THE LAW OF ACCOUNTANT LIABILITY IN THE

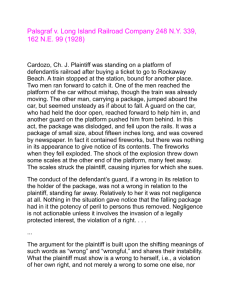

advertisement