Personal Finance Test Review 5

advertisement

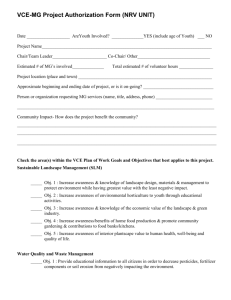

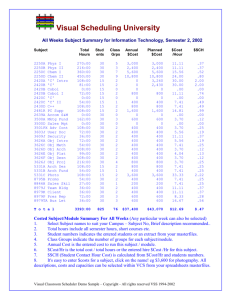

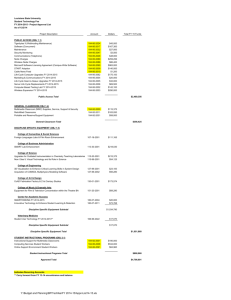

Personal Finance Test Review 5 True/False Indicate whether the statement is true or false. 1. The formula to determine the amount financed is the cash price minus the down payment. 2. The down payment is the final payment you make when you are done paying off your loan. 3. A repayment schedule shows the distribution of interest and other charges over the life of a loan. It usually does not show the principal. 4. One reason you might want to make the final payment of your loan before the end of the term is so that you will pay less interest. Multiple Choice Identify the choice that best completes the statement or answers the question. 5. Malik Fulton savings account has a principal of $1,640. It earns 6% interest compounded quarterly. What is the amount at the end of the second quarter? a. $1,643.23 c. $1,689.57 b. $1,657.89 d. $1,897.67 6. Ginger Yiu has a principal of $900 in her savings account. It earns 6% interest compounded quarterly. What is the amount in the account at the end of the third quarter? a. $935.67 c. $945.22 b. $941.11 d. $987.33 7. Yujin Pon has a principal of $900 in her savings account on October 1. The money earns interest at a rate of 6.5% compounded quarterly until July 1 of the following year. What is the amount in the account on July 1? a. $914.63 c. $943.87 b. $943.75 d. $944.59 Figure 5.2. Use this table with the question(s) below, as needed. Day 21 22 23 24 25 Amount of $1.00 at 5.5% Compounded Daily, 365-Day Year Amount Day Amount 1.00316 31 1.00468 1.00331 32 1.00483 1.00347 33 1.00498 1.00362 34 1.00513 1.00377 35 1.00528 8. Use Figure 5.2. On June 1, Mary Barkley deposited $1,000 in a savings account that pays 5.5% interest compounded daily. On June 26, how much interest had been earned on the principal in her account? a. $3.55 c. $3.75 b. $3.65 d. $3.77 9. Use Figure 5.2. Victoria Firth’s savings account balance is $247. She deposits an additional $353. The account pays 5.5% interest compounded daily. She makes no other deposits or withdrawals. What will the new balance be after 31 days? a. $1.81 c. $602.48 b. $2.81 d. $602.81 10. Use Figure 5.2. Asia Desai deposited $6,000 in a savings account that pays 5.5% interest compounded daily. How much interest did she earn in 21 days? a. $18.96 c. $21.44 b. $19.02 d. $22.96 Figure 5.5 Elapsed Time Table Day No. 17 18 19 20 21 22 23 24 25 Jan. 17 18 19 20 21 22 23 24 25 Feb. 48 49 50 51 52 53 54 55 56 March 76 77 78 79 80 81 82 83 84 Apr. 107 108 109 110 111 112 113 114 115 May 137 138 139 140 141 142 143 144 145 June 168 169 170 171 172 173 174 175 176 Compounded Interest Day 21 22 23 24 25 Amount of $1.00 at 5.5% Compounded Daily, 365-Day Year Amount Day Amount 1.00316 31 1.00468 1.00331 32 1.00483 1.00347 33 1.00498 1.00362 34 1.00513 1.00377 35 1.00528 11. Use Figure 5.5. On March 20, Paul Herzog deposited $1,000 into his savings account that pays 5.5% interest compounded daily. How much interest will the money earn by April 20? a. $3.77 c. $4.83 b. $4.68 d. $4.98 12. On February 24, Larissa Paul deposited $5,000 in a savings account that pays 5.5% interest compounded daily. What will be the amount in her account on March 17? a. $5,015.80 c. $5,037.33 b. $5,031.30 d. $5,039.80 13. Gene McDonald’s bank granted him a single-payment loan of $5,000 for 90 days at 9% ordinary interest. What is the amount of ordinary interest owed? a. $112.50 c. $150.00 b. $132.50 d. $156.20 14. Scott Peter’s bank granted him a single-payment loan of $3,250 to pay a repair bill. He agreed to repay the loan in 31 days at an exact interest rate of 11.75%. What is the maturity value of the loan? a. $3,211.09 c. $3,300.90 b. $3,282.43 d. $3,554.66 15. Marina Guzmon’s bank granted her a single-payment loan of $3,250 to pay a repair bill. She agreed to repay the loan in 31 days at an ordinary interest rate of 11.75%. What is the maturity value of the loan? a. $3,012.21 c. $3,282.88 b. $3,221.09 d. $3,454.99 16. Manuel Fraser’s bank granted him a single-payment loan of $9,650. He agreed to repay the loan in 146 days at an ordinary interest rate of 7.75%. What is the maturity value of the loan? a. $9,091.22 c. $9,953.30 b. $9,949.15 d. $10,011.01 17. Barbara D’Angelo’s bank granted her a single-payment loan of $1,000 for 100 days at 12% ordinary interest. What is the amount of ordinary interest owed? a. $32.15 c. $34.55 b. $33.33 d. $36.77 18. ALGEBRA Walt Carter borrowed $2,500.00 to purchase a motorcycle. He agreed to pay back $2,800.50 in 270 days. What exact interest rate was he paying? (Round your answer to the nearest tenth of a percent.) a. 8.0% c. 15.1% b. 11.4% d. 16.2% 19. Tasheka Quinn is buying a new couch for $989. She made a down payment of $200 and financed the remainder. What amount did she finance? a. $766 c. $799 b. $789 d. $877 20. Spencer Ward purchased a new riding mower for $1,989. He made a 15% down payment and financed the remainder. What amount did he finance? a. $1,610.00 c. $1,678.99 b. $1,613.60 d. $1,690.65 21. Rebecca Whitaker purchased a new flat screen television for $767. She made a 20% down payment and financed the remainder. What amount did she finance? a. $613.60 c. $665.00 b. $617.50 d. $767.00 22. Adolfo Ramirez purchased a microwave and dishwasher for $897. He made an 18% down payment and financed the remainder. What amount did he finance? a. $735.54 c. $786.12 b. $766.34 d. $791.01 23. Juanita Karoz purchased lawn furniture for $727. She made a 27% down payment and financed the remainder. What amount did she finance? a. $510.88 c. $600.11 b. $530.71 d. $627.84 24. Bonita Wolfe purchased a media system for her home which included a television for $1,398.77, a computer for $895.60, surround sound for $1,560.99, and a DVD player for $231.15. She lives in Florida and pays a 7% sales tax. If she made a down payment of 15% and financed the rest using the store’s installment plan, what amount did she finance? a. $3,716.68 c. $4,171.57 b. $3,871.68 d. $4,372.57 Figure 8.1. Use this table with the question(s) below, as needed. MONTHLY PAYMENT ON A $100 LOAN Annual Percentage Rate Term in Months 8.00% 10.00% 12.00% 14.00% 6 17.06 17.16 17.25 17.35 12 8.70 8.79 8.88 8.98 18 5.91 6.01 6.10 6.19 24 4.52 4.61 4.71 4.80 30 3.69 3.78 3.87 3.97 36 3.13 3.23 3.32 3.42 42 2.74 2.83 2.93 3.03 48 2.44 2.54 2.63 2.73 25. Use Figure 8.1. Corey Griffin obtained an installment loan of $1,000. The annual percentage rate is 8%. He must repay the loan in 18 months. What is the finance charge? a. $59.10 c. $75.10 b. $63.80 d. $78.20 26. Use Figure 8.1. Katie Cole purchased a mountain bike with an installment loan that has an APR of 14%. The mountain bike sells for $762. The store financing requires a 15% down payment and 24 monthly payments. What is the finance charge? a. $91.05 c. $98.46 b. $95.50 d. $99.00 27. Use Figure 8.1. Tulio Fernandez purchased a treadmill with an installment loan that has an APR of 12%. The treadmill sells for $1,672. The store financing requires a 10% down payment and 12 monthly payments. What is the finance charge? a. $89.00 c. $98.76 b. $92.50 d. $99.50 28. Use Figure 8.1. Maxwell Barber purchased a chain saw with an installment loan that has an APR of 8%. The chain saw sells for $169. The store financing requires a 10% down payment and 18 monthly payments. What is the finance charge? a. $9.13 c. $10.95 b. $9.72 d. $12.22 29. Chico Alvarez obtained a loan of $2,400 to install a new roof on his home. The interest rate is 12% and the monthly payment is $113.04. What is the interest on the first monthly payment? a. $24.00 c. $29.90 b. $25.04 d. $32.01 30. Camryn Mason obtained a $1,200 loan for her scuba diving lessons. She borrowed the money for 6 months at 7% interest. Her monthly payment is $204.10. What is the balance of her loan after three payments? a. $199.41 c. $605.24 b. $404.67 d. $804.65 31. Camryn Mason obtained a $1,200 loan for her scuba diving lessons. She borrowed the money for six months at 7% interest. Her monthly payment is $204.10. What is the interest for the second payment? a. $3.53 c. $5.85 b. $4.69 d. $7.00 32. Brad Clark took out a simple interest loan at 13% interest for 12 months. His previous balance is $619. What is the final payment if the loan is paid off with the next payment? a. $621.00 c. $634.00 b. $625.71 d. $675.09 33. Marc Maxwell took out a simple interest loan at 13% interest for 12 months. His previous balance is $2,681.04. What is the final payment if the loan is paid off with the next payment? a. $2,710.08 c. $2,876.91 b. $2,801.01 d. $2,998.01 34. Chloe Closson paid for her vacation to the mountains with a $3,000 installment loan at 10% for 12 months. Her monthly payments were $263.75. After five payments, the balance due was $1,786.20. If Chloe pays off the loan with the sixth payment, how much will she save? a. $45.17 c. $213.85 b. $135.67 d. $308.95 35. Dan Williams took out a simple interest loan at 14.5% interest for 12 months. His previous balance is $119.42. What is the final payment if the loan is paid off with the next payment? a. $98.74 c. $132.90 b. $120.86 d. $151.23 36. Roper Fox took out a simple interest loan at 5% interest for 12 months. His previous balance is $200. What is his final payment if the loan is paid off with the next payment? a. $200.31 c. $200.72 b. $200.56 d. $200.83 Figure 8.2. Use this table with the question(s) below, as needed. APR Term 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 6 12 $2.94 5.50 $3.01 5.64 Finance Charge per $100 of Amount Financed $3.08 $3.16 $3.23 $3.31 $3.38 $3.45 5.78 5.92 6.06 6.20 6.34 6.48 18 24 8.10 10.75 8.31 11.02 8.52 11.30 8.73 11.58 8.93 11.86 9.14 12.14 9.35 12.42 9.56 12.70 12.00% 12.25% $3.53 6.62 $3.60 6.76 9.77 12.98 9.98 13.26 37. Use Figure 8.2. Joseph Alexander obtained an installment loan of $1,500. He agreed to repay the loan in 18 monthly payments. The finance charge is $146.25. What is the APR? a. 10.25% c. 11.00% b. 10.75% d. 12.00% 38. Use Figure 8.2. Anthony Howard obtained an installment loan for $800 to pay for a home repair. He agreed to repay the loan in six monthly payments. The finance charge is $24.64. What is the APR? a. 10.00% c. 10.50% b. 10.25% d. 11.00% 39. Use Figure 8.2. Anthony Jones obtained an installment loan for $460 to pay for a washing machine. The finance charge is $15.88. He must pay off the loan in six monthly payments. What is the APR? a. 10.00% c. 11.50% b. 10.75% d. 11.75% 40. Use Figure 8.2. Alan Cohl obtained an installment loan for $3,560. His finance charge is $308.56, and he will make 18 monthly payments. What is the APR? a. 10.25% c. 10.75% b. 10.5% d. 11.00% Figure 8.5 Formula for Computing the APR on an Installment Loan APR = Where m = Number of payments per year f = Finance Charge n = Number of scheduled payments a = Amount Financed 41. ALGEBRA Haywood Price purchased living room furniture for $1,860. He borrowed $1,200 and promised to repay the loan in 2 years. The finance charge was $308.25. To the nearest hundredth of a percent, what is the annual percentage rate? a. 14.02% c. 23.02% b. 18.02% d. 25.02% 42. John Simms is shopping for a new sport utility vehicle. A portion of the sticker for an SUV is shown below. What is the sticker price? SUV Base Price Optional Equipment Description Anti-Lock Brakes (ABS) Automatic Transmission (ATO) Destination Charge a. $29,680 b. $30,379 $28,150 900 630 699 c. $31,379 d. $40,256 43. Janet Smith is shopping for a new sport utility vehicle. A portion of the sticker for an SUV is shown below. What is the sticker price? SUV Base Price Optional Equipment Description Anti-Lock Brakes (ABS) Automatic Transmission (ATO) Deluxe CD/Radio $28,150 900 630 1,420 Destination Charge a. $28,150 b. $31,300 699 c. $31,799 d. $33,849 44. Mike Shepherd purchased a new sedan. He paid $28,905.50 for the car’s base price and a $164.00 destination charge. The car’s options, a sunroof and air-conditioning, cost $3,609.00. What is the sticker price? a. $28,905.50 c. $32,514.50 b. $29,069.50 d. $32,678.50 45. Palmer Mercedes wants to buy a new sport hatchback. The base price for the car is $26,970 and the destination charge is $600. The option package, including a 12-disc CD changer for his trunk, costs $2,440. What is the sticker price? a. $27,570 c. $30,010 b. $28,110 d. $30,550 46. Car dealer Ben Carter paid 97% of the base price of $22,567. He also paid 93% of options totaling $3,465, and a destination charge of $650. What is the dealer’s cost? a. $22,539.99 c. $25,762.44 b. $25,242.44 d. $26,889.99 47. Car dealer Lisa Kovach paid 82% of a car’s options totaling $3,098. She paid 85% on a base price of $15,480. The destination charge was $890. What is the dealer’s cost? a. $13,158.00 c. $18,020.36 b. $16,588.36 d. $19.001.20 48. Car dealer Aakar Singh pays 89% for a car that has a base price of $23,998. He pays 87% of its $3,425 options price and a $460 destination charge. What is the dealer’s cost? a. $21,358.22 c. $24,337.97 b. $21,818.22 d. $24,797.97 49. Terri Davis is planning to buy a new car. While on the Internet she learned that the car has a base price of $16,007, options that total $2,334, and a $500 destination charge. She read on a consumer’s Web site that the dealer’s cost for the car is about 94% of the base price and 89% of the options price. What should Davis estimate as the dealer’s cost? a. $17,623.84 c. $18,421.09 b. $17,800.25 d. $18,862.11 50. A 2-door sedan sticker shows a base price of $12,130.00, with options totaling $2,623.00 and a $515.00 destination charge. Consumer Reports shows the dealer cost at about 93% of the base price and 97% of the options. What is the dealer’s cost? a. $14,340.21 c. $15,419.75 b. $14,419.75 d. $16,513.85 51. Paula Brock wants to purchase a four-year-old V6 sedan 4-door, which is advertised at $11,925. The car has no air-conditioning and no power seats. It has been driven 49,000 miles. The used-vehicle guide does not indicate any adjustment for this car’s mileage. What is the average retail price for this vehicle? Four-Year-Old Vehicles V6 Sedan 4-Door Deduct with no Air-Conditioning Average Retail Value $11,925 800 Deduct with no Power Seats Add Aluminum/Alloy Wheels Add Compact Disc Player Add Leather Seats Add Theft Recovery System a. $2,560 b. $9,750 150 200 100 350 50 c. $10,908 d. $10,975 52. Eddie O’Neil found a car advertised at a local used-car dealership for $34,000. The car is clean and in good condition. Its average retail value is $33,400. It has air-conditioning valued at $840 and leather seats valued at $200, but it does not include a CD player, which is valued at $100. The used-vehicle guide indicates that $1,450 should be deducted for excessive mileage on the car. What is the average retail price for this vehicle? a. $32,890 c. $34,501 b. $33,971 d. $34,890 53. Nate Shermach found a two-year-old luxury car advertised for $31,175. Its average retail value is $30,850. It has aluminum alloy wheels valued at $300 and a theft recovery system valued at $75, but it does not include a CD player, which is valued at $100. The car has been driven 47,005 miles. The used-vehicle guide indicates that if the car’s mileage is between 46,000 and 51,000 miles, $700 should be deducted. What is the average retail price for this vehicle? a. $30,164 c. $31,098 b. $30,425 d. $32,874 54. William Meyer bought a used car for $6,500 two years ago. He spent $1,299 for gas, $160 for oil changes, $209 for maintenance, and $200 for two new tires. He paid $657 for insurance and $158 for registration and licenses. He calculates the car has depreciated by about $2,100. William also drove the car a total of 16,789 miles and estimates that its present value is $4,400. What was the cost per mile for William to operate and maintain his car? a. $0.25 c. $0.30 b. $0.28 d. $0.32 55. For the past two years Lynda Santana has recorded the costs of operation of her car. They total $1,600 of fixed costs and $2,134 of variable costs. She’s driven a total of 14,000 miles. What was the cost per mile? a. $0.25 c. $0.27 b. $0.26 d. $0.28 56. Carlos Rivera purchased a car three years ago at a price of $21,950. Today the car’s estimated worth is $15,110. The Complete Car Cost Guide states the annual variable cost of the car to be $1,150 per year with insurance costing $1,259 per year. For each year, Rivera paid $140 for license and registration fees and he drove the car about 17,000 miles per year. After computing the car’s depreciation and its total annual cost, find the cost per mile. a. $0.26 c. $0.30 b. $0.28 d. $0.32 57. Dario Canseco’s variable automobile costs for last year were: gasoline, $1,993.83; oil and filters, $230.90; and a new tire, $89.76. Insurance cost $1,201.20, registration was $120.25; and the loan interest totaled $389.06. Canseco drove about 12,560 miles. What was the cost per mile for Canseco to operate his vehicle last year? a. $0.16 c. $0.32 b. $0.22 d. $0.43 58. Instead of purchasing a new car, Maria Smits decided to lease one. Her deposit was $3,000 and her payments are $230 per month for 60 months. She also paid a $90 title fee and a $50 license fee. What is her total lease cost? a. $15,380 c. $16,890 b. $16,788 d. $16,940 59. Jennifer Sosa leased a new car. She pays $300 per month for 48 months. She paid a $78 title fee, a $110 license fee, and her deposit was $5,000. What is the total lease cost? a. $15,092 c. $19,588 b. $19,510 d. $15,987 60. Enrico Alonso recently leased a new luxury car. His payments are $658 per month for 60 months. His deposit was $6,000. He paid a $105 title fee and an $80 license fee. What is his total lease cost? a. $39,761 c. $45,665 b. $42,380 d. $59,718 61. Margaret Faso leased a car. This included 36 monthly payments of $545, a $4,000 deposit, a $100 title fee, and a $90 license fee. What is her total lease cost? a. $23,810 c. $25,865 b. $24,390 d. $26,002 62. Victoria Santos recently leased a new convertible. The $1599 due at signing includes the title and license fee. Her monthly lease payments are $700 per month. The leasing company allows 12,000 miles per year with a $0.12 per mile overage charge. If the total lease cost is $26,800, for how many months does the lease last? a. 24 c. 48 b. 36 d. 60 Completion Complete each statement. 63. When a bank adds interest to a savings account each day, it is called ___________________. Matching Match the following terms with the descriptions. a. b. c. d. sticker price base price destination charge variable costs e. f. g. h. fixed costs depreciation closed-ended lease open-ended lease ____ 64. Also known as MSRP ____ 65. Includes insurance, registration fees, loan interest and depreciation ____ 66. The decrease in the value of your vehicle from one year to the next ____ 67. Required by law to be displayed on a new vehicle’s window ____ 68. Increases as the number of miles driven increase ____ 69. A contract allowing you to use a car for a set time period ____ 70. Allows you to buy the car at the end of the lease period ____ 71. The cost of shipping the vehicle from the factory to the dealer Essay 72. Describe compound interest and explain why it is preferable to simple interest. 73. Assume you are considering buying, leasing, or renting a car. Using the data in the table below, create a bar graph comparing the related costs of owning, leasing, or renting. Plan on the vehicle being owned, leased, or rented for three years. Comparison of Owning, Leasing, or Renting a Car Owning Leasing Renting Vehicle Cost: $32,100 Lease: 36 months @ $398 per Rental Charge: $30 per day month Maintenance: $560.09 Maintenance: $0 Maintenance: $0 Insurance: $1,302.30 Insurance: $1,090.80 Insurance: $1,090.80 Gasoline: $1,993.83 Gasoline: $1,993.83 Gasoline: $1,993.83 Personal Finance Test Review 5 Answer Section TRUE/FALSE 1. 2. 3. 4. OBJ: OBJ: OBJ: OBJ: 8.2 8.2 8.4 8.5 MULTIPLE CHOICE 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 5.5 5.5 5.5 5.7 5.7 5.7 5.7 5.7 8.1 8.1 8.1 8.1 8.1 8.1 8.2 8.2 8.2 8.2 8.2 6.1 | 8.2 8.3 8.3 8.3 8.3 8.4 8.4 8.4 8.5 8.5 8.5 8.5 8.5 8.6 8.6 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 8.6 8.6 8.6 9.1 9.1 9.1 9.1 9.2 9.2 9.2 9.2 9.2 9.3 9.3 9.3 9.5 9.5 9.5 9.5 9.6 9.6 9.6 9.6 9.6 COMPLETION 63. OBJ: 5.7 MATCHING 64. 65. 66. 67. 68. 69. 70. 71. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 9.1 | 9.5 | 9.6 ESSAY 72. OBJ: 5.5 73.