FOUNDATION for Windows - Foundation Client Login

advertisement

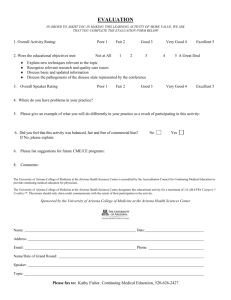

FOUNDATION® for Windows® Tax tables for the state of Arizona* To enter state tax tables: 1. From the Main Menu, choose Payroll, Maintenance, Tax Tables, State. 2. If the record already exists, switch to Modify Mode and select it. Click [OK]. 3. Complete the appropriate fields using the data below and information specific to your company. 4. Click [OK] to save the record. The “General” Tab Be sure to add a new row in the Effective Date area. Do NOT modify any existing rows. * Please check all tax table information with the state tax authority and/or your tax professional. The “Exemptions” Tab Leave all fields on the “Exemptions” tab blank. FOUNDATION® for Windows® Arizona Tax Tables Page 1 12/7/12 The “Tables” Tab When accessing the “Tables” tab, be sure to click on the row with the appropriate Effective Date (1/1/2013) on the upper portion of the window. Information for Table 1: Leave all fields on the “Brackets,” “Exemptions,” “Additional” and “Additional 2” sub-tabs blank. FOUNDATION® for Windows® Arizona Tax Tables Page 2 12/7/12 Additional Information IMPORTANT: Effective July 1, 2010, the State of Arizona is changing its method of calculating Arizona tax withholding. Prior to July 1, 2010, it is calculated as a percentage of federal withholding. For payrolls on or after July 1, 2010, it will be calculated as a percentage of gross taxable wages. The new calculation has been programmed in FOUNDATION version 9.13 and later. Prior to July 1, 2010: After defining Arizona State Tax Tables, you should access each Employee Record to enter the Arizona % of Federal. Perform the following actions: 1. From the Main Menu, choose Payroll, Maintenance, Employees. 2. Switch to Modify Mode. 3. Enter an Employee Number in the Employee field, and press <Enter>. 4. Click the “Additional Tab.” 5. Complete the Arizona % of Federal field using information entered on the employee’s Form A-4, Withholding Exemptions Certificate. 6. Click [OK] to save the changes. After July 1, 2010: NOTE: For this calculation to work correctly, you must update to FOUNDATION version 9.13 or later. Perform the following actions: 1. Obtain a new Arizona Form A-4 (Employee’s Arizona Withholding Percentage Election) from each of your Arizona employees. 2. Access the Employee Record as described above. 3. Click the “Additional” tab. 4. Delete the percentage entered in the Arizona % of Federal field. 5. Click the “Deductions” tab. 6. Complete the Percent field on the Arizona line using information entered on the employee’s Form A-4. 7. Click [OK] to save the changes. FOUNDATION® for Windows® Arizona Tax Tables Page 3 12/7/12