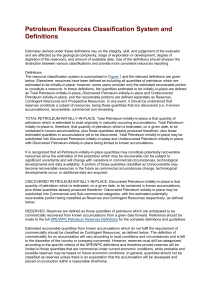

Petroleum Resources Management System

advertisement