Moffatt & Nichol, NCSPA Ports Business Case Project

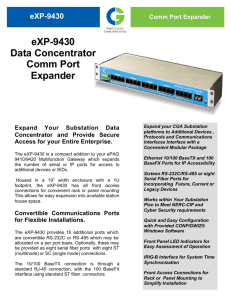

advertisement