State of South Carolina Department of Revenue SALES AND

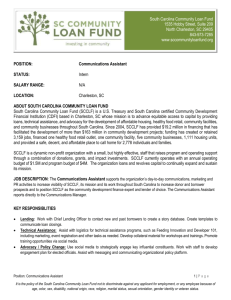

advertisement