Chapter 6-Commercial Tax Services TAX SERVICES

advertisement

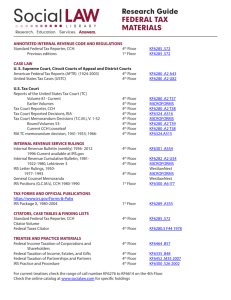

Federal Tax Research, Ninth Edition Page 6-1 Chapter 6-Commercial Tax Services TAX SERVICES 1. 2. Tax services a. Every tax researcher should have access to at least one commercial tax service. b. Most appropriate view of commercial tax services is as an index to primary and secondary sources of the tax law materials, not as an end in themselves. Tax services classified as two types a. Annotated - Organization based on Code. Also called Compilations. b. Topical - Organized by topic and transaction. c. Organization of electronic less visible. 3. All primary tax data is available via the Internet but more information can result in information overload. 4. One great benefit of electronic tax services is currency of information. ILLUSTRATIVE RESEARCH EXAMPLE 1. Very important that the students attempt the illustrative project. 2. Procedural knowledge acquired only by doing not by reading. APPROACHING THE RESEARCH PROBLEM 1. 2. Starting point for a tax research project is to formulate the tax issues as questions being asked. a. Research will gradually are refined. b. New questions may arise from the searching. c. Research is an iterative process (see Chapter 2). Refinement of tax questions and searches will not insure that a definite answer will be found. Must use judgment because the law is imprecise. ASSESSING TAX INFORMATION 1. Finding the relevant materials needed to resolve the tax question is the key to effective research. a. How the tax services are entered will determine how efficiently the searching is. b. The documents retrieved as a result of the search will be listed in order of relevance or by database source. c. Researcher unfamiliar with topic should start with an editorial explanation. Page 6-2 INSTRUCTOR’S MANUAL d. Once relevant primary sources are identified but before reading them carefully, the researcher should check whether the authority is still valid with a citator (see Chapter 8, citators). RIA CHECKPOINT 1. Checkpoint: a. Provided by Research Institute of America (RIA). b. One of most authoritative and well-known services. c. Provides a full range of products - all primary tax sources, Federal Tax Coordinator 2d (topical), United States Tax Reporter (USTR), Citator 2nd Series, Warren, Gorham & Lamont (WG&L) journals, WG&L textbooks, IRS publications, etc. d. Electronic services may be entered using three search methods: keyword, content, and citation (Code section and case name). CCH INTELLICONNECT 1. New redesigned tax research platform that supports the same search methods as RIA Checkpoint (Keyword Search, Content and Citation Searches). BNA TAX & ACCOUNTING 1. Best known as publisher of more than 500 BNA Tax Management Portfolios (Portfolios). WESTLAW 1. Although more popular with law firms than accounting firms, Westlaw and its new product WestlawNext provide tax research capabilities using search queries or its KeySearch system. LEXISNEXIS 1. Possibly the largest full-text information source. 2. Tax Center is designed exclusively for tax practitioners. 3. Includes analytical materials from CCH, BNA, Tax Analysts, Matthew Bender and Kleinrock as well as options to use keyword searches or to find authorities by citation (Get a Document Option). 4. LexisNexis Academic is a customized version of LexisNexis for academic institutions and public libraries. a. Good source of business news and also includes Federal and state primary sources, legal and professional journals and analytical materials. SUMMARY The main tax services discussed in this chapter are RIA Checkpoint, CCH IntelliConnect, BNA Tax & Accounting, Westlaw and LexisNexis. While the services provide different features, all are effective research tools and practitioners must determine which products they are most comfortable with and which fit the research requirements of their firm. Changes in technology and the tax services happen on a continuous basis. Thus, what is illustrated in Federal Tax Research, Ninth Edition Page 6-3 this text may become dated over time. However, the research methodology will still apply. The tax researcher should employ tax services as gateways to the primary sources and not as a substitute for primary source research. Tax services can make the research process more efficient and productive, but should not replace thorough review of primary sources and professional judgment.

![[09/17/99]](http://s3.studylib.net/store/data/009038449_1-e1d6b1c3e19b6942e494bdc9fbac2d14-300x300.png)