Chapter 6

Cost Behaviour: Analysis and Use

Solutions to Questions

6-1 An activity base is a measure of whatever

causes the incurrence of a variable cost.

6-2

a. Unit fixed costs increase as volume decreases.

b. Unit variable costs remain constant as volume decreases.

c. Total fixed costs remain constant as volume

decreases.

d. Total variable costs decrease as volume decreases.

6-3

a. Cost behaviour: Cost behaviour refers to the

way in which costs change in response to

changes in a measure of activity such as

sales volume, production volume, or orders

processed.

b. Relevant range: The relevant range is the

range of activity within which assumptions

about variable and fixed cost behaviour are

valid.

6-4

A curvilinear cost is one where the relationship between the cost and activity is a curve

rather than a straight line. Examples include:

utilities where the amount charged per unit increases as the amount used increases; and

wages where the rate per hour increases as

more hours are worked and overtime is paid.

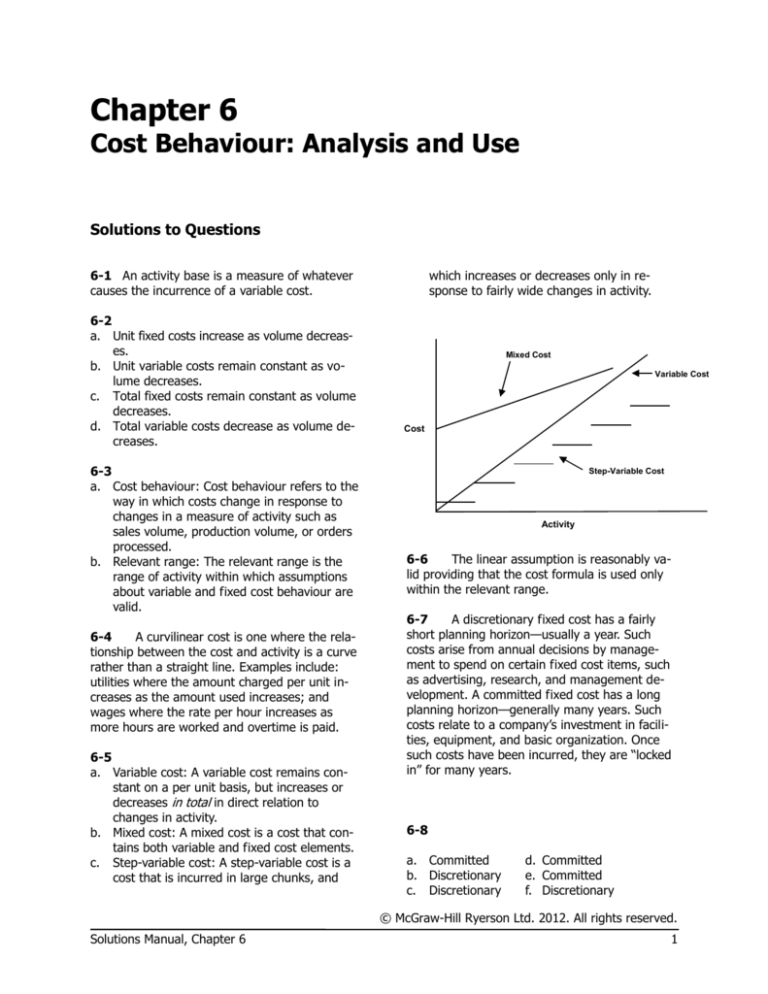

6-5

a. Variable cost: A variable cost remains constant on a per unit basis, but increases or

decreases in total in direct relation to

changes in activity.

b. Mixed cost: A mixed cost is a cost that contains both variable and fixed cost elements.

c. Step-variable cost: A step-variable cost is a

cost that is incurred in large chunks, and

which increases or decreases only in response to fairly wide changes in activity.

Mixed Cost

Variable Cost

Cost

Step-Variable Cost

Activity

6-6

The linear assumption is reasonably valid providing that the cost formula is used only

within the relevant range.

6-7

A discretionary fixed cost has a fairly

short planning horizon—usually a year. Such

costs arise from annual decisions by management to spend on certain fixed cost items, such

as advertising, research, and management development. A committed fixed cost has a long

planning horizon—generally many years. Such

costs relate to a company’s investment in facilities, equipment, and basic organization. Once

such costs have been incurred, they are “locked

in” for many years.

6-8

a. Committed

b. Discretionary

c. Discretionary

d. Committed

e. Committed

f. Discretionary

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

1

6-9

Yes. As the anticipated level of activity

changes, the level of fixed costs needed to support operations may also change. Most fixed

costs are adjusted upward and downward in

large steps, rather than being absolutely fixed at

one level for all ranges of activity.

6-10 The engineering approach to cost analysis is a detailed analysis of cost behaviour based

on an industrial engineer’s evaluation of the inputs that are required to carry out an activity

and of the costs of those inputs. It could be

used to estimate the costs of a new product not

previously produced. It could also be used to

determine the cost of providing a particular service or department such as customer complaints.

6-11 The major disadvantage of the high-low

method is that it uses only two data points, the

highest and lowest levels of activity. If either of

these points is an extreme value (well above or

well below normal activity levels) the accuracy

of the cost estimation model will be reduced.

levels are being used to predict the costs, not

vice-versa. Accordingly, the high-low activity

levels provide the greatest possible variation in

the selected cost driver.

6-13 The formula for a mixed cost is Y = a +

bX. In cost analysis, the “a” term represents the

fixed cost, and the “b” term represents the variable cost per unit of activity.

6-14 The contribution approach income

statement organizes costs by behaviour, first

deducting variable expenses to obtain contribution margin, and then deducting fixed expenses

to obtain operating income. The traditional

approach organizes costs by function, such as

production, selling, and administration. Within a

functional area, fixed and variable costs are intermingled.

6-12 The high-low activity levels are used

instead of the high-low costs because activity

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

2

Managerial Accounting, 9th Canadian Edition

Exercise 6-1 (15 minutes)

1.

Smoothies Served

in a Week

2,100

2,800

3,500

Fixed cost ......................................................................

$2,500

$2,500

$2,500

Variable cost ($0.75 per cup) ..........................................

1,575

2,100

2,625

Total cost ......................................................................

$4,075

$4,600

$5,125

Cost per smoothie served * ............................................

$1.94

$1.64

$1.46

* Total cost ÷ smoothies served in a week

2. The average cost of a smoothie declines as the number of smoothies

served increases because the fixed cost is spread over more units.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

3

Exercise 6-2 (30 minutes)

1. The completed scattergraph is presented below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

4

Managerial Accounting, 9th Canadian Edition

Exercise 6-2 (continued)

2. (Students’ answers will vary considerably due to the inherent imprecision and subjectivity of the scattergraph method of estimating variable

and fixed costs.)

The approximate monthly fixed cost is $6,000—the point where the

straight line intersects the cost axis.

The variable cost per unit processed can be estimated as follows using

the 8,000-unit level of activity, which falls on the straight line:

Total cost at the 8,000-unit level of activity ...........

Less fixed costs ...................................................

Variable costs at the 8,000-unit level of activity .....

$14,000

6,000

$ 8,000

$8,000 ÷ 8,000 units = $1 per unit.

Observe from the scattergraph that if the company used the high-low

method to determine the slope of the line, the line would be too steep.

This would result in underestimating the fixed cost and overestimating

the variable cost per unit.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

5

Exercise 6-3 (20 minutes)

1.

Month

High activity level (August) ..

Low activity level (October)..

Change ...............................

OccupancyDays

3,608

186

3,422

Electrical

Costs

$8,111

1,712

$6,399

Variable cost = Change in cost ÷ Change in activity

= $6,399 ÷ 3,422 occupancy-days

= $1.87 per occupancy-day

Total cost (August) ....................................................

Variable cost element

($1.87 per occupancy-day × 3,608 occupancy-days)

Fixed cost element ....................................................

$8,111

6,747

$1,364

2. Electrical costs may reflect seasonal factors other than just the variation

in occupancy days. For example, common areas such as the reception

area must be lighted for longer periods during the winter. This will result

in seasonal effects on the fixed electrical costs.

Additionally, fixed costs will be affected by how many days are in a

month. In other words, costs like the costs of lighting common areas are

variable with respect to the number of days in the month, but are fixed

with respect to how many rooms are occupied during the month.

Other, less systematic, factors may also affect electrical costs such as

the frugality of individual guests. Some guests will turn off lights when

they leave a room. Others will not.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

6

Managerial Accounting, 9th Canadian Edition

Exercise 6-4 (20 minutes)

1

.

The Rhythm Shop

Income Statement—Acoustic Guitar Department

For the Quarter Ended March 31

Sales ................................................................

Variable expenses:

Cost of goods sold ($400 per guitar ×

$800,000

2,000 guitars*) ............................................

Selling expenses ($75 per guitar × 2,000

150,000

guitars) .......................................................

Administrative expenses (25% ×

50,000

$200,000) ...................................................

Contribution margin ..........................................

Fixed expenses:

Selling expenses (400,000-150,000) ................250,000

Administrative expenses(75% x 200,000) ........150,000

Operating income .............................................

$1,600,000

1,000,000

600,000

400,000

$ 200,000

*$1,600,000 sales ÷ $800 per guitar = 2,000 guitars.

2. Since 2,000 guitars were sold and the contribution margin totaled

$600,000 for the quarter, the contribution of each guitar toward fixed

expenses and profits was $300 ($600,000 ÷ 2,000 guitars = $300 per

guitar). Another way to compute the $300 is:

Selling price per guitar .......................

Less variable expenses:

Cost per guitar ................................

Selling expenses..............................

Administrative expenses

($50,000 ÷ 2,000 guitar) ..............

Contribution margin per guitar ............

$800

$400

75

25

500

$300

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

7

Exercise 6-4 (continued)

3. If the Rhythm Shop sells 100 more guitars in the quarter ending June

30, than they did for the quarter ending March 31, profits will increase

by:

100 x $300* per guitar = $30,000

*$800 selling price - $500 total variable cost per guitar

Total operating income for the quarter ended June 30 will be:

Operating income for the Quarter ended March 31

Contribution margin from additional unit sales

Total operating income**

** Check:

2,100 guitars sold x $300/guitar

Less fixed expenses

Total operating income

$200,000

30,000

$230,000

$630,000

400,000

$230,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

8

Managerial Accounting, 9th Canadian Edition

Exercise 6-5 (20 minutes)

1. The company’s variable cost per unit would be:

$150,000

=$2.50 per unit.

60,000 units

Taking into account the difference in behaviour between variable and

fixed costs, the completed schedule would be:

Units produced and sold

Total costs:

Variable costs .......................

Fixed costs ...........................

Total costs ..............................

Cost per unit:

Variable cost .........................

Fixed cost .............................

Total cost per unit ...................

*Given.

60,000

80,000

100,000

$150,000 *

360,000 *

$510,000 *

$200,000

360,000

$560,000

$250,000

360,000

$610,000

$2.50

6.00

$8.50

$2.50

4.50

$7.00

$2.50

3.60

$6.10

2. The company’s income statement in the contribution format would be:

Sales (90,000 units × $7.50 per unit) ............................

Variable expenses (90,000 units × $2.50 per unit) .........

Contribution margin......................................................

Fixed expenses ............................................................

Operating income .........................................................

$675,000

225,000

450,000

360,000

$ 90,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

9

Exercise 6-6 (45 minutes)

1.

High activity level ............

Low activity level .............

Change ..........................

Units Shipped

8

2

6

Shipping Expense

$3,600

1,500

$2,100

Variable cost element:

Change in cost

$2,100

=

=$350 per unit

Change in activity 6 units

Fixed cost element:

Shipping expense at the high activity level ...................

Less variable cost element ($350 per unit × 8 units).....

Total fixed cost ...........................................................

$3,600

2,800

$ 800

The cost formula is $800 per month plus $350 per unit shipped or

Y = $800 + $350X,

where X is the number of units shipped.

2. a. See the scattergraph on the following page.

b. (Note: Students’ answers will vary due to the imprecision and subjective nature of this method of estimating variable and fixed costs.)

Total cost at 5 units shipped per month [a point

falling on the line in (a)] ......................................

Less fixed cost element (intersection of the Y axis)..

Variable cost element.............................................

$2,600

1,100

$1,500

$1,500 ÷ 5 units = $300 per unit.

The cost formula is $1,100 per month plus $300 per unit shipped or

Y = $1,100 + 300X,

where X is the number of units shipped.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

10

Managerial Accounting, 9th Canadian Edition

Exercise 6-6 (continued)

2. a. The scattergraph appears below:

3. The cost of shipping units is likely to depend on the weight and volume

of the units shipped and the distance traveled as well as on the number

of units shipped. In addition, higher cost shipping might be necessary to

meet a deadline.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

11

Exercise 6-7 (20 minutes)

1.

High level of activity ............

Low level of activity .............

Change ...............................

Kilometres

Driven

120,000

80,000

40,000

Total Annual

Cost*

$13,920

10,880

$ 3,040

* 120,000 kilometres × $0.116 per kilometre = $13,920

80,000 kilometres × $0.136 per kilometre = $10,880

Variable cost per kilometre:

Change in cost =

Change in activity

$3,040____ = $0.076 per kilometre

40,000 kilometres

Fixed cost per year:

Total cost at 120,000 kilometres ...........................

Less variable cost element:

120,000 kilometres × $0.076 per kilometre ........

Fixed cost per year ..............................................

$13,920

9,120

$ 4,800

2. Y = $4,800 + $0.076X

3. Fixed cost ...............................................................

Variable cost: 100,000 kilometres × $0.076 per

kilometre ..............................................................

Total annual cost .....................................................

$ 4,800

7,600

$12,400

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

12

Managerial Accounting, 9th Canadian Edition

Exercise 6-8 (20 minutes)

1.

High activity level (February)........

Low activity level (June) ..............

Change .......................................

Blood Tests

3,500

1,500

2,000

Costs

$14,500

8,500

$ 6,000

Variable cost per blood test:

Change in cost =

$6,000

= $3 per blood test

Change in activity

2,000 blood tests

Fixed cost per month:

Blood test cost at the high activity level ................

Less variable cost element:

3,500 blood tests × $3.00 per test .....................

Total fixed cost ....................................................

$14,500

10,500

$ 4,000

The cost formula is $4,000 per month plus $3.00 per blood test performed or, in terms of the equation for a straight line:

Y = $4,000 + $3.00X

where X is the number of blood tests performed.

2. Expected blood test costs when 2,300 tests are performed:

Variable cost: 2,300 blood tests × $3.00 per test.......

Fixed cost ...............................................................

Total cost ................................................................

$6,900

4,000

$10,900

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

13

Exercise 6-9 (30 minutes)

1. The scattergraph appears below.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

14

Managerial Accounting, 9th Canadian Edition

Exercise 6-9 (continued)

2. (Note: Students’ answers will vary considerably due to the inherent lack

of precision and subjectivity of the scattergraph method.)

Total costs at 2,500 blood tests per month [a point

falling on the line in (1)] ......................................... $11,500

Less fixed cost element (intersection of the Y axis).....

3,250

Variable cost element................................................ $8,250

$8,250 ÷ 2,500 blood tests = $3.30 per blood test.

The cost formula is therefore $3,250 per month plus $3.30 per blood

test performed. Written in equation form, the cost formula is:

Y = $3,250 + $3.30X,

where X is the number of blood tests performed.

3. The high-low method would not provide an accurate cost formula in this

situation, since a line drawn through the high and low points would have

a slope that is too flat. Consequently, the high-low method would overestimate the fixed cost and underestimate the variable cost per unit.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

15

Exercise 6-10 (30 minutes)

1. Monthly operating costs at 70% occupancy:

2,000 rooms × 70% = 1,400 rooms;

1,400 rooms × $21 per room per day × 30 days ..

Monthly operating costs at 45% occupancy (given) .

Change in cost ......................................................

Difference in rooms occupied:

70% occupancy (2,000 rooms × 70%).................

45% occupancy (2,000 rooms × 45%).................

Difference in rooms (change in activity) ..................

Variable cost=

$882,000

792,000

$ 90,000

1,400

900

500

Change in cost

$90,000

=

=$180 per room.

Change in activity 500 rooms

$180 per room ÷ 30 days = $6 per room per day.

2. Monthly operating costs at 70% occupancy (above) ..

Less variable costs:

1,400 rooms × $6 per room per day × 30 days ......

Fixed operating costs per month ..............................

$882,000

252,000

$630,000

3. 2,000 rooms × 60% = 1,200 rooms occupied.

Fixed costs ..............................................................

Variable costs:

1,200 rooms × $6 per room per day × 30 days ......

Total expected costs ................................................

$630,000

216,000

$846,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

16

Managerial Accounting, 9th Canadian Edition

Problem 6-11 (45 minutes)

1.

Home Entertainment

Income Statement

For the Month Ended April 30

Sales (150 televisions × $1,500 per set) .............

Cost of goods sold

(150 televisions × $900 per set) ......................

Gross margin ....................................................

Selling and administrative expenses:

Selling expenses:

Advertising ..................................................

Delivery of televisions

(150 televisions × $40 per set) ...................

Sales salaries and commissions

[$2,900 + (4% × $225,000)] .....................

Utilities ........................................................

Depreciation of sales facilities .......................

Total selling expenses .....................................

Administrative expenses:

Executive salaries .........................................

Depreciation of office equipment...................

Clerical

[$1,500 + (150 televisions × $40 per set)] .

Insurance ....................................................

Total administrative expenses ..........................

Total selling and administrative expenses ............

Operating income ..............................................

$225,000

135,000

90,000

$

950

6,000

11,900

400

3,000

22,250

8,000

500

7,500

400

16,400

38,650

$ 51,350

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

17

Problem 6-11 (continued)

2.

Home Entertainment

Income Statement

For the Month Ended April 30

Sales (150 televisions × $1,500 per set) .............

Variable expenses:

Cost of goods sold

(150 televisions × $900 per set) ...................

Delivery of televisions

(150 televisions × $40 per set) .....................

Sales commissions (4% × $225,000) ...............

Clerical (150 televisions × $40 per set) ............

Total variable expenses.................................

Contribution margin...........................................

Fixed expenses:

Advertising .....................................................

Sales salaries ..................................................

Utilities...........................................................

Depreciation of sales facilities ..........................

Executive salaries ...........................................

Depreciation of office equipment .....................

Clerical ...........................................................

Insurance .......................................................

Total fixed expenses ..........................................

Operating income ..............................................

Total

$225,000

Per Unit

$1,500

135,000

900

6,000

9,000

6,000

156,000

69,000

40

60

40

1,040

$ 460

950

2,900

400

3,000

8,000

500

1,500

400

17,650

$ 51,350

3. Fixed costs remain constant in total but vary on a per unit basis with

changes in the activity level. For example, as the activity level increases,

fixed costs decrease on a per unit basis. Showing fixed costs on a per

unit basis on the income statement make them appear to be variable

costs. That is, management might be misled into thinking that the per

unit fixed costs would be the same regardless of how many televisions

were sold during the month. For this reason, fixed costs should be

shown only in totals on a contribution-type income statement.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

18

Managerial Accounting, 9th Canadian Edition

Problem 6-12 (45 minutes)

1. Cost of goods sold ....................

Shipping expense .....................

Advertising expense .................

Salaries and commissions .........

Insurance expense ...................

Depreciation expense ...............

Variable

Mixed

Fixed

Mixed

Fixed

Fixed

2. Analysis of the mixed expenses:

High level of activity .....

Low level of activity ......

Change ........................

Units

4,500

3,000

1,500

Shipping

Expense

£56,000

44,000

£12,000

Salaries and

Comm. Expense

£143,000

107,000

£ 36,000

Variable cost element:

Variable cost per unit =

Shipping expense:

Change in cost

Change in activity

£12,000

= £8 per unit

1,500 units

Salaries and comm. expense:

£36,000

= £24 per unit

1,500 units

Fixed cost element:

Cost at high level of activity ...

Less variable cost element:

4,500 units × £8 per unit ....

4,500 units × £24 per unit...

Fixed cost element ................

Shipping

Expense

£56,000

36,000

£20,000

Salaries and

Comm. Expense

£143,000

108,000

£ 35,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

19

Problem 6-12 (continued)

The cost formulas are:

Shipping expense: £20,000 per month plus £8 per unit or

Y = £20,000 + £8X.

Salaries and Comm. expense: £35,000 per month plus £24 per unit or

Y = £35,000 + £24X.

3.

Frankel Ltd.

Income Statement

For the Month Ended June 30

Sales revenue ............................................

Variable expenses:

Cost of goods sold

(4,500 units × £56* per unit) ................

Shipping expense

(4,500 units × £8 per unit) ....................

Salaries and commissions expense

(4,500 units × £24 per unit) ..................

Contribution margin....................................

Fixed expenses:

Shipping expense ....................................

Advertising ..............................................

Salaries and commissions .........................

Insurance ................................................

Depreciation ............................................

Operating income .......................................

£630,000

£252,000

36,000

108,000

20,000

70,000

35,000

9,000

42,000

396,000

234,000

176,000

£ 58,000

*Per unit amount based on low level of sales activity: £168,000 ÷ 3,000

= £56

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

20

Managerial Accounting, 9th Canadian Edition

Problem 6-13 (30 minutes)

1. a.

b.

c.

d.

e.

f.

g.

h.

i.

6

11

1

4

2

10

3

7

9

2. Without a knowledge of the underlying cost behaviour patterns, it would

be difficult if not impossible for a manager to properly analyze the firm’s

cost structure. The reason is that all costs don’t behave in the same

way. One cost might move in one direction as a result of a particular

action, and another cost might move in an opposite direction. Unless the

behaviour pattern of each cost is clearly understood, the impact of a

firm’s activities on its costs will not be known until after the activity has

occurred.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

21

Problem 6-14 (45 minutes)

1. High-low method:

High activity level ..............

Low activity level ...............

Change .............................

Number of

Jobs

Repair

Costs

260

80

180

$24,000

9,600

$14,400

Variable cost per job:

Change in cost =

Change in activity

$14,400

180 jobs

= $80 per job

Fixed cost: Total repair cost at high activity level ........

Less variable element:

260 jobs × $80 per job .........................

Fixed cost element ..................................

$24,000

20,800

$ 3,200

Therefore, the cost formula is: Y = $3,200 + $80X.

2. Scattergraph method (see the scattergraph on the following page):

(Note: Students’ answers will vary due to the inherent imprecision and

subjectivity of the scattergraph method of estimating fixed and variable

costs.)

The line intersects the cost axis at about $4,250. The variable cost can

be estimated as follows:

Total cost at 180 jobs (a point that falls on the line) ...

Less the fixed cost element (intersection of the Y axis

on the graph) ........................................................

Variable cost element at 180 jobs (total) ....................

$18,000

4,250

$13,750

$13,750 ÷ 180 jobs = $76.38 per job.

Therefore, the cost formula is: Y = $4,250 + $76.38X.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

22

Managerial Accounting, 9th Canadian Edition

Problem 6-14 (continued)

The completed scattergraph follows:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

23

Problem 6-14 (continued)

3.

Total predicted repair costs for 200 jobs:

Y = $3,200 + $80(x)

Y = $3,200 + $80(200)

Y = $3,200 + $16,000

Y = $19,200

4.

Neither of the formulas developed in parts 1 and 2 should be used to

predict costs for a 600-job month because that level of activity appears to be well outside of the relevant range. The next closest activity level is only 260 jobs (May), which is less than half of the number

of jobs the manager wants to predict costs for. Both fixed and variable costs could increase if the level of activity is 600 jobs. For example, additional mechanics may need to be hired, more repair equipment may be needed and facilities may need to be expanded (even

temporarily) to accommodate an increase of that magnitude.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

24

Managerial Accounting, 9th Canadian Edition

Problem 6-15 (45 minutes)

1. Maintenance cost at the 140,000 machine-hour level of activity can be

isolated as follows:

Total factory overhead cost .............

Deduct:

Utilities cost @ $1.30 per MH* ......

Supervisory salaries .....................

Maintenance cost ...........................

Level of Activity

80,000 MH 140,000 MH

$340,400

$483,200

104,000

120,000

$116,400

182,000

120,000

$181,200

*$104,000 ÷ 80,000 MHs = $1.30 per MH

2. High-low analysis of maintenance cost:

High activity level ..............

Low activity level ...............

Change .............................

Maintenance MachineCost

Hours

$181,200

116,400

$ 64,800

140,000

80,000

60,000

Note: in this problem the high level of activity (140,000 hours) does not

correspond to the highest level of total overhead costs, which occurs in

November.

Variable cost per unit of activity:

Change in cost =

Change in activity

$64,800

60,000 MHs

= $1.08 per MH

Total fixed cost:

Total maintenance cost at the low activity level ............ $116,400

Less the variable cost element

(80,000 MHs × $1.08 per MH) ..................................

86,400

Fixed cost element ..................................................... $30,000

Therefore, the cost formula is $30,000 per month plus $1.08 per

machine-hour or Y = $30,000 + $1.08X, where X represents machinehours.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

25

Problem 6-15 (continued)

3.

Maintenance cost ..............

Utilities cost:

$104,000/80,000 ...............

Supervisory salaries cost ....

Totals ...............................

Variable Rate per

Machine-Hour

Fixed Cost

$1.08

1.30

$2.38

$ 30,000

120,000

$150,000

Therefore, the cost formula would be $150,000 plus $2.38 per machinehour, or Y = $150,000 + $2.38X.

4. Fixed costs ..........................................................

Variable costs: $2.38 per MH × 90,000 MHs..........

Total overhead costs ............................................

$150,000

214,200

$364,200

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

26

Managerial Accounting, 9th Canadian Edition

Problem 6-16 (45 minutes)

1.

Direct materials cost @ $15 per unit

Direct labour cost @ $6 per unit ......

Manufacturing overhead cost ..........

Total manufacturing costs ...............

Add: Work in process, beginning .....

Deduct: Work in process, ending .....

Cost of goods manufactured ...........

July—Low

9,000 Units

$135,000

54,000

107,000 *

296,000

14,000

310,000

25,000

$285,000

October—High

12,000 Units

$180,000

72,000

131,000 *

383,000

22,000

405,000

15,000

$390,000

*Computed by working backwards from cost of goods manufactured.

2.

October—High level of activity ..........

July—Low level of activity .................

Change ............................................

Variable cost =

=

Units

Produced

12,000

9,000

3,000

Cost

Observed

$131,000

107,000

$ 24,000

Change in cost

Change in activity

$24,000

= $8 per unit

3,000 units

Total cost at the high level of activity ..................

Less variable cost element

($8 per unit × 12,000 units) ............................

Fixed cost element .............................................

$131,000

96,000

$ 35,000

Therefore, the cost formula is: $35,000 per month plus $8 per unit produced, or Y = $35,000 + $8X, where X represents the number of units

produced.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

27

Problem 6-16 (continued)

3.

The cost of goods manufactured if 9,500 units are produced:

Direct materials cost (9,500 units × $15 per unit)..

$142,500

Direct labour cost (9,500 units × $6 per unit) .......

57,000

Manufacturing overhead cost:

Fixed portion .................................................... $35,000

Variable portion (9,500 units × $8 per unit) ........ 76,000 111,000

Total manufacturing costs ....................................

310,500

Add: Work in process, beginning ..........................

16,000

326,500

Deduct: Work in process, ending ..........................

19,000

Cost of goods manufactured ................................

$307,500

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

28

Managerial Accounting, 9th Canadian Edition

Problem 6-17 (30 minutes)

1. Maintenance cost at the 80,000 machine-hour level of activity can be

isolated as follows:

Level of Activity

60,000 MH

80,000 MH

Total factory overhead cost .. 274,000 pesos

Deduct:

Indirect materials @ 1.50

pesos per MH* ............... 90,000

Rent ................................. 130,000

Maintenance cost ................ 54,000 pesos

312,000 pesos

120,000

130,000

62,000 pesos

* 90,000 pesos ÷ 60,000 MHs = 1.50 pesos per MH

2. High-low analysis of maintenance cost:

High activity level ..............

Low activity level ...............

Change observed...............

Variable cost =

=

Maintenance Cost

62,000 pesos

54,000

8,000 pesos

Machine-Hours

80,000

60,000

20,000

Change in cost

Change in activity

8,000 pesos

= 0.40 peso per MH

20,000 MHs

Fixed cost element = Total cost – Variable cost element

= 54,000 pesos – (60,000 MHs × 0.40 pesos)

= 30,000 pesos

Therefore, the cost formula is 30,000 pesos per year, plus 0.40 peso per

machine-hour or

Y = 30,000 pesos + 0.40 peso X.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

29

Problem 6-17 (continued)

3. Indirect materials (65,000 MHs ×

1.50 pesos per MH) .......................

Rent ................................................

Maintenance:

Variable cost element (65,000 MHs

× 0.40 peso per MH) ................... 26,000 pesos

Fixed cost element ......................... 30,000

Total factory overhead cost ...............

97,500 pesos

130,000

56,000

283,500 pesos

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

30

Managerial Accounting, 9th Canadian Edition

Case 6-18 (30 minutes)

1. The completed scattergraph for the number of direct labour hours as

the activity base is presented below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

31

Case 6-18 (continued)

2. The completed scattergraph for the number of jobs as the activity base

is presented below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

32

Managerial Accounting, 9th Canadian Edition

Case 6-18 (continued)

3. The number of direct labour-hours should be used as the activity base

for predicting overhead costs. There are several reasons for this. First, a

visual inspection of the scattergraphs suggest that it is easer to approximate the relationship between labour-hours and overhead costs with a

straight line than it is for total number of jobs completed in a month.

Although both activity measures appear to have linear relationship with

overhead costs, direct labour-hours appears to a better fit. Second, jobs

differ with respect to complexity with more complex jobs requiring more

direct labour-hours since they take longer to complete. Thus more complex jobs would likely result in the incurrence of more variable overhead

costs such as electricity. Evidence of the differing mix of job complexity

is indicated by the fact that during several months, around 500 jobs

were completed (January, July, September, and December) but overhead

ranged from $75,045 to $83,434 across those months. Third, management has the flexibility to change the mix of welders used across jobs.

More experienced welders are more efficient and waste less indirect materials suggesting labour-hours may be a better predictor of overhead

costs.

4.

August—High level of activity ............

May—Low level of activity .................

Change ............................................

Direct LabourHours

6,114

1,914

4,200

Overhead Costs

$81,582

60,162

$ 21,420

Variable cost per unit of activity:

Change in cost =

Change in activity

$21,420

4,200 DLHs

= $5.10 per DLH

Total cost at the high level of activity ..................

Less variable cost element

($5.10 per unit × 6,114 hours)

Fixed cost element .............................................

$81,582.0

0

31,181.4

0

$ 50,400.

60

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

33

Case 6-18 (continued)

Therefore, the cost formula is:

$ Y = $50,400.60 + $5.10X, where X represents the number of direct

labour-hours.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

34

Managerial Accounting, 9th Canadian Edition

CASE 6-19 (90 minutes)

1. Direct labour-hour allocation base:

Electrical costs (a) .................................

Direct labour-hours (b)...........................

Predetermined overhead rate (a) ÷ (b) ...

Machine-hour allocation base:

Electrical costs (a) .................................

Machine-hours (b) .................................

Predetermined overhead rate (a) ÷ (b) ...

SFr 3,868,620

427,500 DLHs

SFr 9.05 per DLH

SFr 3,868,620

365,520 MHs

SFr 10.58 per MH

2. Electrical cost for the custom tool job using direct labour-hours:

Predetermined overhead rate (a) ............

SFr 9.05 per DLH

Direct labour-hours for the job (b) ..........

30 DLHs

Electrical cost applied to the job (a) × (b)

SFr 271.50

Electrical cost for the custom tool job using machine-hours:

Predetermined overhead rate (a) ............

SFr 10.58 per MH

Machine-hours for the job (b) .................

25 MHs

Electrical cost applied to the job (a) × (b)

SFr 264.50

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

35

CASE 6-19 (continued)

The scattergraph for electrical costs and direct labour-hours appears

below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

36

Managerial Accounting, 9th Canadian Edition

CASE 6-19 (continued)

The scattergraph for electrical costs and machine-hours appears below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

37

CASE 6-19 (continued)

In general, the allocation base should actually cause the cost being allocated. If it doesn’t, costs will be incorrectly assigned to jobs. Incorrectly

assigned costs are useless for decision-making.

Examining the two scattergraphs reveals that electrical costs do not

appear to be related to direct labour-hours. Electrical costs do vary, but

apparently not in response to changes in direct labour-hours. On the

other hand, looking at the scattergraph for machine-hours, electrical

costs do tend to increase as the machine-hours increase. So if one must

choose between machine-hours and direct labour-hours as an allocation

base, machine-hours seems to be the better choice. Even so, it looks

like little of the overhead cost is really explained even by machine hours.

Electrical cost has a large fixed component and much of the variation in

the cost is unrelated to machine hours.

4. High-low method:

Week 2—High level of activity ...........

Week 7—Low level of activity ............

Change ............................................

Machine

Hours

8,620

6,000

2,620

Electrical

Costs

SFr 82,270

73,100

SFr 9,170

Variable cost per unit of activity:

Total cost at the high level of activity ..................

Less variable cost element

SFr 3.50 per MH × 8,620

hours)…………………….

Fixed cost element .............................................

SFr82,270

30,170

SFr 52,100

Therefore, the cost formula is:

SFr Y = $52,100 + SFr 3.50X, where X represents the number of machine hours.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

38

Managerial Accounting, 9th Canadian Edition

CASE 6-19 (continued)

5. The custom tool job requires 25 machine-hours. At SFr 3.50 per

machine-hour, the electrical cost actually caused by the job would be only

SFr 87.50. This contrasts with the electrical cost of SFr 271.50 under the

old cost system and SFr 264.50 under the new ABC system calculated in

part 2 above. Both the old cost system and the new ABC system grossly

overstate the electrical costs of the job. This is because under both cost

systems, the large fixed electrical costs of SFr 52,100 per week are allocated to jobs along with the electrical costs that actually vary with the

amount of work

being done. In practice, almost all categories of overhead costs pose similar problems. As a consequence, the costs of individual jobs are likely to

be seriously overstated for decision-making purposes under both traditional and ABC systems. Both systems provide acceptable cost data for

external reporting, but both provide potentially misleading data for

internal decision-making unless suitable adjustments are made.

6. Electricity is used for heating and lighting the building as well as to run

equipment. Therefore, consumption of electrical power is likely to be

affected at least by the weather and by the time of the year as well as by

how many hours the equipment is run. (Shorter days mean the lights

have to be on longer.)

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

39

CASE 6-20 (90 minutes)

Note to the instructor: This case requires the ability to build on concepts

that are introduced only briefly in the text. To some degree, this case anticipates issues that will be covered in more depth in later chapters.

1. In order to estimate the contribution to profit of the charity event, it is

first necessary to estimate the variable costs of catering the event. The

costs of food and beverages and labour are all apparently variable with

respect to the number of guests. However, the situation with respect

overhead expenses is less clear. A good first step is to plot the labour

hour and overhead expense data in a scattergraph as shown below.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

40

Managerial Accounting, 9th Canadian Edition

CASE 6-20 (continued)

This scattergraph reveals several interesting points about the behaviour

of overhead costs:

• The relation between overhead expense and labour hours is approximated reasonably well by a straight line. (However, there appears to

be a slight downward bend in the plot as the labour hours increase—

evidence of increasing returns to scale. This is a common occurrence

in practice.

• The data points are all fairly close to the straight line. This indicates

that most of the variation in overhead expenses is explained by

labour hours. As a consequence, there probably wouldn’t be much

benefit to investigating other possible cost drivers for the overhead

expenses.

• Most (about $40,000) of the overhead expense appears to be fixed.

Christine should ask herself if this is reasonable. Does the company

have large fixed expenses such as rent, depreciation, and salaries?

The overhead expenses can be decomposed into fixed and variable elements using the high-low method, least-squares regression method, or

even the quick-and-dirty method based on the scattergraph.

• The high-low method throws away most of the data and bases the

estimates of variable and fixed costs on data for only two months. For

that reason, it is a decidedly inferior method in this situation. Nevertheless, if the high-low method were used, the estimates would be

computed as follows:

High level of activity ......

Low level of activity .......

Change ......................

Labour

Hours

4,500

1,500

3,000

Overhead

Expense

$67,750

48,400

$19,350

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

41

CASE 6-20 (continued)

Variable cost per unit of activity:

Change in cost =

Change in activity

Fixed cost element

$19,350

3,000 MHs

= $6.45 per DLH

= Total cost – Variable cost

= $67,750 – ($6.45 x 4,500)

= $38,725

Using the high-low method estimate of the variable overhead cost per

direct labour hour, the total variable cost per guest is computed as follows:

Food and beverages .............................

Labour (0.5 hour @ $15 per hour) ........

Overhead (0.5 hour @ $6.45 per hour) .

Total variable cost per guest .................

$19.00

7.50

3.22

$29.72

The total contribution from 200 guests paying $50 each is computed as

follows:

Revenue (200 guests @ $50.00 per guest) .........

Variable cost (200 guests @ $29.72 per guest) ...

Contribution to profit ........................................

$10,000.0

0

5,944.00

$4,056.00

Fixed costs are not included in the above computation because there is

no indication that any additional fixed costs would be incurred as a consequence of catering the cocktail party. If additional fixed costs were incurred, they should also be subtracted from revenue.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

42

Managerial Accounting, 9th Canadian Edition

CASE 6-20 (continued)

2. Assuming that no additional fixed costs are incurred as a result of catering the charity event, any price greater than the variable cost per guest

of $29.72 would contribute to profits.

3. Bidding slightly less than $45 to get the contract is advisable. Any bid

above $29.72 would contribute to profits and a bid at the normal price

of $50 is unlikely to land the contract. Apart from the contribution to

profit, catering the event would also show off the company’s capabilities

to potential clients. The danger is that a price that is lower than the

normal bid of $50 might set a precedent for the future or it might initiate a price war among caterers. However, the price need not be publicized and the lower price could be justified to future clients because this

is a charity event. Another possibility would be for Christine to maintain

her normal price but throw in additional services at no cost to the customer. Whether to compete on price or service is a delicate issue that

Christine will have to decide after getting to know the personality and

preferences of the customer.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

43

Research and Application 6-21

Answers will vary among groups.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

44

Managerial Accounting, 9th Canadian Edition

Exercise 6A-1 (20 minutes)

The least-squares regression estimates of fixed and variable costs can be

computed using any of a variety of statistical and mathematical software

packages or even by hand. The solution below was calculated using Microsoft® Excel.

The fixed cost element is estimated to be $3,426 per month, and the variable cost element is $2.80 per rental return. Expressed as an equation, the

relation between cleaning costs and rental returns is

Y = $3,426 + $2.80x

where X is the number of rental returns.

The R2 estimated by Excel, is 0.92, which is quite high, and indicates a

strong linear relationship between cleaning costs and rental returns.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

45

Exercise 6A-1 (continued)

While not a requirement of the exercise, it is always a good to plot the data

on a scattergraph. The scattergraph can help spot nonlinearities or other

problems with the data. In this case, the regression line (shown below) is a

reasonably good approximation to the relationship between cleaning costs

and rental returns.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

46

Managerial Accounting, 9th Canadian Edition

Exercise 6A-2 (30 minutes)

1.

Month

January

February

March

April

May

June

July

Units

Shipped

(X)

4

7

5

2

3

6

8

Shipping

Expense

(Y)

$2,200

$3,100

$2,600

$1,500

$2,200

$3,000

$3,600

A spreadsheet application such as Microsoft® Excel or a statistical software package can be used to compute the slope and intercept of the

least-squares regression line for the above data. The results are:

Intercept (fixed cost) ...............

Slope (variable cost per unit) ....

R2 ...........................................

$1,011

$318

0.96

Therefore, the cost formula is $1,011 per month plus $318 per unit

shipped or

Y = $1,011 + $318X.

Note that the R2 is 0.96, which means that 96% of the variation in shipping costs is explained by the number of units shipped. This is a very

high R2 and indicates a very good fit.

2.

Scattergraph method ..........................

High-low method ................................

Least-squares regression method ........

Variable

Cost per

Unit

$300

$350

$318

Fixed

Cost

per

Month

$1,100

$800

$1,011

Note that the high-low method gives estimates that are quite different

from the estimates provided by least-squares regression.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

47

Exercise 6A-3 (30 minutes)

1.

Units

(X)

24

15

30

12

18

27

Total Quality Control

Cost

(Y)

$540

$400

$620

$380

$480

$580

A spreadsheet application such as Microsoft® Excel or a statistical software package can be used to compute the slope and intercept of the

least-squares regression line for the above data. The results are:

Intercept (fixed cost) ...............

Slope (variable cost per unit) ....

R2 ...........................................

$215

$13.57

0.98

Therefore, the cost formula is $215 per week plus $13.57 per unit.

Note that the R2 is 0.98, which means that 98% of the variation in quality control costs is explained by the number of units produced. This is a

very high R2 and indicates a very good fit.

2. Y = $215 + $13.57X, where X is the number of units produced.

3. Total expected quality control costs if 20 units are produced:

Variable cost: 20 units × $13.57 per unit ..............

Fixed cost ...........................................................

Total expected cost ..............................................

$271.40

215.00

$486.40

4. It seems very plausible that as more units are produced, quality control

costs would increase since each unit produced goes through a quality control process.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

48

Managerial Accounting, 9th Canadian Edition

Problem 6A-4 (45 minutes)

1.

Number of Leagues

(X)

5

2

4

6

3

Total Cost

(Y)

$13,000

$7,000

$10,500

$14,000

$10,000

A spreadsheet application such as Excel or a statistical software package

can be used to compute the slope and intercept of the least-squares regression line for the above data. The results are:

Intercept (fixed cost) ..................

Slope (variable cost per unit) .......

R2 ..............................................

$4,100

$1,700

0.96

Therefore, the variable cost per league is $1,700 and the fixed cost is

$4,100 per year.

Note that the R2 is 0.96, which means that 96% of the variation in cost

is explained by the number of leagues. This is a very high R2 and indicates a very good fit.

2. Y = $4,100 + $1,700X

3. The expected total cost for 7 leagues would be:

Fixed cost .........................................................

Variable cost (7 leagues × $1,700 per league).....

Total cost ..........................................................

$ 4,100

11,900

$16,000

The problem with using the cost formula from (2) to estimate total cost

in this particular case is that an activity level of 7 leagues may be outside the relevant range—the range of activity within which the fixed cost

is approximately $4,100 per year and the variable cost is approximately

$1,700 per league. These approximations appear to be reasonably accurate within the range of 2 to 6 leagues, but they may be invalid outside

this range.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

49

Problem 6A-4 (continued)

4.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

50

Managerial Accounting, 9th Canadian Edition

Problem 6A-5 (45 minutes)

1. Units Sold

(000s)

(X)

16

18

23

19

17

20

25

22

Shipping

Expense

(Y)

$160,000

$175,000

$210,000

$180,000

$170,000

$190,000

$230,000

$205,000

A spreadsheet application such as Excel or a statistical software package

can be used to compute the slope and intercept of the least-squares

regression line for the above data. The results are:

Intercept (fixed cost) ...............

Slope (variable cost per unit) ....

R2 ...........................................

$40,000

$7,500

0.99

Therefore the cost formula for shipping expense is $40,000 per quarter

plus $7,500 per thousand units sold ($7.50 per unit), or

Y = $40,000 + $7.50X,

where X is the number of units sold.

Note that the R2 is 0.99, which means that 99% of the variation in shipping cost is explained by the number of meals served. This is a very

high R2 and indicates a very good fit.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

51

Problem 6A-5 (continued)

2.

Mayer Company

Budgeted Income Statement

For the First Quarter of Year 3

Sales (21,000 units × $50 per unit) ....................

$1,050,000

Variable expenses:

Cost of goods sold

(21,000 units × $20 per unit) ....................... $420,000

Shipping expense

(21,000 units × $7.50 per unit) ..................... 157,500

Sales commission ($1,050,000 × 0.05) ............

52,500

Total variable expenses ......................................

630,000

Contribution margin...........................................

420,000

Fixed expenses:

Shipping expenses ..........................................

40,000

Advertising expense ........................................ 170,000

Administrative salaries ....................................

80,000

Depreciation expense ......................................

50,000

Total fixed expenses ..........................................

340,000

Operating income ..............................................

$ 80,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

52

Managerial Accounting, 9th Canadian Edition

Case 6A-6 (90 minutes)

1a.

Units

Produced

(X)

60,000

44,000

84,000

48,000

72,000

100,000

120,000

112,000

Utilities

Cost

(Y)

$200,000

$180,000

$240,000

$300,000

$400,000

$420,000

$340,000

$480,000

A spreadsheet application such as Excel or a statistical software package

can be used to compute the slope and intercept of the least-squares regression line for the above data. The results are:

Intercept (fixed cost) ...............

Slope (variable cost per unit) ....

R2 ...........................................

$113,407

$2.58

0.47

Therefore, the cost formula using units produced as the activity base is

$113,407 per month plus $2.58 per unit produced, or

Y = $113,407 + $2.58X.

Note that the R2 is 0.47, which means that only 47% of the variation in

utility costs is explained by the number of units produced.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

53

Case 6A-6 (continued)

b. The scattergraph plot of utility costs versus units produced appears

below:

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

54

Managerial Accounting, 9th Canadian Edition

Case 6A-6 (continued)

2a.

DLHs

(X)

15,000

9,000

12,000

18,000

30,000

27,000

24,000

33,000

Utilities Cost

(Y)

$200,000

$180,000

$240,000

$300,000

$400,000

$420,000

$340,000

$480,000

A spreadsheet application such as Excel or a statistical software package

can be used to compute the slope and intercept of the least-squares

regression line for the above data. The results are:

Intercept (fixed cost) ...............

Slope (variable cost per unit) ....

R2 ...........................................

$68,000

$12

0.94

Therefore, the cost formula using direct labour-hours as the activity

base is $68,000 per quarter plus $12 direct labour-hour, or

Y = $68,000 + $12X.

Note that the R2 is 0.94, which means that 94% of the variation in utility

costs is explained by the number of direct labour-hours. This is a very

high R2 and is an indication of a good fit.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

55

Case 6A-6 (continued)

b. The scattergraph plot of utility costs versus direct labour-hours appears below:

3. The company should probably use direct labour-hours as the activity

base, since the fit of the regression line to the data is much tighter than

it is with units produced. The R2 for the regression using direct labourhours as the activity base is twice as large as for the regression using

units produced as the activity base. However, managers should look

more closely at the costs and try to determine why utilities costs are

more closely tied to direct labour-hours than to the number of units

produced.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

56

Managerial Accounting, 9th Canadian Edition

Case 6A-6 (continued)

4. It is plausible that both units produced and direct labour hours would be

related to utilities costs. However, because different models require different amounts of direct labour, it seems more plausible to expect a

strong association between labour hours and utilities costs. Using units

produced as the independent variable assumes no difference in labour

hour requirements across the various models. Not surprisingly, the results of the regression analysis are consistent with the qualitative assessment of economic plausibility with a much higher R2 value for the

model using direct labour hours.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 6

57