Sent to Consumer Testing Number One

advertisement

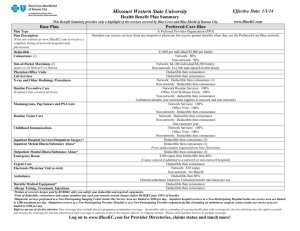

Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO This is only a summary. For more information about this plan, or to get a copy of the plan documents, contact Direct Health Insurance Company at 1-800-555-1234 or www.directhealth.com once you have enrolled in health coverage. Important Questions What is the overall deductible? Answers $1,000/$2,500 designated network $2,500/$7,500 network Why This Matters: Generally, you must pay all the costs from doctors, hospitals, labs up to the deductible amount before this plan begins to pay. If you have other family members on the policy, they have to meet their own deductible until the family deductible amount has been met. $5,000/$15,000 nonnetwork Are there services covered before you meet your deductible? Yes This plan covers some items and services even if you haven’t yet met the annual deductible amount. But a copayment or coinsurance may apply. See Common Medical Events chart. Are there other deductibles for specific services? Yes Congenital heart disease surgery services; hospital inpatient services; lab, xray and major diagnostic (CT, PET, MRI, MRA, etc.); and outpatient services have specific and separate deductibles in addition to the annual deductible. Please check with your health plan for full details. What is the out-ofpocket limit for this plan? $4,000/$10,000 designated network $6,000/$20,000 network The out-of-pocket limit is the most you could pay during a coverage period (usually one year) for your share of the cost of covered services. This limit helps you plan for health care expenses. $15,000/$45,000 nonnetwork If you have other family members on the policy, they have to meet their own out-of-pocket limit until the family out-of-pocket limit has been met. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Important Questions Answers Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Why This Matters: What is not included in the out-of-pocket limit? Premiums, balance-billed charges, copayments, coinsurance, deductibles on certain services and health care this plan doesn’t cover, and any charges from non-network services. Even though you pay these expenses, they don’t count toward the out-ofpocket limit. Does this plan use a network of providers or tiers of provider network? Yes. This plan uses tiers of network providers. See www.directhealth.com or call 1-800-555-1234 for a list of participating providers. Dental and vision benefits may use different provider networks. If you use “designated network” or “network” provider, this plan covers some or all of the covered costs. You will pay more if you use a non-network provider or providers not in the “designated network”. Be aware, your “designated network” or “network” provider may use a non-network provider for some services (such as lab work). Check with your provider before you get services. Do I need a referral to see a specialist? No. You can see the specialist you choose without getting a referral. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO All copayment and coinsurance costs shown in this chart are after your overall deductible has been met, if an overall deductible applies. You should review the Services Your Plan Does NOT Cover for information about what services will not be covered by this plan. Common Medical Event Services You May Need Primary care visit to treat an injury or illness Specialist visit If you visit a health care provider’s office or clinic If you have a test Preventive care/screening/ immunization Diagnostic test (x-ray, blood work) Advanced Imaging (CT/PET scans, MRIs) Your Cost If You Use a Level 1 Designated Network Provider $25 copay/visit $50 copay/visit Your Cost If You Use a Level 2 Network Provider Your Cost If You Use a Level 3 Non-Network Provider $45 copay/visit $65 copay/visit 40% coinsurance 40% coinsurance No charge 40% coinsurance $50 copay/test $100 $50 copay/test copay/test 40% coinsurance 40% coinsurance No charge $30 copay/test Limitations, Exceptions and Other Important Information The copayment/coinsurance and deductible apply for the following services received in doctor’s office: lab, x-ray, diagnostic services, outpatient drugs, outpatient surgery and outpatient therapy. You may have to pay for services that are not preventive. Ask your provider if the service is needed to treat a condition or is a recommended preventive service. Then call and check with your plan what they will pay for. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Tier 1 drugs (generic and certain preferred brands) Tier 2 drugs (generic and certain preferred brands) If you need prescription drugs to treat your illness or condition More information about prescription drug coverage www.directhealth/dr ug.com. Your Cost If You Use a Level 1 Designated Network Provider $10 copay/drug $15 copay/drug Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 2 Network Provider Your Cost If You Use a Level 3 Non-Network Provider $20 copay/drug 40% coinsurance after $50 copay/drug $25 copay/drug 40% coinsurance after $75 copay/drug Tier 3 drugs (non-preferred brands) $50 copay/drug $75 copay/drug 40% coinsurance after $100 copay/drug Specialty drugs 20% coinsurance 40% coinsurance Not covered Limitations, Exceptions and Other Important Information Copayment/coinsurance will not apply to drugs that are considered preventive services. Prior authorization is required. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event If you have outpatient surgery If you need immediate medical attention Services You May Need Your Cost If You Use a Level 1 Designated Network Provider Your Cost If You Use a Level 2 Network Provider Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 3 Non-Network Provider Limitations, Exceptions and Other Important Information Services provided by a nonnetwork physician in a “designated network” or “network” facility will be based on “designated network” or “network” benefit levels. However, you will be responsible to the non-network physician for any amount billed over the eligible amount. Facility fee (e.g., ambulatory surgery center) 20% coinsurance 30% coinsurance 40% coinsurance Physician/surgeon fees $50 copay/visit $65 copay/visit 40% coinsurance Emergency room services $500 copay/visit 40% coinsurance 40% coinsurance If you are admitted to a “designated network’ or a “network” hospital directly from the emergency room you will not have to pay these amounts. If you choose to stay in a nonnetwork hospital after the date we decide a transfer is medically appropriate, benefits will not exceed the non-network benefit level. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Emergency medical transportation Urgent care If you have a hospital stay If you need mental health, behavioral health or substance abuse services Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 1 Designated Network Provider $100 copay/ Your Cost If You Use a Level 2 Network Provider Your Cost If You Use a Level 3 Non-Network Provider $250 copay/ $250 copay/ transport transport transport $75 copay/visit $100 copay/visit 40% coinsurance Facility fee (e.g., hospital room) $100 deductible; then 20% coinsurance $250 deductible; then 20% coinsurance $1,000 deductible; then 40% coinsurance Physician/surgeon fees $50 copay/visit $65 copay/visit 40% coinsurance Outpatient services $35 copay/ visit; 20% coinsurance/ other outpatient services $50 copay/ visit; 30% coinsurance/ other outpatient services 40% coinsurance Limitations, Exceptions and Other Important Information Copayment applies to the first 5 days of inpatient care. You must obtain prior authorization for services received in a nonnetwork hospital. If you fail to obtain prior authorization, benefits will be reduced to 50% of eligible expenses. 50 visit limit. Prior authorization required for intensive treatment programs, electro-convulsive treatment, psychological testing, extended visits beyond 50. Failure to obtain prior authorization will result in benefits being reduced to 50% of eligible charge. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Inpatient services Office visits Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 1 Designated Network Provider Your Cost If You Use a Level 2 Network Provider Your Cost If You Use a Level 3 Non-Network Provider 20% coinsurance after you pay $100 per day copay 20% coinsurance after you pay $200 per day copay. 40% coinsurance after you pay $500 per day copay. $25 copay/visit $45 copay/visit 40% coinsurance If you are pregnant Limitations, Exceptions and Other Important Information Prior authorization required unless a non-scheduled admission. Must notify the plan as soon as reasonably possible for non-scheduled admission. Failure to obtain prior authorization will result in benefits being reduced to 50% of eligible charge. Copayment does not apply to first visit with “designated network” or “network” physician. No cost-share for preventive services. Childbirth/delivery professional services $50 copay/visit $65 copay/visit 40% coinsurance For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Childbirth/delivery facility services Home health care Your Cost If You Use a Level 1 Designated Network Provider $100 deductible; then 20% coinsurance $50 copay/visit Your Cost If You Use a Level 2 Network Provider $250 deductible; then 20% coinsurance $65 copay/visit Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 3 Non-Network Provider Limitations, Exceptions and Other Important Information $1,000 deductible; then 40% coinsurance Copayment applies to the first 5 days of inpatient care. You must obtain prior authorization for services received in a nonnetwork hospital. If you fail to obtain prior authorization, benefits will be reduced to 50% of eligible expenses. 40% coinsurance Limited to 100 visits per year. Prior authorization required. Failure to obtain prior authorization will result in benefits being reduced to 50% of eligible expenses. If you need help recovering or have other special health needs Rehabilitation services $5 copay/visit $10 copay/visit $25 copay/visit • Physical Therapy: 40 visits per year • Occupational Therapy: 40 visits per year • Speech Therapy: 40 visits per year 40 visit per year maximum for pulmonary, cardiac or cognitive therapy. The 40 per year visit maximum does not apply to Autism Spectrum Disorder treatment. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Your Cost If You Use a Level 1 Designated Network Provider Your Cost If You Use a Level 2 Network Provider Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 3 Non-Network Provider Habilitation services $5 copay/visit $10 copay/visit $25 copay/visit Skilled nursing care 20% coinsurance after you pay $100 per day copay 20% coinsurance after you pay $200 per day copay. 40% coinsurance after you pay $500 per day copay. Limitations, Exceptions and Other Important Information • Physical Therapy: 40 visits per year • Occupational Therapy: 40 visits per year • Speech Therapy: 40 visits per year 40 visit per year maximum for pulmonary, cardiac or cognitive therapy. The 40 per year visit maximum does not apply to Autism Spectrum Disorder treatment. Prior authorization is required. Failure to obtain prior authorization will result in 50% reduction in eligible expenses for non-emergency care. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Common Medical Event Services You May Need Durable medical equipment If your child needs dental or eye care Your Cost If You Use a Level 1 Designated Network Provider 20% coinsurance Your Cost If You Use a Level 2 Network Provider 30% coinsurance Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Your Cost If You Use a Level 3 Non-Network Provider Limitations, Exceptions and Other Important Information 40% coinsurance Prior authorization required. Mobility devices and speech aid devices and tracheoesophageal voice devices are limited to one per lifetime. To receive network benefits, you must purchase or rent the DME from the vender we identify or purchase it directly from the prescribing “designated network” or “network” physician. Hospice services $20 copay $30 copay $50 copay Prior authorization is required. Failure to obtain prior authorization will result in 50% reduction in eligible expenses. Eye exam $25 copay/visit $35 copay/visit Not covered Limit of 1 exam per year. For dependents up to age 19. Glasses $25 copay/visit $35 copay/visit Not covered Limit of 1 pair of eyeglasses per year. No coverage for contact lenses. Dental check-up $25 copay/visit $35 copay/visit Not covered Limit of 2 visits per year. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Excluded Services & Other Covered Services: Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) • Acupuncture • Cosmetic surgery • Dental care (adult) • Non-emergency care when traveling outside the U.S. • Routine eye care (adult) • Routine foot care Other Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for these services.) • Chiropractic care (30 visits per year) • Hearing aids (1 per lifetime) • Diabetes • Prosthetic and Orthotic Devices • Infertility Treatment • Obesity Surgery Additional consumer protections may be available under your plan. For instance, several agencies and organizations are available to assist if you have a complaint (also called grievance or appeal) against your plan, for a denial of a claim, or if you want to continue your coverage after coverage would otherwise end. For more information about your rights if a claim is denied, review the explanation of benefits for that medical claim. Your plan documents also provide complete information to submit a claim appeal or a grievance for any reason to your plan. State DOI, 1-800-888-8888 or http://statedoi.state.gov/consumer/complaints for complaints, grievances, appeals and external reviews. Healthcare.gov www.HealthCare.gov or call 1-800-318-2596 for more coverage options. As required by the Affordable Care Act: Does this plan provide Minimum Essential Coverage? Yes If you don’t have Minimum Essential Coverage, you’ll have to pay a penalty unless you get an exemption from the requirement that you have health coverage. For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. Direct Health Insurance Company: Star PPO Plus Summary of Benefits and Coverage: What this Plan Covers & What it Costs Does this coverage meet the Minimum Value Standard? Coverage Period: 01/01/2016 – 12/31/2016 Coverage for: Individual + Family | Plan Type: PPO Yes If your coverage doesn’t meet the Minimum Value Standard, you can get exchange coverage and may be eligible for a premium tax credit to help you buy coverage through the marketplace. Language Access Services: Spanish (Español): Para obtener asistencia en Español, llame al 1-800-555-1234 Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-555-1234. Chinese (୰ᩥ): ዴᯝ㟂せ୰ᩥⓗᖎຓ㸪庆㕷㓢扨₹⚆䪐1-800-555-1234. Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-555-1234. ----------------To see examples of how this plan might cover costs for a sample medical situation, see the next section.----------------- For definitions of common terms, see the Glossary at www.hhs.cms.gov or call 1-800-555-1234 to request a copy. How cost share works For the examples below, this cost-sharing information is used: These three examples show the patient how health insurance covers the costs of medical care and how deductibles, copayments and coinsurance impact what the patient’s will pay. Do not use these examples below to estimate what you will pay. What you pay will be different, depending on the care you need, if you get in-network care, what your doctor and other providers charge, and other factors. Annual deductible for in-network services received $1,000 Copayment for doctor visit $50 In-network doctor visit (managing diabetes) Emergency room in-network visit $0 Deductible left to meet $500 Copayment $50 Copayment $500 Example allowed amount $200 (amount on which plan will base payment) Coinsurance Not applicable Example allowed amount $2,500 (amount on which plan will base payment) Calculating example out-of-pocket costs $500 80% 20% Having a baby in-network Deductible left to meet Coinsurance Not applicable Copayment for emergency room visit Coinsurance (plan pays) (patient pays) Deductible left to meet $1,000 Copayment Not applicable Coinsurance (plan pays) 80% Example allowed amount $20,000 (amount on which plan will base payment) Calculating example out-of-pocket costs Calculating example out-of-pocket costs Example allowed amount $200 Example allowed amount $2,500 Example allowed amount $20,000 Deductible left to meet – $0 Deductible left to meet – $500 Deductible left to meet – $1,000 Copayment – $50 Copayment – $500 Copayment – $0 Coinsurance – $0 Coinsurance – $0 Coinsurance – $3,800 In this example, patient pays $50 In this example, patient pays $1,000 In this example, patient pays $4,800 In this example, plan pays $150 In this example, plan pays $1,500 In this example, plan pays $15,200 )RUGH¿QLWLRQVRIFRPPRQWHUPV, see the Glossary at www.[insert].com or Call 1-800-[insert] to request a copy. Page 12 of 12