as the commodity nature of inputs used in synthetic fiber production, timely reporting is necessary to understand an ever-changing marketplace. GA strives to contextualize important indicators in order to provide a more in-depth perspective of the market as a whole. GA internally tracks recovery ranges for cotton fabrics and apparel, greige goods, specialty textiles, synthetic fibers such as nylon and polyester, and a wide variety of apparel in all price points, but we are mindful to adhere to your request for a simple reference document. GA welcomes the opportunity to make our expertise available to you in every possible way. Should you need any further information or wish to discuss recovery ranges for a particular segment, please feel free to contact your GA Business Development Officer using the contact information shown in this and all Textiles and Apparel Monitor issues. GA’s Textiles and Apparel Monitor provides market value and industry trend information for a variety of textile and apparel products. The information contained herein is based on a composite of GA’s industry expertise, contact with industry personnel, liquidation and appraisal experience, and data compiled from a variety of well-respected sources believed to be reliable. We do not guarantee the completeness of such information or make any representation as to its accuracy. EXPERIENCE GA has been involved in the liquidation of select industrial manufactures and wholesalers such as Atlas Textiles, Garment Services, Seatco, and Textile Alliance, store locations for Jo-Ann Fabrics, Hancock Fabrics, and A.C. Moore, and numerous apparel retail stores such as Kids Mart, Clothestime, Mervyns, and Eddie Bauer. Other industrial machinery and equipment liquidations include Alfani Shirts, Barth & Dreyfus, Belding Hausman, Linens & Things, Rock and Republic Jeans, Teddi of California, and Textile Alliance. GA has worked with and appraised numerous companies within the apparel and textiles industry, including industry leaders within each category. While our appraisal clients remain confidential, GA’s extensive list of appraisal experience includes: One of the world’s largest integrated producers of synthetic fibers, with annual net sales exceeding $3.0 billion. One of the largest manufacturers of performance synthetic fabrics, offering over 480 styles of synthetic fabric with varying weights, textures, and technical functions. A wholesale distributor of imprintable apparel, including t-shirts, fleece apparel, sports shirts, headwear, and athletic wear, with net sales exceeding $700 million annually. An industry leader in textile and chemical products, which include denim, dyed fabrics, and flame retardant fabrics for use in apparel and home furnishings. One of the U.S.’s foremost producers of retail fabrics, specialty fabrics, and craft products, manufacturing goods in a wide variety of synthetic fibers. A manufacturer of cotton-nylon greige fabrics used in the design of military and fire retardant apparel. One of the world’s leading manufacturers of performance synthetic fabrics, offering over 480 styles of synthetic fabric in varying weights and textures. A designer and manufacturer of various home textiles, including linens, sheets, towels, aprons, uniforms, curtains, and pillows, among many others. Producers of various apparel types, including headwear, sweaters, and sporting apparel. A manufacturer of tufted carpets from synthetic fibers serving residential and commercial applications. GA also maintains appraisal experience involving more regionalized and specialized companies, allowing for the utmost depth in our valuations: Textile spinning mills producing fabric for the apparel, automotive, and home textile industries. Distributors of fabrics for furniture, apparel, and other applications. Manufacturers and distributors of apparel, rugs, and other woven fabric products. Manufacturers and distributors of cotton, polyester, nylon, and acrylic fibers and specialty fabrics for various industries. Spinners of cotton yarn. Manufacturers of performance synthetic fabrics. Retailers of textile products and apparel. GA has also conducted a wide variety of appraisals of textile machinery. Some of the most recent appraisals included a large producer of polyester and nylon yarns; several non-woven textile manufacturers from a variety of industrial sectors; carpet manufacturers; and manufacturers of apparel and other fibers and fabrics. In addition to our vast liquidation and appraisal experience, GA maintains contacts within the Textile and Apparel industry that we utilize for insight and perspective on recovery values. 8 APPRAISAL & VALUATION TEAM BUSINESS DEVELOPMENT Mike Marchlik National Sales & Marketing Director mmarchlik@greatamerican.com 818-746-9306 David Seiden Executive Vice President - Southeast Region dseiden@greatamerican.com 770-551-8114 Ryan Mulcunry Executive Vice President - Northeast Region, Canada & Europe rmulcunry@greatamerican.com 617-692-8310 Bill Soncini Senior Vice President - Midwest Region bsoncini@greatamerican.com 312-777-7945 Drew Jakubek Vice President - Southwest Region djakubek@greatamerican.com 972-265-7981 Jennie Kim Vice President - West Region jkim@greatamerican.com 818-746-9370 Gordon Titley Director of Valuations, GA Europe Valuations gtitley@gaeurope.co.uk +44 2073180574 OPERATIONS Mark Weitz President mweitz@greatamerican.com 818-884-3737 Ken Bloore Chief Operating Officer kbloore@greatamerican.com 818-884-3737 Eric Campion Associate Project Manager, Textile and Apparel Specialist ecampion@greatamerican.com 781-429-4068 ABOUT GREAT AMERICAN GROUP Great American Group is a leading provider of asset disposition solutions and valuation and appraisal services to a wide range of retail, wholesale and industrial clients, as well as lenders, capital providers, private equity investors and professional services firms. In addition to the Textiles and Apparel Monitor, GA also provides clients with industry expertise in the form of monitors for the metals and metalworking equipment; chemicals and plastics; food and food equipment; automotive; wine and spirits; and paper and packaging industries, among others. GA also offers the European Manufacturing Monitor via its subsidiary, GA Europe Valuations Limited. Headquarters: 21860 Burbank Blvd. Suite 300 South Woodland Hills, CA 91367 800-45-GREAT www.greatamerican.com Atlanta Boston Chicago Charlotte Dallas London Los Angeles New York San Francisco 9