Economic Turmoil and its Impact on People

advertisement

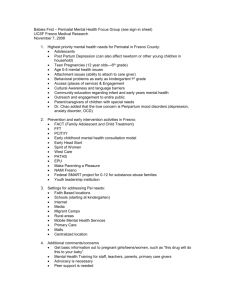

Economic Turmoil and its Impact on People Dr. Antonio Avalos aavalos@csufresno.edu (559) 278-8793 Department of Economics California State University, Fresno OSHER Lifelong Learning Institute Jan 28, 2008 Presentation 1) Global perspective of the origin of the crisis 2) Connection to the US Economy 3) The increased complexity of the finance world 4) The current economic crisis 5) Impact on people 6) Attempts to ‘fix the economy’ (TARP & ARRP) 7) Economic Forecasts 8) Final notes about Fresno County The world is getting richer… World GDP (current trillion US$) 70.0 60.0 50.0 40.0 30.0 20.0 10.0 08 20 6 20 0 4 20 0 02 20 00 20 8 19 9 6 19 9 94 19 2 19 9 0 19 9 8 6 19 8 4 19 8 2 19 8 19 8 19 8 0 0.0 Source: World Development Indicators 2008, World Bank • • World GDP has multiplied by 6 in the last 3 decades After last recession (2001-2002), growth increased significantly …and people worldwide is saving more. World Gross Domestic Savings (current trillion US$) 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 High income Middle income 20 08 06 20 04 20 02 20 00 20 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 19 80 0.0 Low income Source: World Development Indicators 2008, World Bank Result A “huge global pool of money” 2000 36 trillion US$ 2007 70 trillion US$ > 2007 World GDP SHARP INCREASE IN SAVINGS !!! • Insurance companies saving for a catastrophe, pension funds saving for retirement, deposits in central banks around the world, etc. Important Consequences: • • Global army of nervous investment managers hungry for attractive returns to make it bigger and not to loose a penny. Traditionally, they invest in secure financial instruments such as Tbills…..HOWEVER In the US Monetary policy was changing… Recession Periods 1 • Federal Reserve started lowering Federal Funds Rate to reach 1% making this usually attractive instrument incredible unattractive and driving global investment managers to look for substitutes. …and the global pool of money discovered a new financial instrument: MORTGAGE LOANS in the American Housing Market T-bills Paying 1% or Mortgage loans Paying 5%-9% ? But there was a problem mortgage loans were too big of a hassle to global international investors: They did not want to get involved with actual people and their messy lives (their health issues, divorces, and any other reason that could stop payment). SO Geniuses at Wall Street came up with an scheme to give global investors the high yield of mortgage loans but without the hassle and risks. Mortgage Backed Securities (MBSs) Family Broker Small Bank Big Investment Firm (Wall Street) Global Pool of Money Wall Street financial companies bought thousands of mortgages. Thousands of mortgage monthly checks producing a huge stream of income, presumably for the next 30 years! Companies sold shares of that monthly income to investors as MBSs. Global investors loved MBSs Wall Street had troubles keeping up producing enough of them to satisfy the increasing demand. A very nasty consequence Enormous pressure to reduce standards! An imprudent partnership In the beginning, most MBSs were composed by secure, responsible, made mortgages and MANY of them were sold. Until 2003, pretty much everybody that needed a mortgage had gotten one, but the Global Pool of Money wanted more… “Race to the Bottom” competition that produced lending to people that under normal conditions would not receive a loan!!! Standard Loans Stated Income Verified Assets Stated Income Stated Assets NINJA LOANS No Income No Assets A New Era Banks did not need to hold loans for 30 years Banks did not have to wait to see if loan would be paid or not. Only hold loans for 30 days and sell them to big investment firms (Goldman Sachs, Merrill Lynch, Bearn Stearns, JP Morgan, etc). Home prices were increasing very rapidly, which fueled the notion that home prices in the US would never go down. IN FACT Even if the worse happened (default on a mortgage), the bank would end up with a house that was increasing in price! HUGE competition to lend since juicy commission depended on number of loans BOTTOM LINE: LINE If they were BAD loans, that was somebody else’s problem! Another factor Triumph of data over common sense Computer financial software analyzed huge amounts of data, and it never produced a negative result or even a warning!!! WHY? They were using the WRONG data: These data were based on regular loans, not the newly created loans! Historical data on foreclosure rate indicated it was less than 4% (they calculated 10% or 12% in a worse case scenario). Historical data was IRRELEVANT as some loans have registered a 50% foreclosure rate. INCREDIBLY Even rating agencies (Fitch, Moody’s, Standard & Poor’s, etc.) which were supposed to accurately assess risk and creditworthiness of these loans, assigned AAA ratings to MBSs. The straw that broke the camel’s back Collateralized Debt Obligation (CDOs) Pool of slices of MBSs, some of which are riskier than others. REMEMBER MBSs are pools of thousands of mortgages Those CDOs that have higher risk are called “TOXIC WASTE” AGAIN, in 2005 and 2006, global pool of money loved them! Due to competition for funds by selling CDOs, a similar pressure to lower the standards occurred. INCONSISTENCY Even though housing prices were going up (2002-2006) in this speculative housing bubble, households were not making more money! The housing bubble pops! Late 2006 As people were given more and more homes they could not afford, around Halloween 2006, realtors started noticing that some households could not make even the first payment! 2006: The average home cost 4 times the average family income (historic number was between 2 and 3 times) THE REVERSAL OF THE TREND: as more people defaulted, more houses became available in the market and the price of homes started to decline. Early 2007: Wall Street started to stay away from risky loans but small banks were already indebted (borrowing money to buy loans that now they could not sell!) So Banks had no option but to default! The Global “Credit Crisis” Nobody really knows how much of the global pool of money was lost. The global pool of money now wants SAFETY! (zero risk!) Once again, T-bills look attractive, despite their incredibly low return THUS, borrowing money is very difficult or costly Freezing of credit is new in the world, we have never seen anything like this before. Trust among banks and financial institutions has been severely damaged. Spreading to other markets COMERCIAL PAPER MARKET Similar to credit cards for people to pay day to day expenses such as payment to suppliers, payroll, etc. (most large companies operate in this market basically writing short term IOUs). Treasury of a company calls Wall Street (Goldman Sachs, Merrill Lynch, Bearn Stearns, JP Morgan, Lehman Brothers, etc.) to issue commercial paper (sometimes every day) and without this the US Economy could hardly operate on a regular basis. HOWEVER, in SEP 2008 this market got frozen, which marked the beginning of a series of attempts on behalf of policy makers to rescue it. And all this is closely related to the MONEY MARKET MUTUAL FUNDS! Money Market Mutual Funds Usually very secure markets although the return is not very high. Earning this return usually implies buying Commercial Paper. SAFE People lending money to companies with great reputation that for years had been paying on time these returns. Safe until one very important and old mutual fund BROKE THE BUCK! (“Reserve Fund” lost money from its depositors!) WHY? They were buying from a company called Lehman Brothers This caused the typical bank run Pension fund managers and other investors started pulling their money out of the commercial paper market. The mortgage crisis was spreading to other markets!!!!!! The Largest “Mattress” of the World Lehman Brothers went bankrupt because of its own exposure to bad home loans. Then AIG almost collapsed as well. IN TWO WEEKS Basically there was no money in the commercial paper market, it dried up! A huge trust problem started. Nobody knew who had losses and who did not. THUS, most people went to the safest instruments of all: T-bills CONSEQUENCE Borrowing money would be almost impossible with tremendously negative consequences for a market economy such as the U.S. Economy. Every day there are reports of companies cancelling plans because inability to borrow money. The ‘breaks’ that slowed down the economy Consumption falls Housing Crisis Investment falls Confidence falls All this happens as credit markets gets frozen and crisis spreads to all sectors of the economy Government tax revenues fall at all levels: Federal, State and Local The Current Economic Crisis U.S. Employment Monthly Change (Thousands): 1998-2008 Source: U.S. Bureau of Labor Statistics (BLS) Nearly 2.6 million jobs were lost over 2008, the highest yearly job-loss total since 1945. The Current Economic Crisis U.S. Unemployment Rate (%): 1970-2008 7.2% Source: U.S. Bureau of Labor Statistics (BLS) Not quite the 10.8% we reached in Dec 1982, but rising very quickly! Unemployment Rate (annual average), 1990-2007 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 1990 Down ward 13.2% trend 9.1% 1992 1994 1996 1998 2000 Fresno County 2002 2004 2006 2008 California Source: California Employment Department, 2008 For the last 20 years, the unemployment rate in Fresno County has exceeded the one for California by an annual average of 5.6 percentage points. HOWEVER This differential has tended to get smaller. Impact of People DIRECT: Losing jobs and losing homes (loss of wealth) Loosing health insurance Difficulties to afford child care and education (school) Lost of savings, mainly through pension funds Shifting behavior toward lower quality goods and services Emotional distress and tension between and among families INDIRECTLY: INDIRECTLY Loss of unemployment insurance Inability to borrow money (school loans, car loans, etc.) Reduction or even loss of important government services at federal, state and local levels (health, education, security, etc.) Increase in crime rates Size and variety of goods and services available is being reduced First attempt to solve the crisis: The TARP TARP = Troubled Asset Relief Program ($700 billion) Originally, it allowed the US Department of the Treasury to purchase or insure (TOXIC) "troubled” assets from banks and other financial institutions. IMPORTANT GOAL: to encourage banks to resume lending at levels seen before the crisis, both to each other and to consumers and businesses (this goal has not been met). Revision to the plan: Treasury bought preferred stock and warrants in the nine largest American Banks, and is buying preferred stock and warrants from hundreds of smaller banks. The first $350 billion TARP money was primarily used to buy preferred stock, which is similar to debt in that it gets paid before common equity shareholders. Just recently, former President Bush extended the use of TARP funds to support the auto industry. Why the TARP is not working? Hundreds of billions of dollars have been injected into the marketplace with no demonstrable effects on lending. WHY? American taxpayers are the major provider of finance to the banks, yet they have no voice in how the banks are run. It is almost impossible to value ‘toxic assets’ since they are not being traded right now (government had to ‘make up’ a price). Banks are heavily leveraged, in some cases 25 or even 30 times their equity (at 25 to 1 leverage, a 4% fall in the price of assets wipes out a bank’s net worth!) Many millions poured into banks, is being poured out to their executives in the form of bonuses and to their shareholders in the from of dividends (but no lending!) The Case for Bigger Government For the last 30 years, US economy relied on the magic of free markets: today major sectors are deeply in trouble: health care, energy, transportation, finance, etc. Social and environmental needs are vast. Furthermore, the US is not better off than other rich nations in the world: child-poverty and infant-mortality rates are higher, life expectancy is lower, teenagers rank among the lowest on tests of math and science. Most analysts agree that we need a more active role of the government: We need more government and we need deficit spending to help revive the economy from a recession. BUT ONLY if the price is right and the strategies are convincing. Government intervention should deal with the present crisis but at the same time should be sensible of the future. The second attempt: The AARP AARP = American Recovery and Reinvestment Plan ($825 billion) Doubling the production of alternative energy in the next three years. Modernizing more than 75% of federal buildings and improve the energy efficiency of two million American homes. Making the immediate investments necessary to ensure that within five years, all of America’s medical records are computerized. Equipping tens of thousands of schools, community colleges, and public universities with 21st century classrooms, labs, and libraries. Expanding broadband across America, so that a small business in a rural town can connect and compete with their counterparts anywhere in the world. Investing in the science, research, and technology that will lead to new medical breakthroughs, new discoveries, and entire new industries. Obama’s additional plans Responsibly end the war in Iraq and dedicate more resources to the fight against the Taliban and al Qaeda in Afghanistan. Eliminate Our Current Imports from the Middle East and Venezuela within 10 Years. Create Millions of New Green Jobs by investing $150 billion over the next ten years to catalyze private efforts to build a clean energy future. Make the Tax System More Fair and Efficient. Affordable, accessible health care for all Americans. Expand the Earned Income Tax Credit. Raise the Minimum Wage to $9.50 an Hour by 2011. Provide Tax Relief (plan will eliminate taxes for seniors making under $50,000 per year). Commitment to ensuring Social Security is solvent and viable for the American people. Simultaneously Restore Fiscal Discipline to Washington US Economic Forecasts SOURCE 2008 2009 The Conference Board RGDP UR IIIQ* -0.5% 6.0% UCLA Anderson RGDP UR -0.5% 6.0% -4.1% 6.5% -3.4% 7.6% -0.8% 8.2% RGDP UR -0.5% 6.0% -5.0% -3.0% -1.0% RGDP UR -0.5% 6.0% -2.9% 6.6% Goldman Sachs Survey of Professional Forecasters IVQ -5.9% 6.9% IQ -3.4% 7.5% IIQ -1.5% 8.2% IIIQ 2.4% 8.6% IVQ 2.5% 8.9% 8.4% 8.5% 9.0% -1.1% 7.0% 0.8% 7.4% 0.9% 7.6% 2.3% 7.7% RGDP = Real Gross Domestic Product UR = Unemployment Rate * = Actual official numbers Recovery period As far as financial markets… The crisis showed the flaws in financial markets, they were plagued by: Poor regulation Dangerous incentives Reckless use of mathematical models using the wrong data What can we expect in the near future? Smaller markets and smaller financial institutions More (or at least) better regulation More conservative Rapid Population Growth in Fresno County 2000 2010 2020 2030 2040 2050 Fresno County Population Growth Rate 804,508 983,478 22.2% 1,201,792 22.2% 1,429,228 18.9% 1,670,542 16.9% 1,928,411 15.4% California Population Growth Rate 34,105,437 39,135,676 14.7% 44,135,923 12.8% 49,240,891 11.6% 54,266,115 10.2% 59,507,876 9.7% Source: State of California, Department of Finance, Population Projections for California and Its Counties 2000-2050, Sacramento, California, July 2007. • • By 2050, total population in Fresno County will be 2.4 times higher. By 2050, total population in California will only be 1.7 times higher. • Despite the projected declining rates of growth, Fresno County will continue to grow faster than California. Hispanics Growing the Fastest: Fresno County 100% 90% 5.1% 8.2% 4.8% 9.4% 5.0% 8.9% 4.6% 4.6% 4.6% 11.1% 11.7% 12.2% 24.5% 21.2% 18.7% 10% 28.5% 20% 33.7% 30% 40.4% 40% 2 2010 3 2020 4 2030 2040 5 2050 6 0% 1 2000 62.4% 60.4% 57.7% 50% 55.6% 60% 50.1% 70% 44.0% 80% White Hispanic Asian Black Other Source: State of California, Department of Finance, Population Projections for California and Its Counties 2000-2050, Sacramento, California, July 2007. 2050: Hispanic population will be 3.4 times higher than in 2000 1,202,527 2050: White population will only be 1.1 times higher than in 2000 361,135 Larger Numbers of Working Age People: Fresno County 1,200,000 1,054,108 936,484 1,000,000 799,043 800,000 689,426 20-64 65+ 574,467 600,000 440,153 400,000 200,000 136,226 79,282 193,075 243,540 317,524 92,657 0 2000 2010 2020 2030 2040 2050 Source: State of California, Department of Finance, Population Projections for California and Its Counties 2000-2050, Sacramento, California, July 2007. • • Working age population in Fresno County will double by 2040 Retirement age population in Fresno County will triple by 2040 Fresno County Declining Worker/Elder Ratio Worker / Elder Ratio 7 6 5 4 3 2 1 0 2000 2010 2020 Fresno County 2030 2040 2050 California Source: State of California, Department of Finance, Population Projections for California and Its Counties 2000-2050, Sacramento, California, July 2007. • In Fresno County: – 2000 Approximately 5.5 working people for every retired person. – 2040 Approximately 3.8 working people for every retired person. Income Distribution by Quintiles: Fresno, MSA: 2006 Low Middle 3% Poorest 1% Middle 5% Upper Middle 9% Richest 82% Source: U.S. Census Bureau, American Community Survey (ACS) In 2006, while the richest 20% of families earned 82% of the total household income in Fresno, the poorest 20% of families earned only 1%. 10 Fastest Growing Occupations (2004-2016) Fresno County Occupational Title Network Systems and Data Communications Analysts Computer Software Engineers, Applications Pharmacy Technicians Home Health Aides Medical Assistants Substance Abuse and Behavioral Disorder Counselors Employment, Recruitment, and Placement Specialists Bartenders Computer Systems Analysts Pharmacists Respiratory Therapists Annual Average Employment 2006 2016 280 420 430 600 550 750 1,570 2,140 1,720 2,250 230 300 370 470 460 580 370 460 500 620 340 420 Percent Change 50.0% 39.5% 36.4% 36.3% 30.8% 30.4% 27.0% 26.1% 24.3% 24.0% 23.5% Median Hourly Wage $31.36 $38.72 $16.62 $8.89 $12.81 $15.94 $26.43 $8.66 $36.06 $58.08 $30.08 Source: California Employment Department, 2008 Average hourly wage of 10 fastest growing occupations ($28.37) is higher than average hourly wage for all occupations ($21.08). 9,010 new jobs in these occupations will represent more than 27% of the total new jobs in 2016. Business Situation (Entrepreneurship), Selected Years Number of Establishments by Employment-size Class County/1997 Fresno Riverside San Bernardino Washoe Maricopa County/2004 Fresno Riverside San Bernardino Washoe Maricopa County/2006 Fresno Riverside San Bernardino Washoe Maricopa 1-4 8,017 13,105 13,064 5,748 35,741 1-4 7,937 16,338 14,905 6,378 42,460 1-4 8,139 18,286 16,143 6,623 47,290 5-9 10-19 3,070 4,792 5,159 2,002 12,719 5-9 2,056 3,006 3,427 1,297 8,821 10-19 3,019 5,824 5,776 2,124 13,893 5-9 2,314 4,001 4,209 1,622 10,192 10-19 3,132 6,234 6,056 2,226 14,938 2,366 4,365 4,409 1,699 11,076 20-49 50-99 100-249 250-499 500-999 1000+ TOTAL 1,409 416 2,142 726 2,656 875 869 274 6,324 2,214 197 368 445 149 1,298 44 75 115 39 341 20 29 34 11 110 5 9 16 16 79 15,234 24,252 25,791 10,405 67,647 20-49 50-99 100-249 250-499 500-999 1000+ TOTAL 1,648 530 3,011 1,058 3,282 1,099 1,060 350 7,599 2,846 231 564 635 196 1,654 54 123 165 39 445 20 50 46 16 170 9 24 27 14 86 15,762 30,993 30,144 11,799 79,345 20-49 50-99 100-249 250-499 500-999 1000+ TOTAL 1,786 564 3,262 1,159 3,604 1,160 1,189 373 8,433 3,276 281 682 720 234 1,923 59 153 188 54 585 23 61 47 19 183 11 30 29 14 86 16,361 34,232 32,356 12,431 87,790 Source: County Business Patterns, U.S. Census Bureau, 2008 Signs of Improvement In only 2 years (2004-2006) the total number of Establishments grew 3.8% compared to 3.5% in the previous 7 years. Number of small businesses is also growing, rather than declining. Thanks very much! Dr. Antonio Avalos aavalos@csufresno.edu (559) 278-8793