Business Studies

advertisement

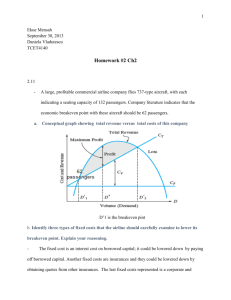

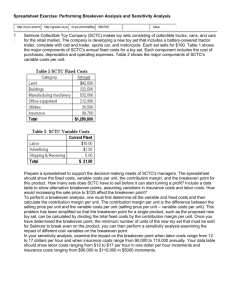

GCSE Business Studies For first teaching from September 2009 For first award in Summer 2011 Breakeven Analysis Learning Outcomes At the end of this unit students should be able to: • • • • • Calculate the margin of safety. Explain the term breakeven point; Distinguish between fixed and variable costs; Calculate the breakeven point both graphically and by formula; Sketch and label a breakeven chart; and Setting the Scene Breakeven analysis Breakeven analysis is a technique used by businesses such as Zoom Airlines to estimate the minimum output they need to produce and sell in order to survive in the industry. To conduct a breakeven analysis, firms need to compare their sales revenue with their total costs over a range of output and calculate the break even point. The breakeven point for a company such as Zoom airlines is the point at which it sells exactly the right number of seats and other products so that its sales revenue is exactly equal to its total cost. At the breakeven point the firm makes neither a profit nor a loss. Businesses use breakeven analysis to: • Calculate how many goods they need to sell to make an acceptable profit. Zoom Airlines suspend all flights • Transatlantic budget carrier Zoom Airlines has suspended all flights and is applying to go into administration. Thousands of passengers due to fly with Zoom have been told to rebook with other carriers, and to contact credit or debit card issuers about refunds. Calculate the level of costs that can be borne by the company – Zoom airlines calculated that they could not survive if fuel went above $140 per barrel. • Calculate how much they need to charge for their goods. • Calculate how changes in price affect their profits and break even point. UK-Canadian Zoom blamed its problems on the “horrendous” price of jet fuel - which had added over £27m to annual fuel bills - and the economic slowdown. The rising cost of oil - which topped $147 a barrel in July - has led to aviation fuel bills soaring. “They had based their business model on oil prices of about $70 or $80,” said Simon Calder, travel editor of The Independent. “Once it topped $140 they simply could not survive as they were no longer able to breakeven.” Zoom, which began flying in 2001, employed 450 staff in Canada and 260 staff in the UK. It operated flights from London Gatwick, Glasgow, Manchester, Cardiff and Belfast, as well as Paris and Rome. Calculating the breakeven point To conduct a breakeven analysis and calculate the breakeven point a firm must first consider its total revenue, its fixed costs, its variable costs and its total costs. Total Revenue (TR) is the income the firm receives from selling its products. It is calculated by multiplying the price of the product by the quantity sold. For example if Zoom Airlines sold 1000 seats at £50 each, then its total revenue is £50,000. On a graph the total revenue curve would slope upwards from left to right and would start at the origin. Fixed Costs (FC) are those business costs that are not directly related to the level of production or output. They are called fixed since they do change as output levels change. Business rent and rates are examples of fixed costs since they will have to be paid whether the firm produces nothing or produces at full capacity. On a graph the fixed cost curve would be a horizontal line which would start above the origin. Breakeven chart Variable Costs (VC) are costs which vary directly with the level of output. If output is zero then variable costs are zero but as output increases so to do variable costs. An example of a variable cost for Zoom Airlines would be its fuel costs. The more seats it sells the more fuel is needed to fly the plane. Other examples of variable costs include workers wages and electricity charges. On a graph the variable cost curve is drawn as a straight line sloping upwards from the origin. Total Cost (TC) is calculated by adding the fixed costs and the variable costs of the business together. On a graph the total cost curve is a diagonal line which has the same slope as the variable cost curve, but which starts at the level of fixed cost and not at the origin. This is because even at zero output the firm has to pay its fixed costs therefore its total costs will never fall below its fixed costs. The following illustrates how these three cost curves are shown on a graph. Total Cost Total Revenue & Total Costs One way to calculate the breakeven point is to draw a breakeven chart. On a breakeven chart the firm will plot its total revenue, total cost and fixed cost curves. The diagram below shows a breakeven chart for a typical firm. The vertical axis shows the total revenue received from selling each level of output and the total cost of producing each level of output. The horizontal axis shows the quantity of output sold. TR/TC Total Revenue 40 Breakeven Point 20 Fixed Costs Loss Margin of Safety Variable Costs 40 Total Cost Profit 3 6 Units Sold (#) We can see from the diagram above that the breakeven point (the point where TR =TC) occurs when the firm sells 3 units. 20 Fixed Costs 3 6 Units Sold (#) Activity: Fixed & Variable Costs In the table below indicate which costs are fixed and which are variable by placing a tick in the appropriate box. If actual sales are below this breakeven point then the firm will be making a loss. If actual sales are above this breakeven point then the firm will be making a profit. The actual amount of any profit or loss is shown by the vertical distance between the total cost and total revenue curves. Margin of safety Cost Fixed Mortgage The margin of safety is the difference between the current level of output and the breakeven level of output. It represents the number of units that output can fall by before the business makes a loss. In the diagram above if the actual level of output is 6 units then the margin of safety is 3 units of output. Rates Calculating the breakeven point by formula Telephone Raw materials Another way to calculate the breakeven point is to use the following formula Electricity Managers’ salaries Workers wages Interest payments on loans Advertising Variable Total fixed costs Breakeven point = Contribution Selling price – variable cost per unit For example, let’s assume a producer is selling shoes at £30 per pair. He has total fixed costs of £20,000 and his variable costs per pair of shoes of £5. To calculate the breakeven point we put this information into the above formula. £20,000 Breakeven point = £25 (£30 - £5) We find that the breakeven point 800 pairs of shoes. Key Terms • The breakeven point is the point at which sales revenue is exactly equal to total cost. At the breakeven point the firm makes neither a profit nor a loss. • Total Revenue is the income the firm receives from selling its products. It is calculated by multiplying the price of the product by the quantity sold. • Fixed Costs are those business costs that are not directly related to the level of production or output. Examples include managers salaries and interest payments on loans. • Variable Costs are costs which vary directly with the level of output. Examples include workers wages and raw material costs. • Total Cost is calculated by adding the fixed costs and the variable costs of the business together. • The margin of safety is the difference between the current level of output and the breakeven level of output. Activity: Pete’s Pizza Slices Peter Smith has just opened his pizza slice shop in Belfast. He wants to calculate how many pizzas he will have to sell each month in order to breakeven. He has calculated his monthly fixed costs to be £2,000 and his variable costs to be £0.20 per pizza slice. Pete sells his pizza slices for £1 per slice. 1. Using the information above complete the following table. The first row is done for you. Number Total Fixed Variable Total Profit of pizza revenue costs costs costs /Loss slices sold (TR-TC) 0 0 2000 0 2000 500 1000 1500 2000 2500 3000 3500 2. -2000 Use the information in the table above to plot a breakeven chart. On this chart you should clearly label: • The vertical and horizontal axis. • The TR, TC and FC curves. • The breakeven point. • The area of profit and loss. 3. Calculate the margin of safety if Pete sells 3,500 pizza slices each month and put it on the graph. 4. Use the formula given in the notes above to calculate how the breakeven point and the margin of safety would change if Pete increased his price to £1.20 per slice. Revision questions 1. Explain the difference between fixed and variable costs. 2. Explain what is meant by the breakeven point. 3. Give 3 reasons why a firm would conduct a breakeven analysis. 4. Sketch and label a breakeven chart for a typical business. 5. Explain the difference between a profit and a loss. 6. Explain what is meant by the margin of safety.